Banking

Again? Wells Fargo Fined $100 Million for Creating Fake Accounts

September 8, 2016The CFPB fines Wells Fargo, again — this time for opening unauthorized deposit and credit card accounts.

The agency fined the bank $100 million after employees opened “more than two million deposit and credit card accounts” unbeknownst to borrowers, racking up fees and charges, the CFPB said in a statement. Wells Fargo is also required to pay $2.5 million in customer refunds.

According to an internal analysis conducted by the bank, employees opened 1.5 million deposit accounts and 565,000 credit card accounts, issued debit cards and enrolled customers to online banking without consent, for bonuses and meeting sales goals.

“Wells Fargo employees secretly opened unauthorized accounts to hit sales targets and receive bonuses,” said CFPB Director Richard Cordray. “Because of the severity of these violations, Wells Fargo is paying the largest penalty the CFPB has ever imposed. Today’s action should serve notice to the entire industry that financial incentive programs, if not monitored carefully, carry serious risks that can have serious legal consequences.”

This is strike two for Wells Fargo from the CFPB which alleged that the bank indulged in illegal student loan practices by charging consumers illegal fees, not reporting credit score information accurately and a failure to provide adequate disclosures for payment information. The bank agreed to settle the case for $4 million.

Watch out Bank Tellers, Robots are Coming for your Job

March 31, 2016 Watch out bank tellers, robots are coming for your job.

Watch out bank tellers, robots are coming for your job.

Investment in private fintech companies and upstarts has grown ten fold from $1.8 billion in 2010 to $19 billion in 2015 and in the same time, bank staff has been slimming down as investors bet on automated finance to eventually overthrow banking. Already, 46 percent of private funding has gone to lending companies selling cheaper loans easily.

The ambition to oust bank behemoths however will need continuous fueling. As things stand now, these lenders are nowhere close to managing that coup. Revenue impact from the digital banking upstarts cause a one percent dent in the $850 billion global banking revenue.

It may be negligible but not to be neglected, investors might say. In the US, online lenders like Lending Club and Prosper Loans sold loans worth $8 billion last year and are looking at a target market of $254 billion, 8 percent of the total consumer credit market.

In its report, Citigroup predicts that US and European banks will shed 1.7 million jobs by 2025 as the banking sector undergoes its own “Uber moment,” forcing banks to automate some lines of business. Anthony Jenkins, former Barclays CEO translates this to halving the number of branches and people over the next few years. If this is an eventuality, different markets will take different paths to get there.

While Nordic and Dutch banks have cut total branch levels by around 50 percent from recent peak levels, branch openings in the top US cities including Seattle, Denver and Dallas have increased between 2-17 percent in the last five years. Part of the reason is because customers still have to visit a branch for identity verification but mostly the benefits (easy access, brand recall) of having a bank branch in wealthy states outweighs the costs involved. “With wealth concentrated in the top cities in the US, a strong branch presence in these cities allows banks to capture wealth,” the report said.

Though the transition of the branch’s role from transactions to advisory/consultancy is imminent, the pace has been gradual, about 11-13 percent since peak pre-crisis. That number could reach 30 percent by 2025. As for the US, there are 15 percent less tellers than there were in 2007.

But the banks want in and are willing to pay. Citigroup and Goldman Sachs have been active in seeding fintech rivals. In the last five years, Citigroup has invested in 13 companies including Square.

Is it time to make another David and Goliath reference?

Banks Admit They’re Scared of Startups

March 16, 2016If you cannot keep up with everything that is happening in fintech, you are not alone.

In the post financial crisis world, fintech startups perched themselves in the crevice between the big world of banks and the regulatory reform which controls their free reign. And since then, financial upstarts have only multiplied.

From P2P insurance, realty crowdfunding, marketplace loans and not to forget bitcoin, the capital infusion in fintech testifies for the market hype. In its report in November last year, CB Insights estimated that $24 billion has been invested in fintech startups and half that amount ($12.2 bn) was invested in 2015 alone.

