Related Headlines

| 05/17/2023 | Florida to enact DailyFunder rule? |

| 06/06/2022 | Florida: avg gas price $4.76/gallon |

| 03/17/2021 | On Covid: "Florida got it right" |

| 12/07/2020 | SoFi exploring an IPO |

| 09/27/2020 | Florida enters Phase 3, bars packed |

Related Videos

Exploring the Latest in Tech With Trey Markel |

Stories

Florida Disclosure and Broker Law Signed by Governor, But Will The Effective Date Be Revised?

June 26, 2023Florida’s governor signed H1353 into law on Friday, a set of disclosure rules that will impact both brokers and funders. One key element of it was drawn from the DailyFunder forum, for example.

As written, the law says it is supposed to go into effect on July 1, 2023. One wonders given the timeline if that will be extended to give the industry an opportunity to even understand what the requirements are.

Florida has now been updated on the deBanked regulatory map.

Pending Florida Law Draws From DailyFunder’s Rulebook

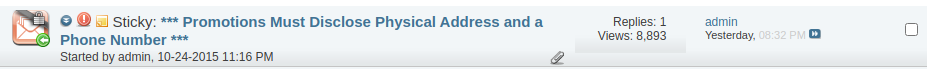

May 17, 2023Florida’s impending disclosure law is not so unique after all. As one user pointed out, Florida’s plan to require that brokers disclose their actual address and phone number in any advertisement is actually a copy & paste of a rule on DailyFunder.

On October 24, 2015, for example, DailyFunder declared that any company soliciting business would have to disclose their physical address and phone number. The rule was stickied in the Promotions subforum and is the first thing shown to users visiting that area.

This phone number and address requirement did not appear in commercial financing disclosure laws passed by other states yet it reared its head in Florida’s bill, a state with a strong user base of DailyFunder users.

The bill is currently awaiting the signature of Governor DeSantis. If enacted, the DailyFunder rule as a legal statute would be the first of its kind.

Florida Set to Enact Commercial Financing Disclosure Law With Unique Broker Rule

May 15, 2023Update: the governor signed the bill into law on June 23.

It’s a new state disclosure law but with a twist. Florida’s bill, which passed both chambers of the legislature on May 4th and now awaits the governor’s signature, has a specific code of conduct aimed directly at brokers.

It’s a new state disclosure law but with a twist. Florida’s bill, which passed both chambers of the legislature on May 4th and now awaits the governor’s signature, has a specific code of conduct aimed directly at brokers.

Among these rules is that the broker cannot:

- Offer its services in any advertisement without disclosing the actual address and telephone number of the business of the broker and the address and telephone number of any forwarding service the broker may use, if any.

- Make or use any false or misleading representation or omit any material fact in the offer or sale of the services of a broker or engage, directly or indirectly, in any act that operates or would operate as fraud or deception upon any person in connection with the offer or sale of the services of a broker, notwithstanding the absence of reliance by the business.

- Make or use any false or deceptive representation in its business dealings.

- Assess, collect, or solicit an advance fee from a business to provide services as a broker. However, this subsection does not preclude a broker from soliciting a business to pay for, or preclude a business from paying for, actual services necessary to apply for a commercial financing transaction, including, but not limited to, a credit check or an appraisal of security, if such payment is made by check or money order payable to a party independent of the broker.

The bill, as written, says it is poised to go into effect on July 1, 2023 (assuming the governor signs it). deBanked first reported on this bill on March 16th.

And Now Florida Has Introduced a Commercial Financing Disclosure Bill

March 16, 2023 Florida has joined the chorus of states introducing commercial financing disclosure bills. While Florida’s bill looks more like Utah’s than it does California’s or New York’s, it seems to make a point about brokers using potentially deceptive business practices. Brokers take note, especially the last paragraph.

Florida has joined the chorus of states introducing commercial financing disclosure bills. While Florida’s bill looks more like Utah’s than it does California’s or New York’s, it seems to make a point about brokers using potentially deceptive business practices. Brokers take note, especially the last paragraph.

