Articles by deBanked Staff

Amex: Organic Growth of Small Businesses Has Slowed

July 25, 2023 “…when we look at small business, I think the biggest thing there from a small business perspective is really the organic growth. I think organic growth has slowed,” said Amex CEO Steve Squeri in the company’s Q2 earnings call. Squeri said that this wasn’t just something that Amex was seeing but more of an industry phenomenon.

“…when we look at small business, I think the biggest thing there from a small business perspective is really the organic growth. I think organic growth has slowed,” said Amex CEO Steve Squeri in the company’s Q2 earnings call. Squeri said that this wasn’t just something that Amex was seeing but more of an industry phenomenon.

“…what you saw through the pandemic, is you saw small businesses continue to add and add and add, and you got to remember small businesses use a card to run their entire business,” Squeri said, “and so, there was a lot of buying ahead from a goods and services perspective, from an inventory perspective.”

Delinquencies have been flat at Amex, however, and still remain below pre-covid levels, a feat attributed to the company having made proper adjustments from a risk management perspective.

Squeri said he believes the organic growth will eventually rebound.

“…after the slowdown comes the recovery,” he said.

Business Blueprint, the rebrand of the Kabbage business it acquired, was not mentioned by name in the company’s earnings presentation or 10-Q.

Summer Dealmaking

July 18, 2023The summer of 2023 has not disappointed. The industry is making moves! In case you missed what moves we’re talking about, here’s a list of the most notable:

7/17/23 – Nav Acquires Tillful

7/14/23 – IOU Financial announces it is being acquired

7/12/23 – Loanspark expands to Canada

7/10/23 – Owners Bank launches SMB loans

6/29/23 – Blue Bridge Financial extends and upsizes corporate note to $20M

6/15/23 – CFG Merchant Solutions surpassed $1B in MCA originations

6/13/23 – Merchant Growth acquires small business loan rights from Loop

Celsius Founder Alex Mashinsky is Charged by DOJ, SEC, CFTC

July 13, 2023Crypto platform Celsius founder Alex Mashinsky has been charged by multiple agencies including the US Attorney’s Office for the Southern District for his role in a multibillion dollar fraud and market manipulation schemes. Although he has been referred to as a “crypto lender,” some of the most unusual stories surrounding the alleged fraud have to do with the customers. For instance, in the Celsius bankrupty proceeding, one customer pleaded for their funds back on the basis that they had yolo’d their entire EIDL funds into it.

“I placed my entire EIDL loan, $525,000 in Celsius to earn an APY to help pay back the 3.9% interest on the loan while I was in the process of deciding on if I would keep the EIDL or use it on my business,” the customer wrote. “I deposited these funds a few weeks after the Celsius rules changed on their ‘Earn’ accounts which required a user to be an Accredited Investor, which I was not.”

That victim’s story was publicized 12 months ago. At its peak, Celsius managed $25 billion of customer funds. The company declared bankruptcy in July 2022. Federal charges allege that much of the Celsius business was just a fraud run by Alex Mashinsky and another co-defendant.

The SEC and CFTC have also filed civil charges against Mashinsky.

Fintech Nexus AKA LendIt Discontinues Its Large-Scale Event Business

June 29, 2023 Fintech Nexus, which began as the LendIt Conference in 2013, announced it is exiting the large-scale event business after a 10-year run.

Fintech Nexus, which began as the LendIt Conference in 2013, announced it is exiting the large-scale event business after a 10-year run.

“This is not a decision we took lightly,” wrote co-founder Peter Renton in a blog post. “We know many of you have loved coming to Fintech Nexus events for many years. And we have loved bringing you those events. But after 10 years of doing that, it was time to move on to the next chapter.”

Fintech Nexus plans to focus on its online digital media business going forward.

Fintech Meetup, a recent rival to Fintech Nexus, is acquiring Fintech Nexus’ sponsors, exhibitors, and attendees.

