Industry News

Square: Banking, Bitcoin, Now Streaming Beats?

March 4, 2021 Square bought a majority stake in Tidal, a music streaming service owned by Jay-Z, for $247 million.

Square bought a majority stake in Tidal, a music streaming service owned by Jay-Z, for $247 million.

Jay-Z will be joining the Square board and Tidal artists will keep their ownership in the firm. Jack Dorsey announced the move on Twitter, seeming to assuage worries from the first post.

“Why would a music streaming company and a financial services company join forces,” Dorsey wrote. “We believe there’s a compelling one between music and the economy. Making the economy work for artists is similar to what Square has done for sellers.”

Square is acquiring a majority ownership stake in TIDAL through a new joint venture, with the original artists becoming the second largest group of shareholders, and JAY-Z joining the Square board. Why would a music streaming company and a financial services company join forces?!

— jack (@jack) March 4, 2021

Dorsey and Jay have been friends for years and were spotted hanging out with Beyonce on a yacht in the Hamptons this summer. Dorsey and Jay-Z last month went in on a multimillion Bitcoin trust fund to support Bitcoin development in India and Africa.

Beyoncé, JAY-Z, Rumi, Blue Ivy w/ Twitter CEO Jack Dorsey in the Hamptons — Aug. 24th. pic.twitter.com/bNEz0Nch2y

— BEYONCÉ LEGION (@Bey_Legion) August 25, 2020

Jay-Z bought Tidal in 2015 for $56 million, but despite working with top music artists like Coldplay and Kanye West, the service has struggled to compete with Apple and Spotify. After a year of closed venues, Billboard reported that last year Tidal had a cash problem and was missing payments to rights holders. Tidal got a cash injection from the sale, while Square spent less than 1% of the firm’s value to bring Jay-Z’s leadership and network of music industry heavy-hitters into the fold.

Jay-Z bought Tidal in 2015 for $56 million, but despite working with top music artists like Coldplay and Kanye West, the service has struggled to compete with Apple and Spotify. After a year of closed venues, Billboard reported that last year Tidal had a cash problem and was missing payments to rights holders. Tidal got a cash injection from the sale, while Square spent less than 1% of the firm’s value to bring Jay-Z’s leadership and network of music industry heavy-hitters into the fold.

“I said from the beginning that Tidal was about more than just streaming music, and six years later, it has remained a platform that supports artists at every point in their careers,” said Jay-Z in a press statement. “Artists deserve better tools to assist them in their creative journey. Jack and I have had many discussions about Tidal’s endless possibilities that have made me even more inspired about its future. This shared vision makes me even more excited to join the Square board. This partnership will be a game-changer for many. I look forward to all this new chapter has to offer!”

LoanMe Has Been Acquired Along With Liberty Tax By Canadian Listed SPAC

February 22, 2021 LoanMe has been acquired. The announcement was made by Nextpoint, a SPAC listed on the Toronto Stock Exchange that simultaneously acquired Liberty Tax.

LoanMe has been acquired. The announcement was made by Nextpoint, a SPAC listed on the Toronto Stock Exchange that simultaneously acquired Liberty Tax.

The combined company will be called NextPoint Financial.

NextPoint will acquire LoanMe at an enterprise value of approximately US$102 million, US$18 million of which is payable in cash, approximately US$49 million of which is payable in NextPoint common stock equivalents and with the balance of which reflects the assumption of existing corporate net debt at LoanMe.

“We are a one-stop financial services destination empowering hardworking and credit-challenged consumers and small businesses to get to the NextPoint in the financial futures,” the company said of its newly formed self.

The company says that LoanMe had originated $2 billion since inception, 340,000+ borrowers since inception, and has a $200 million loan portfolio. Liberty Tax, meanwhile, processes 185,000+ SME tax returns, 1 million+ US consumer tax returns, and 400k+ Canadian tax returns.

Combined, the company projects $317M in revenue in 2021.

“NextPoint has obtained a commitment for a new US$200 million revolving credit facility, advances under which may be used for NextPoint’s general corporate purposes, including to fund the Liberty Tax and LoanMe cash purchase prices, and to fund potential future acquisitions,” the company said in a public release.

