Tether is Now So Big, Its Collapse Could Disrupt the Short-Term Credit Markets

More than $62.5 billion worth of Tethers have been printed in the last few years to facilitate liquidity in the crypto markets. The system has worked because the company behind Tether had long claimed that each unit of the digital currency was backed somewhere by a real dollar in a bank account.

More than $62.5 billion worth of Tethers have been printed in the last few years to facilitate liquidity in the crypto markets. The system has worked because the company behind Tether had long claimed that each unit of the digital currency was backed somewhere by a real dollar in a bank account.

That was determined false. “Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie,” wrote the New York State Attorney General in February after the regulator announced a settlement with the company. “These companies obscured the true risk investors faced and were operated by unlicensed and unregulated individuals and entities dealing in the darkest corners of the financial system.”

Despite the characterization, Tether has continued to be the glue that makes the global crypto market hum. And their size is now so big, that it’s no longer just a crypto problem.

According to the Federal Reserve Bank of Boston, Tether now poses a risk to all short-term credit markets. The central bank listed it as an example of “new disruptors” that pose financial stability challenges.

Eric S. Rosengren, the CEO of the Boston Fed, said “There are many reasons to think that stable coins, at least many of the stable coins are not actually particularly stable and actually have some of the same features as money market funds. The difference is prime money market funds have been losing market share but these stable coins have been growing very rapidly in part because of their use along with the cryptocurrency market.”

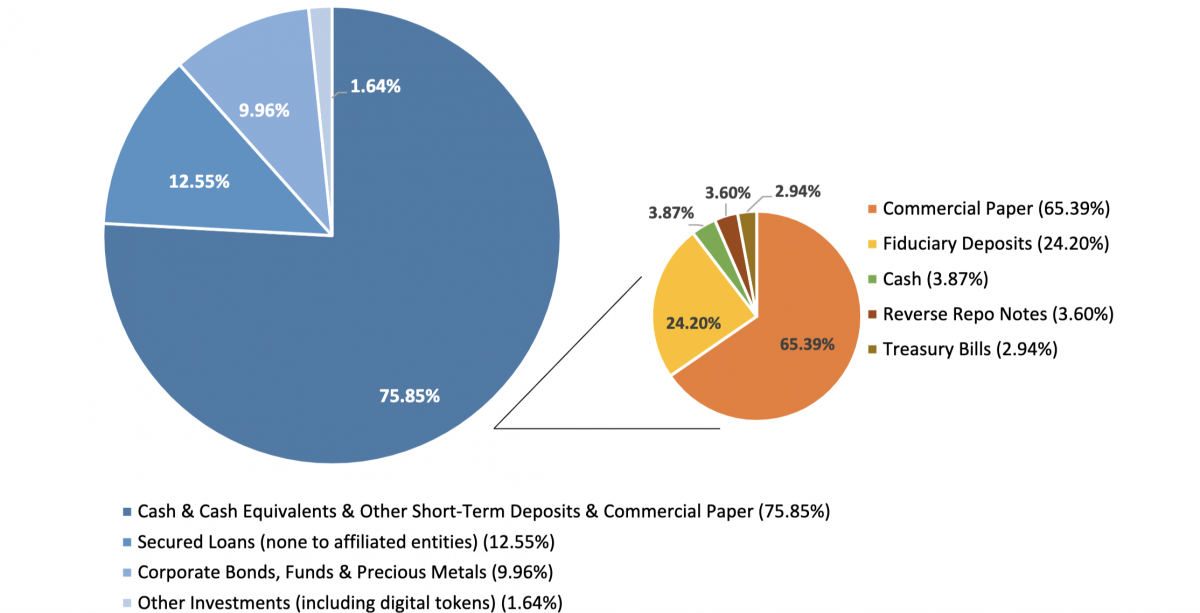

On Tether in particular, he said, “While [Tether talks] about being stable, if you look at the set of assets that are there, it includes corporate bonds, secured loans, commercial paper, in effect this is a very risky prime fund. Prime funds would not be able to hold all these assets.”

Tether has drawn enhanced public scrutiny in recent months after releasing the following breakdown of its assets. The digital asset company that once claimed all Tethers were backed by dollars, revealed that less than 3% of them were actually backed by dollars.

Tether’s riskiness was also the subject of a recent segment on Jim Cramer’s Mad Money show on CNBC:

deBanked first shed light on the Tether mystery more than two years ago in a story that questioned what drove the cryptocurrency bull market of 2017.

Last modified: June 26, 2021Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.