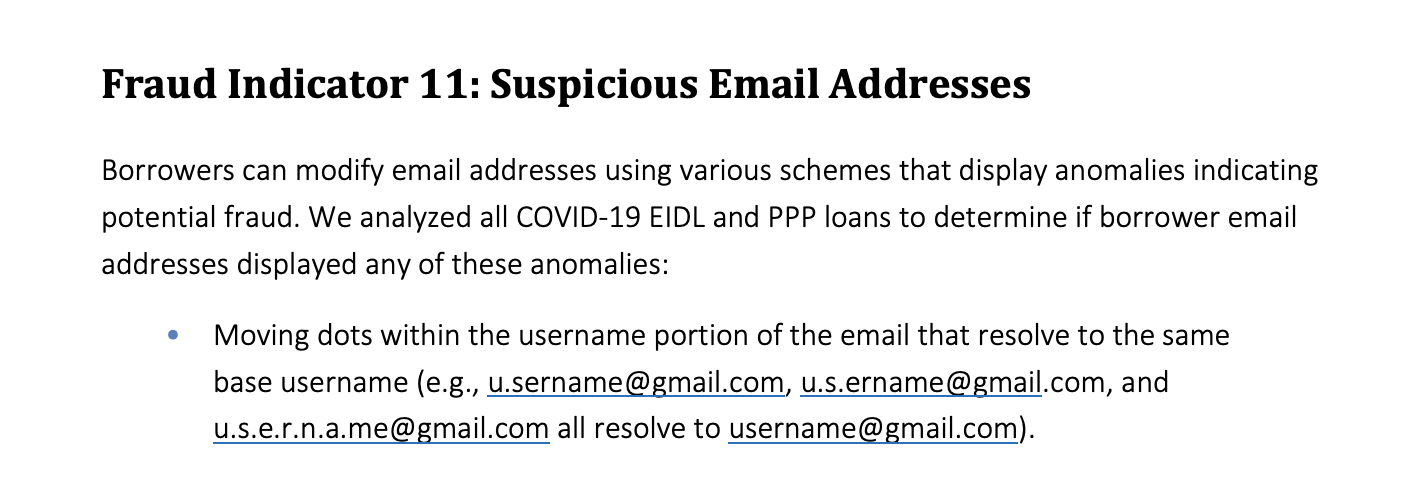

Loan Scammers Play With Email Dots

June 28, 2023 Did you know if you send an email to myname@gmail.com or my.name@gmail.com or myna.me@gmail.com, they would all go to the same place? Scammers do. In a recent bombshell report published by the SBA and OIG, $200 billion in PPP/EIDL fraud was accomplished through a number of common techniques, one of which appears to be through the manipulation of email addresses.

Did you know if you send an email to myname@gmail.com or my.name@gmail.com or myna.me@gmail.com, they would all go to the same place? Scammers do. In a recent bombshell report published by the SBA and OIG, $200 billion in PPP/EIDL fraud was accomplished through a number of common techniques, one of which appears to be through the manipulation of email addresses.

Some mail servers, including Gmail’s for example, ignore the dots, a feature likely built in because periods are commonly used as concatenation operators to join two strings in programming. Reader’s Digest recently called this “The Gmail Trick That’s Been Around for 15 Years—But Few People Know About It.”

“Any combination of your e-mail address and those little dots is sent to the exact same inbox. You own all dotted versions of your address,” RD wrote.

The implications of this, however, are that scammers can potentially bypass systems that rely on e-mail addresses as a primary form of verification or identity. Both scammer@gmail.com and scam.mer@gmail.com could have separate accounts in one system even though it’s the same email address. This method is useful to scammers because they do not have to register additional gmail accounts, which could potentially trigger additional unnecessary verifications or reviews from Google for suspicious activity. Instead, they can rely on the single account.

Furthermore, the SBA report said that aliases or email forwarding or disposable email addresses are also used in fraud and are a fraud indicator.

