The Search for a Bad Credit Startup Loan

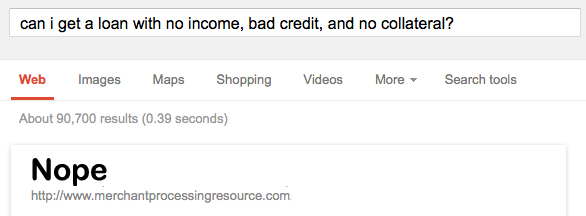

Are you trying to start a business despite having no income, bad credit, and no collateral? Well I’ve got news for you… and it isn’t good. There isn’t any hope for you to get a loan. None. Call me a pessimist or a sensationalist for saying so. Heck, I dare someone to prove me wrong! If there is something out there that even exists for people in that situation, be sure to also explain why undertaking such risk would be viable. Let me reiterate the circumstances again:

So why this example? Well it just so happens thousands of people per day that face all 3 circumstances at once are applying online for business loans. How do I know this? I’m in the lending business. I’ve experienced it firsthand in sales and have also amassed the data through a venture I operate. First let me applaud the entrepreneurs that are making an effort to do something. Some folks believe that people with no job and bad credit just sit at home all day waiting for an unemployment check to come in. That doesn’t seem to be the case at all, not by a long shot. People want to work and when they can’t find a job, they’re trying to start a business. Thousands, tens of thousands, or perhaps even millions of people are saying “Hey you know what? My situation sucks, so I’m going to try and open that store I’ve always dreamed of. I have nothing else to lose.” And that’s great but that’s also the problem. Someone that has absolutely nothing to lose has absolutely nothing to offer a lender.

So why this example? Well it just so happens thousands of people per day that face all 3 circumstances at once are applying online for business loans. How do I know this? I’m in the lending business. I’ve experienced it firsthand in sales and have also amassed the data through a venture I operate. First let me applaud the entrepreneurs that are making an effort to do something. Some folks believe that people with no job and bad credit just sit at home all day waiting for an unemployment check to come in. That doesn’t seem to be the case at all, not by a long shot. People want to work and when they can’t find a job, they’re trying to start a business. Thousands, tens of thousands, or perhaps even millions of people are saying “Hey you know what? My situation sucks, so I’m going to try and open that store I’ve always dreamed of. I have nothing else to lose.” And that’s great but that’s also the problem. Someone that has absolutely nothing to lose has absolutely nothing to offer a lender.

There are those that are dreamers who pursue their business idea thinking they’re going to get a $2 million loan at 4% interest. They interpret ads that say business loans UP TO $2 million as something of a borrower’s choice instead of the lender’s cap for the most qualified applicant in the world. Believe me, there are actually people with no income, bad credit, and no collateral that will not settle for less than the $2 million stated loan cap. And there are those that accept their predicament of not being credit worthy and broke and apply for a small loan with a very high rate of interest. There’s a still a flaw in that plan though since you can’t even get a payday loan if you don’t actually have a pay day.

Some applicants see this as a challenge. If they just search the Internet long enough and hard enough then surely someone will give them a loan, even if it’s expensive. My belief is that if there is a lender that is willing to give you a loan when you don’t have a business, don’t have an income, don’t have collateral to offer, and have a history of not repaying debts, then it is likely a scam. They’ll ask you for money upfront to secure getting the loan, a hustle known as an advance fee loan scam.

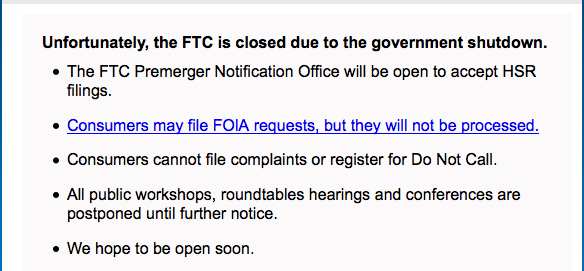

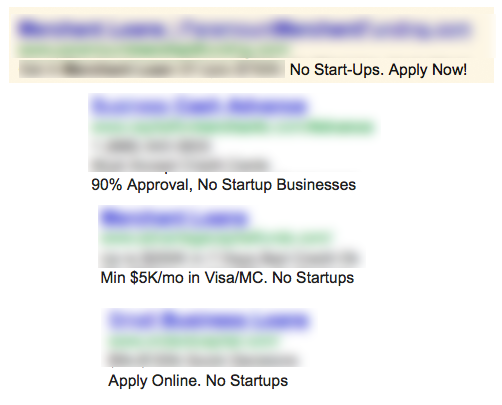

I partially blame search engines for keeping loan hopes alive for someone that has no income, no collateral, and bad credit. Some merchant cash advance companies tell it like it is though in their advertising and are still overwhelmed by startups that have no shot.

