Announcements

DataMerch.com Surges Past 10,000 Records

November 28, 2017 Tampa, FL, November 28, 2017 – Today, DataMerch.com, an online underwriting database for the alternative financing industry, announced that they have surpassed over 10,000 records in their database. After creating the online database only 2 years ago, DataMerch has experienced rapid growth in users and records to reach this milestone.

Tampa, FL, November 28, 2017 – Today, DataMerch.com, an online underwriting database for the alternative financing industry, announced that they have surpassed over 10,000 records in their database. After creating the online database only 2 years ago, DataMerch has experienced rapid growth in users and records to reach this milestone.

Director of Credit Risk Management at 1 st Merchant Funding LLC Dylan Edwards commented, “DataMerch has been an excellent resource for 1 st Merchant. We’ve been able to get additional information on potential clients that we wouldn’t have had otherwise. This really helps our underwriting decisions and adds another layer of safeguard. It’s something our industry needed for a long time.”

“DataMerch has been an excellent resource for 1st Merchant. We’ve been able to get additional information on potential clients that we wouldn’t have had otherwise.”

– Dylan Edwards, Director of Credit Risk Management at 1st Merchant Funding

“We make it easy for our members to search and enter records on our platform,” said Co-Founder Scott Williams. “Members can easily enter records manually, send us an excel spreadsheet for mass uploads, or they can integrate their underwriting software using our API to automate the process.” Scott added, “We are thrilled to see the enthusiasm and positive feedback we have received. Funders see the value DataMerch brings by revealing if a future client has a bad track record in the alternative funding industry. DataMerch can literally save a funder hundreds of thousands of dollars; that’s why we have been able to grow so much in the first few years. We expect the growth of members and records to continue to grow at a rapid pace.”

DataMerch’s leadership said they plan to continue to add new features and improvements to their platform. DataMerch currently offers members fraud alerts, API access, unlimited searches and uploads, personal support, and more. They plan to offer data reporting and analytics for trends within different categories soon.

About DataMerch

DataMerch LLC was founded in 2015 and is designed to help Funders determine if a future client of theirs has a bad track record in the alternative finance industry. DataMerch members can scrub their files using DataMerch’s specifically designed FEIN search and enter unsatisfactory businesses into the database. DataMerch currently has over 40 industry-leading subscribed members working together as a community. DataMerch continues to grow subscriber base and record count daily. DataMerch can be accessed at https://www.datamerch.com and contacted at support@datamerch.com

Source: DataMerch LLC

Kabbage Taps Debt Capital Markets for a Cool $200 Mil

November 16, 2017 Kabbage has been accessing the capital markets fast and furiously, most recently on the debt side. Today they’ve announced a new $200 million asset backed revolving credit facility with Credit Suisse. Just a couple of months ago, Kabbage attracted $250 million in equity to its coffers from SoftBank, which the alternative funder will direct toward ongoing operational expenses and expansion.

Kabbage has been accessing the capital markets fast and furiously, most recently on the debt side. Today they’ve announced a new $200 million asset backed revolving credit facility with Credit Suisse. Just a couple of months ago, Kabbage attracted $250 million in equity to its coffers from SoftBank, which the alternative funder will direct toward ongoing operational expenses and expansion.

With the Credit Suisse deal, the tally for Kabbage’s debt funding capacity reaches $750 million. “The new revolving credit facility will be issued by Kabbage Asset Funding 2017-A LLC, a wholly owned subsidiary of Kabbage Inc,” according to a press release.

Kabbage expects the credit facility will help them to scale faster. They plan to use the credit to add bigger small businesses to its client roster as well as extend higher lines of credit with longer durations.

“The new revolving credit facility with Credit Suisse is a debt round. Those funds are for our small business customers, and will be used to continue to provide them with easy access to working capital,” Deepesh Jain, Kabbage Head of Capital Markets, told deBanked.

It’s Kabbage’s maiden credit facility to be rated by credit rating agency DBRS. “The top two classes of the multi-class transaction earned investment-grade ratings of ‘A’ and ‘BBB’ and are collateralized entirely with assets originated through Kabbage’s fully-automated underwriting technology,” according to the press release.