Affirm Goes Public at $11.9B Valuation and Climbing

January 13, 2021Affirm, an online buy-now-pay-later platform, was listed on the Nasdaq on Wednesday at $49 a share under the ticker AFRM. Based on outstanding shares sold to IPO investors, the company saw an $11.9B valuation. Minutes after public sales began at noon, the price shot up to $100/share.

Company founder Max Levchin spoke through the big Nasdaq screen in Times Square as he virtually rang the starting bell. Levchin championed the hard work of the Affirm team.

Hear from the CEO of @Affirm, Max Levchin (@mlevchin) on the company improving the lives of consumers by empowering shoppers with honest financial products. @Affirm joins us this morning to ring the Opening Bell in honor of its IPO. #AFRM pic.twitter.com/QfkZsgXItM

— Nasdaq (@Nasdaq) January 13, 2021

Affirm makes money when a customer uses their tech to make a purchase at the point-of-sale.

Levchin is a member of the “PayPal mafia,” a co-founder of the online payments firm that went on to establish massively successful tech startups. Members of the “mafia” include Tesla’s Elon Musk, Linkedin chairman Reid Hoffman, and Yelp founder Jeremy Stoppelmen.

After publishing earnings this summer, the San Francisco-based firm filed for an IPO on Nov 18. The move revealed revenue of $465M for the first 3 quarters of 2020 with a $66M net loss.

Embedded with the company’s S-1, were comments from Levchin that said:

“The barely-readable fine print makes only one thing clear to consumers: You’ll never know exactly what your purchase will really cost you,” Levchin wrote. “With most of the payments industry deriving profits from late fees, overdraft charges, and gimmicks like deferred interest, it’s not hard to agree that there has to be a better way; it’s time to evolve payments again.”

Levchin took to Twitter to post about the firm, championing the millions of transactions the platform has serviced since 2013, all without one late fee.

“More than eight years ago, we set out to take on credit cards and change the way we pay,” Levchin wrote. “We built Affirm from the ground up to align with the needs of consumers and merchants and to succeed when they succeed.”

Additional OnDeck Employees Set Their Sights Elsewhere

January 4, 2021On New Year’s Day, OnDeck Head of Business Development Kevin Chin announced he was parting ways with the company and joining Avant. “As we wrap up 2020,” Chin posted on LinkedIn, “I wanted to take a moment to thank all of my colleague at OnDeck as well as Noah Breslow and Cory Campfer for building such an outstanding company with great people and culture.”

Similarly, Matt Cluney, who was VP of Brand and Product Marketing at OnDeck, announced that he was leaving to become Chief Marketing Officer for Yardline Capital. On LinkedIn, he wrote: “New year, new adventures… excited to join Ari Horowitz, Tomo Matsuo, Seth Broman and the rest of the team at Yardline Capital at a time when ecommerce is booming and the opportunity to provide a differentiated growth capital solution for ecommerce sellers is big!” Cluney will be in good company at Yardline with another OnDeck veteran Dennis Chin.

SRS Capital Enters Chapter 7 Bankruptcy

January 4, 2021SRS Capital, a merchant cash advance company based in Long Island, NY, has entered Chapter 7 bankruptcy, according to court documents obtained by deBanked. In September, several of the company’s creditors petitioned for involuntary bankruptcy. Although it was contested by SRS, the Court granted relief under the Code and appointed a trustee.

The primary entity is listed as SRS Capital Funds, Inc.

The company had revenues of $1.5 million in 2020.

The proceedings are ongoing. SRS Capital’s website is presently offline.

deBanked Meme Time – Happy Thanksgiving

November 21, 2020It’s Thankgiving time, which means…. more deBanked memes! This tradition started 8 years ago. Enjoy the holidays and be safe!

In Loving Memory of Elliot J Dabah

November 17, 2020

Elliot J Dabah, CEO of NYC-based Merchants Cash Partners, LLC, recently passed away. Known throughout the merchant financing industry, friends and colleagues began collecting kind words to reflect on his life to be able to share them here.

