Merchant Processing

The 28% You Don’t Want – New IRS TIN Matching Regulation

January 21, 2012 If your merchant service provider (MSP) doesn’t have your proper business information on file, you could be in for a world of hurt. As per Section 6050W of the Housing Assistance Tax Act of 2008, all electronic payment transactions have been reported to the IRS since January 1st of last year. In order to ensure this reporting is accurate, certain business data must match the data on file with the IRS, such as:

If your merchant service provider (MSP) doesn’t have your proper business information on file, you could be in for a world of hurt. As per Section 6050W of the Housing Assistance Tax Act of 2008, all electronic payment transactions have been reported to the IRS since January 1st of last year. In order to ensure this reporting is accurate, certain business data must match the data on file with the IRS, such as:

- Your Taxpayer Identification Number (TIN)

- Your Legal Business Name

- Your Legal Business Address

- Your Business Organization Type (e.g. Corporation, LLC, Partnership, Sole Prop., etc.)

MSPs are required to report gross revenue, so chargebacks and refunds are included. The official ruling states:

Section 6050W(a) provides that each payment settlement entity must report the gross amount of reportable payment transactions for each participating payee. The proposed regulations defined gross amount as the total dollar amount of aggregate reportable payment transactions for each participating payee without regard to any adjustments for credits, cash equivalents, discount amounts, fees, refunded amounts, or any other amounts.

And if your tax information doesn’t match, the IRS will withhold 28% of all your payments starting on January 1st, 2013, whether it’s your fault or not. Once that happens, your MSP can’t refund you and all issues must then be handled with the IRS directly. If you haven’t received any kind of alarming notice that your information doesn’t match, this warning doesn’t apply to you. Although, it can’t hurt to call your account representative to confirm that all information is up to date and verified. Better safe than sorry.

If you didn’t know about this law, now is a good time to read up on the dense technicalities of it in this 520 page document.

A Personal Review of ROAMpay – The Mobile POS

January 4, 2012 According to ROAM Data, ROAMpay works in tandem with a compatible merchant account. That’s great, but we wondered throughout most of 2011 if the swiping unit and POS interface were any good. We wonder no more because Santa got us ROAMpay for Christmas. Thanks Santa!

According to ROAM Data, ROAMpay works in tandem with a compatible merchant account. That’s great, but we wondered throughout most of 2011 if the swiping unit and POS interface were any good. We wonder no more because Santa got us ROAMpay for Christmas. Thanks Santa!

When we tried out Square a few weeks back, we couldn’t believe how easy it was to set up and use. We figured nothing else would come close, but we were wrong. ROAMpay is awesome! We dare not claim one to be better than the other because both platforms are different.

Square has no activation fees or monthly fees but is limited in the sense that Square must also be your merchant processor.

- PLUS: Money is deposited the next day!

- PLUS: No monthly fees or setup fees.

- MINUS: The processing rates are non-negotiable.

- MINUS: You must use the Square POS technology to manage all your payments.

ROAMpay has a small activation fee and monthly fee to use but you can choose from a variety of merchant processors.

- PLUS: You have a variety of processors to choose from and therefore the ability to negotiate your rates.

- PLUS: You can supplement the ROAMpay mobile unit with your normal credit card terminal or desktop POS. They can all work together with the same merchant processor.

- MINUS: Most merchant processors charge regular monthly fees in addition to the ROAMpay fee.

- MINUS: You are not guaranteed to get overnight deposit. This is up to the processor to approve.

The MINUSes for ROAMpay are not necessarily negative marks. If you are a small business owner that already has a traditional merchant account, you can easily add mobile processing to your existing mix of payment methods. Nothing is different aside from the costs we mentioned.

Once you’ve got the swiping unit, the setup on your phone is unbelievably simple. You can even track cash payments through the POS interface and issue instant e-mail receipts to your customers. For instance, if you’re at a trade show, street fair, or similar event and a customer pays you with cash, those transactions can also be recorded and processed professionally through your phone. All historical transactions both cash and plastic can be accessed, reviewed, refunded, or voided if need be.

