Story Series: Section 1071

CFPB Reverses Course: Now Proposes to Remove Merchant Cash Advances from Section 1071 Rule

November 16, 2025The CFPB has come back with a new proposal on how to roll out its section 1071 rules. Inside the 198 pages, the agency opines at length on merchant cash advances and reverses its previous opinions. It now believes they should not be subject to the rules.

The CFPB believes that at the onset of data collection under section 1071 the rule should focus on core, generally applicable, lending products that are most likely to be foundational to small businesses’ formation and operation—loans, lines of credit, and credit cards—before determining whether to expand the scope of the rule to include more niche or specialty lending products. The CFPB therefore proposes to exclude MCAs, agricultural lending, and small dollar loans from the definition of covered credit transaction to better ensure the smooth operation of the initial period of data collection, while minimizing disruptions and regulatory complexity in the credit markets subject to section 1071.

Current § 1002.104(a) defines a “covered credit transaction” as “an extension of business credit that is not an excluded transaction under paragraph (b) of this section.” Section 1002.104(b)(1)-(6) enumerates six types of transactions that are excluded from covered credit extensions. The Bureau proposes adding MCAs to the list of excluded transactions in § 1002.104(b). Proposed § 1002.104(b)(7) would exclude MCAs, which it would define as an agreement under which a small business receives a lump-sum payment in exchange for the right to receive a percentage of the small business’s future sales or income up to a ceiling amount. Consistent with this proposed new exclusion, the CFPB proposes deleting several references to MCAs, and the related term sales-based financing, in commentary.

In the 2023 final rule, the CFPB explained its belief that the statutory term “credit” in ECOA is intentionally broad so as to include a wide variety of products without specifically identifying any particular product by name, such that all credit products should be included in the rule unless the CFPB specifically excluded them and concluded that “credit” encompasses MCAs. It further explained that MCAs should not be understood to constitute factoring within the meaning of the existing commentary to Regulation B subpart A or the definition in existing comment 104(b)-1, because factoring involves entities selling an existing legal right to payment from a third party, while no such contemporaneous right exists in an MCA. The CFPB also noted its understanding that, as a practical matter, MCAs are underwritten and function like a typical loan (i.e., underwriting of the recipient of the funds; repayment that functionally comes from the recipient’s own accounts rather than from a third party; repayment of the advance itself plus additional amounts akin to interest; and, at least for some subset of MCAs, repayment in regular intervals over a predictable period of time), although it also implicitly acknowledged practical differences between MCAs and conventional loans by including numerous provisions intended to capture MCA-specific data.

This proposal reconsiders the CFPB’s previous conclusions, as illustrated in existing comment 104(a)(1)-1, which does not exclude MCAs from the definition of “covered credit transactions” under § 1002.104(a), for several independent reasons. First, the CFPB believes that at the onset of the data collection under section 1071 the focus should be on core lenders and products before the CFPB considers expanding the scope of the rule. MCAs are structured differently from traditional lending products; traditional lending concepts like “interest rate” do not fit the way that MCAs are priced. As a result, it is not clear that data collection on MCA transactions under section 1071 would yield information that advances section 1071’s statutory purposes to the extent that some or many such transactions do not constitute credit. The CFPB believes it would advance the purposes of section 1071 at this time to exclude MCAs from the definition of covered credit transaction, and to focus on ensuring the smooth operation of data collection as to core lending products and providers most likely to be foundational to small businesses’ formation and operation.

Second, the CFPB believes it erred in prematurely determining that collection of data on MCA transactions would serve section 1071’s statutory purposes by concluding that all MCAs constitute credit. The 2023 final rule’s one-size-fits-all approach also does not take into account the varied terms and features of MCAs across the market that may be relevant to whether the products meet the definition of “credit” under ECOA, nor did it account for the fact that MCAs are relatively new products whose features and practices may be evolving, including in response to State regulation. Moreover, while some State courts have analyzed whether some MCAs meet State law definitions of “debt” or “credit,” there is a dearth of case law analyzing whether MCAs meet ECOA’s definition of “credit.”