It can be argued that some of these startups with multibillion dollar valuations are essentially smaller banks without the frills. Take SoFi for example, the San Francisco-based online lender is which worth $4 billion known for its touting we-are-not-a-bank image but provides most services from student loans, mortgage lending, personal loans to loan refinancing without the “bank branch.” The company also wants to start a hedge fund.

So, are the banks feeling left out? It depends on whom you ask, but a recent report from PwC surveying 544 CEOs, revealed that 23 percent believed their businesses were “at risk” by fintech innovation and 67 percent of the respondents said that they were under profit margin pressure.

“We thought we knew our customers, but FinTechs really know our customers,” the report quoted a senior bank official as saying. The report ranked consumer banking, payments and wealth management to be disrupted the most by these fintech startups.

The big bucks and the hype that follows it has made regulatory authorities sit up and take notice of the financial services upstarts and bring them under the supervisory purview. And while that may be legitimizing their foothold on the industry, the real questions around project revenues, possible exits and the companies’ wherewithal to handle a complex credit market remain unanswered.

Are we really at a tipping point of innovation or is it just new wine in old bottles?

You Can Ask Alexa to Pay Your Credit Card Bill – Will Loans Be Next?

March 11, 2016 Very soon, you will be able to pay your bills just a second after you turn on that thermostat.

Very soon, you will be able to pay your bills just a second after you turn on that thermostat.

Capital One and Amazon want to give Alexa, the “skill” to become your personal teller and allow the home automation device to pay your bills, check balances and review transactions.

Starting next week, Capital One customers will be able to use the app through Alexa and instruct the digital assistant.

“Alexa, ask Capital One for recent transactions on my checking account”

“Alexa, ask Capital One for my Quicksilver Card balance.”

“Alexa, ask Capital One to pay my credit card bill.”

Of course, security concerns will remain key as Internet Of Things slowly finds a way into people’s homes. But for now, Alexa can take care of that outstanding cellphone bill.

If the feature catches on, it will only be a matter of time before loans become a thing you can wish for out loud and have Alexa make a reality.

Credit Unions Beat Banks With Free Checking Accounts

March 8, 2016 Want a free checking account? Your best chance is still a credit union.

Want a free checking account? Your best chance is still a credit union.

A Bankrate report surveying 50 credit unions found that 38 of them offered free checking accounts.

The average credit union overdraft fee is $27 compared to $33 average charge at banks. When it came to ATM fees, 34 percent of the unions had no fee for out of network ATMs, or at least one free out-of-network withdrawal per week.

“At a time when free checking has become increasingly rare at large banks, it is still very prevalent among credit unions,” said Greg McBride, CFA, Bankrate.com’s chief financial analyst.

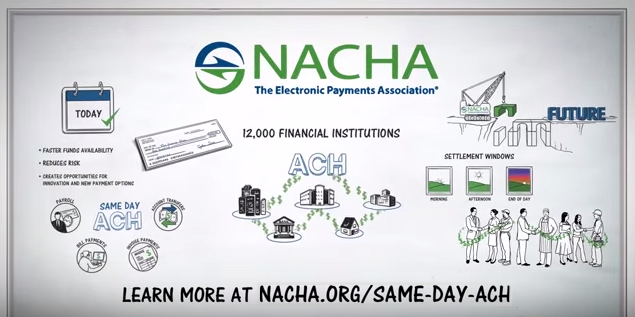

OMG: Same Day ACH

September 25, 2015 Coming soon, the ability to ACH funds same-day will finally exist. The change will be a boon to tech-based lenders that have become famous (or infamous) for their ability to approve and issue loans quickly. No matter how fast the systems have become however, the ACH network has continued to slow the process down.

Coming soon, the ability to ACH funds same-day will finally exist. The change will be a boon to tech-based lenders that have become famous (or infamous) for their ability to approve and issue loans quickly. No matter how fast the systems have become however, the ACH network has continued to slow the process down.

