Study Claims Canadian Market Needs to Improve Financial Literacy

This week Loans Canada, a lead generation company, released a study documenting the disparities between perceived financial literacy and actual financial well-being. Surveying 1,665 Canadians, the report asserts that those individuals who claim to have a firm grasp of their financial situation may in fact be out of touch.

This week Loans Canada, a lead generation company, released a study documenting the disparities between perceived financial literacy and actual financial well-being. Surveying 1,665 Canadians, the report asserts that those individuals who claim to have a firm grasp of their financial situation may in fact be out of touch.

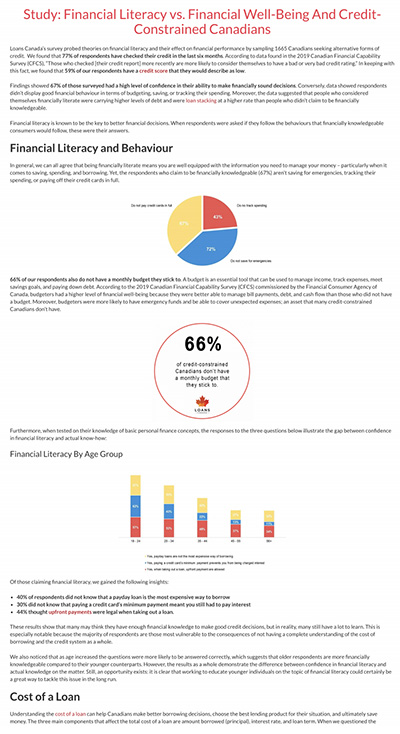

This being highlighted by major misunderstandings about how to budget for the future as well as a lack of education regarding loan repayments. 72% of the respondents said that they did not save for emergencies, 43% did not track their spending, and 66% do not stick to a monthly budget. Such budgetary omissions outline the potential for a large portion of the Canadian market to be in trouble should unforeseen expenses arise, and the fact that two thirds of the market aren’t even drawing up budgets is a cause for concern.

Such factors are made worse by the community’s seeming misinterpretations of loan terms. With 40% of the survey stating that they didn’t know payday loans were one of the most expensive ways to borrow money, 30% not understanding that paying the minimum amount of a credit card charge still meant you had to pay interest, and just over half of those surveyed were not able to identify the factors which affect the cost of loans, there appears to be a problem surrounding financial literacy and education of individuals regarding loans.

As well as these issues, there is the case of stacking loans, with the study indicating that the practice is not fully understood by Canadians and that the two top reasons for taking on multiple loans are for emergency costs (25%) and making ends meet (43%). Interestingly, the respondents who claimed to have the most confidence in their capacity to make financially sound decisions are more likely to be individuals who stack loans, leading them, inevitably, to have similar or more debt than those surveyed who said they were not confident in their financial decision-making ability.

Altogether, the study paints the picture of Canada as a market in need of further education. While financial literacy isn’t in crisis, the report points towards vulnerable sectors, such as such as those individuals with poor knowledge of loans and interest rates, as well as budgeting, are groups that need to develop a better understanding.

Last modified: January 24, 2020Brendan Garrett was a Reporter at deBanked.