A broker may not:

Assess, collect, or solicit an advance fee from a business to provide services as a broker. However, this subsection does not preclude a broker from soliciting a business to pay for, or preclude a business from paying for, actual services necessary to apply for a commercial financing product, including, but not limited to, a credit check or an appraisal of security, if such payment is made by check or money order payable to a party independent of the broker;

Make or use any false or misleading representation or omit any material fact in the offer or sale of the services of a broker or engage, directly or indirectly, in any act that operates or would operate as fraud or deception upon any person in connection with the offer or sale of the services of a broker, notwithstanding the absence of reliance by the business;

Make or use any false or deceptive representation in its business dealings; or

Offer the services of a broker by making, publishing, disseminating, circulating, or placing before the public within the state an advertisement in a newspaper or other publication or an advertisement in the form of a book, notice, handbill, poster, sign, billboard, bill, circular, pamphlet, letter, photograph, or motion picture or an advertisement circulated by radio, loudspeaker, telephone, television, telegraph, or in any other way, in which the offer or advertisement does not disclose the name, business address, and telephone number of the broker. For purposes of this subsection, the broker shall disclose the actual address and telephone number of the business of the broker in addition to the address and telephone number of any forwarding service that the broker may use.

Both the State Senate and House versions of the bill were introduced by republicans.

SEAA Kicks Off in Florida

May 25, 2021More than a thousand people are attending the 20th annual SEAA conference in Bonita Springs, FL that started on Monday. The show is a staple of the payments industry.

“It’s a changing game every minute,” said SEAA board member Derek Vowels about what’s going on in payments .

The packed event has more than 90 companies exhibiting. The “Flamingo” level sponsors include American Express, IRIS CRM, Worldpay, Cardconnect, and Electronic Merchant Systems.

deBanked has been streaming live at debanked.com/tv/. Attendees are saying that it’s great to be back in person.

The May 25th Live Stream schedule is as follows:

9:00 – 10:45am,

3:00 – 4:00pm

5:00 – 6:30pm

Opening 9 minutes from May 24th:

Greenbox Capital Comments on Landmark Florida Legal Victory

January 7, 2021 Greenbox Capital was the victor of a major lawsuit argued before Florida’s Third District Court of Appeal that conclusively established the legality of merchant cash advances in the state.

Greenbox Capital was the victor of a major lawsuit argued before Florida’s Third District Court of Appeal that conclusively established the legality of merchant cash advances in the state.

When asked for comment, Greenbox Capital® CEO Jordan Fein said:

“It’s been a long, arduous, and expensive battle over the last few years proving in a court of law that a Merchant Cash Advance is not a loan. Today, we celebrate a win for all Merchant Cash Advance companies in Florida and the entire United States who are dedicated to funding small businesses through ethical practices. Our hard work and commitment to helping small businesses grow was validated and we are thrilled with the final decision of the District Court of Appeal.”

The decision in Florida echoes a similiar opinion reached in New York in 2018.

It’s Official, Merchant Cash Advances Not Usurious in Florida

January 6, 2021 Big news in the State of Florida. The Third District Court of Appeal entered its order on January 6th to decide the fate of Craton Entertainment, LLC, et al., v Merchant Capital Group, LLC, et al..

Big news in the State of Florida. The Third District Court of Appeal entered its order on January 6th to decide the fate of Craton Entertainment, LLC, et al., v Merchant Capital Group, LLC, et al..

Merchant Capital Group, LLC dba Greenbox Capital sued Craton in December 2016 over a default in a Purchase and Sale of Future Receivables transaction. In turn, Craton responded with various defenses and counterclaims that asserted the underlying transaction was really an unenforceable usurious loan.

The Circuit Court for Miami-Dade County sided with Greenbox in August 2019. The defendants appealed.

The District Court of Appeal decided the matter conclusively on January 6, holding that the original ruling was affirmed on the basis that:

- The transaction is not indicative of a loan where repayment obligation is not absolute but rather contingent or dependent upon the success of the underlying venture

- that the transactions in which a portion of the investment is at speculative risk are excluded from the usury statutes

- when the principal sum lent or any part of it is placed in hazard, the lender may lawfully require, in return for the risk, as large a sum as may be reasonable, provided it is done in good faith.

