Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.

Articles by Sean Murray

Getting Backdoored? Put Your Mark on the Docs

April 30, 2025Christina Duncan was once working on a renewal as an MCA broker when things turned south. Her client suddenly received so many calls with offers for funding that they had to turn their phone off.

“[The client] eventually reached out to us via email and basically said, ‘Hey I don’t know what’s going on but these people are saying they’re with you and they have my bank statements. I’m really concerned,'” Duncan said.

Duncan’s renewal had been backdoored. It was hardly the first time, and she was hardly the only victim. As many in the industry often complain, it has become a growing trend in which a broker submits a client’s deal and it somehow slips out the back door into the hands of a third party. The broker then ends up competing on their own deal, or they lose out on it completely. And that’s how many brokers see it—as something that happened to them. But there’s also the business owner who is now left wondering how their data ended up in the wrong hands and what to do about it.

In the above example, Duncan tried to help the client learn how an unauthorized party came into possession of those bank statements, but she was simply hung up on and blocked. It was a dead end.

“So those are the situations that we encounter every day and it’s tough to navigate,” she said.

Born in San Jose, CA and based in San Francisco, Duncan has seen it all. She started in equipment financing more than 15 years ago and gradually shifted into brokering MCAs. When complaints about backdooring began to crop up, everyone had their own opinion on the cause.

“I’ve seen people get caught up on just trying to point the finger or use backdooring as an excuse for their lack of success,” Duncan said, “But the reality is that it is very real. I’m a part of the DailyFunder forum. I see people talking about it all the time but there just hasn’t really been an efficient way to deal with it.”

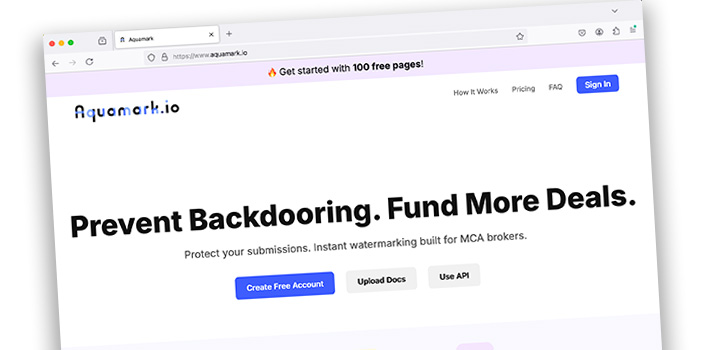

But then she came up with a solution: Aquamark, a defensive watermarking tool that differs from other tactics employed across the industry to reduce the risk of backdooring. It allows brokers to permanently stamp the documents as having originated from them.

With the assistance of AI and a small team, Duncan left the broker world behind to go full-time into developing the technology, which she said can be used on all the documents in the process.

With the assistance of AI and a small team, Duncan left the broker world behind to go full-time into developing the technology, which she said can be used on all the documents in the process.

“It’s not just the bank statements, it’s tax returns, your application,” Duncan said. “What’s happening is it’s someone who has access to these submissions, these packages, and it very well could be internal, someone on your team, it could be a lender and the lender doesn’t know that…”

So it’s not only a problem, but one that can happen at multiple levels in the process. The Aquamark tool, still in its early days but already being used by funders and brokers, can apply custom-branded watermarks onto PDF files with ease. On the one hand, she said, the tool had to be designed to prevent AI from removing the watermarks, and on the other hand it had to work with encrypted statements. When she solved both challenges, she knew she had something. Now, brokers simply upload their documents through the portal, and the platform returns them in seconds.

“By design, I built this in a way that it’s very lightweight and it’s self-service,” Duncan said. “You don’t really need me to do anything and more importantly we’re not storing anything. So essentially you’re uploading your documents and I’m giving it back to you. There’s no logs, there’s no history, none of that is happening behind the scenes.”

The company’s mission statement is a simple one: “Prevent Backdooring. Fund More Deals.”

As Duncan explains, lenders might not even know that a deal they’ve received has been backdoored because the submitting party doesn’t always make it obvious where they got it.