We don’t have a relationship with ROAM Data so Santa took the big risk that we’d dislike the product and put it on the Merchant Processing Resource’s naughty list. But that didn’t happen because this product is NICE!

Sean describes the experience of receiving and setting up ROAMpay in a 45 second video he created below:

To learn more about ROAMpay, visit ROAM Data’s official site.

Review Summary:

ROAMpay

Mobile Card Reader and POS

Reviewed by: Sean Murray

ROAMpay Swiper

Rating: 5 out of 5 stars

Date of Review: January 4, 2012

Beware of Phishing Attempts! Hacker Pretends to be Elavon

January 3, 2012We don’t have a merchant account with Elavon but according to an e-mail we received, we thought maybe we did. In the last month, we’ve had the honor of testing out some cool payment technology, which often times required the use of a test account. So when we received an e-mail saying our account at Elavon had been compromised, we thought there might be some truth to it. Turns out it was a bogus phishing attempt. A representative at Elavon has advised us not to click the link. If you receive an e-mail like the one below, DELETE IT!

—————–

From: “VirtualMerchant” <alerts@myvirtualmerchant.com>

Subject: Security Alert

Date: December 21, 2011 2:35:30 PM EST

Reply-To: noreply@myvirtualmerchant.com

|

Dear Client, We recently reviewed your account, and we are suspecting that your Merchant account may have been accessed from an unauthorized computer. We are asking you to immediately login and report any unauthorized activity. Client Login |

|

| Copyright © 2011 Elavon, Inc.All rights reserved.

—————– |

Elavon has informed us that they would never send an e-mail that requested their clients to login. Be careful! When in doubt, call your merchant account rep.

The point of sale isn’t what it used to be

December 16, 2011 “I’m sorry sir but our credit card machine just went down. Can you wait 11 minutes while I activate a card reader on my iPhone so I can take your payment?”

“I’m sorry sir but our credit card machine just went down. Can you wait 11 minutes while I activate a card reader on my iPhone so I can take your payment?”

11 minutes. That’s how long it took Sean, the founder of the Merchant Processing Resource to set up a merchant account with Square. The point of sale is changing quickly. Dial-up terminals are becoming more and more like their carbon copy imprint predecessors and there’s no way to stop the changing tide. According to Square, 1 out of every 8 merchants in the U.S. uses Square to process credit cards.

The revolution in payments seems to have gone over the heads of Merchant Cash Advance (MCA) providers, a financial industry that purchases future card revenues of small businesses. If the big MCA players have plans in the works to overcome the obstacle of capturing revenues, they certainly haven’t made them public.

We first sounded the warning bell to the industry back in May, 2011, in an article that characterized the modern merchant as having four methods of accepting electronic payments: Desktop POS software, a terminal, PayPal, and mobile payment software. This payment makeup directly leads to rising costs of the MCA product. The ultimate result of our warning was…nothing. MCA providers have for the most part shrugged off the changes in the point of sale, rather than stay ahead of the curve. It’s a shame.

The Electronic Transactions Association (ETA) recently created a certification, a nationally recognized level of excellence for the payment industry employed to become true professionals. A Certified Payment Professional (CPP) will be best equipped to work with business owners and they are required to be knowledgeable on the subject of MCA, as indicated in the CPP handbook. The reverse is unfortunately not required of those employed in the MCA industry, where underwriters mostly hail from the worlds of lending or leasing. Bankcard is certainly not their strong point.

There is a big void of bankcard knowledge in the risk assessment of MCAs. Underwriters are accustomed to reviewing “batch data,” the amount settled out by a merchant, normally once at the end of the day. But press an underwriter for an explanation of where the batch came from, if the technology was PCI compliant, or what would happen to their interchange rates if they delayed settlement for a few days, and you’ll likely catch them scratching their head.

