Articles by deBanked Staff

BHG Financial Originations Surge to $6.1B in 2025

February 20, 2026“With regards to BHG, that team down there just continues to deliver, you can see that with their performance in 2025,” said Pinnacle Financial Partners CFO Jamie Gregory on the company’s recent Q4 earnings call. Pinnacle owns 49% of BHG Financial. BHG’s average business loan is between $20,000 to $250,000. It also does personal loans. Combined they originated $6.1B in 2025, up from $3.7B in 2024.

Pinnacle has been very impressed with BHG’s performance and outlook going forward.

“I mean we’re talking 25% to 35% growth for the company,” said Gregory. “So they continue to perform. And I go through all that because it just shows that they are focused on their core business. They’re focused on growing it, adding value.”

In the earnings presentation, it says that BHG targets borrowers through direct mail and “other sophisticated marketing techniques using a wide range of proprietary marketing tools.”

CFPB Costs Consumers At Least 10x More Than They Get Back

February 19, 2026A new study published by the White House Council of Economic Advisors found that the CFPB costs consumers more than it saves them. According to the report, CFPB regulations increased borrowing costs to consumers by $222 billion to $350 billion over the time period of 2011 – 2024. In return the CFPB has touted that it has returned more than $21 billion to consumers over the same time period.

A takeaway is that the while the CFPB has provided the optics of doing good for consumers it has actually cost them far in excess of the perceived benefit to them.

Shopify Capital Finishes 2025 With $4.2B in MCAs and Business Loans

February 18, 2026Shopify revealed its full year MCA & business loan origination figures. $4.2 billion. That’s $1.2 billion over the previous year. Only 91.9% of these deals were considered “current” as of December 31, 2025. That’s down slightly from last year when 93.7% of deals were considered current at year-end.

For clarity, Shopify Capital offers funding in 8 total countries. The product is considered a value-add to its e-commerce platform and only offered to merchants who use it. Shopify Capital is in the same league as Square Loans and Enova in terms of origination volume.

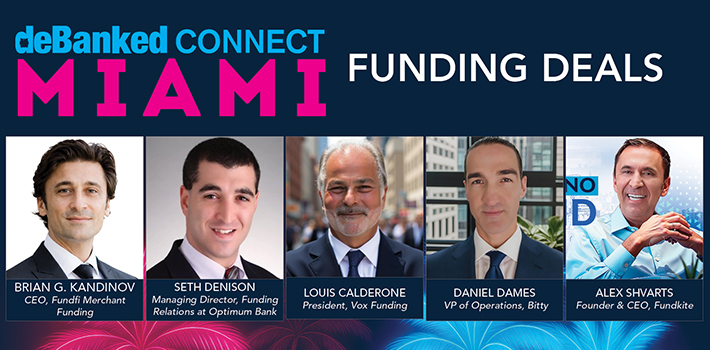

deBanked CONNECT MIAMI Draws 1,100 People, Sets All-Time Record: See Photos Here

February 16, 2026deBanked CONNECT MIAMI 2026 surpassed all expectations and set a small business finance industry all-time record for signups with 1,100 people.

Lightspeed: ‘our largest use of cash will be growing our merchant cash advance business’

February 10, 2026 Lightspeed Capital originated $257M in merchant cash advances in the last 9 months of 2025, up from $207M over the same period in 2024. The company has repeatedly talked up the healthy profit margins earned on MCAs and last quarter called them a “super popular upsell.” Lightspeed operates in the POS and e-commerce space, competing against companies such as Shopify, Square, Toast, and Clover. Lightspeed Capital is its MCA business.

Lightspeed Capital originated $257M in merchant cash advances in the last 9 months of 2025, up from $207M over the same period in 2024. The company has repeatedly talked up the healthy profit margins earned on MCAs and last quarter called them a “super popular upsell.” Lightspeed operates in the POS and e-commerce space, competing against companies such as Shopify, Square, Toast, and Clover. Lightspeed Capital is its MCA business.

“Aside from potential buybacks, our largest use of cash will be growing our merchant cash advance business,” said Lightspeed CFO Asha Bakshani during the company’s recent quarterly earnings call. “There are currently $106 million in merchant cash advances outstanding, and we intend to continue to grow this high-margin business over time.”

Lightspeed MCAs are typically satisfied by merchants within seven months, but they want to shrink that timeframe even more. “Our goal is to target a shorter remittance time frame, and we are making great progress towards that end,” said Bakshani. The average factor rate is a 1.14.

A Thousand People Expected at deBanked CONNECT MIAMI 2026

February 9, 2026deBanked CONNECT MIAMI 2026 taking place on February 12 at the Fontainebleau in Miami Beach is projected to log more than 1,000 registrations. If you were on the fence about going, this is the event to go to if you work in or with the small business finance industry. Due to capacity, registration could shut off in advance of the event so be sure to have your tickets already. You can REGISTER HERE.

Industry Event Calendar 2026

February 9, 2026February 12, 2026: deBanked CONNECT MIAMI (Miami Beach)

June 1, 2026: Broker Fair (New York City)

October 20-21, 2026: B2B Finance Expo (Las Vegas)

National Alliance of Commercial Loan Brokers LLC Back in Roglieri’s Hands

February 5, 2026The United States Bankruptcy Court ordered the Roglieri Estate return its interest in the National Alliance of Commercial Loan Brokers LLC back to Roglieri himself. The order was dated January 30, 2026. That interest includes all the assets and liabilities attached to the National Alliance of Commercial Loan Brokers LLC. The Trustee’s reasoning was that management over the business had become burdensome to the Roglieri Estate.

Nearly two years ago, Roglieri declared in a bankruptcy filing that National Alliance of Commercial Loan Brokers LLC (often referred to as NACLB) was valued at $1 million.

Roglieri is currently imprisoned at the Rensselaer County Correctional Facility. He pleaded guilty to wire fraud conspiracy this past November. His sentencing hearing is scheduled for March 11 and he is facing up to 20 years in prison.