“It’s tough, especially in this environment with all the competition, cost to acquire customers are through the roof, and you lose that,” she said. “It sucks. And honestly it’s so frustrating because aside from it being [how brokers make their money], for the merchants it puts that bad taste in their mouth in the industry. And it’s very real. And so I just wanted to come out with something that—again, the MCA industry gave me a lot and this just feels like a way to give back, as cheesy as that sounds.”

deBanked Returns as Sponsor of CAFE’s Fintech Accelerator

April 14, 2025deBanked is sponsoring CAFE’s Fintech Accelerator program for the Spring 2025 Cohort. This is the 2nd cohort that deBanked has been a sponsor of.

“The accelerator offers a hands-on, immersive two month experience where mission-driven founders gain direct exposure to financial institutions, regulators, and investors who are eager to collaborate.”

“With expert-led sessions, customer pitch opportunities and a strong community of like-minded innovators, CAFE provides a scaling opportunity for startups to accelerate growth, navigate complex industry landscapes, and drive meaningful financial inclusion.”

The spring 2025 Cohort companies include DubPrime, GoodTrust, SPARE, Starlight, TAZI, and Trackstar.

The sponsors include Best Egg, American Bankers Association, Cohen Circle, deBanked, Delaware Technology Park, JPMorgan, Discover, Growthstage Incubator, NayaOne, and Wolf & Company, P.C.

To learn more visit: https://ftcafe.org/apply/

Going All In: How Joe Sasson Saw the Opportunity of Being a Broker Early On

April 7, 2025 “For me, the biggest approach to the industry that I took was honoring integrity and transparency to our clients more than anything else.” That’s what Joe Sasson, Chief Sales Officer at Advance Funds Network (AFN), attributes his success to in the small business finance industry. Sasson saw the vision and the potential of this business at a younger age than most of his peers. That’s because he started as a summer intern for AFN right before his freshman year of college at George Washington University, when he was only 18.

“For me, the biggest approach to the industry that I took was honoring integrity and transparency to our clients more than anything else.” That’s what Joe Sasson, Chief Sales Officer at Advance Funds Network (AFN), attributes his success to in the small business finance industry. Sasson saw the vision and the potential of this business at a younger age than most of his peers. That’s because he started as a summer intern for AFN right before his freshman year of college at George Washington University, when he was only 18.

“I said I could use some money, obviously, going into school being a freshman, so why not?” Sasson explained. “And then I really enjoyed it that summer. I kind of discovered that sales is kind of a knack for me, and correlates well with the way I like to operate, the way I like to do things. So it kind of just stuck with me.”

The company had a mutually good feeling about his abilities, and they agreed to extend the arrangement, which consisted mostly of making sales calls, even while he was in school. By the time summer rolled around again, they handed him the reins for the entire internship program. The student was now the teacher for 20-25 eager high school juniors and seniors hoping to learn the ropes, an experience he recalls fondly. That was in 2019, and its impact is still felt today since some of those interns are still with AFN. But it was a crossroads for Sasson because his college curriculum required him to be in Washington, D.C., but AFN’s office was in New York. Ultimately, he said his eyes had been opened to the opportunity.

“I saw that our company really had the right values and the right approach to the way we do things,” Sasson said. “Thank G-d I was I was able to kind of recognize that early and that I was working with really good people.”

Sasson transferred to Baruch in New York, a school much closer to AFN. It was a move that paid off since he’s risen up to become part of the C-suite. His day-to-day is managing new business, overseeing dozens of agents, and helping them out wherever he can. That means at any given moment he could be giving advice, helping an agent finish a deal, or on the phone with a lender. Knowing a lender’s box is only part of it, as he says that relationships play an important role in AFN’s success.

Last year, when AFN’s Chief Revenue Officer, Irving Betesh, had earned a spot as one of six finalists to compete in the live inaugural Broker Battle at deBanked CONNECT Miami, it was Sasson who roleplayed with him to practice beforehand, which they did in front of the whole company as both a teaching experience and entertainment. As fate would have it, the roles reversed because it was Sasson himself who ended up on stage in person for Broker Battle 2 this past February, where he secured the runner-up position in a strong matchup after he made it to the championship.