Search engines present links and ads that allude that ANYTHING is possible, but the responders to one search result in a Yahoo Answers question seem to understand reality. One commenter emphasizes that if you got a loan with bad credit, no job, no co-signer, and no checking account, then you’d best get it on film since it would be an act of divine intervention.

But Yahoo Answers is just one result in Google’s endless link options and searchers are likely to disregard it.

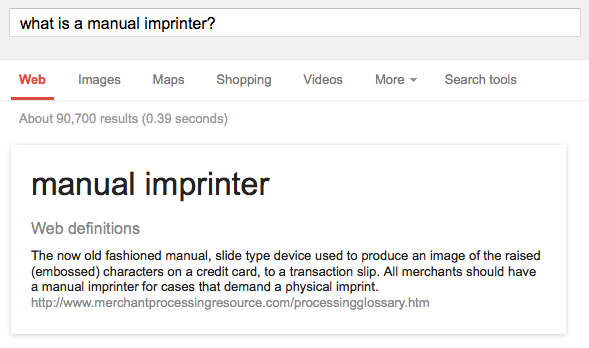

If you’re familiar with Google’s knowledge graph and the coming age of Semantic Search, I’d advise they get right to the point to save a lot of people time and energy. I mean if you search for what is a manual imprinter? Google will literally get right to the point and spell it out for you. Notice the authoritative source for this definition below:

Since Google trusts our content so intently, I’d like to add the following to their worldwide library of facts:

Is there an opportunity here?

No one is serving the incomeless, creditless, and assetless loan market… my God is there an opportunity here?! Kind of… but not with loans. There is a lot this massive market could benefit from and that’s guidance. A loan is out of the question, but it doesn’t mean these distressed entrepreneurs can’t get their hands on capital. Crowdfunding is a term that a lot of people throw around but startups shy away from it. I mean… what is crowdfunding really? Sites like Kickstarter and Indiegogo allow people to pitch their ideas to try to raise donations. If enough donations are pledged to meet the entrepreneur’s goal, the money is granted to the entrepreneur. If the donation goal is not reached, the money is returned to the donors.

What I like to think is different between myself and your average journalist on this topic is that I have been down this road. If you’re wondering who in the world is going to donate funds to launch your startup, project, or product idea, you should know that I have done just that. About a month ago, time expired on an Indiegogo campaign to produce an Ubuntu phone. Ubuntu is a Linux OS distribution. It’s like Mac OS or Windows, except it’s neither of those, it’s Linux. Ubuntu believed there was demand for their distro on the mobile platform. In an iOS and Android world, who says there’s not room for one more? Ubuntu users tend to be passionate about their systems and so Ubuntu called on everyday people to take their product to the mobile level.

$12,814,196 was raised but they fell short of the $32 million goal so the funds were returned to the donors. I was one of those donors.

Now you may only need $5,000 or $10,000 or $20,000 and that’s probably a whole lot easier than $32 million. If your business is really viable in the first place, then pitching it on a crowdfunding site is the best trial run you could possibly hope for. Get people emotionally invested or excited about your business. Go nuts promoting your campaign on social media and on blogs. If you can’t get anyone to care about your campaign through crowdfunding though, then you need to seriously consider how you would somehow make people care about your business once it’s operational. I didn’t donate money to the Ubuntu phone project just because it was posted on the site, I did it because I felt like I couldn’t imagine a world where there wasn’t an Ubuntu phone. I became emotionally invested in it.

Supplementary solutions

In my experience, many individuals applying for a startup loan want to address issues like their bad credit, not being incorporated, and not having a business plan until AFTER they get the money. Not all, but many think these are roadblocks or tricks to get them to shell out money they don’t have. They want a guarantee that if they do X, then they will be approved for Y, but it doesn’t work that way. Sometimes you have get your ducks in a row just to make the case that you are credit worthy even if it’s ultimately decided that you are not. Stinks right? That’s the way it goes though.

No income, bad credit, BUT you have collateral

I may have started my rant by painting an apocalyptic picture for startups faced with 3 terrible circumstances, but there is light in the darkness if you’re shooting only 2 for 3. If you’ve got collateral, that’s awesome. My question is though, what do you have? You might be able to get a title loan with your car or a pawn loan for your valuables. I didn’t say the heavens were opening up with these choices, but the possibilities are. Lenders like Borro will actually let you put your jewelry, artwork, antiques, diamonds, gold, or luxury automobiles up as collateral for a short term loan. The only downside is that they will actually come and pick up the item(s) for safekeeping to make sure you pay. And if you don’t, they’ll sell the item(s) off to make up the difference. But hey, if you fully plan on paying back the loan, then what’s the problem?

