Funding Circle Report Shows Demand for Alternative Financing

June 14, 2018Funding Circle, together with Oxford Economics, released a report this week using data from its customers last year. Funding Circle is a business loan platform that matches small business borrowers with investors that want to lend. Some of these findings may be reflective of the broader alternative finance market.

Data from the report conveys that there is an increased appetite among small business merchants for online lending products. Of the small business customers surveyed, 70 percent did not attempt to get a bank loan before applying for an alternative loan from the Funding Circle platform. The main reason for this, cited by more than three-quarters of these customers, was a perception that the bank loan process would be too burdensome. Another nine percent skipped banks because they said they thought they would be rejected.

Of the businesses that had first approached a bank before seeking funding from Funding Circle, 50 percent said they didn’t obtain a bank loan because their application was rejected. Another 36 percent responded that the bank loan process took too long, and seven percent felt that the bank’s rates and fees were too high.

When asked about the impact of not receiving funding through Funding Circle (or we can imagine a different online funder), the most common response, given by 27 percent of respondents, was that they would have missed an opportunity. After this, 22 percent believed they would not be able to consolidate their debt and 16 percent thought that they would not have been able to achieve profit growth.

Loan volume in the U.S. rose significantly for Funding Circle last year. A total of $509 million in new loans were issued in the U.S. in 2017, an increase of 80 percent from $281 million issued the previous year.

“It has become evident that small businesses are underserved in every country we operate,” said Funding Circle co-founder and CEO Samir Desai. “From butchers and bakers, to IT consultants and accountants, these are the businesses that are creating jobs, boosting productivity and driving our economies forward. The economic impact that these businesses have had as a result of accessing finance through Funding Circle is hugely rewarding to see.”

Founded in 2010, Funding Circle has helped 40,000 small businesses find financing. The company operates in the U.S., U.K., Germany and the Netherlands.

Lending Express Opens Office in Silicon Valley

June 13, 2018 Tel Aviv-based Lending Express announced its entrance into the U.S. market yesterday. It opened an office in San Matteo, CA and has officially appointed Moshe Kazimirsky as VP of Strategic Partnerships and Business Development to support the new West Coast office.

Tel Aviv-based Lending Express announced its entrance into the U.S. market yesterday. It opened an office in San Matteo, CA and has officially appointed Moshe Kazimirsky as VP of Strategic Partnerships and Business Development to support the new West Coast office.

“After the immense success we’ve had in the Australian market, we knew that our platform was ready to take on the U.S.,” said Lending Express CEO Eden Amirav.

Lending Express initially launched its business in Australia in October 2016. The company provides an online marketplace that connects merchants to alternative funders. After only a year and a half, Amirav told deBanked that Lending Express is now the largest business of its kind in Australia – even though they only set foot on the continent a month ago.

Meanwhile, Lending Express has also been operating in the U.S. for months and has already partnered with leading online lenders like OnDeck, Kabbage and Fundbox, according to Amirav. Given the company’s experience in both the Australian and American markets, deBanked asked Amirav what he thought the differences were.

“In general, they are much more similar than people think,” Amirav said. “But in the U.S., people like to look around more.”

Generally, if an Australian merchant is approved, they will move forward with the deal right away, Amirav said. Lending Express offers a myriad of products on its platform, including equipment financing, invoice funding, business line of credit and merchant cash advance.

So far, Kazimirsky, who has worked in business development for other Silicon Valley technology companies, will be the only one in the new California office. But Amirav anticipates that the office with grow. The Lending Express office in Tel Aviv has 25 employees, many of whom – namely the account managers – start their day at 3 a.m. in order to speak to their Australian and American customers in different time zones.

Lending Express uses an algorithmic system called MatchScore to pair borrowers with lenders.

Equipment Leasing Report Foresees Rising Inflation and Interest Rates

June 12, 2018 The Equipment Leasing and Finance Foundation issued a report called “How Inflationary Pressures and Rising Interest Rates Could Impact the Equipment Finance Industry.”

The Equipment Leasing and Finance Foundation issued a report called “How Inflationary Pressures and Rising Interest Rates Could Impact the Equipment Finance Industry.”

Given its name, the report is fairly self-explanatory. Its premise is that within the next one to three years there is likely to be a rise in inflation and interest rates which may affect the equipment finance industry, including customer demand, portfolio performance, spreads, and the propensity to finance.