Roleplaying and practice are important at AFN. Sasson said that the company is really good at training new talent, regularly conducts fun motivational contests, and even hosts an annual retreat to get the team out of the office and away from the grind, though sometimes they find themselves having to handle a deal or two on the beach, an unavoidable part of the business even though they definitely try to wind down.

As someone who’s been in the business since before the Covid era, he’s seen a remarkable amount of change. In his opinion, less expensive options, more creative options, and quicker options are now more widely available than when he started. That means he and others have to constantly stay on top of what’s changing and be able to deliver to their clients. That also means knowing what all their lenders are doing, staying on top of AI, monitoring the tariff situation, and more.

Through it all, doing good business with good people seems to be a recurring theme, whether that be the internal team or partners they work with.

“I’ve been doing this for a while now, quite well,” Sasson said. “And I would say, since I started seven years ago, we do a lot of business with a lot of the same people still. So for us, the relationships really do matter more than anything else.”

How AI is Scaling a Veteran Small Business Financing Brokerage to New Heights

March 19, 2025 “There are [AI] voice systems out there that have just blown me away,” said Cheryl Tibbs, owner of Atlanta-based Commercial Capital Connect. “So we are using those and I’m implementing some in my office in my day to day—we have an AI receptionist that answers the phone, it just frees up time.”

“There are [AI] voice systems out there that have just blown me away,” said Cheryl Tibbs, owner of Atlanta-based Commercial Capital Connect. “So we are using those and I’m implementing some in my office in my day to day—we have an AI receptionist that answers the phone, it just frees up time.”

As a broker, Tibbs recognizes the value of being able to answer a potential client anytime, anywhere, but there needs to be time to sleep, train others, and expand as well. And thanks to the advent of actual AI, it’s now become increasingly possible to scale on multiple fronts where it wasn’t before. Tibbs told deBanked that she’s been using AI to duplicate herself across anything she can.

“So we train these models on everything about our business, everything about us, and it can just answer questions, either through chat or having a conversation,” she said.

AI can call leads or qualify a customer through online chat at three in the morning if need be—not theoretically; it’s doing it for her already.

“Some mornings I wake up, I see full conversations between the conversational AI and somebody that filled out a lead form,” she said. “The chat agent has the ability to send them a text message with our full application link, or book them on our calendar.”

But more customers coming in the door means more questions from her team about where to place a deal. She’s got a solution for that, a bot she created named BrokerBuddy that can answer on her behalf when she’s not available to do it herself.

“I trained it on most of the lender guidelines that we work with, so they can just go in and just type a question, you know, ‘hey, BrokerBuddy, I’ve got a customer with a 680 FICO score.’ He says, ‘two years time in business, looking to buy a $40,000 skid steer. What else should I ask him? Which lender in our organization do you think will do this deal?'”

There’s a role for AI to just skip the questions and place a deal all by itself using advanced algorithms, something many tech companies tout these days, but the human nuance is a key component to her service, since any deal could be equipment financing, SBA, or working capital rather than solely one thing. It’s not always immediately obvious which one it’s going to be or what the customer would prefer. Way back in the day, Tibbs started purely with MCAs, back when they could only be done via a credit card machine. Since then she added equipment financing, working capital loans, and SBAs. For a long time now, she’s offered it all. She pairs up customers with the best fit and relies on her knowledge and relationships to know what’s going to work and what’s not.

“SBA is a hot button right now and merchants are really excited to know that this is definitely a possibility,” Tibbs said.

One opportunity with SBAs in particular is to consolidate MCAs, which, if the business owners qualify, can have a tremendous impact. Sometimes these business owners find her by seeing her posts online, and they reach out. Maybe it’s her they’ll get right away, or maybe it’s her AI. In any case, all of her experience has long since led other brokers to refer their own business to her, since she has a reputation for being able to get the deals done.

“I’ve been operating as a super broker most of the 20 to 25 years that I’ve been in this alternative space,” she said, “and as a super broker, I’m able to offer my broker partners more stuff than they even thought about. […] I study this stuff. I eat, live, and breathe it.”