“Using an alias technique to add an extension to an existing email address through use of a dash (-) or plus (+) that resolve to the same email (e.g., username-123@gmail.com or username+bob@gmail.com both resolve to username@gmail.com)” was something that the SBA analyzed in its fraud investigation. “Using a disposable email service to remain anonymous by receiving emails at a temporary address that may self-destruct after a certain time elapses” is another technique that was examined.

Is your system checking for dots in gmail addresses? If they weren’t before, they should now!

Florida Disclosure and Broker Law Signed by Governor, But Will The Effective Date Be Revised?

June 26, 2023Florida’s governor signed H1353 into law on Friday, a set of disclosure rules that will impact both brokers and funders. One key element of it was drawn from the DailyFunder forum, for example.

As written, the law says it is supposed to go into effect on July 1, 2023. One wonders given the timeline if that will be extended to give the industry an opportunity to even understand what the requirements are.

Florida has now been updated on the deBanked regulatory map.

Lightspeed Capital Generated $8.1M in MCA Revenue Last Year

June 23, 2023 When Lightspeed announced it was expanding its MCA program to the United Kingdom, Australia, New Zealand and Quebec, one may have been wondering who they were. The POS e-commerce platform has actually been around since 2005 and has been slowly building up its MCA offerings. Indeed, last quarter deBanked pointed out that the company had been increasing its volume.

When Lightspeed announced it was expanding its MCA program to the United Kingdom, Australia, New Zealand and Quebec, one may have been wondering who they were. The POS e-commerce platform has actually been around since 2005 and has been slowly building up its MCA offerings. Indeed, last quarter deBanked pointed out that the company had been increasing its volume.

As of the company’s fiscal year-end of March 31, 2023, the company had an MCA receivable balance of $29.5M, up from $6.3M YoY. Altogether, Lightspeed generated $8.1M in revenue in FY 2022, amounting to only about 1% of its overall revenue. That means there’s still a lot more room for growth.

“We believe real-time access to capital is one of the largest challenges facing merchants today,” said JP Chauvet, Lightspeed CEO in a press release. “This expansion of Lightspeed Capital provides a simple, streamlined opportunity for our merchants to invest in their business. Our goal is to help turbocharge their operations … all through a single, integrated commerce solution.

Google Files Lawsuit Over Fake Business Profiles and Fake Reviews

June 21, 2023 Agroup of defendants with an alleged common owner have brought a whole new meaning to Search Engine Optimization. According to a lawsuit filed by Google, one Ethan Qiqi Hu set up more than 350 fraudulent business profiles and bolstered them with more than 14,000 fake reviews. Although this case has no tie to the financial services industry, it may be worth knowing how the scheme was carried out.

Agroup of defendants with an alleged common owner have brought a whole new meaning to Search Engine Optimization. According to a lawsuit filed by Google, one Ethan Qiqi Hu set up more than 350 fraudulent business profiles and bolstered them with more than 14,000 fake reviews. Although this case has no tie to the financial services industry, it may be worth knowing how the scheme was carried out.

Defendants did not limit themselves to a niche. According to the complaint, they pretended to be repair shops, chiropractors, cleaning services, spas, painters, and more. They got around the verification step by skipping the mailed postcard and consenting to video chat inspections, in which defendants relied on movie-like sets and props to convince Google’s staff they were at whatever business in question. Once established, its alleged they relied on thousands of fake reviews from Bangladesh and Vietnam and then used the business profiles to either generate and sell leads or to sell the profiles themselves for a profit. Google said that the scheme undermines people’s faith in their products.

“In 2022, we protected more than 185,000 businesses from further abuse after detecting suspicious activity and abuse attempts,” Google said. “We also stopped 20 million attempts to create fake Business Profiles in 2022, and continue to invest in new technologies and processes to keep information on our products helpful and reliable.”

Google said that they took this legal action “against a bad actor for deceiving and scamming consumers.” It added that it hopes the lawsuit “builds awareness that we will not sit idly by as bad actors misuse our products.”

There’s a message here that one can’t rely on Google business profiles alone to authenticate legitimacy (looking at you underwriting) just as one may not be able to rely heavily on Google Maps.