CFPB Small Business Lending Rule Compliance Delayed a Year

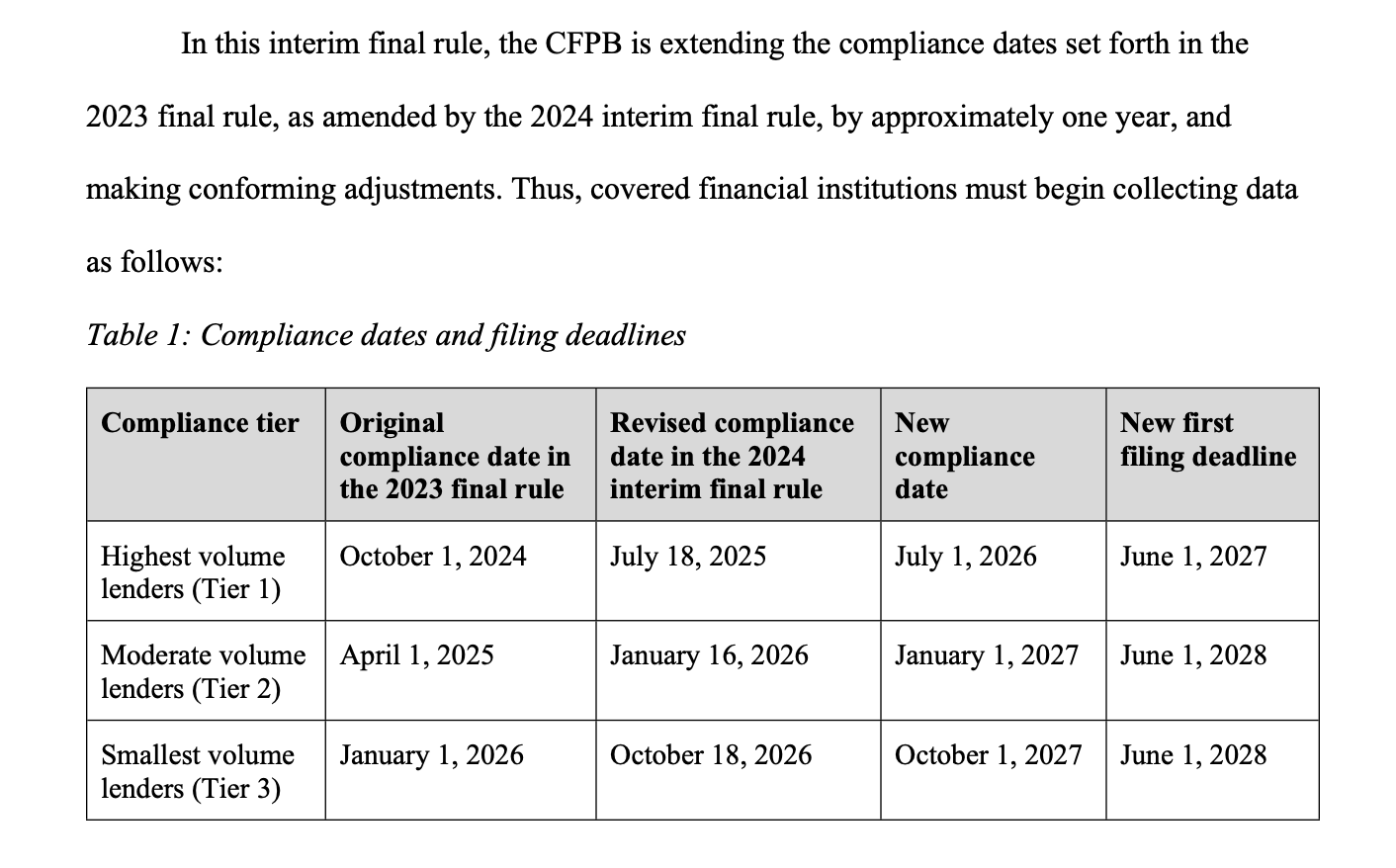

The CFPB has officially hit the pause button on complying with the small business lending data collection rules. They were supposed to go into effect next month. The Agency, however, announced in April that it planned to rewrite all of the rules and would not enforce them in the interim. Alas, covered parties wondered if they were still required to comply regardless of the whims on enforcement. Consequently, a new deadline for compliance was set for July 1, 2026. That assumes the new rules are ready by then or that there are no further delays.

The CFPB has officially hit the pause button on complying with the small business lending data collection rules. They were supposed to go into effect next month. The Agency, however, announced in April that it planned to rewrite all of the rules and would not enforce them in the interim. Alas, covered parties wondered if they were still required to comply regardless of the whims on enforcement. Consequently, a new deadline for compliance was set for July 1, 2026. That assumes the new rules are ready by then or that there are no further delays.

The rules have technically been delayed by fifteen years already since the law requiring such rules to be implemented was passed in 2010 (Dodd-Frank). Other priorities, politics, debates over the legislation’s scope, and endless litigation relating to it pushed back rule-making and compliance to where it is now. During Trump’s first term, there was even disagreement as to what the CFPB should even be called. deBanked has been covering the law for more than 10 years.

The law had previously been deemed applicable to both loans and merchant cash advances. The rules had been codified in 888 pages of guidelines.