Archive for 2021

Implementation of New York’s Commercial Financing Disclosure Law Delayed

April 6, 2021The implementation of New York’s commercial financing disclosure law has been pushed back. Originally scheduled to go into effect in June of 2021, an amending bill changed the date to January 1, 2022.

The only other material change of note is that the exemption from the law for transactions greater than $500,000 has been increased to $2.5 million.

Industry Ponders: Broker Blacklisting, or Certification?

April 5, 2021 It’s a concept that’s been thrown around the industry for years- swapped like business cards at meetups, conventions, and chatrooms. Shouldn’t there be a broker certification, database, or even blacklist for known bad actors?

It’s a concept that’s been thrown around the industry for years- swapped like business cards at meetups, conventions, and chatrooms. Shouldn’t there be a broker certification, database, or even blacklist for known bad actors?

As deBanked petitioned the question, the industry responded with its naturally diverse responses. The problem: bad actors can keep getting away with shenanigans. The solution? Well, no one size fits all approach could work in the alternative finance industry, but a certification source may do the trick.

CEO of FundFi, Efraim “Brian” G. Kandinov, recently brought up the idea of a “Datamerch for Brokers.” Like a DNC list, Kandinov said there has got to be a way to sort out the known bad actors, scam artists, and even the brokers that play the funding houses by training merchants.

“I think opposed to a blacklist: a list that notes bait and switches, where the merchant was coached by the broker,” Kandinov said. “This way can go around a lawsuit or any fear of that, and the funder is free to choose once reading others’ notes.”

Kandinov said that most of his “problem files” show signs of brokers coaching merchants to start protesting deals after the clawback period ends. Get paid, pass the smell test during a 30-60 day waiting period, and then tell the merchant to jump ship on the deal or argue to lower the payments.

“If they were not [suddenly going out of business], they were calling in like a schedule to lower their payments. No way it can be that uniform unless they were being coached. The broker comes off as the good guy that he played the funding houses,” Kandinov said. “I think harsh means are necessary to expel these guys from the industry.”

Other funding side members of the industry have voiced their support for some type of broker record database. Kristen Ferrara, Director of Underwriting at The LCF Group based in New York, said that LCF pays a high expense to select ISOs. A vetting platform could be a great resource.

“I think it would be a good resource for funders,” Ferrara said. “We turn down about 50% of the ISOs who try to sign up with us. This resource could save funders millions of dollars in deals going bad from ISOs over-promising or committing fraud.”

“I think it would be a good resource for funders,” Ferrara said. “We turn down about 50% of the ISOs who try to sign up with us. This resource could save funders millions of dollars in deals going bad from ISOs over-promising or committing fraud.”

On the other side of the country in San Diego, CEO David Leibowitz from Mulligan Funding said he is all for a way to help funders vet brokers. Mulligan is lucky to work with a trusted brokers network and drops a client like a broken elevator at the first sign of fraud or unethical behavior, he said.

“We are extremely careful about which brokers we do business with. If we see any kind of practice that we think is unethical, we’ll cut a broker loose in a heartbeat,” Leibowitz said. “Is there value in the sort of thing you’re talking about? I think there probably is because I think it makes vetting brokers for [funders] a lot easier, and it also allows brokers to differentiate themselves against their competition by their ethics.”

Leibowitz is a proponent of ethics as an indicator of value and said a certification could help members of the public tell the difference between good and bad funders and let funders spot good ISOs and bad ISOs.

A worry for some is that whatever company, organization, or site that hosts a broker ledger could face lawsuits for liability, could accept payments to make bad reviews go away, list competitors to hurt them, or be outright ignored by an industry always hungry for deals.

But industry lawyers seem to agree that a broker certification or blacklist would ultimately benefit the industry if provided from the right source. Patrick Siegfried, the Deputy General Counsel at Rapid Finance, said that whatever agency would be rating brokers would need its own trusted reputation.

“To have a legitimate background or rating system, it needs to be done by an independent third-party that has its own credentials,” Siegfried said. “I think that’s a big reason you don’t see many third-party or private rating systems.”

Siegfried said one option that ensures a true third-party point of view is a government agency taking care of a broker tracking system. Another option would be an industry coalition, but then it’s a question of cost- Who is paying to staff and maintain a complaint system?

Siegfried said one option that ensures a true third-party point of view is a government agency taking care of a broker tracking system. Another option would be an industry coalition, but then it’s a question of cost- Who is paying to staff and maintain a complaint system?

