Regulation

New Jersey Tries Commercial Financing Disclosure Bill Again

October 17, 2024For the 7th year in a row the legislature in New Jersey is trying to pass a commercial financing disclosure bill. While a notable component is an APR requirement it also applies a broad warning to brokers.

A broker shall not make or use:

(1) any false or misleading representations or omit any material fact in the offer or sale of the services of a broker or engage, directly or indirectly, in any act that operates or would operate as fraud or deception upon any person in connection with the offer or sale of the services of a broker, notwithstanding the absence of reliance by the buyer; or

(2) any false or deceptive representation in its business dealings.1

The full language can be found here.

California Bill Aims to Add Consumer Debt Collection Protections to Commercial Debts

August 20, 2024Among several commercial finance bills currently making their way through the legislature in California is SB1286, which would apply consumer debt collection protections to commercial debts.

If this bill were to eventually pass commercial debt collectors would need to obtain the same license currently required under existing law for consumer collectors. In addition, it would be a crime for a collector of a commercial debt “to send a communication that simulates legal or judicial process or that gives the appearance of being authorized, issued, or approved by a governmental agency or attorney if it is not.”

There are still more components that would require compliance as well. Like the fact that under current law a debt collector is required to stop collecting a consumer debt when an alleged debtor provides the debt collector with certain information, including information relating to the debtor’s status as an alleged victim of identity theft. This would also apply to commercial debts. The full language of the bill can be read here.

Another bill moving along right now is SB1482, which would “would impose various duties on commercial financing providers and brokers, including, among other things, prohibiting the taking of a confession of judgment or power of attorney at any time before a default.”

Although both bills were introduced all the way back in February, they are currently being passed through committees.

The Status of the Legal Situation in New York

April 8, 2024| A lot has transpired on the legal front in New York State over the last month. If you’re a broker, funder, or lender that does business in New York, you cannot afford to miss this session at Broker Fair on May 20 in NYC. Come and learn about the current status and future outlook of the industry from this panel of knowledgeable attorneys. Your success is dependent on being informed. Take advantage of this opportunity!

|

Federal Regulator Tasked With Small Business Finance Oversight is Now Protesting Itself?

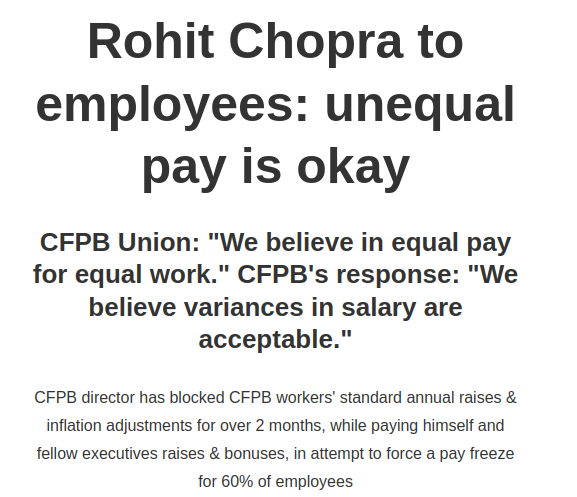

April 5, 2024If you saw a protest outside the office of the CFPB in Washington DC lately, you’d be forgiven for assuming it was a group of aggrieved consumers. Alas, it’s something much more bizarre, the CFPB protesting itself. That’s because the regulator is currently engaged in a labor union dispute with its own employees over fair pay. Mind you this is the same regulator that is tasked with adjudging fairness in the private sector. CFPB employees are members of Chapter 335 of the National Treasury Employees Union (NTEU) and this union is currently engaged in heavy mobilization and protest efforts against the CFPB.

The campaign slogan is Pay Up, CFPB, which has been printed on banners that are being paraded by CFPB enforcement attorneys outside the CFPB office on 1700 G St NW. The NTEU actually has a formal online signup sheet for CFPB employees to pick their time to picket outside. On April 3rd, the union even took a page out of the New York City playbook when it apparently wheeled in a Scabby the Rat inflatable.

Apparently this guy was in front of CFPB headquarters yesterday. pic.twitter.com/5mq7R2h1Tf

— Evan Weinberger (@reporterev) April 3, 2024

As recent as March 27, the National President of the NTEU scolded CFPB Director Rohit Chopra in a letter that accused him of being uncooperative in negotations.

“I believed you when you said you valued CFPB employees and that you respected NTEU as CFPB’s exclusive representative. However, your actions have not supported your words. I have reached out to your office multiple times, both by letter and by phone without receiving a proper response. To build a strong relationship, we must prioritize communications to work through issues, especially when we disagree. Instead, you have avoided all communication. I have even offered to meet with you on the weekend to let you know my commitment to this relationship and to stress to you how important having ongoing discussions is to help resolve this dispute. Your lack of response is unacceptable.”