While it’s unclear if AI qualifies as alive, her band of automated agents are beginning to breathe the rush of it all right alongside her. So many brokers (and lenders) are diversifying their product sets that her referral business is escalating, and she wouldn’t be able to scale without the assistance.

“Even though we get appointments, if we’re not on the phone with that merchant usually within three to five minutes, sometimes it’s hard to get them back on the phone. And even if they make an appointment, they may not show up. Having that instant engagement it definitely helps.”

Talk to People, Ask Questions, and Deals Are Everywhere

March 17, 2025 “Well, when everybody says it’s tough, that’s when I start smiling, because I’m going to sit there and collect them all,” said Adam Oster, Director of Canyongate Financial. Oster was talking about financing deals for trucks in a tough market, though he’s known to be able to handle any kind of equipment in any kind of market. Part of the joy he gets from the challenge of the job is rooted in just how many great people he gets to speak with. Connecting, helping, and building relationships are his passions. And it never stops for him.

“Well, when everybody says it’s tough, that’s when I start smiling, because I’m going to sit there and collect them all,” said Adam Oster, Director of Canyongate Financial. Oster was talking about financing deals for trucks in a tough market, though he’s known to be able to handle any kind of equipment in any kind of market. Part of the joy he gets from the challenge of the job is rooted in just how many great people he gets to speak with. Connecting, helping, and building relationships are his passions. And it never stops for him.

“I like to jump in and do everything. I have to have direction so I got to be talking to somebody,” Oster said.

True to form, when he’s taking a break from talking about semis, box trucks, and medical equipment, he’s marketing 3″ filled bones, beef cheek rolls, and gourmet treats for dogs.

“My fiancée has a dog food company, so Thursday, Friday, Saturday, Sunday, we’re out slinging dog food, we’re promoting her business,” said Oster. That business is called Abby’s Barkery, and he’s proudly featured on the company’s main Shopify page. Sometimes the two worlds overlap—in that he could be processing payments for treats while placing an equipment deal at the same time.

“…by 7:30 you get home and you’re like, ‘I think just every day is Monday.’ That’s how I’m going to look at it. Every day is just Monday in my life,” he said jokingly.

Oster began his career in mortgages, followed by a stint as the owner of a supplements store. He launched Canyongate right in the early days of the COVID pandemic after a colleague said he’d be really good in the field.

“When we came on we were strictly working capital, and working capital has its peaks and valleys, so I needed to fill the gap when working capital was down,” Oster said. “I’m like, ‘Hey, let’s transition here.’ So we started onboarding.”

Onboarding with equipment financing providers is precisely what he did. It helped that some of those providers were located right in his own neighborhood, which shortened the learning curve and helped lead to some great relationships. These days, Canyongate’s business is now 70% equipment financing and 30% working capital. Like others deBanked has spoken to, not everyone who makes deals in equipment financing starts off by knowing everything about equipment.

Onboarding with equipment financing providers is precisely what he did. It helped that some of those providers were located right in his own neighborhood, which shortened the learning curve and helped lead to some great relationships. These days, Canyongate’s business is now 70% equipment financing and 30% working capital. Like others deBanked has spoken to, not everyone who makes deals in equipment financing starts off by knowing everything about equipment.

“I knew enough in transportation, semis, trailers, that we lean there. But then I found very quickly that you got medical equipment—everything is a piece of equipment, essentially. So if I get a lot of invoices and I don’t know what they are, I have to Google it. I’ve got to look because the broker doesn’t tell you what it is. So I’m looking it up. I’m like, ‘Okay, this is a CNC machine… or this is a piece of yellow iron.'”

By now he knows so many things so well that he helps other brokers learn the ropes. As part of that he does coaching and training for large groups of people looking to break in. For example, they recently conducted an orientation for 500 people, where they started off by teaching them to focus on a niche. That could be semis or trailers or something else to get in the game. The deals themselves can come from anywhere, including simply knowing someone at the local gas station who might know someone who, in turn, knows another person—turning into a referral. It’s all about building relationships and asking the right questions.

“At the end of the day, it’s just conversation, ‘what are you trying to buy?’ And they’ll tell you. If I don’t know what that equipment is, I’ll say ‘what do you use that equipment for?’ They’ll tell you.”