Excluding MCAs from the definition of “covered credit transaction” would be consistent with the way the CFPB has already treated leases, which also present close questions as to whether they meet the definition of “credit” under ECOA. In the 2023 final rule’s analysis of leases, the CFPB acknowledged that some lease transactions could constitute “credit.” But rather than include all lease transactions in the 2023 final rule to ensure coverage of those leases that did actually constitute credit and credit disguised as leases, the CFPB determined that it would be able to monitor the market for such products without including them in the 2023 final rule. The CFPB proposes taking a similar approach to MCA transactions as it did to leases.

Further, the CFPB believes that the 2023 final rule’s coverage of MCAs does not take into account State law developments addressing sales-based financing. Several States have legislation and/or regulations in place addressing the MCA market and requiring providers to disclose terms such as the total cost of capital and the financing rate. Such laws provide key protections for users of MCAs and may shape MCA terms and practices in ways that bear on the question of whether they meet ECOA’s definition of “credit.” While the 2023 final rule referenced these pieces of State legislation, it did not consider the extent to which the evolving landscape under State law rendered premature a determination that including MCAs in the definition of “covered credit transaction” for purposes of mandating data collection furthered section 1071’s statutory purposes. The CFPB believes that it would be advantageous to observe how State laws address MCAs before the CFPB decides how, and whether, to collect data regarding MCAs pursuant to section 1071.

Finally, while the final rule cited concerns about high costs and predatory practices in the MCA market, those concerns may be addressed by Federal and State law enforcement agencies through their respective enforcement authorities.

The CFPB believes that taking into account the factors listed above, the relative novelty and evolving landscape of the MCA industry and the ongoing changes at the State level concerning the regulation of MCAs, that excluding MCA transactions from coverage under the rule at this time is necessary and appropriate to carry out the purposes of section 1071.

As explained above, MCAs differ in kind from traditional lending products, such that collecting data on MCA transactions under Section 1071 may not produce information that is comparable to data collected on other types of transactions. And because MCAs have not generally been regulated as credit, many smaller MCA providers may lack the infrastructure needed to manage compliance with regulatory requirements associated with making extensions of credit. Taken together, requiring MCAs to be reported could lead to data quality issues, which would not advance the purposes of section 1071.

The CFPB will continue to monitor developments in the markets for MCAs and other sales-based financing to determine whether over time a subset might be appropriately included in the definition of “covered credit transaction” for purposes of data collection.

The CFPB seeks comment on this proposed revision to the rule. It also seeks comment on topics including, but not limited to, the extent to which MCAs differ from or resemble traditional lending products; the diversity of MCA terms and practices and how they impact whether MCAs, or a subset of MCAs, meet the definition of “credit” under ECOA; whether certain types of MCAs are more or less appropriate for exclusion; and suggestions for how the 2023 final rule could be modified with respect to MCAs if the CFPB ultimately does not exclude them. The CFPB further seeks comment on alternative definitions to the one proposed in

§ 1002.104(b)(7).

