events

PayPal is Changing Its Ways, Embracing Main Street

October 23, 2018 PayPal Chief Operating Officer Bill Ready shared his childhood experience of working for his parents’ auto repair shop to convey his understanding of the challenges that face small businesses.

PayPal Chief Operating Officer Bill Ready shared his childhood experience of working for his parents’ auto repair shop to convey his understanding of the challenges that face small businesses.

“Tech has gotten faster, but money has gotten slower,” he said, referring to how small businesses, like his parents’, used to receive most of its money right away in cash. “Now, money is tied up in the digital world and it can take days, even weeks [to collect.]”

Ready said that, through PayPal, small business owners can get their money immediately. He also said that some small business owners can get loans from PayPal almost instantly. He gave the example of a business owner in Arizona with a staff of 12 who couldn’t get a loan from a bank because his company didn’t have assets. But the company did have a payment history with PayPal which qualified it for a small business loan that Ready said hit the owner’s account in 30 seconds.

Not all of Ready’s presentation touted the company’s capabilities. Part of his talk had an apologetic tone.

“Paypal was hesitant about partnerships, but not anymore,” he said, acknowledging that helping “Mainstreet” will require the collaboration of fintech companies and changing attitudes about customers.

“You might have heard people say ‘Who owns the customer?’ We’ve been guilty of that,” he said.

But Ready said that PayPal has changed its perspective and that they want to make it easy for other fintech companies to partner with them.

Petralia Says to Focus on Millennials

October 23, 2018 Kabbage CEO and Co-founder Kathryn Petralia gave a fast-paced presentation at Money 20/20 yesterday that touched on gun violence, marijuana and gender identity, all in 20 minutes.

Kabbage CEO and Co-founder Kathryn Petralia gave a fast-paced presentation at Money 20/20 yesterday that touched on gun violence, marijuana and gender identity, all in 20 minutes.

The loose connecting thread was millennials, which Petralia’s powerpoint identified as people born between 1981 and 2002. There are 90 million millennial Americans and they have outnumbered babyboomers since 2017, Petralia asserted. So we have to pay attention to them and cater to their needs, she conveyed.

“Millennials are not as short on money as they are on time,” Petralia said, and she expressed that using data to improve speed and efficiency is therefore critical.

“The millennials are coming” read one of the powerpoint slides. But Petralia said they already have.

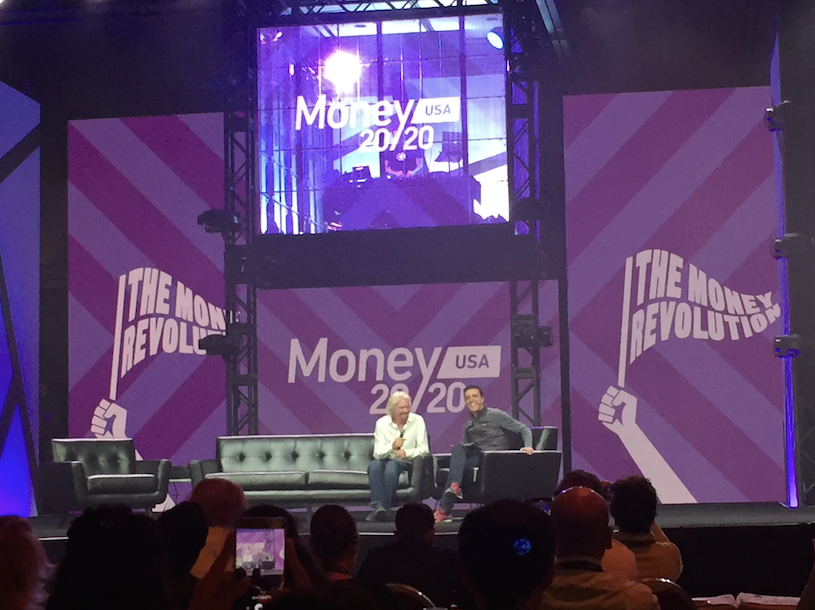

Branson Adds Charm, Not Expertise, to Money 20/20

October 23, 2018 Money 20/20’s keynote speaker, serial entrepreneur and philanthropist Sir Richard Branson, delivered inspiration and laughs to a packed audience yesterday. He was interviewed by Nuno Sebastiao, CEO of Feedzai, which fights financial crime.

Money 20/20’s keynote speaker, serial entrepreneur and philanthropist Sir Richard Branson, delivered inspiration and laughs to a packed audience yesterday. He was interviewed by Nuno Sebastiao, CEO of Feedzai, which fights financial crime.