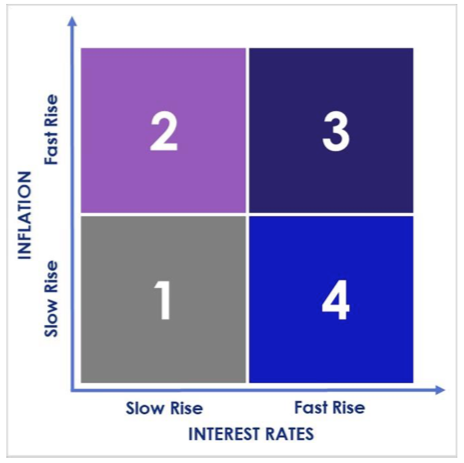

The report conveys three potential scenarios regarding inflation and interest rates. Scenario #1 is “Status Quo,” or a continuation of low interest rates and inflation levels. This would place the economy in quadrant 1 of the accompanying chart.

Scenario #2 is “Breakout Inflation Prompts Strong Fed Response.” According to the report, in this scenario, inflation rises quickly, moving in quadrant 2. Then, in order to slow inflation, the Fed raises interest rates and the economy moves into quadrant 3.

What would this Scenario #2 look like for the equipment leasing industry? Among other outcomes, the report said that “equipment end-users are better able to make payments when their revenues are being driven up by higher prices, but their equipment payments are fixed.” This is a good thing for the industry, but may be a double-edged sword because, with more cash on hand, customers may be more likely to buy equipment, rather than lease it.

Scenario #3 is “Aggressive Fed Action While Inflation Lags.” This would put the economy in quadrant 4 with rising interest rates, but slow inflation. According to the report, this could create an environment where “real interest rates are rising in the absence of persistently strong economic growth, [and] business confidence is likely to fall.” This would translate to a falling demand for investment and a decline for the industry.

Established in 1989, the Equipment Leasing & Finance Foundation is a non-profit dedicated to inspiring innovation and contributing to the improvement of the equipment leasing and finance industries.

New York Institute of Credit Celebrates 100 Years and Honors Harvey Gross

June 12, 2018 About 300 people gathered underneath the soaring ceilings of Guastavino’s ballroom in Manhattan last night to celebrate the 100th anniversary of the New York Institute of Credit (NYIC). Most attendees were members of the association, which provides networking opportunities and education to a myriad of constituents, including factors, financial advisors, lawyers, investors and accountants.

About 300 people gathered underneath the soaring ceilings of Guastavino’s ballroom in Manhattan last night to celebrate the 100th anniversary of the New York Institute of Credit (NYIC). Most attendees were members of the association, which provides networking opportunities and education to a myriad of constituents, including factors, financial advisors, lawyers, investors and accountants.

“[NYIC] is one of the few meeting places that brings judges, investors and professionals together,” said Jack Butler, CEO of Birch Lake, a boutique merchant bank based in Chicago.

In addition to Butler, other members, like Maxwell Cohen, traveled to attend to event. Cohen works in Fort Lauderdale, FL as Managing Partner for Corporate Strategy & Financial Consulting LLC and specializes in underwriting and brokering business loans.

“[NYIC] is great because it connects people in similar sandboxes…and sometimes we can build off each other’s strengths, ” Cohen said. “Everyone here is verified [and] if you’re here, we know you have capabilities to deliver.”

A central part the NYIC centennial celebration was the honoring of the organization’s Executive Director, Harvey Gross, who has worked for organization for 54 years.

A central part the NYIC centennial celebration was the honoring of the organization’s Executive Director, Harvey Gross, who has worked for organization for 54 years.

A montage video of congratulations to Gross included praises from New York judges and others, including:

“He has a way of putting people together that produces spectacular results.”

“He’s been a mentor to so many.”

“Harvey has communicated best practices.”

“Some organizations looks inward. NYIC looks outward, because of Harvey’s leadership.”

“To talk about 54 years in five minutes is not easy, but I will try,” Gross said to the audience upon receiving the award. He explained that when he was 12 years old, his brother suggested that he get into the factoring business. He later told deBanked that he spent the next five or so years learning the business and left school by the time he was 18 to start a career in factoring. When he started working for the NYIC, the organization primarily served the factoring business, and has since expanded.

“I think tonight showed that the NYIC went through a lot of transitions over the last 100 years,” Gross told deBanked. “And we’re excited about new transitions in the next 100 years. And that includes MCA and fintech.”