You have an income, but you have bad credit

This is a start. Having a steady income just upped your chances of repaying a loan. The bad credit is still a problem though, a big one. Mainstream lenders and mainstream alternative lenders are a long shot because the FICO scoring model predicts with high likelihood that you will become delinquent on your payments. Payday lenders are in reach with an income, but they’re probably not a good source for startup capital. How much can you really do with $500 to $2,000 anyway? Just the act of incorporating can run $500.

You have both income and really good credit

This is the only point where the merchant cash advance industry has a chance to find common ground with startups. People have been asking me for years about what in the heck to do about all the startups that flood their phone lines and mob their websites. First the question was about how to make them go away, then how to sell them products to help get their businesses started, then how to find someone who will lend to them, and the back again to how to make them go away. The consensus is that no one will fund startups. Well, some will say they do but as long as they are in business already and can show documented sales history and bank statements. 99% of startups that apply for a loan in the merchant cash advance arena haven’t gotten that far yet though.

This is the only point where the merchant cash advance industry has a chance to find common ground with startups. People have been asking me for years about what in the heck to do about all the startups that flood their phone lines and mob their websites. First the question was about how to make them go away, then how to sell them products to help get their businesses started, then how to find someone who will lend to them, and the back again to how to make them go away. The consensus is that no one will fund startups. Well, some will say they do but as long as they are in business already and can show documented sales history and bank statements. 99% of startups that apply for a loan in the merchant cash advance arena haven’t gotten that far yet though.

A 600 FICO is not a good credit score. Maybe some folks in the merchant cash advance industry will tell you that it is but in the traditional lending world this score is crap. If you have good credit (700+) and a verifiable income, you can in fact get a loan to start a business. It won’t be a true business loan though, perhaps to the dismay of entrepreneurs that falsely believe they can set up a legal entity to shield them from any liability to guarantee it. It will be a personal loan that is personally guaranteed.

This is the point where a regular journalist would cite a random press release about all the startup loans available to small businesses even though they have no idea what’s involved or how true it is. Much like my personal experience with Indiegogo above, I have personally succeeded in taking applicants with no operational or functional business and helped them get a loan. It hasn’t been a lot of people and there’s very little money to be made in it from a reseller standpoint but startup loans exist. I’ve done it with Prosper and Lending Club, but I should warn you, they are very strict on credit criteria and manually underwrite files like a bank would. The only difference is that it’s faster and there are realistic odds of approval.

I didn’t particularly like my experience with Prosper, mainly because they seemed to harbor ill will towards the merchant cash advance industry. This was communicated to me in my conversations with them and as such the decline rate on applicants I referred to them neared a whopping 99%. My experience with Lending Club was a little bit better, in part perhaps because of their recent backing by Google. The last time I ran the numbers, they had approved 11.1% of my deals. To an entrepreneur this success rate probably sounds horrible, but compare it to the 0% approval rate for a startup loan with a merchant cash advance company.

Entrepreneurs with really good credit and an income can up the approval rate by trying another channel, the credit card. Just know that even if you get it in the name of the business, it’s going to be personally guaranteed. And how do I know that you can get a business credit card for a startup? There’s that experience thing again… When I was starting a business, I was able to get a business credit card with a decent sized line just because I had good credit and sufficient income. They didn’t care so much about the business itself, so long as I met their other criteria. You will need to be incorporated and have all of your business ducks in a row though to make this happen.

You have a very young operating business

Once you cross the threshold from a startup business with no sales to a startup business with sales, supporting business documents, and bank statements, well then congratulations because you’ve finally entered the realm of being eligible for a merchant cash advance. You’re not guaranteed an approval and there are still minimum criteria to be met depending on where you apply. Credit may or may not be a factor. Sales volume will make a major difference in what you’re eligible for. Most funders require an absolute minimum of $10,000 in monthly gross sales. The rates will be less than ideal and you’ll likely have to settle for less than the lender’s $2 million loan maximum. $10,000 in monthly gross sales might only equate to a $5,000 approval.

If you’re looking for that real shot in the arm, like a million dollars on really low sales volume, then you could always try the equity game and pitch investors like on Shark Tank:

If you had to ask Billionaire Mark Cuban where to get a startup loan, he’d say not to bother with one at all. Good credit? Bad credit? It doesn’t matter. So many startups fail so why would you risk screwing yourself over with debt if things just don’t work out?

I agree with Cuban’s comments in the video that it’s a hell of a risk to a take out a loan when you’re just getting started and lenders look at it the same way… one giant hell of a risk.

That’s why I shake my head when I see applicants out there with no income, bad credit, and no collateral applying for loans on any and every lending website on the Internet. The odds of an approval no matter what the advertisement says is astronomically low. I don’t think startup loans for applicants like that exist and I invite anyone to prove me wrong.

I’m serious about this. E-mail me at Sean@merchantprocessingresource.com

Last modified: April 20, 2019Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.