CFPB Small Business Lending Rule Compliance Delayed a Year

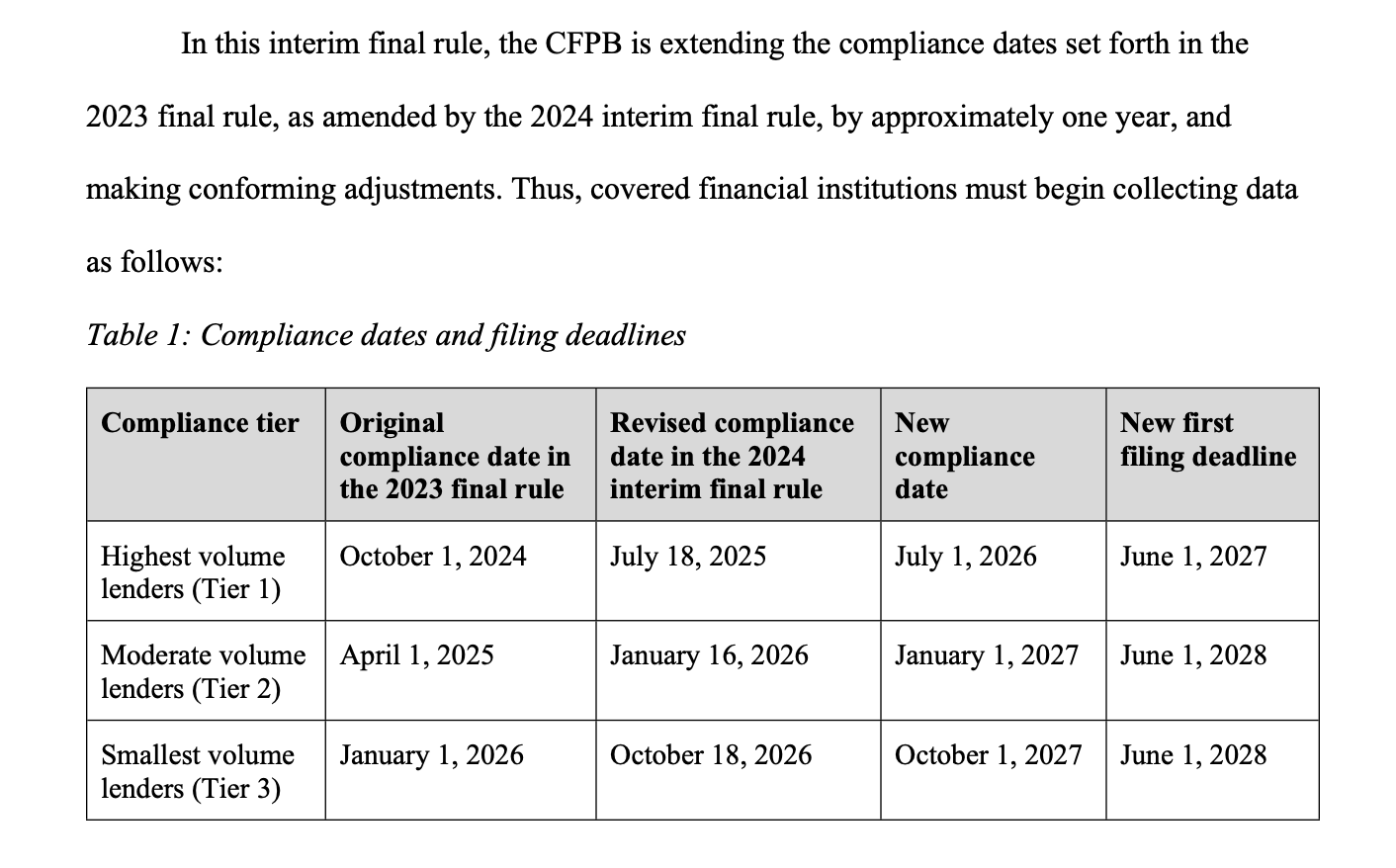

June 17, 2025 The CFPB has officially hit the pause button on complying with the small business lending data collection rules. They were supposed to go into effect next month. The Agency, however, announced in April that it planned to rewrite all of the rules and would not enforce them in the interim. Alas, covered parties wondered if they were still required to comply regardless of the whims on enforcement. Consequently, a new deadline for compliance was set for July 1, 2026. That assumes the new rules are ready by then or that there are no further delays.

The CFPB has officially hit the pause button on complying with the small business lending data collection rules. They were supposed to go into effect next month. The Agency, however, announced in April that it planned to rewrite all of the rules and would not enforce them in the interim. Alas, covered parties wondered if they were still required to comply regardless of the whims on enforcement. Consequently, a new deadline for compliance was set for July 1, 2026. That assumes the new rules are ready by then or that there are no further delays.

The rules have technically been delayed by fifteen years already since the law requiring such rules to be implemented was passed in 2010 (Dodd-Frank). Other priorities, politics, debates over the legislation’s scope, and endless litigation relating to it pushed back rule-making and compliance to where it is now. During Trump’s first term, there was even disagreement as to what the CFPB should even be called. deBanked has been covering the law for more than 10 years.