Second Annual Alternative Finance Bar Association Conference Draws Lawyers from Afar

June 11, 2018 Attorneys who represent alternative finance companies congregated in New York on Friday for the second annual conference of the Alternative Finance Bar Association (AFBA.)

Attorneys who represent alternative finance companies congregated in New York on Friday for the second annual conference of the Alternative Finance Bar Association (AFBA.)

They came for a day of learning about the latest legal developments pertaining to alternative finance, and MCA in particular. Seminars at the conference had names like: “Credit Facilities 101: What an Alternative Finance Company Can Expect,” “Syndication Relationships: Partner? Participant? Investor?” and “Bankruptcy Developments: The Rise of the Adversary Proceeding.”

“I think it’s like heaven for a new attorney in the MCA world,” said Judith Ramos, who is Corporate Counsel at McKenzie Capital in the Miami area.

Another attorney somewhat new to the MCA space and eager to learn more was Alexis Shapiro, General Counsel at Forward Financing in Boston.

“This was one stop shopping to learn about the latest legal developments in the MCA industry,” Shapiro said.

In one seminar, called “Updates on Recent Case Law,” attorney panelists Steven Berkovitch of ABF Servicing and Adam Stein and Christopher Murray of Stein Adler Dabah and Zelkowitz, discussed the positive impact of the Pearl Beta Funding v Champion Auto Sales decision in New York. They spoke about how judges have dismissed lawsuits against their MCA clients by referencing this decision, which establishes that MCA deals are not loans.

Murray reviewed the current climate with regard to MCA cases in New York, California, Texas and Utah. And one panelist emphasized the importance of simply being knowledgeable about the industry by relating a story of an MCA defense lawyer who, when asked by a judge about the interest rate on a particular MCA deal, fumbled and gave a percentage. (MCA deals do not have interest rates given that payments are subject to change over time).

Later, Gregory Nowak, a partner at Pepper Hamilton, entertained the crowd with a few jokes before diving into the details and the risks of syndication. The conference was held at New York offices of Pepper Hamilton, with expansive views of the Hudson River.

Later, Gregory Nowak, a partner at Pepper Hamilton, entertained the crowd with a few jokes before diving into the details and the risks of syndication. The conference was held at New York offices of Pepper Hamilton, with expansive views of the Hudson River.

“We are energized by the response of so many attorneys from different backgrounds in this emerging and evolving industry,” said one of founders of the AFBA, Lindsey Rohan, General Counsel at Platinum Rapid Funding Group in Long Island.

AFBA’s other founders are Kate Fisher, partner at Hudson Cook outside of Baltimore, Patrick Siegfried, Assistant General Counsel at Rapid Advance in Bethesda, MD, and Murray, attorney at Stein Adler outside of New York City.

Robert Cook, one of Hudson Cook’s founding partners, was at the conference. He told deBanked that he remembered back in 2006 when an investment bank client asked his firm to do due diligence on a merchant cash advance company.

Robert Cook, one of Hudson Cook’s founding partners, was at the conference. He told deBanked that he remembered back in 2006 when an investment bank client asked his firm to do due diligence on a merchant cash advance company.

“We didn’t know what that was,” Cook said. “The client looked around for a law firm that had experience with MCAs. They couldn’t find any. So they came back to us and said, ‘You’re going to have to learn.’”

More than a decade later, MCA is no longer so obscure and the AFBA has at least three more planned events in 2018. The next event will be a cocktail reception on October 24th.

For more information, contact: Tiffany@LRohanlaw.com

deBanked was also a sponsor of the second annual AFBA conference.

US Business Funding Will Retain Name & Special Sauce in Wake of Fora Deal

June 8, 2018Fora Financial’s announcement yesterday that it acquired a sizable stake in US Business Funding (USBF) will create one of the “largest, broadest reaching direct sales organizations in the small business alternative lending space,” the company said in a statement.

USBF is a direct sales and marketing company of about 40 to 50 people. Fora Financial founder and CEO told deBanked that his company started working with USBF to obtain leads two years ago and that this acquisition has been in the works for between 12 to 18 months.

Jared Feldman, CEO, Fora Financial

Jared Feldman, CEO, Fora Financial“We were looking for a team that does direct sales and marketing that complements what we do,” Feldman said. “And they’re one of the best at [direct marketing] in the business.”