While over 20 years ago Branson founded Virgin Money, a sizable UK-based bank, he demonstrated clear discomfort and disinterest in talking about banking. When asked about finance, he said, “I brought notes,” and produced what looked like a thick chunk of papers from his pocket. When Sebastiao said, “moving out of the financial space,” Branson said “thank you!” which elicited a wave of laughter.

“I’ve seen situations in life that have frustrated me,” Branson said, and explained that Virgin Money is the result of a contract he was about to sign with a money management firm. He said that when he asked the investment firm what “bid offered 5%” meant, they got quiet. He then learned that it meant that they would take five percent of the amount he gave them before investing anything. Upset by that, he thought he could do better in financial services and he hired a banker to help launch the company.

Similarly, he said Virgin Airlines was born when he couldn’t get a flight from Puerto Rico to the Virgin Islands because the airline said there weren’t enough passengers that day. He thought he could do better.

Since he first saw a man walk on the moon, he said he always imagined that he and his family would go to the moon someday. But when he realized about 14 years ago that it didn’t look like that was going to happen, he created Virgin Galactic Airways, which is the first commercial rocket program to the moon.

“I registered Virgin Galactic Airways and Virgin Intergalactic Airways, because I’m quite an optimist,” Branson said, producing another wave of laughter.

After years of testing, in which one test pilot was killed, Branson said that he plans to go to the moon next year.

“We can’t leave it up to government to solve the world’s problems,” Branson said, conveying that businesses, small and large, must play a role in improving the world, whether it be on a local or international level.

At the close of the interview, to bring the topic back to finance, Branson said, “Hopefully I’ll learn a little more about banking for next time.”

Regulators Say ‘Sandboxes’ Work

October 22, 2018

At the regulatory technology (or RegTech) sessions at Money 20/20 yesterday, toy shovels seemed glaringly absent given the number of times the word “sandbox” was used. Of course, panelists were referring to a regulatory sandbox.

Nick Cook, Head of RegTech and Advanced Analytics at the Financial Conduct Authority in the UK, discussed his experience facilitating regulatory sandboxes. According to Cook, a regulatory sandbox is an arrangement between a company and a regulator where, in order to test the viability of a new business or product, the regulator grants some kind of allowance to the company for a fixed period of time in exchange for the regulator’s ability to observe carefully how the new business or technology works and behaves in the market.

“Whether you call it ‘sandbox’ or not, are you going to just talk about it, or are you going to encourage actual experimentation?” Cook posited to other regulators broadly. “Don’t kid yourself that standing still is an option.”

“I hope that states continue these sandboxes,” said Chris Camacho, President & CEO of the Greater Phoenix Economic Council.

Seated on two of the panels on regulation was Paul Watkins, who, as Civil Litigation Division Chief at the Arizona Office of the Attorney General, drafted and advocated for legislation that established the first Fintech Sandbox in the US. Watkins said that coordination between the federal and state regulators will be important moving forward.

One of the panelists was Melissa Koide, CEO of FinRegLab, a research organization that is designed to test new technologies to inform public policy, much like a sandbox.

“Regulators have anxiety about liability if something goes wrong,” Koide said. And she that therefore dialogue among regulators is very helpful, especially the ability for regulators to learn together.

“Regulators can’t innovate if they can’t experiment,” said JoAnn Barefoot, who moderated a few of the sessions. Barefoot is the co-founder of Hummingbird Regtech, a platform for anti-money laundering.

How Regulators Like to Be Approached

October 22, 2018

On the first day of Money 20/20 yesterday, a panel of current and former regulators discussed how the regulatory environment can help emerging fintech companies and how the leaders of such companies ought to interact with regulators. “How do regulators want to be approached?” was a question presented to the panel.

“The first person I hear from I don’t listen to,” said Paul Watkins, Director of the Office of Innovation for the U.S. Bureau of Consumer Financial Protection (BCFB). He clarified with deBanked after the panel discussion that this is in reference to his previous regulatory role as Civil Litigation Division Chief at the Arizona Office of the Attorney General. He said that this “first person” he doesn’t listen to refers to the lobbyist. Watkins continued: “The second person might have something interesting to say and the person who is quiet maybe knows what’s going on, and I’m interested to learn from them.” The “second person,” he explained, might be the CEO of a company and the “quiet person,” he said, would often be a non-senior level employee at a company who really sees what’s happening on the ground level.

Melissa Koide, who once served as the U.S. Treasury Department’s Deputy Assistant Secretary for Consumer Policy, said that she always appreciated hearing directly from the innovators themselves about their relationships with banks.

“It can be valuable to make trips to [visit regulators,]” Koide said.

Koide is now CEO of FinRegLab, a financial services research organization that examines how technology and data can help achieve public policy that leads to a more efficient and inclusive marketplace.