The law had previously been deemed applicable to both loans and merchant cash advances. The rules had been codified in 888 pages of guidelines.

Dodd-Frank 1071: Regulatory Uncertainty in Small Business Financing

May 28, 2025Jeffrey S. Paige is the Chief Legal Officer of CFG Merchant Solutions. Visit: https://cfgmerchantsolutions.com

A Changing Regulatory Landscape for Commercial Finance in New York & Beyond

When President Trump returned to office on January 20, 2025, he signed several executive orders with significant implications, particularly for New York’s commercial finance sector and the revenue-based financing industry. One such order was a regulatory freeze that could impact rules issued by the Consumer Financial Protection Bureau (CFPB), specifically those concerning small business financing data collection under Dodd-Frank Section 1071. The rationale behind this freeze is that the CFPB, an agency not directly controlled by Congress, exceeded its intended regulatory scope.

Trump’s order not only halts the issuance of new rules but also mandates the withdrawal of any rules previously sent to the Office of the Federal Register. More critically, it directs agency heads to “consider postponing” any rules that have been published but have not yet taken effect, creating a 60-day review period for reassessment of their legal and policy implications.

“Should actions be identified that were undertaken before noon on January 20, 2025, that frustrate the purpose underlying this memorandum, I may modify or extend this memorandum to require that department and agency heads consider taking steps to address those actions,” the order concludes. This places Section 1071 in limbo, leaving financial institutions uncertain about compliance obligations moving forward.

However, New York funders may still need to prepare. Under 12 U.S.C. § 5552 of the Dodd-Frank Act, individual states (including their respective financial regulators and attorneys general) have the authority to enforce federal consumer financial law, specifically, the Consumer Financial Protection Act and 18 enumerated consumer laws such as TILA, EFTA, FDCPA, GLBA, and regulations issued by the CFPB. Simply put, New York has the ability to enforce these laws and regulations, including Section 1071, by bringing suit in federal or state courts or other appropriate proceedings against any “covered person or service provider” as defined and not excluded by the Dodd-Frank Act’s terms. It is therefore prudent for non-exempt lenders and funders to take a proactive approach.

What Is Dodd-Frank 1071?

The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in 2010, sought to address vulnerabilities in the financial system exposed during the 2008 financial crisis. On March 30, 2023, Section 1071 amended the Equal Credit Opportunity Act (ECOA), empowering the CFPB to collect and report key data from financial institutions on small business financing. The compliance deadline varies based on the size of the institution, with the earliest deadline set for July 18, 2025, affecting Tier 1 providers, defined as high-volume financial institutions.

The goal of Section 1071 is to identify and address disparities in small business financing by analyzing key metrics such as:

- Demographics of business owners (race, gender, ethnicity).

- Financing terms, rates, and credit outcomes.

- Geographic data, including trends in underserved regions.

By requiring funders to disclose this information, the regulation seeks to foster accountability and ensure that small businesses—especially those owned by minorities and women—have equitable access to credit and capital.

CFPB & Section 1071 Timeline

2010: Dodd-Frank Act Enacted

- Section 1071 of the Dodd-Frank Wall Street Reform and Consumer Protection Act is established.

2011: CFPB Established

- The Consumer Financial Protection Bureau (CFPB) is created as an independent agency overseeing consumer financial protection laws, including small business lending regulations under Section 1071.

2017: CFPB Faces Legal Challenges

- Industry groups challenge the CFPB’s authority and structure, arguing that it lacks proper congressional oversight.

- Under the Trump administration, regulatory focus shifts toward deregulation, and CFPB rulemaking efforts on Section 1071 slowed down.

2020: U.S. Supreme Court Decision – Seila Law v. CFPB

- The Supreme Court rules that the president can remove the CFPB director at will, weakening its independence but allowing it to continue functioning.

2021: Biden Administration Revives Section 1071 Rulemaking

- The CFPB under Director Rohit Chopra prioritizes implementing Section 1071, aiming to enhance transparency in small business lending.