Elliot Ashkenazie, his business partner and best friend, said “Elliot Dabah would step up and help anyone in need whether that be his own employee, another ISO, or a complete stranger on the street. He didn’t keep any secrets so he would have an advantage over others, he simply paid it forward and helped the community as a whole benefit from it. Merchants Cash Partners will work tirelessly to carry on his legacy and his values.”

“Elliot Dabah was the heartbeat of the Financial District and he was an integrated part of my life, both professional and personal,” said Gigi Russo. “Not only did Elliot and I live three blocks from each other, but I first had the privilege and pleasure of meeting him while I was working for deBanked, at CONNECT San Diego. We quickly became close friends. He truly never took advantage of our tight knit friendship. His professional support was a reflection of his character— a respectable person that respected his family, friends and business associates. Elliot wanted everyone to succeed. He believed that friends and business colleagues should support one another to build a viable network.”

Tom Dool of Power Funding, said “Of all of the offices I’ve ever visited, I can honestly say that no other partner of mine compares to Merchants Cash Partners. From the moment I met both Elliots, they were inviting. I could tell right away that they had a special bond of shared enthusiasm, honesty, generosity, thoughtful, caring people.” He adds, “Elliot [Dabah] lived life with such a genuine love for people and getting to know people, discussing higher level ideas, sharing feelings. He was one of the best and I’ll never forget him.”

“Elliot was one of the most welcoming people I had the pleasure of knowing,” says Colt Kucker of Libertas Funding, “and always tried helping out whether it be a customer, myself, or anybody in need. He was a hard worker and will truly be missed by all he came across.”

Justin Friedman of Enova SMB, described Dabah, “Smart, strategic, urgent, generous and wise are a few words to describe Elliot. He was universally popular and a known professional in our industry, which isn’t common to come by. He cared about his customers and business relationships. Elliot’s presence in alternative lending was a positive one and he will be remembered for exactly that.”

Ben Lugassy of SOS Capital states that he was “Always smiling and enthusiastic, Elliot was the embodiment of joyful. A friend with tremendous respect and gratitude, he will always be remembered and in our prayers.”

Paul Boxer of Velocity Capital Group added, “Every-time I met Elliot he had the largest smile, always happy to talk shop and discuss the industry. He was very knowledgeable and had a wealth of information, he will surely be missed.”

Ken Peng of Elevate Funding recounts that Elliot, “was always great to work with. He was always very friendly and understanding when we did review any of his files. He will be missed.”

Gigi Russo, who was instrumental in putting this tribute together, further added that Elliot “treated everyone he came into contact with as a friend.” He has “a sincere, dignified, and affable reputation that will follow him after his passing. He will surely be remembered for supporting his colleagues, clients, business acquaintances, and network. The legacy Elliot has left behind is simple: Respect one another. Support one another. Honesty and hard work are necessities of success.”

Part of Elliot’s legacy is the company he built. Merchants Cash Partners, despite the pandemic, was so successful this year that it outgrew its office space.

“Elliot had a revolutionary style of making this industry a community,” says his partner Ashkenazie. “He referred clients and prospects alike to small firms and national firms, expecting nothing in return.”

