Brendan Garrett was a Reporter at deBanked. Articles by Brendan Garrett

Factoring for Freelancers

November 8, 2019 The number of freelancers in America is quickly growing year on year, with a recent study indicating the percentage of full-time freelancers has increased from 17% of the workforce in 2014 to 28% in 2019. Representing a host of fields, from writing and photography to marketing and programming, the incomes and needs of such workers vary as much as their roles do, however a commonality between them is their difficulties with financing.

The number of freelancers in America is quickly growing year on year, with a recent study indicating the percentage of full-time freelancers has increased from 17% of the workforce in 2014 to 28% in 2019. Representing a host of fields, from writing and photography to marketing and programming, the incomes and needs of such workers vary as much as their roles do, however a commonality between them is their difficulties with financing.

Being infamous for the difficulties involved in getting paid, freelancers have historically had trouble with the timings of payments. With 59% of freelancers reporting that they live pay check to pay check, missing a payment or waiting until an untimely employer responds to an invoice may not be possible for many; and beyond payments, banks have yet to catch up with the needs of freelancers.

“There’s this great big area in between consumer banking and business banking that freelancers fall into and the big banks aren’t dealing with that,” George Kurtyka of Joust explained. “They have strategies but it’s not really something they know how to do.”

Kurtyka, after a period of jumping between phone services, payments, and the fintech end of banking, is now COO and Co-founder of Joust, a financial services company occupied with providing for those freelancers ill-suited to traditional banking, which has been operating since 2017.

How are they going about it? Following a conversation Kurtyka had with a friend who told him over half of freelancers don’t separate their business and personal finances, he figured the best place to start was with bank accounts, which became the first product available from Joust. Next was the issue of non-payment, a problem his team thought was suited to underwriting. Offering guaranteed payment within 30 days for 1% of the invoice or instant payment for 6%, factoring, via its PayArmour product has become a large part of Joust’s business model.

“It feels almost like an insurance product,” Kurtyka observed. “When you send an invoice, we’re doing risk assessment on you, we’ve onboarded you and given you a bank account so we know about you.”

And so, after an early partnership with the Freelancers Union, Joust has been offering its cocktail of banking, invoicing, and alternative financing services to freelancers and self-owned businesspeople across America, with eyes on expanding its products further down the line.

“As you can imagine, we can start with just invoice factoring, but we can move into working capital and lines of credit … We’ve heard stories of freelancers losing houses and apartments because they were paid late. The next step is income smoothing. If you can predict how much you’re going to earn, we can smooth your income and then work with one of our bank partners to prequalify you for a loan. We’re obviously not a chartered institution but we work with a host of chartered banks and payments companies and we sit on top of them and the great news is we work with a lot of partners who want access to this burgeoning market of freelancers who may not qualify for a FICO score because their income is like this … Down the line we’d love to offer loans and mortgages. We think the underwriting models we’re building could be like the next FICOs for freelancers.”

David Goldin is BACK – The Scoop Behind His Return

November 7, 2019 “When I started, the term merchant cash advance didn’t even exist. There really were no business loans back then, the word ‘fintech’ didn’t exist, ‘alternative lender’ didn’t exist … Back in the day it was all about getting a credit facility, and that was like the iPhone 5, and now we’re the iPhone 11. There’s more ways to be a lot less stressful, a lot more productive, and a lot less time consuming. There’s other financial instruments to really help companies excel.”

“When I started, the term merchant cash advance didn’t even exist. There really were no business loans back then, the word ‘fintech’ didn’t exist, ‘alternative lender’ didn’t exist … Back in the day it was all about getting a credit facility, and that was like the iPhone 5, and now we’re the iPhone 11. There’s more ways to be a lot less stressful, a lot more productive, and a lot less time consuming. There’s other financial instruments to really help companies excel.”

This is how David Goldin speaks of the difference between the early days of the alternative funding industry, a marketplace which he helped form in the pre-crash years of the noughties, and now, a moment which sees the CEO’s return to the market after years abroad.

Having founded Capify, an alternative finance company, in 2002, Goldin had worked in the space for over a decade before he exited the US market in January of 2017, choosing to instead focus his efforts on the UK and Australia.