2022-2023: CFPB Proposes & Finalizes Section 1071 Rule

- The proposed rule is released in 2022, requiring lenders to collect and report loan application data, including business owner demographics.

- In March 2023, the final rule is issued, with compliance deadlines set for 2024 and 2025 based on lender size.

2023-2024: Legal Pushback & Court Challenges

- Industry groups file lawsuits, arguing that Section 1071 creates excessive regulatory burdens and violates constitutional limits on CFPB authority

- In October 2023, a Texas court stays the rule for certain plaintiffs, pausing enforcement for some lenders.

- In 2024, additional lawsuits escalate concerns over the rule’s implementation.

January 20, 2025: Trump Returns to Office & Freezes Regulations

- On his first day back in office, President Trump issues an executive order freezing pending regulations, including Section 1071.

- The order:

- Blocks new CFPB rulemaking,

- Withdraws rules not yet finalized,

- Delays implementation of already published rules for a 60-day review period.

- President Trump’s justification: The CFPB is an unelected agency that overstepped its authority, and its rules should be reassessed.

2025: Uncertainty & State-Level Action

- The CFPB’s authority remains in question, leaving financial institutions uncertain about compliance requirements.

- New York may independently implement similar reporting requirements, as it has done with previous commercial financing regulations.

- Many New York funders continue preparing for potential state-level enforcement despite the federal freeze.

How Alternative Financing Providers Can Adapt

Funders in the alternative financing space should remain agile and prepare for multiple scenarios. Even if Section 1071 is rolled back, transparency and fair funding practices remain critical for fostering trust and maintaining credibility in the market.

Steps funders can take include:

- Investing in technology to automate compliance processes, ensuring readiness for future regulations.

- Engaging with industry stakeholders to advocate for practical regulatory approaches that balance fairness and business efficiency.

- Maintaining transparency in financing practices to build stronger relationships with merchants and partners.

Looking Ahead

As the financial industry navigates the potential rollback of Dodd-Frank 1071 (Republican Congressman Roger Williams of Texas has introduced H.R. 976 seeking to do just that), alternative financing companies should focus on long-term strategies that prioritize both compliance and innovation. This is especially true in New York, where the legislature is currently considering a bill called the Fair Business Practices Act, modeled after Title X of Dodd-Frank, that would among other things expand the New York Attorney General’s enforcement powers and enhance penalties in this industry sector for UDAP violations. This further signals that New York as well as other states is seeking to fill any void left by the weakening of the CFPB. Whether the regulation remains in effect or is dismantled, financial institutions should stay proactive in adapting to changes while ensuring fair access to capital for small businesses.

Will the CFPB’s Small Business Data Collection Rules Change?

April 4, 2025On April 3, the CFPB filed papers agreeing with the Revenue Based Finance Coalition’s (RBFC) request to stay the litigation between them over coverage of the Small Business Lending Rule. As it last stood, a federal court was leaning toward the CFPB’s side that the 888 pages of data collection rules should apply to MCAs despite them not being loans.

As to why the CFPB would agree to a stay, the agency explained that it may now be tweaking the rules at issue.

“New leadership has been assessing the Final Rule and the issues that this case presents to determine the CFPB’s position. CFPB’s new leadership has directed staff to initiate a new Section 1071 rulemaking. The CFPB anticipates issuing a Notice of Proposed Rulemaking as expeditiously as reasonably possible. Because the anticipated rulemaking process may moot or otherwise resolve this litigation, holding this matter in abeyance would conserve the Court’s resources.”

– CFPB in its response to the Motion to Stay

“The CFPB respectfully proposes submitting periodic status reports every 90 days during the pendency of the rulemaking and will promptly inform the Court when the rulemaking process is complete,” the Agency stated. “Within 30 days of the issuance of a final rule, the CFPB proposes that the parties confer and notify the Court of whether and how they wish to proceed.”

The small business data collection rules are scheduled to go into effect in July.