“At the end of the day, having a good industry regulator is a benefit for the industry,” Siegfried said. “It will allow a third-party, government entity to vet brokers in terms of licensing and then maintenance, looking into valid complaints.”

As conversations across the country point toward a licensing regime, Siegfried said it’s a sign the industry is maturing and that one day there will be a government agency to lodge complaints with and to actually vet brokers in the space.

Steve Denis from the Small Business Finance Association (SBFA) proposed a solution to the issue. He said that in the works right now is an SBFA-sponsored certification program.

“We started just looking at brokers and thinking about how to certify them,” Denis said. “We think that it’s the time, from the feedback we’ve gotten from regulators, that we launch a true industry-wide certification.”

In the coming months, brokers may be able to apply for certification when the program rolls out. Instead of a ‘blacklist,’ Denis said brokers could set themselves apart as trusted providers by going through a basic background test or industry knowledge checks.

“If you’re a broker and you can’t get certified, then there’s probably some issues,” He said. “So our hope is if you carry a certification, that’s sort of a message that you are a good broker.”

When it comes to government regulation, Denis said he is still cautious. While he 100% expects certification programs to crop up for state licenses, he thinks no government agency can achieve what an industry coalition can do.

North Mill Continues Record-Setting Trajectory as March Volume Hits All-Time High

April 2, 2021

NORWALK, CT – North Mill Equipment Finance LLC (“North Mill”), a leading independent commercial equipment lessor providing small-ticket financing through its network of referral agents, announced today that the company reached an all-time high in monthly loan and lease originations in March. Funded volume surged to more than $24 million, a growth rate of 53% from last March and an increase of 22% from the company’s previous high-water mark last December.

“We’re firing on all cylinders,” said David C. Lee, Chairman and CEO, North Mill. “We reported a record breaking year in 2020 and I anticipate that we’ll continue to see an upward trajectory as the economy opens up. First quarter volume topped $54 million, an increase of more than 18% from Q1 of last year while our weighted average FICO climbed an additional 9 points to 717.” Average deal size also hit a record for March, according to Lee, as it reached nearly $90k per transaction.

A strategic initiative that has had a resounding impact on North Mill’s success is its continued commitment to financing assets across an array of industries. Transportation, which made up nearly 100% of the firm’s asset portfolio a few years ago, now accounts for about 40% of funded volume. The company has expanded into many types of equipment including, but not limited to, construction, health care, franchise opportunities and livery.

As referral agents continue to turn to North Mill to obtain financing for their customers, the capital markets have also demonstrated confidence in the company. Last month, North Mill closed NMEF Funding 2021-A, its fourth commercial equipment backed securitization (ABS), its largest ever. The $236,588,000 ABS issuance was well received by institutional investors as evidenced by strong oversubscription levels across all tranches of notes. Capital was raised from a total of 23 investors, more than double the number from the company’s previous issuance (NMEF 2019-A).

About North Mill Equipment Finance

Headquartered in Norwalk, Connecticut, North Mill Equipment Finance originates and services small-ticket equipment leases and loans, ranging from $15,000 to $300,000 in value. A broker-centric private lender, the company handles A – C credit qualities and finances transactions for numerous asset categories including, but not limited to, construction, transportation, vocational, healthcare, manufacturing, printing, franchise opportunities and material handling equipment. North Mill is majority owned by an affiliate of Wafra Capital Partners, Inc. (WCP). For more information, visit www.nmef.com.

