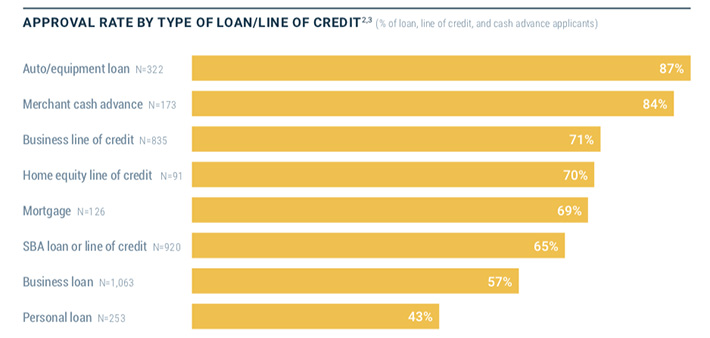

Merchant Cash Advance Approval Rate Was 84% in 2020, Federal Reserve Finds

Eighty-four percent of applicants that applied for a merchant cash advance in 2020 were approved, according to the latest study published by the Federal Reserve. However, that figure includes the pre-March 2020 covid era.

When MCAs and online loans were blended, for example, the approval rate shrank from 81% pre-March 1st to 70% after March 1st.

Eight percent of all small businesses sought a merchant cash advance in 2020, down slightly from 9% in 2019. Leasing dropped from 9% to 7% and factoring dropped from 4% to 3%. Pursuit of credit cards even dropped, down from 29% to 21%.

There were some downsides for the online lending industry reported.

Only 9% of PPP applicants used an online lender.

Online lenders had the lowest satisfaction rate (43%) for small business credit needs. Credit unions scored the highest (87%).

Net satisfaction with online lenders dropped to its lowest level since 2016.

Small businesses satisfaction with big banks actually grew from 2019 to 2020.

Small businesses were less likely to apply for a business loan or MCA from an online lender in 2020 and more likely to apply for them at a bank in 2020 than they were in 2019.

Eighty-two percent of businesses applied for a PPP loan. Forty-seven percent applied for an EIDL loan.

Banks, perhaps counterintuitively, were the big winners in 2020. That trend could increase as banks and online lenders become the same thing.

You can view the full report here.

Last modified: February 4, 2021Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.