Court Leans Toward CFPB in MCA Section 1071 Lawsuit

February 19, 2025A federal magistrate judge found that the CFPB did not overstep its authority when it subjected MCA transactions to the Small Business Data collection rule slated to go into effect this year. The lawsuit was filed a little over a year ago by the RBFC. The RBFC has the opportunity to file an objection within 14 days. For an analysis of the findings, you should consult with an attorney. It can be downloaded here.

This course of events is not related to the recent headwinds the CFPB is facing otherwise.

CFPB HQ Temporarily Closed, Operations Frozen

February 10, 2025The CFPB’s headquarters in Washington DC will be closed this week as the agency undergoes an audit from the Department of Government Efficiency. The audit coincides with the arrival of yet another new Acting Director, Russell Vought, who is also serving officially as the Director of OMB. At the CFPB this weekend, Vought told employees not to “approve or issue any proposed or final rules or formal or informal guidance” and to “suspend the effective dates of all final rules that have been issued or published but that have not yet become effective.” He also told the Federal Reserve that the agency does not need funding at this time due to having too much on hand already.

Pursuant to the Consumer Financial Protection Act, I have notified the Federal Reserve that CFPB will not be taking its next draw of unappropriated funding because it is not "reasonably necessary" to carry out its duties. The Bureau's current balance of $711.6 million is in fact…

— Russ Vought (@russvought) February 9, 2025

While he has ordered all final rules that have been issued or published but not yet effective be suspended, some legal observers have indicated that the small business data collection process overseen by the CFPB (pursuant to Section 1071 of Dodd-Frank) that is scheduled to start on July 18 is technically bound by rules already in effect and that the deadline is merely the start date for compliance. However, that interpretation may be at odds with the spirit and intent of the suspension.

The Independent Community Bankers Association (ICBA) welcomed Vought into the role. “We look forward to working closely with Director Vought, the Trump administration, and the 119th Congress to implement needed CFPB regulatory reforms to help community banks meet the needs of local communities,” they said. The statement included a link in which they call for the small business lending data collection rules to be repealed.

“Intrusive data collection will compromise the privacy of small business applicants, effectively ‘commoditize’ small business lending, and increase the cost of credit,” they say. “ICBA urges the 119th Congress to promptly repeal or substantially revise Section 1071 to limit the implementation of a destructive rule.”

With Trump’s Freeze on New Regulations, What to Make of the New CFPB Rules?

January 23, 2025 On January 20, Trump’s ceremonial display of taking action and signing orders on his very first day might warrant a closer look for those in the small business finance industry. That’s because he signed a regulatory freeze order that could potentially affect rules promulgated by the CFPB on small business loan data collection that have yet to go into effect.

On January 20, Trump’s ceremonial display of taking action and signing orders on his very first day might warrant a closer look for those in the small business finance industry. That’s because he signed a regulatory freeze order that could potentially affect rules promulgated by the CFPB on small business loan data collection that have yet to go into effect.

Specifically Trump’s order not only puts a freeze on issuing new rules but also mandates rules be withdrawn if they’ve been sent to the Office of the Federal Register. And then lastly, and most relevant, it orders agency heads to “consider postponing” any rules that have been published or “any rules that have been issued in any manner but have not taken effect, for the purpose of reviewing any questions of fact, law, and policy that the rules may raise.” It asks for a 60-day review period overseen by an agency head appointed or designated by Trump to review and approve the rule.

“Should actions be identified that were undertaken before noon on January 20, 2025, that frustrate the purpose underlying this memorandum, I may modify or extend this memorandum, to require that department and agency heads consider taking steps to address those actions,” the order concludes.

House Bill Seeks More Time for Lenders to Comply with CFPB Small Business Lending Rule, Redefine Small Business

December 18, 2024A recently amended bill that was introduced in the US House of Representatives earlier this year aims to push back compliance deadlines with the CFPB’s Small Business Lending data collection rule. Specifically, HR 8338 seeks a 3-year preparation period from the time the rule was issued (which was March 2023) followed by a 2-year safe harbor where penalties are not issued for a failure to comply.

Furthermore, the bill aims to clarify the definition of “small business” as being any entity having gross annual revenue of $1 million or less in the most recently completed fiscal year.

You can read the text of the bill here.