Jain told deBanked the DRBS rating is highly significant. “It strongly demonstrates the proven success of Kabbage’s fully-automated platform and its data-driven risk analysis for small business lending. It speaks to the company’s leading position in the SMB-lending marketplace and Wall Street’s confidence in Kabbage,” he noted.

As Jain pointed out, Credit Suisse has been an early supporter of fintech. Indeed, the Swiss bank a year ago similarly provided a $200 million asset-backed revolving credit facility to another alternative funder, OnDeck.

Alternative Funders and Bank Partnerships in the Spotlight

Jain declined to comment on whether Credit Suisse might be interested in Kabbage’s lending platform for its own use. Alternative funder and banking partnerships were recently thrust into the spotlight with a lawsuit filed by a Massachusetts-based small business owner against Kabbage and Celtic Bank, which have had a partnership for at least several years.

The lawsuit alleges that the funding model of the defendants “was designed to evade usury laws,” according to The National Law Review. Apparently, the plaintiffs, which are listed in the public filing as Alice Indelicato and NRO Boston, had several small business loans and now accuse Kabbage of “renting” Celtic’s bank charter. Jain declined to comment on the lawsuit and the plaintiffs couldn’t be reached.

Capital Markets Pipeline

Meanwhile, at the rate they are going, we could see Kabbage tap the capital markets again in 2018. “Capital markets are something we will continue to explore to further diversify our funding options,” said Jain.

LENDUP HIRES FIRST CHIEF FINANCIAL OFFICER, ANNOUNCES SIGNIFICANT GROWTH MILESTONES

November 7, 2017San Francisco, November 8, 2017 — LendUp, a socially responsible fintech company for the emerging middle class, today announced that Bill Donnelly, former VP of Global Financial Services for Tesla, has joined as its first CFO. The company further strengthened its leadership team with the addition of a General Manager for its loans business and a Chief Data Scientist.

“Our strengthened leadership team, from some of the world’s fastest-growing and most impactful companies, will help LendUp accelerate our efforts to build a lasting, iconic company that will be a category leader for years to come,” said Orloff.

Donnelly is a 30-year consumer credit veteran with extensive experience in credit cards and loans products. Donnelly spent the last four years with Tesla as VP of Global Financial Services, responsible for providing financing solutions for Tesla’s customers across 29 countries. He also served as President of Tesla’s captive finance company, Tesla Finance LLC, which offered an industry-leading leasing program innovative for its consumer-friendly agreement and for being the first end-to-end electronic lease with the ability to execute contracts on a vehicle’s touchscreen.

Donnelly is a 30-year consumer credit veteran with extensive experience in credit cards and loans products. Donnelly spent the last four years with Tesla as VP of Global Financial Services, responsible for providing financing solutions for Tesla’s customers across 29 countries. He also served as President of Tesla’s captive finance company, Tesla Finance LLC, which offered an industry-leading leasing program innovative for its consumer-friendly agreement and for being the first end-to-end electronic lease with the ability to execute contracts on a vehicle’s touchscreen.

“We couldn’t be more excited to have an executive of Bill’s caliber join our quickly expanding team,” said Sasha Orloff, co-founder and CEO of LendUp. “Tesla is one of the most innovative companies in the world, and completely disrupted the sleepy auto industry. Bill’s experience leading complex global financing programs, and building first-of-their-kind, mobile-first platforms, will be invaluable to us as we continue to build out our product ecosystem and be on the forefront of serving more Americans in need of better financial services options.”

Donnelly previously spent a decade with BMW. As CFO and then President of its industrial bank, he led BMW’s credit card program and was awarded a patent for a new credit card product. In addition, Donnelly’s background includes more than 15 years with the credit card, installment loan, and automotive finance divisions of JPMorgan Chase. He was also President and CEO of retail card issuer First Electronic Bank, where he led the bank’s turnaround and achieved record profits.

“I have long admired LendUp for the important work the company is doing to expand credit access and help people improve their financial health,” said Donnelly. “At Tesla I witnessed how a strong sense of mission combined with a talented, passionate team can lead to incredible success and to overcoming seemingly insurmountable challenges. I have found that same sense of mission among LendUp’s amazingly talented and passionate team. I look forward to leading our finance organization and serving as a strategic partner to the entire team as we continue building innovative and mobile-first financial services products. Together, I can’t wait to achieve extraordinary success — for our customers and for our investors.”