USBF is based in Santa Ana, CA, and has connected customers to financing since 2008, with an emphasis originally on equipment financing. In 2012, they started facilitating working capital deals and that now makes up 85 percent of the company’s business, according to its CEO Peter Ribeiro.

They provide financing solutions ranging from $10,000 to $10 million. Fora Financial, also established in 2008, is a New York-based funding company that funds MCA deals and provides small business loans up to $500,000.

Consistent with yesterday’s announcement, Feldman said that with Fora Financial and USBF combined, they will likely originate $400 million year. Feldman told deBanked today that, of this amount, about $300 million should come from direct sales.

“We’re more heavily weighted towards direct sales,” Feldman said.

Formerly a company of 100, the new entity will now include about 150 employees and will share resources like capital, technology and access to help with compliance, Feldman said. USBF will retain its name, location and all of its employees.

“We wouldn’t have done this deal unless Peter [USBF founder and CEO] and his team agreed to stay on,” Feldman said. “They have a fantastic brand and we want to avoid getting in their way. We just want to help them to continue doing what they do.”

Feldman said that while USBF will retain its name, “we’re now a combined entity with an east and west coast operation.”

Fora Financial acquired USBF because it did something unique, and Feldman said that Fora is looking for opportunities to acquire other companies that do uniques things in the financing space.

BlueVine Raises $60 Million in Major Equity Deal

June 7, 2018

BlueVine announced this week that it closed $60 million in equity funding, the company’s largest funding round to date. The series E round was led by Menlo Ventures and includes new investors, including SVB Capital. All major existing investors also participated.

This new financing will be used to expand the company’s current invoice factoring and business line of credit products, and to develop new products.

“Our vision is to let our customers guide us,” BlueVine Chief Revenue Officer Eric Sager told deBanked, with regard to what products might come next.

BlueVine also plans to use the funding to accelerate R&D hiring. BlueVine’s total funded volume since inception is expected to top $1 billion this year, according to the company’s press release.

“In just four years, BlueVine has scaled two major financing products,” said BlueVine CEO and founder Eyal Lifshitz.

Founded in 2013, the company started with a factoring product and later introduced a line of credit product. BlueVine provides business lines of credit up to $250,000 and invoice factoring lines up to $5 million. These maximum credit lines have been steadily increasing, with the factoring line of credit twice as large as it was at the beginning of the year, according to a deBanked story from February. And its business line of credit was $150,000 at the start of the year.

The company generates its revenue about 50-50 from its factoring and line of credit products, and about 50 percent of its factoring clients also use its line of credit product, Sager said.

This new $60 million investment follows a credit facility of $200 million with Credit Suisse last month.

“BlueVine has continued to impress us since we first invested in 2015,” said Tyler Sosin, a partner at Menlo Ventures, in a written statement. “The company has demonstrated dramatic, sustainable growth and has proven that there is enduring value in developing a comprehensive offering of credit products that small and medium sized businesses can use throughout their lifetimes.”

Headquartered in Redwood City, CA, BlueVine also has offices in New Orleans, Jersey City and Tel Aviv, and employs approximately 200 people.

SuperMoney Launches No-fee Financing Platform

June 7, 2018At the Finovate Spring 2018 conference, CEO Miron Lulic and CFO Jesse Stockwell presented the company’s new SuperMoney No-fee Financing platform, which allows merchants to obtain point of sale financing from online lenders and banks.

“The options for small business point of sale financing are embarrassingly archaic and painfully expensive,” Stockwell said during their presentation. “In the current market, consumers lose, merchants lose and most lenders don’t even get a chance to play.”

The new platform allows a small business merchant, like a furniture store, to create a free profile that is co-branded with SuperMoney. With the profile, the merchant can easily see when a customer has applied for financing and follow up.

In addition to a sales boost for small businesses that can now offer financing to customers for free, Stockwell said that customers also win by being able to compare financing options. And he said that it’s a boon for lenders as well, as a high quality loan source.

According to a Forrester Consulting study on SuperMoney’s website, businesses that offer point of sale financing enjoy an average increase in sales of 17 percent and an average increase in order value of 15 percent.

The No-fee Financing platform is an expansion of SuperMoney’s core business as a financial services comparison platform. The platform will at first provide point of sale financing to three industries: home improvement, medical and trade schooling.

In May, Stockwell said that the company, which was founded in 2013, had signed up 250 merchants in a closed beta program.

“Now we’re ready to blow the cover off this thing and sign up 10,000 more [merchants] in the next year alone,” Stockwell said.