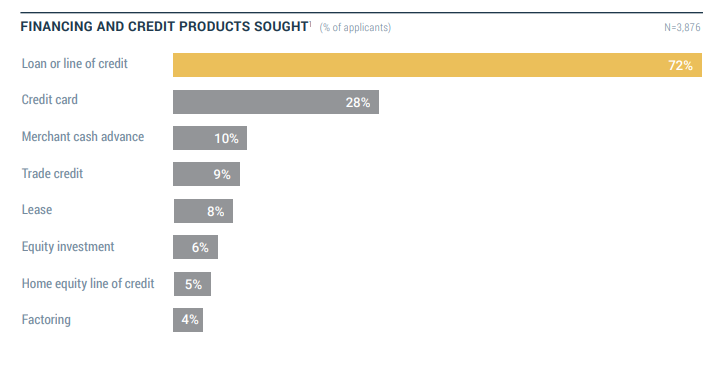

Ten Percent of Small Businesses That Sought Financing in 2021 Sought a Merchant Cash Advance

A whopping 10% of small businesses that sought financing last year sought out a merchant cash advance, according to the latest study published by the Federal Reserve. That figure was up from 8% in 2020 and 9% in 2019. For the the preceding years, that figure had held fairly consistent at 7%. [See 2015, See 2017]. Market penetration, therefore, has arguably increased by about 40% since 2015.

Meanwhile, the percentage of applicants that sought out leasing has gone down over the last seven years: from 11% in 2015 to 8% in 2021. Factoring has hovered around 3-4% consistently.

The pursuit of of loans and lines of credit decreased dramatically from 89% in 2020 to 72% in 2021. And approvals have gone down across the board. Approvals on business loans, lines of credits, and MCAs hit a peak of 83% in 2019 and plunged to 76% in 2020, the first year of Covid. The figure fell even further in 2021, down to 68%. Online lenders and large banks had the lowest approval rates overall, at 51% and 48% respectively.

The full most recent Fed Study can be viewed here.

Last modified: April 18, 2022Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.