Over two years later, Goldin is back in the States with Lender Capital Partners, offering capital to commercial finance companies, with a priority given to those who deal in MCAs and business loans. “It’s very exciting, I’m coming in from a different perspective,” noted Goldin. “It’s still a great industry. I’m just coming at it from a different angle which I think could be a lot more productive and scale a lot faster.”

And as well as funding the funders, this new angle includes forward flow programs, a commitment to participate in deals up to $1 million, credit facilities in the range of $20-100 million, a system by which point of sale providers are able to provide merchant financing via their software, and the Broker Graduate Program. The last of these being LCP’s in-house channel open to brokers who originate a minimum of $500,000 a month, and who want to receive capital and advice from LCP in order to become a direct funder.

When asked why he chose to return via this more top-down approach to the industry, Goldin explained that “there’s enough good players here that are trying to originate on the merchant side, so rather than try to reinvent the wheel I thought I’d come in with my years of experience running a MCA alternative lending platform in the US, knowing what the pain points are.”

Made possible through a partnership with Basepoint Capital, LCP is there to help MCA and business loans companies through both the good times and the bad, according to its founder, saying that what was a lesson for him partly informs LCP’s model.

“The time to raise money is when you don’t need it. If you run into trouble where your lender gets spooked or either has their own financial issues, or it’s a regulatory or macroeconomic condition, you just can’t bring in a new lender within 30 or 60 days, and if you do it’s not going to be on favorable economic terms. It’s really going to be a desperate attempt to get it … It’s almost like having more than one internet connection in your office, if one goes down you have a backup with no downtime.”

Lendio Says There’s Been a Strong Uptake Of Sunrise

November 6, 2019 Last week Lendio announced that its bookkeeping and invoicing service, Sunrise, had partnered with WePay, an integrated payments business of JPMorgan Chase, to form the freemium product Sunrise Pay.

Last week Lendio announced that its bookkeeping and invoicing service, Sunrise, had partnered with WePay, an integrated payments business of JPMorgan Chase, to form the freemium product Sunrise Pay.

Stemming from an acquisition in Q1 of this year, Sunrise, formerly Billy, was picked up by Lendio after the company realized many of its customers who were small business owners were struggling to manage their accounts and invoices.

As such, Lendio CEO Brock Blake claims that there’s been a strong uptake of Sunrise amongst their clients. “They love that it goes out and pulls your bank data every day. That you can sync your credit card to it. That it is a double-entry accounting system. And that it does all your invoicing, your profit and loss, and balance sheet.”

The service is free to Lendio customers, with tiered versions that offer human bookkeepers being available to those willing to pay. Sans such add-ons however, the base product will allow small business owners to collect payments faster through WePay’s streamlining of the payments process.

“Simplifying the invoicing and payments processes for small business owners means they have more time to spend growing their operations,” said WePay VP of Marketing Jennifer Lewis. “WePay’s partnership with Lendio will help small businesses across the country to grow, create jobs, and increase their economic impact.”

Lenders, Leaders, and Las Vegas: Money20/20 Review

November 3, 2019 Two things arrived in Las Vegas last month: the first being an unusual dip in local weather, with temperatures dropping to the low forties at times and woolen hats making an appearance; the second being Money20/20.

Two things arrived in Las Vegas last month: the first being an unusual dip in local weather, with temperatures dropping to the low forties at times and woolen hats making an appearance; the second being Money20/20.

Now in its seventh year, the conference runs smoothly to the point of being habitual, a trait several attendees mentioned to me when asked how they felt about the 2019 edition.

Running from Sunday the 27thto Wednesday the 30th, each day offered a different focus. The first of these being alternative finance, blockchains, and cryptos. Here, leaders from LendingClub, Kabbage, and OnDeck, among others, took to the stages to discuss issues ranging from strategies in the face of a recession to AI in lending. Running throughout were conversations about where cannabis banking regulation was headed and what can be done to prepare. Of note was Jontae James of NatureTrak, who spoke from the Leadership Lodge Stage, pitching his company as a solution to compliance issues facing lenders who want to work with cannabis companies.