In addition to Donnelly, Anu Shultes has joined as General Manager of the company’s loans business, which recently surpassed $1.25 billion in originations. Shultes has 25 years of experience in financial services across lending and credit card products, primarily focused on underserved consumers. Shultes is passionate about financial inclusion, and has managed multi-billion-dollar loan portfolios and built $1B businesses from product launch to widespread adoption. Shultes most recently served as Chief Operating Officer of mobile-first global gifting platform Swych, and before that served in senior leadership roles at Blackhawk Network, AccountNow, National City Bank, and Providian Financial.

Dr. Leonard Roseman has joined LendUp as Chief Data Scientist, to lead a growing team that uses Machine Learning to improve financial inclusion through expanded credit access and lowering the cost of credit to borrowers. Dr. Roseman has 30 years of experience in modeling credit risk, pricing, and model risk capital. He has worked with a variety of companies as a statistician, technical consultant, and strategy consultant focused on experimental design, predictive modeling, and strategic analysis. Roseman most recently served as Head of Group Decision Sciences at the Commonwealth Bank of Australia, and before that served as Deputy Chief Model Risk Officer at Capital One.

LendUp is also announcing a number of significant growth and social impact milestones. The company has now saved its borrowers $150 million in fees and interest through use of its credit card and loan products. These savings have helped close the gap caused by poor credit, which costs Americans roughly $250,000 more over the course of their lifetimes. Additionally, consumers have taken LendUp’s free online financial education courses more than 1.7 million times. Finally, the company launched one of the most innovative credit cards out of beta at the beginning of 2017.

About LendUp

LendUp is a socially responsible fintech company on a mission to redefine financial services for the emerging middle class—the 56% of Americans shut out of mainstream banking due to poor credit or income volatility. LendUp builds tech-enabled loans and credit cards paired with educational experiences to help people save money and get on a path to better financial health.

Follow LendUp

Twitter: @LendUpCredit

Facebook: facebook.com/LendUpCredit

LinkedIn: linkedin.com/company/LendUp

6th Avenue Capital Secures $60 Million Commitment For Merchant Cash Advance Funding

November 2, 2017Highly Experienced Executive Team Offers Flexible Financing Options to Small Businesses

New York City – November 2, 2017 – 6th Avenue Capital, LLC (“6th Avenue Capital”), a leading provider of small business financing solutions, announced today its securement of a $60 million commitment from a large institutional investor. The investor made their commitment based on 6th Avenue Capital’s industry-leading underwriting, compliance standards and processes. 6th Avenue Capital will draw from this commitment to offer merchant cash advances to small businesses through its nationwide network of Independent Sales Organizations (“ISOs”) and other strategic partnerships, such as banks and small business associations.

6th Avenue Capital launched formal operations in 2016 to help finance small businesses that are often ineligible for funding due to traditional underwriting criteria. 6th Avenue Capital evaluates each application for funding individually and keeps the merchant’s short and long-term needs in mind including, most importantly, what they can afford. 6th Avenue Capital also understands that small businesses may need funding quickly. The company’s data-driven underwriting processes, expertise and technology can give the merchant secure and equitable approvals of qualified requests and funding within hours.

Leading the team, CEO Christine Chang oversees all strategic aspects of 6th Avenue Capital. She also serves as COO to sister company Nexlend Capital Management, LLC. She brings more than 20 years experience in institutional asset management, including alternative lending. Previously, Chang served as Chief Compliance Officer at Alternative Investment Management, LLC, COO at New York Private Bank & Trust and Vice President at Credit Suisse. She serves on the board of Blueprint Capital Advisors, LLC and Bottomless Closet, a not-for-profit empowering economic self-sufficiency in disadvantaged NYC women.

“Our mission at 6th Avenue Capital is to help small businesses grow, and we continue to expand our existing network of ISO and strategic partners to ensure these businesses have access to capital in hours,” said Chang. “Our leadership team of financial industry experts has extensive experience navigating multiple economic cycles. We know how to serve merchants and how to deliver quickly while meeting the highest operational standards for our investors.”