The decision can be viewed here.

The lawyers representing Appellee Greenbox Capital were Henderson, Franklin, Starnes & Holt, P.A., William Boltrek III, Shannon M. Puopolo and Douglas B. Szabo.

You should contact an attorney to discuss the implications of this ruling. Merchant Cash Advance contracts are not all the same.

This ruling is similar to a ruling in New York that was made in 2018.

Prashant Fuloria Explains Why Fundbox Has Been Successful in 2020

September 28, 2020 When Prashant Fuloria joined Fundbox as Chief Operations Officer in 2016, the San Franciscan firm was a three-year-old startup with less than eighty employees. By the time Fuloria moved into the office of CEO this July, the small business credit and invoice financing company had grown exponentially, with more than $430 million in raised capital to date and triple the number of employees.

When Prashant Fuloria joined Fundbox as Chief Operations Officer in 2016, the San Franciscan firm was a three-year-old startup with less than eighty employees. By the time Fuloria moved into the office of CEO this July, the small business credit and invoice financing company had grown exponentially, with more than $430 million in raised capital to date and triple the number of employees.

At the height of the pandemic, many firms halted funding or shuttered their doors for good. Meanwhile Fundbox kept lending, and outperformed the market, Fuloria said.

“It’s become very clear to us that we have greatly outperformed the market,” Fuloria said. “In terms of delivering value to customers, and also in terms of our business performance.”

In the toughest weeks of the pandemic, he said that Fundbox’s loan delinquency rose to 8-9%, up from a “low single-digit number” pre-pandemic. In comparison, the industry standard according to Fuloria, was a delinquency rate of 30-40%, including from larger firms and more traditional lenders like big banks.

“I think we’ve performed extremely well during COVID; the numbers just validate the investment we’ve made, especially in data,” Fuloria said. “That puts us in a very good position because a number of folks have exited the market and the need, the demand has not gone away.”

The number one thing you can do to perform well in a recession is to have a strong business going into it, Fuloria explained. Fundbox attributes part of its strength to its data. Nearly a fourth of Fundbox’s capital goes toward data assets, Fuloria said.

“If you add it all up, we’ve invested a little over $100 million in our data asset,” Fuloria said. “It’s a big investment for anybody- particularly a big investment for a mid-sized company.”

Fuloria said this money goes toward collecting customer information, which is processed by in-house tech and a talented team of engineers who can turn data into valuable information for serving SMBs.

“Small businesses,” Fuloria said, “they have the complexity of enterprises but the scale of consumers.”

Coming from twenty years of tech and product managerial experience at firms like Google, Facebook, and Yahoo, Fuloria knows a thing or two about scale. He said he found his roots at Google, working when it was just a small team- by the time he left six and a half years later, Google had 35,000 employees.

When it came to joining Fundbox in 2016, Fuloria said he was attracted by the company’s mission, the talented team there, and how in just three years, the small firm had demonstrated how it could help SMBs.

“Fundbox as a company said ‘We are a financial services platform that is powering the small business economy with new credit and payment solutions,'” Fuloria said. “And that mission was very strong: it made sense to me, and it resonated with me.”

Partnership Opportunity - Join MyAlphaLoans as an Independent Sales Organization... hi. guys, i hope this email finds you well. i am reaching out to you on behalf of myalphaloans, a leading provider of business loans and financing so... |

On The Hunt For Lenders Who Offer Monthly Payback Options... attention all alternative lenders! wolfstone funding is on the hunt for lenders who offer monthly payback options, to ensure we can fulfill all of ou... |

See Post... lorida/world-global-finanacing-370090112, show up at 888 biscayne blvd miami, fl, , and then doing a search on the fl corp search:, http://search.sunbiz.org/inquiry/corporationsearch/s... |

See Post... lorida.intercreditreport.com/company/monforte-express-inc-p17000087521... |

See Post... lorida too. that's so weird, , 20 bucks says they live at the flamingo.... |