Next-day funding has long made borrowers skeptical about the online lenders they apply to and many applicants become anxious when they hear that the funds will be in their account tomorrow rather than today, after the deal has been closed.

Speaking from my own experience, there was almost nothing worse than telling a merchant that the funds had gone out and would be in their account the next day because they would disregard the last part of that statement and check their bank accounts immediately and of course would not see those funds. They’d immediately reach back out to me or the underwriter and say that they had been deceived because no money was there. This scenario played out on at least half of all the deals I ever worked on and it was awful.

And I’d remind them, “It’s an ACH. It’s overnight. It should be there in the morning depending on your bank. If for whatever reason it isn’t, give me a call.”

Even after repeating myself, I’d often get an email later that day at 6 pm (bank closing time) to say that they were at the bank and the teller has just told them that they don’t see any incoming wires.

So many merchants just could not believe that a tech-based funding company could not make the money appear instantly in their account and every passing second caused them more anxiety and fear that they had been tricked.

Enter Same Day ACH, which is slated to launch in September 2016. According to the National Automated Clearing House Association (NACHA), who governs the ACH network, there will be two settlement times.

A morning submission deadline at 10:30 AM ET, with settlement occurring at 1:00 PM.

An afternoon submission deadline at 3:00 PM ET, with settlement occurring at 5:00 PM.

Virtually all types of ACH payments, including both credits and debits, would be eligible for same-day processing, according to their announcement.

The industry can’t get Same Day ACH fast enough!

And if you thought you were excited about ACHing, just watch the below video produced by NACHA about how awesome their network is.

Dodd-Frank and More Paperwork Make Lending Harder

September 19, 2015 It’s not just alternative lenders that have concerns about Dodd-Frank, Section 1071 and the CFPB. Several community bankers recently testified in front of The House Committee on Small Business Subcommittee on Economic Growth, Tax and Capital Access to explain just how detrimental regulations have been to their lending operations.

It’s not just alternative lenders that have concerns about Dodd-Frank, Section 1071 and the CFPB. Several community bankers recently testified in front of The House Committee on Small Business Subcommittee on Economic Growth, Tax and Capital Access to explain just how detrimental regulations have been to their lending operations.

While the discussion encompassed all types of lending including consumer mortgages, B. Doyle Mitchell Jr, the CEO of Industrial Bank said that, “Dodd-Frank was intended for maybe 50 to 100 institutions. It was not intended for mainstream institutions, minority banks around the country.” Mitchell was speaking on behalf of the Independent Community Bankers of America (ICBA).

While repeatedly making the case about how important community banks were to local communities, he explained that Dodd-Frank had not helped them achieve their goals. “It has only increased our costs,” he testified.

Mitchell also expressed a feeling of perpetual anxiety over the loans they make, worrying that a regulator will not like them.

Dixies FCU CEO Scott Eagerton, who was there speaking on behalf of the National Association of Federal Credit Unions (NAFCU) said, “I really feel like we’re getting away from helping people and making sure that we make the loans that Washington agrees with and I think that needs to change.”

While alternative lenders were not on the agenda, the subject of government mandated transparency and its intent to help make things easier for borrowers is both timely and relevant. Referencing some of the new disclosures required in loan documents by Dodd-Frank and/or the CFPB, Congressman Trent Kelly asked if all the added pages to loan agreements make it easier for their customers to understand.

“Do they understand what they’re signing?” he asked.

Mitchell responded that they do not. “It is not any more clear,” he answered. “In fact it is even more cumbersome for them now.”

Regulators should pay special attention to this especially in light of a Federal Reserve study that came to the same conclusion. In Alternative lending: through the eyes of “Mom & Pop” Small-Business Owners, small business owners were asked if they understood financing terms offered by typical online lenders. The feedback was overwhelmingly positive that they did. But when asked a trick question about annual percentage rates, most got confused. While some advocacy groups interpreted this to mean that small business owners are confused by online lenders, it actually offers pretty compelling evidence to the contrary. A future standard of government mandated transparency as it relates to annual percentage rates would only serve to make it harder for small businesses to understand contracts, not easier.