COO Darren Schulman joined the team in March 2017. Schulman is a 20-year veteran of the alternative finance and banking industries. He is responsible for oversight of 6th Avenue Capital’s origination, underwriting, operations and collections, as well as strategic initiatives. Schulman served previously as COO at Capify (formerly AmeriMerchant), a global small business financing company, and President and CFO at MRS Associates, a Business Process Outsourcing (BPO) company specializing in collections. In addition, Schulman was an Executive Vice President at MTB Bank.

“We form strong relationships with the merchant and consider it essential for our underwriters to speak to every merchant, on every deal, regardless of its size,” said Schulman. “We also make our underwriters available for discussions with ISOs whenever necessary. We are proud to offer competitive volume-based commissions, buyback rates and white label solutions.”

About 6th Avenue Capital, LLC

6th Avenue Capital is changing the small business financing landscape by offering a data-driven underwriting process and fast access to capital. The company employs a unique blend of industry experts and is committed to the highest operating standards, high touch merchant service, including a policy of direct merchant access to underwriters. 6th Avenue Capital is a sister company of Nexlend Capital Management, LLC, a fintech investment management firm founded in 2014 and focused on marketplace lending (consumer loans). For more information, visit www.6thavenuecapital.com.

# # #

Fundera Passes $500M in Loans Funded to 8,500+ Small Businesses

November 1, 2017(New York, NY–Nov 1, 2017) – Fundera, the trusted advisor and online marketplace for small business financing, today announced that it has surpassed the $500 million mark in loans funded to over 8,500 small businesses on its platform.

Fundera’s platform allows small business owners to apply to a curated network of 25-30 lenders in the industry with one easy common application. Small business owners come to Fundera for all of their financing needs, from credit cards to SBA loans and everything in between.

“It’s about more than just saving time and money for the small business owner,” said Jared Hecht, CEO and cofounder of Fundera. “At Fundera we’re truly able to become a partner in these businesses’ financial decisions. Our goal is to use our resources and technology to educate small business owners on their credit eligibility, improve their creditworthiness over time, and help them graduate into better and better financing products.”

Fundera replaces small business loan brokers with software and algorithms, making the process faster and easier to navigate. The average loan size on Fundera’s platform is about $60,000, and although no single industry accounts for more than 10% of Fundera’s customer base, the most popular industries include ecommerce and retail.

Since launching in 2014, Fundera has raised over $20M in equity financing.

StreetShares Reports $6.2M Loss For Fiscal Year 2017

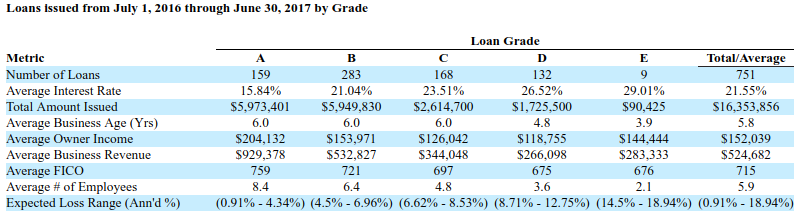

October 31, 2017StreetShares, the veteran-run small business lender, continued to post sizable losses, according to their June 30th fiscal year-end financial statements. The company had a $6,193,154 loss on only $2,168,067 in revenue. While StreetShares has generated significant buzz for their particular focus on military-owned small businesses, the lender only made 751 loans in the 12-month period and there is no requirement that the businesses they lend to actually be military-owned.

The company spent more on payroll and payroll taxes alone ($3,258,960) than they earned in revenue. They had 32 full-time employees and 1 part-time employee as of June 30th.

“As an early stage, venture-funded company that is not yet profitable, we rely heavily on capital investments to fund our operations,” the company wrote in their annual report. “Based on our current financial situation, it is likely we will require additional capital within the next twelve months beyond our currently anticipated amounts to fund the operations of the Company.”

The chart plotting their loan performances by grade below is from their annual report:

Their loan amounts typically range from $2,000 to $150,000 and require weekly payments for anywhere from 3 months to 3 years.

Even though the company spent nearly triple on marketing in this fiscal year ($1,727,478) versus the previous year ($579,331), revenue only doubled.

StreetShares plans to raise additional capital towards the end of this year through a Series B Round.