For brokers already offering products like MCAs, they’re already on the call to steer the conversation in that direction if they so choose, but it’s important to do it thoroughly since the process to get a deal done is a bit more stringent.

“Ask if they need a truck, ask them what they need to finance,” Oster said. “When you’re submitting an equipment finance deal, it’s not an app and banks with no write up. You’ve got to tell me about the customer. Tell me about their experience. How are they going to use this equipment? There’s a lot of detail that goes into the deal before you even submit for underwriting.”

To that end, he said it’s important to set expectations for brokers looking to do equipment finance deals because it isn’t exactly the same even though it’s similar. On one hand if a broker can already sell a daily or weekly payment working capital deal then surely they’d be able to sell a monthly payment equipment financing deal. It’s a no-brainer when it comes to being able to offer the terms.

“Don’t fear it, ask the right questions,” he insists about taking the leap. And be prepared to ask them anytime anywhere. For example, he’s funded five MCA deals just through relationships he’s made through the Barkery.

“That’s a true story,” he said. “And I have pulled probably six or seven equipment deals out of the last year and a half from working at [my fiancée’s] business. So again, it goes back to it’s just conversation. Look at people’s needs. People tell me, ‘Well, I want to update my little shop and do all these things, I just don’t have the money.’ Well, what do you need? ‘Well, I need shelving, I need this…’ ”

Then he offers to help. Suddenly it’s the perpetual Monday all over again where he’s placing the customer while simultaneously processing payment for a good pup to chew on a lamb foot or a mammoth bone.

“And that’s how deals come about. Opportunity is everywhere. I love it. I get excited, man. I get all hyped up about this.”

Brokers: Making the Leap from Working Capital into Equipment Financing

March 13, 2025 “We can finance anything that doesn’t shoot, fly or float,” says Josh Feinberg, CEO of Everlasting Capital. “So no planes, no boats, no guns.” But any other type of equipment and he’s ready to chat. As a seasoned veteran of the equipment finance industry, that conversational starting point of knowing what to ask and how to answer takes a lot of practice to develop.

“We can finance anything that doesn’t shoot, fly or float,” says Josh Feinberg, CEO of Everlasting Capital. “So no planes, no boats, no guns.” But any other type of equipment and he’s ready to chat. As a seasoned veteran of the equipment finance industry, that conversational starting point of knowing what to ask and how to answer takes a lot of practice to develop.

“Roleplaying is like stretching before going for a run,” said Feinberg. “It makes it possible for you to be fast on your feet and really be able to have the answers.”

Everlasting Capital is a broker shop based in Rochester, NH that believes strongly in practicing calls with colleagues to develop their skills. It’s a role play. Many shops do it. But becoming seasoned at it for one product doesn’t mean that a broker automatically becomes an expert at any type of call.

“A lot of [working capital] brokers think that they’re the ones that are trying to figure out if the business owner qualifies, but to be honest with you, in the equipment space, it’s vice-versa,” Feinberg said. “The customer is actually trying to qualify you to see if you are apt to be able to finance their equipment.”

Equipment financing flips the stakes and the direction, and with that a fresh need for practice toward managing it successfully. And that’s where some brokers used to other products get stuck, because their confidence drops in being able to navigate something they don’t fully know. To that point, it can feel intimidating to discuss machinery they’re not familiar with or trucks they’ve never driven.

Feinberg believes that anyone can learn this, however, simply by talking to business owners about these things. One doesn’t need to actually spend 20 years in construction to finance equipment in that industry, for example, though it certainly wouldn’t hurt. Feinberg’s own start in the business is very simple to replicate.

“I just started talking to business owners, figuring out what they want. A lot of times [in the very beginning] I didn’t even know what the equipment did. I would have to Google it while I was on the phone with them.”

That, of course, has changed with experience. Now he and his firm have become so well acquainted with certain industries that they’ve integrated themselves within them. The dump truck market, for example, has become one of their core areas of expertise.

That, of course, has changed with experience. Now he and his firm have become so well acquainted with certain industries that they’ve integrated themselves within them. The dump truck market, for example, has become one of their core areas of expertise.