The following days contained a mix of subjects, with Monday featuring many events relating to payments and entrepreneurship; Tuesday being the day for cybersecurity, regulation, and banking; and Wednesday closing the show with various talks on emerging technologies. Among the highlights of these were a talk from David Marcus of Calibra on the currency’s efforts to alter the financial landscape, a discussion on growth in emerging markets from Ant Financial’s Douglas Feagin, and words from BlueVine’s Eyal Lifshitz on the needs of small businesses.

Outside of the stages where these were held was the main expo hall. Dotted with booths and stands, the narrow pathways that were carved out by these were lined with a mix of businesses.

Outside of the stages where these were held was the main expo hall. Dotted with booths and stands, the narrow pathways that were carved out by these were lined with a mix of businesses.

In overwhelming numbers though were companies offering identity verification services. A growing industry in today’s increasingly online world, their presence dominated the hall, with it being hard to turn around without being offered a pamphlet on the importance of knowing who your customers are and how much it will cost to confirm their existence and authenticity.

And while walking through the hall and stopping at stalls to talk offered pleasant and informative conversation, there was an underlying tenseness to some of the chatting. Perhaps it was the unrelenting air conditioning that caused this? Or the endless stream of coffee available had rattled some nerve endings? Or maybe it was the frequency with which an oncoming recession was referenced in the titles of talks?

Who knows, what is likely though is that if it is the last of these possibilities, in the case of a “looming crisis,” as one event labelled it, what was talked about in Vegas may not stay in Vegas.

deBanked CONNECT San Diego Is A Hit

November 1, 2019 Under the California sun, our most recent CONNECT event kicked off last week in San Diego’s Hard Rock Hotel. Home to Ron Burgundy, we were a few days too early in the city for any sex panther cologne-infused costumes to make an appearance, although that didn’t stop one attendee donning a money-clad suit.

Under the California sun, our most recent CONNECT event kicked off last week in San Diego’s Hard Rock Hotel. Home to Ron Burgundy, we were a few days too early in the city for any sex panther cologne-infused costumes to make an appearance, although that didn’t stop one attendee donning a money-clad suit.

Beginning in the afternoon, event-goers were able to choose between starting the day with a session from Will Murphy and Josh Feinberg on their Equipment Broker School, a program that aims to arm participants with the knowledge to enter the equipment financing scene; or to dive straight into networking.

Following this, deBanked President and Chief Editor Sean Murray delivered an introductory speech laden with his disappointment in the New York Yankees, a gloom that revealed to him a particular silver lining: “if you’re going to lose, make sure you lose to the best.” Embracing it as a mantra, Murray encouraged brokers to carry out their dealings at the event with this perspective in mind, before expounding on what the future of the industry may hold.

Next up was Justin Thompson, CRO of National Funding, who spoke on the importance of building relationships, providing customers with options, and getting “hooks” into customers in order to plan for your company in the long term. A message that led into the proceeding discussion involving leaders from LoanMe, BFS Capital, and Ocrolus on how businesses are leveraging technology to improve their standing in the market and ensure longevity.

And concluding this panel was a ticket giveaway for the upcoming deBanked Miami event in January, which saw four winners pull a guitar pick from under their seat in a musical chairs-inspired take on Willy Wonka.

Closing out the show were a conversation about California’s unique licensing requirements and what one needs to be aware of when striving for legal compliance; and a series of tech demos showcasing a range of verification software from Truepic, Ocrolus, and Nationwide Management Services.

Left with naught to do but enjoy the rest of the evening, the remainder of the sunshine set on the Hard Rock’s outdoor Woodstock area, where food, drinks, and (mostly) poorly played drums were available to the attendees.

With the atmosphere being breezy and the conversation being comfortable, we left California happy. All that’s really left to say is until next time, you stay classy, San Diego.

Become Closes Series A with $12.5 Million

October 29, 2019 Become, formerly known as Lending Express, has finished its Series A funding round with $10 million having been raised from Benson Oak Ventures and Magenta Venture Partners, among others, as well as an additional $2.5 million in venture debt from Viola Credit.

Become, formerly known as Lending Express, has finished its Series A funding round with $10 million having been raised from Benson Oak Ventures and Magenta Venture Partners, among others, as well as an additional $2.5 million in venture debt from Viola Credit.