Chris Camacho, President and CEO of the Greater Phoenix Economic Council said that elected officials want to hear from industry leaders.

“Engage [legislators] thoughtfully and educate them,” Camacho said.

NYIC – IFA Northeast – AFBA – deBanked Conference Recap

October 17, 2018

Yesterday, the New York Institute of Credit (NYIC) hosted a conference in Manhattan with attendees from several segments of the commercial finance industry, including factoring, MCA, and asset based lending. Approximately 100 registrants gathered at Arno Ristorante in the garment district section of midtown. In addition to local New York firms, attendees travelled from as far as Chicago and California to be at the event.

“By all accounts, it was a big success,” said Harvey Gross, Executive Director of the NYIC, which recently celebrated its 100th anniversary. The half-day conference was a collaboration of the NYIC, the Alternative Finance Bar Association (AFBA), the IFA Northeast, and deBanked.

“The joint conference was truly groundbreaking,” said Lindsey Rohan, a cofounder of the AFBA, who also moderated a legal panel. “Having the various business models that make up the alternative finance space in the same room created an opportunity for honest and impactful conversation. While we only scratched the surface and I have many new questions, I’m confident that new business relationships were created and this will open the door to a continued exchange of ideas.”

Nineteen panelists, many of them executives at financial companies and lawyers, contributed to four panels that filled the afternoon with lively and thoughtful conversation. Regulations coming out of California and just recently from New Jersey, were hot topics of discussion.

deBanked founder Sean Murray moderated a panel on Best Practices. “These type of collaborative events are necessary as commercial finance offerings continue to expand. Education and debate create a more fluid marketplace,” Murray said.

Andrew Bertolina, whose company Finvoice offers factors and asset-based lenders a sleek software solution, said it was “great to see everyone at the Lending Conference and cross-pollination of MCA, factors and fintech players. Most cross-pollination at this IFA NYIC event than in prior factoring events.” Bertolina is the co-founder and CEO.

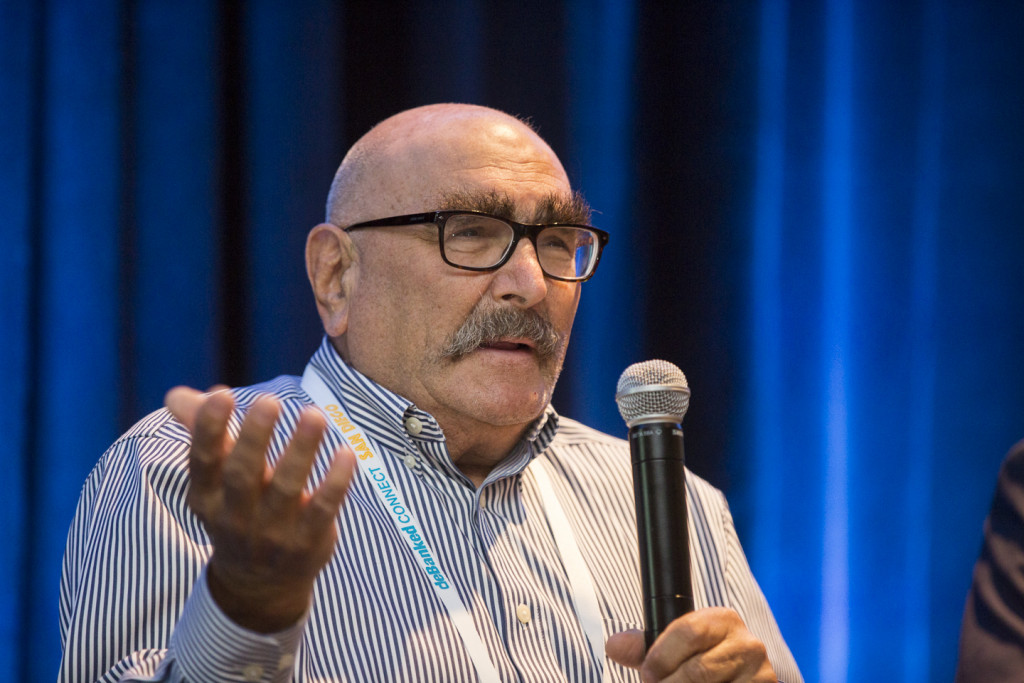

Robert Zadek, an attorney with Buchalter said, “that was a great meeting. It was so instructive to hear intelligent, honorable representatives of factoring and of alternative finance, who share clients and have overlapping products cordially comparing notes and sharing somewhat different views of the marketplace and the future of SMB financing. It is fascinating to see how much each can learn from the other, and to witness how such different financial products are moving towards each. The lesson – adapt or perish.”

