1 Global Capital Issued Securities, Court Rules

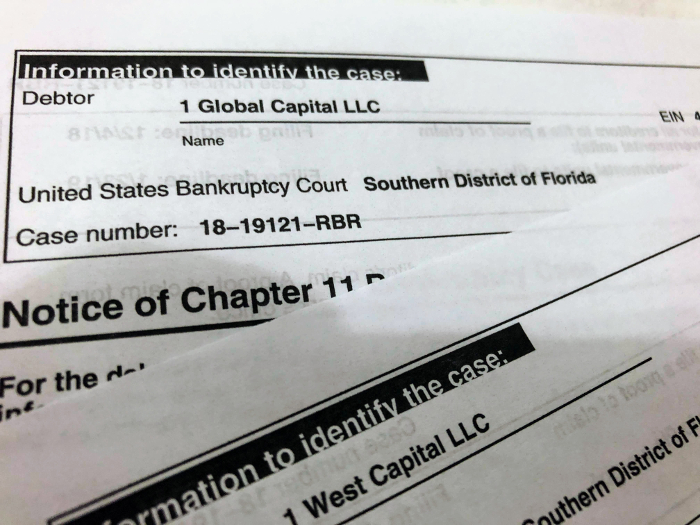

1 Global Capital founder Carl Ruderman suffered a major setback in his case with the SEC earlier this month, when the Court ruled that his company’s Syndication Partner Agreements and Memorandums of Indebtedness were in fact, securities. Ruderman had filed a motion to dismiss the SEC’s claims against him personally but the Court struck it down.

1 Global Capital founder Carl Ruderman suffered a major setback in his case with the SEC earlier this month, when the Court ruled that his company’s Syndication Partner Agreements and Memorandums of Indebtedness were in fact, securities. Ruderman had filed a motion to dismiss the SEC’s claims against him personally but the Court struck it down.

1 Global sold its notes to more than 3,400 investors in at least 25 states, who collectively invested at least $287 million. The company declared bankruptcy last year amid parallel criminal and civil investigations that hampered its ability to raise capital. The SEC filed suit soon after but no criminal charges have been brought to date.

In the ensuing legal discovery, it was revealed that the company funded the largest merchant cash advance in history, a collective $40 million funded over several transactions to an auto dealership group in California. Those dealerships closed not longer after 1 Global Capital’s bankruptcy. Those closures have sparked a lawsuit of its own and with it the revelation that several of 1 Global Capital’s competitors had also funneled millions into the dealerships.

The Court’s ruling in the motion to dismiss whereby the investments were deemed securities can be downloaded here.

Last modified: April 20, 2019