CommonBond Closes $248 Million Securitization, Secures Inaugural S&P Rating of AA

October 27, 2017NEW YORK (October 27, 2017) – CommonBond, a leading financial technology company that helps students and graduates pay for higher education, today announces the close of a $248 million securitization of refinanced student loans. The offering’s most senior notes achieved AA ratings from Moody’s, S&P, and DBRS – Aa2, AA, and AA (high), respectively – the company’s highest ratings to date.

The transaction was CommonBond’s fifth and largest to date. Investors submitted $1 billion in orders, making the deal more than four times oversubscribed. Goldman Sachs served as structuring agent, co-lead manager, book-runner, and co-sponsor. Barclays and Citi also served as co-lead managers and book-runners on the transaction, while Guggenheim Securities served as co-manager.

“Investor demand for CommonBond paper has never been greater,” said David Klein, CommonBond CEO and co-founder. “The strong market reception is a reflection of our pristine credit quality, continued ratings progression, and track record of consistent results.” Klein added, “As a programmatic issuer, we look forward to continuing to bring consistently high performing bonds to the market, providing investors with world-class capital deployment options.”

The transaction was the first of CommonBond’s to be rated by S&P, who assigned AA ratings to the transaction, alongside similar ratings from Moody’s and DBRS. Moody’s and DBRS also recently upgraded CommonBond’s ratings on previous deals in recognition of the company’s strong credit performance.

The securitization marks a significant period of growth for CommonBond, which earlier this year introduced student loans for current undergraduate and graduate students nationwide, to complement its established student loan refinance product. CommonBond is the only financial technology company to offer a full suite of student loan solutions, including new student loans to current students and refinanced student loans to graduates. The company has funded over $1 billion in student loans, and continues to grow its enterprise platform, CommonBond for Business™ – which enables employers to contribute a monthly payment to employees’ student loans, in addition to offering an evaluation tool for employees to determine their best repayment options.

About CommonBond

CommonBond is a financial technology company on a mission to give students and graduates more transparent, simple, and affordable ways to pay for higher education. The company offers refinance loans to college graduates, new loans to current students, and a suite of student loan repayment benefits to employees through its CommonBond for Business™ program. By designing a better student loan experience that combines advanced technology with competitive rates and award-winning customer service, CommonBond has funded over $1 billion in loans for its tens of thousands of members. CommonBond is also the first and only finance company with a “one-for-one” social mission: for every loan it funds, CommonBond also funds the education of a child in need, through its partnership with Pencils of Promise. For more information, visit www.commonbond.co.

Katherine Fisher to testify before House Small Business Subcommittee

October 24, 2017 Hanover, Maryland, October 23, 2017 – Katherine “Kate” Fisher, a partner in the Maryland office of Hudson Cook, LLP, is scheduled to speak at a hearing before the Congressional House Committee on Small Business in Washington, D.C., on October 26, 2017.

Hanover, Maryland, October 23, 2017 – Katherine “Kate” Fisher, a partner in the Maryland office of Hudson Cook, LLP, is scheduled to speak at a hearing before the Congressional House Committee on Small Business in Washington, D.C., on October 26, 2017.

The Committee on Small Business Subcommittee on Economic Growth, Tax and Capital Access will meet for a hearing on “Financing Through Fintech: Online Lending’s Role in Improving Small Business Capital Access.” The hearing will provide the subcommittee with an opportunity to examine recent trends in how small businesses obtain capital, the different business models in the industry and how online lending fits into the overall lending landscape. Fisher is one of several witnesses who will testify before the subcommittee.

Fisher’s practice focuses on consumer financial services and small business financing. She represents banks, finance companies, private equity and investment bank investors, merchant cash advance companies, and small business lenders establishing new programs and products. She also conducts due diligence and compliance reviews of consumer lending and business financing portfolios.

The hearing is scheduled to begin at 10:00 a.m. on Thursday, October 26, 2017, in Room 2360 of the Rayburn House Office Building. The hearing will be published live on the committee’s website on Thursday.

About Hudson Cook, LLP

Celebrating its 20th anniversary this year, Hudson Cook, LLP focuses its practice on banking, consumer and commercial financial services, and privacy law, both state and federal, from its 13 offices across the country. With more than 60 attorneys, the firm offers legal services to local, national and international clients, providing practical and innovative solutions to their legal issues. For more information, visit www.hudsoncook.com.