The conference was sponsored by Change Capital, Finvoice, law firm Platzer, Swergold, Levine, Goldberg, Katz & Jaslow LLP, Aurous Financial, and Financial Poise.

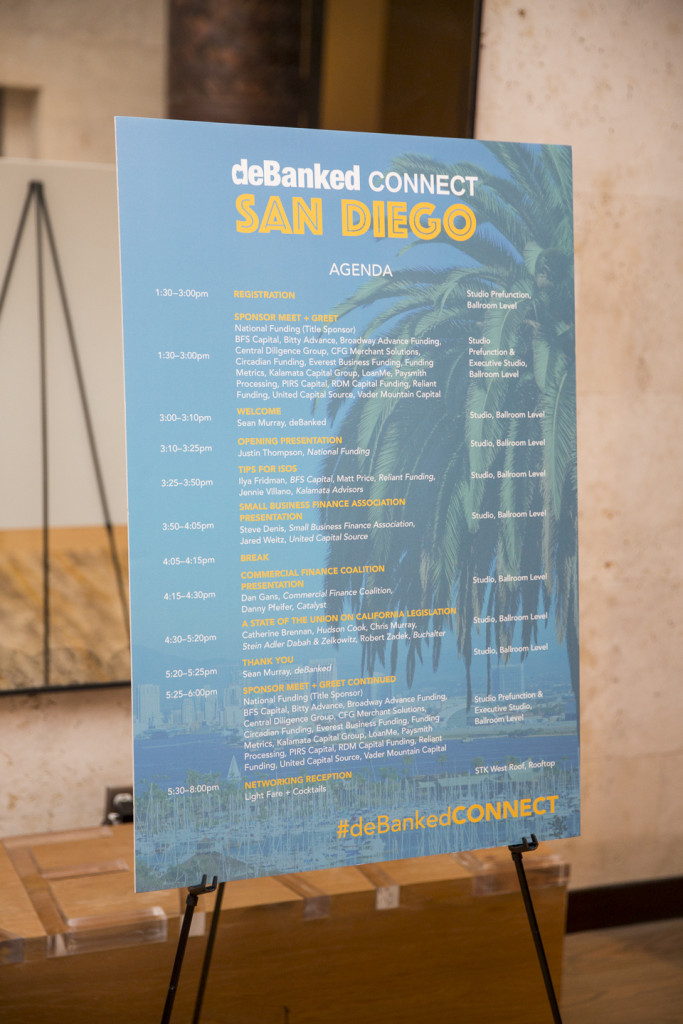

deBanked CONNECT San Diego PHOTOS

October 9, 2018

Brief deBanked San Diego Recap

October 6, 2018 More than 300 people attended the first deBanked CONNECT event on the west coast at the Andaz Hotel in San Diego. The half-day learning and networking conference drew people in the small business finance space from across the country, including New York, Philadelphia, Detroit, Houston, Salt Lake City, and cities in Florida and all throughout California.

More than 300 people attended the first deBanked CONNECT event on the west coast at the Andaz Hotel in San Diego. The half-day learning and networking conference drew people in the small business finance space from across the country, including New York, Philadelphia, Detroit, Houston, Salt Lake City, and cities in Florida and all throughout California.

Sam Bobley, CEO of Ocrolus, which provides technology solutions mostly to direct funders, was among the first to check in before the official start time at 1:30 p.m. He came in from New York.

“We went to Broker Fair in Brooklyn and made a lot of connections,” Bobley said. “We go to the other events, LendIt and Lend360, which are great, but they’re fairly broad. There, 1-2 out 5 people might be relevant [to online lending.] Here, everyone is. There’s no wasting time.”

“We went to Broker Fair in Brooklyn and made a lot of connections,” Bobley said. “We go to the other events, LendIt and Lend360, which are great, but they’re fairly broad. There, 1-2 out 5 people might be relevant [to online lending.] Here, everyone is. There’s no wasting time.”

The learning component of the day focused on sales and dealing with new regulations, primarily coming out of California.

“We wanted to learn about [the status of CA regulations],” said Kyle Readdick, CEO of Synergy Direct Solution in San Diego, a lead generator and funder in San Diego. “It’s obviously a concern.” He attended with his brother and CFO, Travis Readdick.

On the sales sides, Jennie Villano of Kalamata Advisors, Matt Price of Reliant Funding and Ilya Fridman of BFS, gave advice during the “Tips for ISOs” seminar. Technology and CRMs was one area of particular focus among the panelists as a must-have to scale.

“I’m so happy to be here,” said Mike Brooks, ISO relations manager with Smart Business Funding who flew in from New York. “I’m here to meet people, make contacts and make some money.”

Photos will follow soon. You should also follow us on instagram.