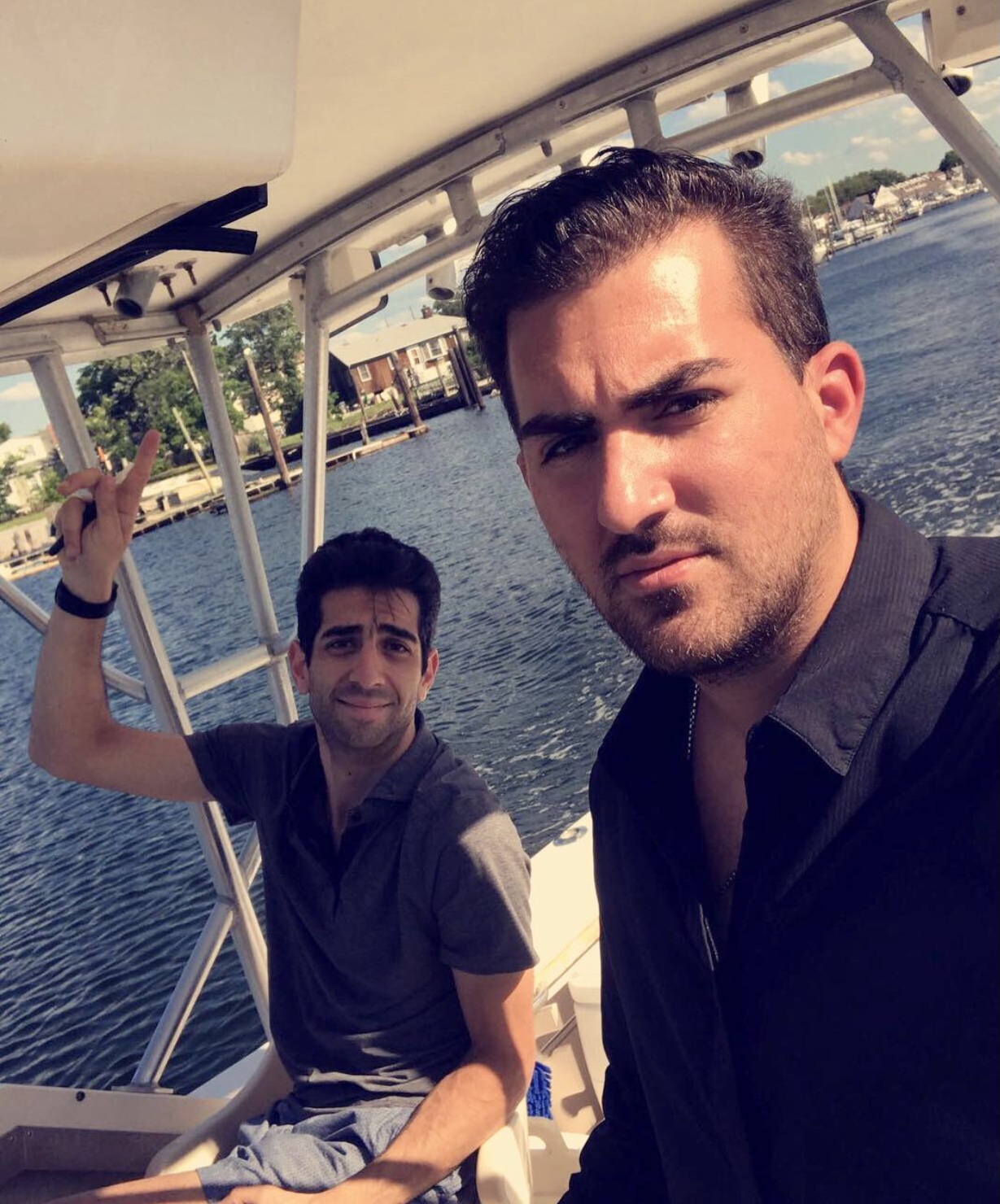

Coincidence would have it that a photo of Elliot at a deBanked event was often used in event marketing promotions. As to how that picture came to be used so prominently, deBanked President Sean Murray said that “Elliot embodied the community we were trying to portray. A nice young business professional who radiated positive energy. Who is part of this industry? It’s guys like Elliot. That’s what we wanted everyone to know.

“Elliot totally noticed how often we were sharing his photo,” Murray said. “He told me that he thought that was pretty cool.”

Neuberger Berman Acquires Significant Stake in IOU Financial

November 4, 2020 Neuberger Berman, an investment manager with $374B under management, is acquiring a 15% stake in IOU Financial, a small business lender. As part of the deal, one of the firm’s funds has agreed to purchase up to $150M a year of IOU’s loans over the next two years.

Neuberger Berman, an investment manager with $374B under management, is acquiring a 15% stake in IOU Financial, a small business lender. As part of the deal, one of the firm’s funds has agreed to purchase up to $150M a year of IOU’s loans over the next two years.

“This investment by a Neuberger Berman managed fund represents a strong vote of confidence in the fundamental, long-term value of our business, and is a testament to IOU’s loan origination and servicing capabilities in addition to its capital markets capabilities” said Phil Marleau, CEO of IOU, in a public statement.

Additionally, Neil Wolfson, a former board member to rival OnDeck, is joining IOU’s board of directors.