Both Eagerton and Mitchell made the case that increased compliance costs undermined the ability of community banks to grow the economy. “You cannot expect a trillion dollar institution to focus on hundred thousand dollar loans,” Mitchell said. And Subcommittee Chairman Tom Rice said, “the burdens created by Dodd-Frank are causing many small financial institutions to merge with larger entities or shut their doors completely, resulting in far fewer options where there were already not many options to choose from.”

Both Eagerton and Mitchell made the case that increased compliance costs undermined the ability of community banks to grow the economy. “You cannot expect a trillion dollar institution to focus on hundred thousand dollar loans,” Mitchell said. And Subcommittee Chairman Tom Rice said, “the burdens created by Dodd-Frank are causing many small financial institutions to merge with larger entities or shut their doors completely, resulting in far fewer options where there were already not many options to choose from.”

Eagerton argued that,”lawmakers and regulators readily agree that credit unions did not participate in the reckless activities that led to the financial crisis, so they shouldn’t be caught in the crosshairs of regulations aimed at those entities that did. Unfortunately, that has not been the case thus far. Accordingly, finding ways to cut-down on burdensome and unnecessary regulatory compliance costs is a chief priority of NAFCU members.”

But Congressman Donald Payne, Jr wondered why the ICBA was objecting to Section 1071 of Dodd-Frank, the part that grants the CFPB authority to collect certain pieces of data from financial institutions. Regulation B of Section 1071, for those that aren’t aware, was intended to study gender, racial and ethnic discrimination in small business lending.

Payne likened the law to The Home Mortgage Disclosure Act (HMDA), pronounced HUM-DUH, in which raw data is disclosed to the public but no penalties are specifically imposed if the data leans one way or another.

Mitchell responded to that by saying HMDA was a good example of something that was already very burdensome and another reason why Section 1071 was a bad idea. “While there is a clear need to outlaw discrimination at any level, I don’t think [this law is] necessary for community institutions,” he said. He pointed out that his bank could suffer reputational damage in the community by disclosing the gender and racial statistics of their business loans to the public at large.

While he did not expand on what he meant by reputational risk, one could fill in the blank that he meant the context that such data would lack. For example, if 75% of Hispanic-owned businesses were declined for business loans while only 25% of African-American-owned businesses were declined for business loans, one might infer from that raw data that there is potential discrimination taking place. Since small business loans are less FICO driven than consumer lending and focused more on the story of the business and the projected financial future, it is impossible to infer anything from raw data as it relates to discrimination.

“Simply put, Dodd-Frank needs to be streamlined,” said Marshall Lux, Cambridge, MA, John F. Kennedy School of Government, Harvard University.

And “the problem with Dodd-Frank,” Mitchell voiced, “is you cannot outlaw and you cannot regulate a corporation’s motivation to drive profit at all costs so while it had a lot of great intentions in over a thousand pages it has not helped us serve our customers any better.”

You can watch the full hearing below:

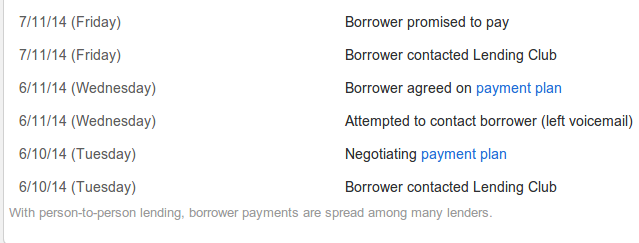

About 1% of my LendingClub consumer loan portfolio bounces their very first payment. It’s discouraging stuff, especially considering these loans range between 3 and 5 years. Granted, most manage to get caught back up at least for a little while.

About 1% of my LendingClub consumer loan portfolio bounces their very first payment. It’s discouraging stuff, especially considering these loans range between 3 and 5 years. Granted, most manage to get caught back up at least for a little while.

The Missing Puzzle Pieces

The Missing Puzzle Pieces