Despite this attainable path to success, some brokers throw up their hands and assume the process will be too hard or the financial incentive too low to even try equipment financing—even though that is generally not the case. In an era where working capital has become so competitive, it should be considered as an additional offering to maximize value at the bare minimum.

“[When] you have the one person calling like, ‘hey we have monthly payments that are single digit rates, and we can do monthly payments one to five years.’ It’s really easy to spark up a conversation and be able to ask the questions that you need to do, and then get answers back,” he said.

Advocating for other brokers to adopt his approach might seem like it would increase competition, but Feinberg explained that the market is wide open with opportunities. Moreover, he feels strongly about matching business owners with the right solution. To that end, he is also the co-founder of Equipment Broker School, a system designed for anyone needing a jump start or a refresher on the art of equipment financing. His company previously starred in an online reality show where new salespeople were trained in person in the office, and Feinberg himself recently appeared as a judge at deBanked CONNECT’s Broker Battle in Miami Beach this past February. The event was a roleplaying competition that evaluated brokers on their ability to diagnose needs and propose solutions. It was like just another day in the office for him.

“It made me really excited to be able to be a part of the Broker Battle, just as a lot of people know, and you know especially just for myself, being able to train people on how to be able to promote, how to be able to work, and how to be able to just partake in equipment financing,” Feinberg said. “It has been a super big passion of mine, especially just within the deBanked community as a whole.”

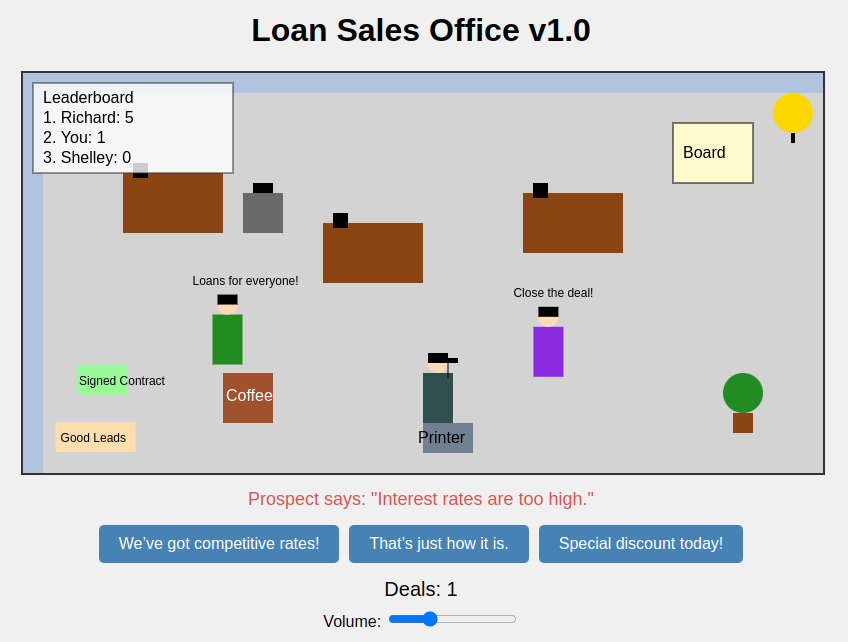

We Used AI to Make a Loan Broker Video Game

March 13, 2025As AI continues to progress beyond LLMs into doing just about anything one wants, I took the liberty of having it create a very simple javascript-based online game (for Desktop browsers only) to see what would happen. With about 5 minutes worth of work, it created something functional that it calls Loan Sales Office v1.0. The game gives the user the option to earn points either by answering a customer objection correctly or by moving the character around the office and racing against the NPC competitors to collect signed contracts. First one to 50 wins. It created the questions and answers itself.

The purpose of the exercise is to bring further awareness to AI.

If you are on a desktop browser, click below to try the game.

HOW TO PLAY

Compete against two other sales reps. First one to 50 deals wins.

Move your character with the keyboard arrows or the on-screen controls.

Collecting a signed contract = 5 deals

Answering a question right = 1 deal

The good leads are elusive. Signed contracts spawn at random.

Must use desktop browser. Good luck!