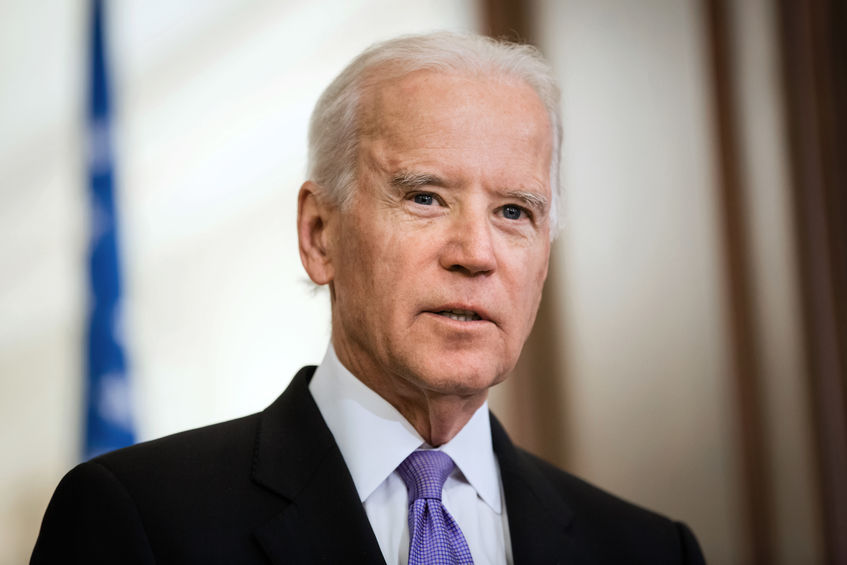

PPP Deadline Extended, Jobs Act Proposed

April 1, 2021 President Biden signed a law extending PPP lending until May 31st. The PPP Extension Act passed through Congress on March 25th and will allow businesses to access emergency loans past the original March 31st deadline.

President Biden signed a law extending PPP lending until May 31st. The PPP Extension Act passed through Congress on March 25th and will allow businesses to access emergency loans past the original March 31st deadline.

According to the PPP loans tracker, as of 3/21 the SBA has disbursed $718 billion of the $806 billion available, leaving $88 Billion left for funding. Businesses will be able to apply until the new deadline, and the SBA will be able to process applications until the end of June. The new filing deadline gives the SBA some breathing room to review the 234,000 applications currently in the queue.

Biden signed it a day after unavailing a $2 trillion American jobs and infrastructure plan, aimed at revitalizing roads, bridges, and protecting the environment. The money is split into a cross-section of infrastructure, subsidies, like $100 billion toward bringing broadband internet to 30 million Americans, $50 billion toward semiconductor research, and $174 billion toward electric car manufacturing.

Not every spending point is for future tech. There are lump sums for healthcare, like $400 billion for long-term elderly care, and $30 billion for pandemic preparedness.

Biden has said he plans to pay for the expenses through the Made In America corporate tax plan raising the corporate tax rate from 21% to 28% after President Trump leveled the tax from 35%.

deBanked Announces SPAC

April 1, 2021April Fools 2021

deBanked employees were summoned to an all-hands meeting in the company’s modest Brooklyn, NY headquarters yesterday afternoon to bear witness to a special announcement.

deBanked employees were summoned to an all-hands meeting in the company’s modest Brooklyn, NY headquarters yesterday afternoon to bear witness to a special announcement.

“We’re launching a SPAC,” deBanked president and chief editor Sean Murray said to a stunned room. “I’ve been writing about fintech for more than ten years, but an inspirational meme posted by a bot on twitter got me thinking. And I was just like, ‘You know what? F*** it, let’s just buy the whole fintech industry.'”

Everyone quickly agreed that it was a genius move.

“What was the last stimulus? like what, $1.9 trillion or something? We’ll raise at least 10x that amount in our IPO,” he continued. “No financial technology company is off limits, we’re going to buy them all. I can’t believe no one has thought of this yet!”

Murray realized that such a brilliant strategy was likely to rattle the largest banks and he said that he had already placed calls to Jamie Dimon at JPMorgan and David Solomon at Goldman Sachs to ease them into his swift rise to financial power.

“I mean did I actually speak to them? Technically per se not really, but I heard them speak on Clubhouse of which I am an elite exclusive member,” Murray said.

When pressed for details about this Clubhouse conversation, Murray backpedaled and said he actually just read an article about Clubhouse but that the article referenced Elon Musk and that he was basically just as important as the famed bankers. Several sources who wished to remain anonymous said that Murray was only invited to Clubhouse after shamelessly begging for an invitation on twitter.

Attempts to verify his membership revealed a profile picture where he is giving a thumbs up while holding a glass of scotch, one of which he said came from a bottle that cost more than I would ever make in my whole life. A fact check, however, revealed that it was really just expired apple juice that a building maintenance worker had left out near the common area garbage disposal.

When asked to explain this, Murray said, “Bro, why do you think we’re doing a SPAC? Once we have the money, we’ll be drinking freaking Apple computers!”

By the end of the big company meeting, Murray pulled out a joint and began puffing it furiously through a mouth hole he cut open in his 7 simultaneously-worn covid masks, prompting one staff member to ask if his fanciful plan was at all related to New York’s newly enacted marijuana law.