– NTEU President Doreen P. Greenwald to CFPB Director Rohit Chopra

The irony of this all cannot be overstated. While the CFPB is literally preparing to enforce 888 pages of regulations in small business lending to assess fairness in the marketplace, the union representing the CFPB’s employees has declared that the CFPB’s leadership does not believe in fairness.

Meanwhile, the CFPB just settled a separate lawsuit with its own employees over previous claims that it had discriminated on the basis of race.

The CFPB Now Wants to Work With Loan Marketplaces?

March 27, 2024 Things are getting weird in government land. The CFPB, the regulator in charge of collecting data from small business finance companies starting this Fall, has just revealed what one of its long term goals of that might be, incorporating the data into loan marketplaces.

Things are getting weird in government land. The CFPB, the regulator in charge of collecting data from small business finance companies starting this Fall, has just revealed what one of its long term goals of that might be, incorporating the data into loan marketplaces.

That’s because on Wednesday, CFPB Director Rohit Chopra said that he plans to do exactly that with another industry the agency collects data on, the credit card industry.

…reliable information about interest rates is also just hard to come by. So, we instead see people comparing cards by annual fee, or rewards, or perhaps just signing up for a card from the same bank where they have a checking account, assuming the interest rate they’re charged will be competitive. To help make this process easier, we are assembling a pricing data set for third-party comparison websites and others to use to help consumers find the best deal for them. This will rely on data submitted under existing requirements of the 1988 law. I hope to share more about those plans in the coming months.

While it may be a leap at this stage to say that this will happen in the small business finance industry any time soon, virtually none of the speculation surrounding what the CFPB will actually do with the data it collects, if anything at all, has been that it would be integrated into loan marketplaces for merchants to compare options. Given current trends across all levels of government this is not so preposterous. For example, the City of New York just introduced its own business loan marketplace and the SBA just upgraded theirs. Couple this with a slew of recent regulatory enforcement activity in the private sector and the idea that there is a plan for government-run business loan marketplaces that are powered by federal agency loan data for comparison shopping is not incomprehensible.

New York State Bill Aims to Recharacterize Factoring, Leasing, Revenue Based Financing, and More

March 22, 2024 A proposal to amend a New York State statute that governs how the rate of interest is computed “upon a loan or forbearance of any money, goods, or thing in action” seeks to broaden its application to an all encompassing umbrella of loan and non-loan products defined as a “financing arrangement” and then subject them all to usury caps.

A proposal to amend a New York State statute that governs how the rate of interest is computed “upon a loan or forbearance of any money, goods, or thing in action” seeks to broaden its application to an all encompassing umbrella of loan and non-loan products defined as a “financing arrangement” and then subject them all to usury caps.

And yes, it applies to commercial financing.

According to Assembly Bill 9585, a financing arrangement will be defined as “to include loans, forbearance of any money, goods or things in action, and all other transactions that involve the lending or advancing of money, goods or things in action for an amount charged, taken or received, and all transactions that operate as substitutes for such products, including but not limited to retail installment contracts, merchant cash advances, invoice financing, revenue-based financing, earned wage access or similar wage advance transactions, lease- or rent-to-own arrangements, rental-purchase agreements as defined in subdivision six of section five hundred of the personal property law, buy-now pay-later transactions, financing for litigation or legal settlements, income-sharing agreements and financing for education.”

And once that rate of interest is computed, “any rate exceeding twenty-five per centum per annum” in accordance with how the rate is allowed to be calculated, will be considered a Class E Felony of Criminal Usury.

This is just a bill. It hasn’t passed anything yet. It can be read here. It was introduced by Assemblywoman Helene E. Weinstein.

Utah Amends Definition of Commercial Finance Broker

March 11, 2024

The Utah state legislature successfully passed a bill amending some elements of its recent commercial financing disclosure law.

As part of that the definition of a broker has changed from:

a person who, for compensation or the expectation of compensation, arranges a commercial financing transaction between a third party and business in the state.

to:

a person who:

(i) for compensation or the expectation of compensation, obtains a commercial financing product or an offer for a commercial financing product from a third party that, if executed, would bind the third party; and

(ii) communicates the offer described in Subsection (2)(a)(i) to a business located in the state .

(b) “Broker” does not include:

(i) a provider; or

(ii) a person whose compensation is not based or dependent on the terms of a specific commercial financing product that the person obtains or offers.

The law will also remove the line about having to disclose “any amount of the funds described in Subsection (2)(a) that the provider pays to a broker in connection with the commercial financing transaction.”

You can read it here. The bill just needs the governor’s signature.

Louisiana Introduces Commercial Financing Disclosure Bill

March 3, 2024Louisiana is the latest state to introduce a commercial financing disclosure bill. SB 335 is a copy & paste of the law that recently passed in Florida.

Other states with pending legislation on the subject include Missouri, Kansas, Illinois, and Maryland.

You can read the Louisiana bill here.