How Mike Brooks Battled in the Ring and Won Top Broker in Equipment Financing

March 6, 2025

“Equipment Financing is HUGE,” declares Mike Brooks, CEO of New York-based Best Connect Capital and recent winner at Broker Battle 2025 in the equipment finance category at deBanked CONNECT MIAMI. If his name sounds familiar, it’s probably because he appeared on stage as one of six finalists in the previous year’s competition. He refused to give up after his loss and returned this year for round two, leading to him securing a title and prizes along with it. To hear him tell it, it had been a long road to get there.

When Brooks got his start as a 27-year-old broker in 2015, for example, he had technically been battling in a ring for most of his life already.

“I had [boxing] on my mind in high school, without any influence,” says Brooks, “and I walked into a gym one day and the rest was history.” That history includes 60 fights in just amateur-level boxing, resulting in 45 wins and 15 losses. When he followed that at the pro level he went 11-2-1.

“I started fighting at the regular club shows, the Golden Gloves, the metro tournaments, national tournaments, and at one point, I was ranked number seven in the whole country,” Brooks recalls. “I beat some really good fighters, lost to some really good fighters and I made it to the highest levels in the country.”

Some of those fights even aired on live TV. As he bobbed and weaved for years in the ring, he started to think about what a possible career in business might look like afterwards. When that day came, he went to work for a local financial service company on Long Island who taught him about helping small businesses access working capital. Eventually he realized it was a business that he was uniquely suited for and now he runs his own company doing it.

First, there’s the endurance aspect, he explains. There’s a lot of calls, leads that don’t pan out, and heartbreak that hits when deals get declined at the finish line.

“A very small percentage of people can be a successful broker,” Brooks says. “You have to be able to take rejections all day long.”

To that point, Brooks noticed that as the industry grew he was not the only broker offering revenue-based financing to a client. Sometimes there were even as many as four or five other brokers talking to the same client at the same time, which meant that he wasn’t going to win every one and he did not want to bend his ethics just to eke it out. That’s when he started considering another approach and expanded his offerings.

“An equipment financing deal was my first big check during [the covid] lockdowns,” Brooks says. It was a $200,000 deal for a packaging plant. The terms were very attractive and he had the help of an equipment finance veteran who mentored him through it. When it worked out, he knew he had something very big in his arsenal and he’s been offering it ever since to anyone that qualifies for it.

“I said to myself anybody that needs equipment, this is a no brainer right here,” Brooks recalls of it. Now Brooks says when there is competition, he’s almost always the only one asking questions about equipment and the only one prepared to actually move forward with a deal tied to it. Of that experience, Brooks says he’s realized that some brokers have become so accustomed to the mindset of telling customers to take a specific deal, that they don’t stop to consider what they actually want. So his approach is to go in and diagnose what it is they’re trying to do first and then advise them of their options accordingly. And that’s what he does day after day.

“I said to myself anybody that needs equipment, this is a no brainer right here,” Brooks recalls of it. Now Brooks says when there is competition, he’s almost always the only one asking questions about equipment and the only one prepared to actually move forward with a deal tied to it. Of that experience, Brooks says he’s realized that some brokers have become so accustomed to the mindset of telling customers to take a specific deal, that they don’t stop to consider what they actually want. So his approach is to go in and diagnose what it is they’re trying to do first and then advise them of their options accordingly. And that’s what he does day after day.

At Broker Battle 2025, it was very much like time spent in the office. He was expected to be his normal self, but on stage in front of a large audience, while three judges played the role of prospective client and asked him questions about what they should do. The end result of it all was that Mike Brooks, former fighter in the ring, walked away as the Broker Battle champion in the equipment finance category in 2025.

“It felt amazing to be able to showcase what I do on a daily basis,” Brooks says, making it a point to say that even the venue took note of his win and offered him a personal congratulations on social media.

In the final photo-op on stage with his prize check, Brooks was the epitome of his dual life—the suit and tie spoke of business, while the cigar and sunglasses hinted at his former life in the ring. “I was a crowd pleaser,” he jokes. “You want to be like ‘bam bam bam’ and the crowd to be like ‘AHHHH!!!’ I want them to do that. I had a great time at deBanked.”