“We strongly believe it is time to disrupt conventional and ‘alternative’ lending practices,” said Become’s CEO and Co-founder Eden Amirav in a press release. “Become’s technology provides SMBs with the transparency and insights they need to improve their unique financial profiles to attract legitimate funders. This creates a new market for alternative lenders and opens opportunities for formerly ‘unfundable’ SMBs to be bigger, better and [sic] more successful. This funding will allow us to expand our global reach and change the industry for the better, as we ensure that every business that deserves funding has the tools to make it happen.”

The technologies being referred to here are Become’s LendingScoreTM, an analytics program that uses a host of variables to determine businesses’ chances of funding; and their new online marketplace that was launched last month.

Marketed as “Expedia for loans,” the marketplace allows all players in the alternative funding ecosystem, be they funders, brokers, or small business owners, to carry out their functions in one place. The draw being that all processes, such as the looking around for funders, the application for funds, and the approval, can be done through the marketplace. Beyond this, Amirav told deBanked that Become’s systems monitors the performance of those businesses who have signed up to the marketplace and makes recommendations of when to apply for funds, as well as how much to apply for, based on the data they accrue.

“There’s nothing like this in small business. The idea is to give small businesses the power, instead of sending them to lenders, where they’re applying for funding and each application hurts their credit score,” asserted Amirav. “Until today the only ways businesses would get money would be to go out and beg lenders. But now we’re giving the businesses the power.”

BlueVine to Enter Banking in 2020

October 28, 2019 BlueVine Capital, the Redwood City-based alternative funder, has announced today that it will launch its BlueVine Business Banking product in 2020, which will offer checking accounts that come with debit Mastercards, checks, and ATM access exclusively to small businesses. And just like many of the new competitors in the banking space, BlueVine Business Banking will be app-based, with access also being available through an online dashboard.

BlueVine Capital, the Redwood City-based alternative funder, has announced today that it will launch its BlueVine Business Banking product in 2020, which will offer checking accounts that come with debit Mastercards, checks, and ATM access exclusively to small businesses. And just like many of the new competitors in the banking space, BlueVine Business Banking will be app-based, with access also being available through an online dashboard.

With the financial infrastructure and regulatory framework being provided by The Bancorp Bank, BlueVine is the next alternative finance company to look toward becoming a bank, a move which has proven difficult for companies who already tried, such as SoFi and Square.

“Historically, banks have under-invested in small businesses and as a result, small businesses have been left with products and services that don’t meet their needs,” said BlueVine CEO and Co-founder Eyal Lifshitz in a press release that claims only 9% of small businesses believe their banks meet all of their needs. “Credit is a core part of banking and with the addition of checking accounts to our existing suite of financing products, customers can have a truly seamless banking experience.”

Such seamlessness spawns from BlueVine’s goal to promote an integrated and instant banking model, Lifshitz told me. “No more waiting for ACH for two days, or for wires to come in. You press a button, you draw from your line of credit, and magically it’s in your checking account … It’s the way that we believe it should be. The fact that it’s not currently like this is incredible in our eyes. This is what we believe the future looks like.”

BlueVine Business Banking will offer customers 1.00% interest rates on their savings and aims to cut out many of the fees associated with checking accounts, as Lifshitz explained that there will be no monthly, excess, or ACH charges; and that wire fees will be a fraction of what they cost with traditional banks.

“We feel we have the ability to build a true small business bank. Finally, one that is built and designed for small businesses rather than one that is having them as the third or fourth priority on the list, which many of the larger banks do … We believe the reason we’re here providing alternative finance is because banking is broken, and our goal is to build better banking, not just financing, but overall better banking.”

