Nuula, Still in the Business Lending Game, Lays Groundwork for Larger Ecosystem

Nuula, formerly known as BFS Capital, has 5,000 merchants on a waitlist to access a line of credit after just four months of its application process being made available.

Nuula, formerly known as BFS Capital, has 5,000 merchants on a waitlist to access a line of credit after just four months of its application process being made available.

But there’s more.

“Nuula is built to not only deliver our own financial products, but it’s developed to help us provision and deploy third party financial products that come from our ecosystem,” said Mark Ruddock, Nuula’s CEO. “So what we’re trying to do here is not really be a broker, but we will carefully curate products.”

“That could be larger, longer loans from one partner, it could be insurance from another partner, it could be entrepreneur wealth management from a third partner,” he continued.

“So we bring those partners onto the platform, and then we expose their functionality within the app, in a way that’s consistent with all the other tools in the app. So yes, there is room for third party lenders.”

Ruddock spoke about how as of now, Nuula’s infrastructure only offers opportunities to those interested in directly funding businesses. The company profits via revenue sharing when businesses are provided with capital from a third party funder on the platform.

Despite not being available yet, he hinted at possibly incorporating broker-esque products as the app’s financial product suite grows.

“Today, we don’t see a near term role for brokers on the app, because we’re not really trying to create a marketplace of a multitude of products, we’re really trying to curate things very, very carefully,” said Ruddock. “However that’s not to say say that we will not over time provide the ability for the more digital brokers or intermediaries to play a role as we seek to broaden the portfolio of tools that we offer.”

“I would say no to brokers in the sense that we really don’t have a compelling offer for them at the moment, but yes to other financial services providers.”

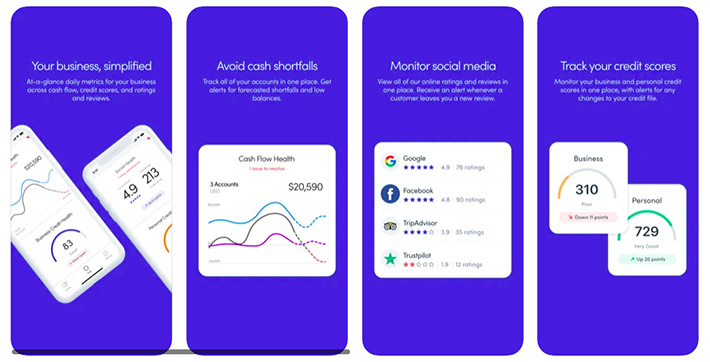

Ruddock described how Nuula is serving a niche customer base, a tech-centric merchant who is looking for an easy-to-use mobile software that can manage their businesses’ X’s and O’s. Not only is this type of merchant underserved and beginning to substantiate in numbers according to Ruddock, but they are extremely eager for access to capital.

“It’s a fundamental change in the way underwriting has been done, away from kind of a rearward looking model, towards a real-time forward looking model, and that’s what we believe is going to be required to unlock capital to this new generation of businesses.”

“[Nuula] reimagines underwriting in a way that says ‘don’t just look at the last six months of bank statements’,” Ruddock said. “[We] look on not only of the day of lending, but the lifetime of your relationship, and how those businesses are recovering, growing, and thriving.”

He spoke about how with real-time data being accessible through Nuula, businesses that are building their creditworthiness can have a mobile reference point for the data that they need to see their real-time financial state, while simultaneously giving lenders a live picture of the businesses’ books.

“So even if a business is not strong enough for credit today, it might be in three months, and we can go watch your progression through this period and unlock the capital when the time is right, and then if that business grows out of the pandemic and recovers and is stronger, we’re going to be able to a broader and richer portfolio of credit.”

Although their target customer seems to be a digitally native merchant, Ruddock says that Nuula’s onboarding process is designed to be simple enough for a merchant who may not be as familiar with fintech.

“I’m a fifty-plus year-old CEO of a fintech company, and I would say I’m as digitally savvy as a twenty year-old, so it isn’t really about age anymore,” said Ruddock. “It’s by the way which [merchants] have embraced technology.”

“What we’ve done with Nuula is we’ve tried to make this product intuitive and simple for a first time app user and we’ve tried to help these folks get access to the data that now is sitting in a multitude of systems. While we believe people who have grown up in an app-centric world are going to be amongst the first adopters, we’re trying to make this product accessible for the fifty year-old restaurant owner too.”

Nuula plans on expanding their data harnessing tools with other fintechs early next year. “Over the next two weeks, we will actually unlock the ability for [merchant] sales data from Shopify or Square,” said Ruddock.

Last modified: December 29, 2021