“Wait, you mean this sh*t’s legal now?” he asked. “F***, make it two SPACs then!”

April Fools 🙂

NY Legalizes Pot, Immediately

March 31, 2021 New York City is going to be blazing this weekend.

New York City is going to be blazing this weekend.

Apparently, the Northeast has had nothing to do but sit inside and smoke weed or eat edibles for more than a year, and the laws finally caught up.

New York lawmakers passed the Marijuana Regulation and Taxation Act in the state Senate on Tuesday. Twelve hours later Governor Cuomo signed the bill, ensuring adults over 21 will be able to toke freely in N.Y.

Effective immediately, adults can carry three ounces of cannabis, store five pounds of the stuff at home, and grow up to six plants per person for personal use. The law creates the Office of Cannabis Management to oversee the markets, setting a sales tax of 13%- 9% state 4% county and municipal on the kush. There will also be a tax on THC content and layers of sales taxes that could bring the total above 20%.

Just like in the N.J. legalization- cops can’t stop a car because it smells like skunk. The new regulatory office will be set up over the next six months. Expungement of past convictions will be made easier: two years after the law goes into effect on Wednesday.

In the bill, specific language aims 40% of the new industry’s tax proceeds toward minority communities disproportionately affected by the state’s drug laws.

“By directing new tax revenues to communities like the ones I represent; easing the pathway to enter this business for new and small companies, and ensuring qualified applicants of color have prioritized access, this bill paves the way for a brighter future” 20th district, Brooklyn State Senator Zellnor Myrie said in a statement. “New York’s marijuana legalization framework can be an equitable, responsible, and growth-oriented model for the rest of the country.”

Now, two-thirds of the Northeast’s 56 million residents live in states that have legalized recreational cannabis.

Governor Cuomo, recently under calls to resign for allegations of sexual assault and harassment, said in a statement that it is a historic day for New York. According to the statement, the legislation could create up to 60,000 jobs and generate $350 million in annual tax revenue for the state. Based on the markets’ size in states that have already legalized pot, the N.Y. weed industry could be a $4 billion cash cow.

Some lawmakers were unhappy with the passage of the bill. State Senator George Borrello voted no and said in a statement that the state’s one-party rule was more concerned with appeasing special interests than creating responsible policies. He and other naysayers cited concerns about driving under the influence of marijuana.

“While I am personally opposed to legalization if New York is determined to head down this path,” Borrello said. “I believe we have a responsibility to craft a law that mitigates the risks to New Yorkers to the greatest extent possible, with no loopholes or gray areas. Regrettably, this bill doesn’t meet that standard.”

Tune in Today Live: debanked.com/tv

March 31, 2021Update: The recording is here

deBanked will be streaming live today at approximately 12:15 with special guest Jennie Villano of NewCo Capital Group. She will be joined by host Sean Murray in the studio. This is not a Zoom or virtual discussion. There is no need to register. Anyone can tune in free at debanked.com/tv or debanked.tv

PayPal Enables Purchasing With Bitcoin

March 30, 2021 PayPal launched Checkout with Crypto, allowing users to use Bitcoin, Litecoin, Ethereum, or Bitcoin Cash to checkout at more than 29 million PayPal merchants.

PayPal launched Checkout with Crypto, allowing users to use Bitcoin, Litecoin, Ethereum, or Bitcoin Cash to checkout at more than 29 million PayPal merchants.

“As the use of digital payments and digital currencies accelerates, the introduction of Checkout with Crypto continues our focus on driving mainstream adoption of cryptocurrencies,” CEO and President Dan Schulman said. “Enabling cryptocurrencies to make purchases at businesses around the world is the next chapter in driving the ubiquity and mass acceptance of digital currencies.”

The transactions will be settled in cash by PayPal automatically, and the firm said it does not plan on holding the coins and will likely sell the balance off. PayPal had previously offered to buy, sell and hold cryptocurrencies on their platform through a partnership with Paxos Trust Company.

PayPal said it added crypto purchasing to engage more customers with online merchants and make their purchasing platform more accessible.

How will the transactions be taxed? The terms and conditions state that PayPal will provide 1099 forms and report to the IRS, but “it is your responsibility to determine what taxes, if any, apply to transactions you make.”

A lot of Crypto news happened at once. Yesterday, Visa announced a USD Coin program, aiming to allow transactions to be settled through a stable coin backed by the USD.