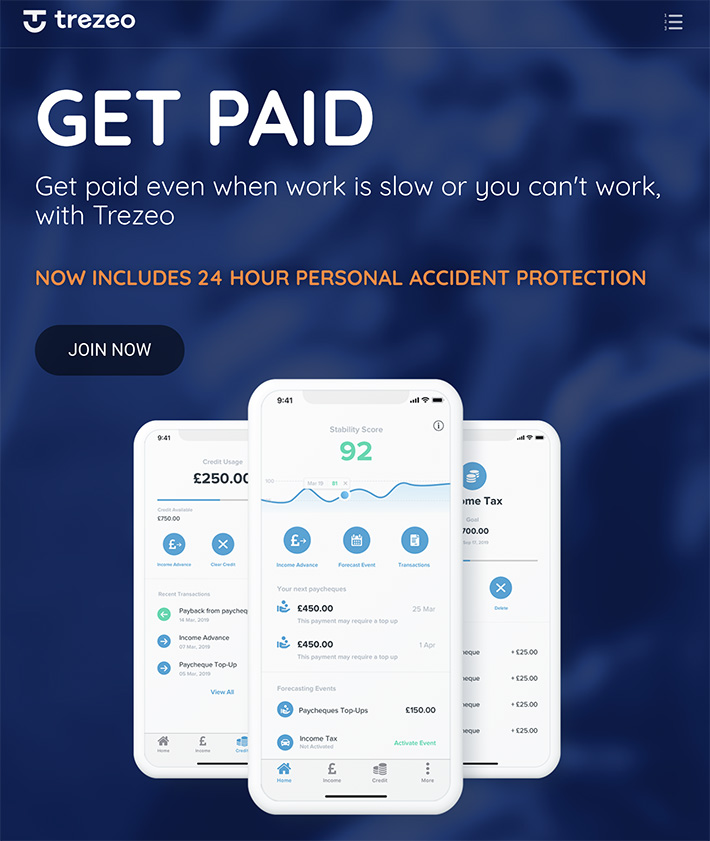

Salaries For All, Even For Gig Workers

October 16, 2019 “If we don’t solve the problems, there’s just a nightmare coming.”

“If we don’t solve the problems, there’s just a nightmare coming.”

This is how Trezeo’s CEO and Co-founder Garrett Cassidy views the work that he and his company are doing. Created in 2016 with the aim to provide support to self-employed people via income smoothing, Trezeo offers workers whose income streams may be irregular the opportunity to have structured and regular paydays similar to those who earn a salary. And with the number of self-employed in the UK currently at approximately five million, as well as projections showing that the majority of US workers will be freelancers by 2027, the company sees its efforts as essential to solving future problems. “There’s a lot of noise around the gig economy,” Cassidy asserted. “But the world is moving that way and we’re very much like ‘that’s fine, you can push back all you want, it’s going that way and we need to create the services that will work for these people.’”

The way it works is that Trezeo serves as an alternative lender, offering regularly paid funds to the customer’s account in exchange for their income that comes in at a later date. A major difference between it and other alternative lenders though is that Trezeo does not charge interest on these advances, instead collecting its revenue from a weekly membership fee of £3.

“We want to allow them to build their own financial resilience and also start looking a bit more useful for traditional financial institutions to engage with,” Cassidy explained. “Our ultimate vision is if you choose to be freelance or self-employed why should you cut yourself off from financial security, why should you trade flexibility for security, and, therefore, that’s the whole ethos of the income smoothing.”

Beyond this service Trezeo has plans to include additional features, such as an income verification system that would help workers be approved for large loans, like mortgages, from banks; as well as an opt-in pension, where instead of being committed to paying a fixed amount each pay cheque, customers could pay 5% of their total income for that period. Trezeo has already gotten the ball rolling with such expansions with the release of its personal accident and disabilities insurance, which covers customers for £300 per week for six months in the case that they are unable to work.

While it may sound as if self-employed and freelance workers are signing up for Trezeo to be their surrogate employer, Cassidy is quick to emphasize that this is instead a new system built to reflect the opportunities presented by technology, distant but reminiscent of the employment structures that came before.

“We’re trying to recreate [the structure] in a way so that a self-employed person controls it and over time can decide what they want … We’re not trying to make them employees, we’re very careful about that, but we’re trying to make it an employee-like experience for them so that they can very easily manage their finances and see them like an employee traditionally would … Platforms are making it easier for people to take the choice of flexibility.”

Speaking to Cassidy in Trezeo’s Irish office in the National Digital Research Centre, an early stage investor in tech companies, we’re snuggly located close by St. James’s Gate Brewery, where the cobbled streets are filled with the nutty and barley-laden smell of Guinness being brewed.

From here is where the development team operates, whereas the risk, sales, and marketing teams work from their London office, with the UK being their only market at this time. However Cassidy assured me that the company is looking interestedly abroad to Western Europe and America with plans to expand.

“This is a very big niche globally,” Cassidy remarked. “And as we’ve gone along, we’ve realized how much of an impact we can have.”