I once personally experienced this firsthand when a relatively new MCA firm sent a 3rd party site inspector to visit a clothing store prior to approval. The inspector’s report and photographs indicated that there was no physical credit card terminal on site but that a USB swiping unit was attached to a desktop computer at the register to accept card payments. The MCA provider declined the deal based on the report since the lack of a credit card machine flew in the face of the processing statements they received. I appealed the case to the CEO, who responded by e-mail with, “The merchant is showing $7,000 a month in credit card sales but when we visited the store, there’s apparently no credit card machine there. The statements we have must be fabricated.” Flabbergasted, I pointed out that the merchant uses desktop POS software and a swiping unit and that it had been verified in the inspector’s report. The last e-mail I received from the CEO was, “I don’t know what you mean by their computer accepting credit cards. Is this PayPal? We don’t do PayPal. We only fund merchants who process on site and they don’t seem to process on site. The deal remains declined.”

Just because I haven’t cited the name of the company, doesn’t mean this exchange wasn’t real. It was and It’s even more embarrassing because their goal was to be in the top three largest funders of MCA in the country. They’re still in business but they’ve suffered some major setbacks.

USB card readers have been in use for a long time and we recently had the pleasure of hearing from Richard Freedkin, the Co-founder of USBSwiper.com. We asked if the mobile pos software revolution was impacting the desktop industry. He shared this, “I don’t think that the USB card readers are being threatened per se… however; I believe that the Mobile Payments industry will make a dent. There will always be people using computers for their POS especially at more fixed locations and Internet access is much cheaper than mobile phone data plans that are required for processing to work.”

And while he’s probably right that the desktop POS experience isn’t going away, they’re not standing on the sidelines either. “We are also about 6 weeks from releasing our new beta version of our software for iPad, iPhone, iPod Touch and Android systems. We will also have a swiper for that platform as well. So we will offer the best of both worlds.”

Great firms innovate so we’re waiting…waiting…waiting for the MCA players to follow suit. If 1 out of 8 merchants are using Square, then the MCA industry is ignoring at least 1 out of every 8 merchants or failing to capture total card revenues from their merchants that use it.

Besides, technology companies like Roam Data are claiming that their mobile payments device has 3x the capabilities of Square. With Text2Pay, you can just SMS text someone funds or better yet, FaceCash allows consumers to make payments using their phone and their FACE!

Capturing payments directly from a merchant account is what made the MCA industry so popular but it could also be their downfall. If a merchant can activate a new account in 11 minutes, then surely there must be an increased focus on the overall banking and financial picture of a small business before purchasing future revenues. That might be where underwriters with lending backgrounds excel but if they don’t know bankcard, then they don’t know squat.

The point of sale isn’t what it used to be…

– The Merchant Cash Advance Resource

Learn Merchant Cash Advance or Else…

December 15, 2011If you don’t know about Merchant Cash Advance (MCA), you’re not qualified to work in the payments industry! As indicated by the Electronic Transactions Association (ETA), Certified Payment Professionals (CPPs) should be savvy with MCA financing. According to the ETA: “The [new] CPP program sets the standard for professional performance in the payments industry and is a symbol of excellence. It signifies that an individual has demonstrated the knowledge and skills required to perform competently in today’s complex electronic payments environment.”

CPP candidates can preview exam sample questions in the official handbook, one of which asks:

An established merchant that processes $25,000 in bank card transactions per month has no marketing budget, but has been offered a sponsorship opportunity. What product/solution should the payments professional recommend?

The answer is “merchant funding” AKA MCA. Believe it folks. The MCA financing product is here to stay, has benefitted thousands of businesses, and payment professionals must be well versed in it if they are to become certified.

But there is more than a test to become a CPP.

[The ETA says] to be eligible to sit for the CPP examination, candidates must demonstrate the following qualifications:

|

|||||||||

|

CPP candidates will then be required to sit for and pass a Certified Payments Professional written examination. Upon successful completion of the exam and the attainment of the CPP credential, certificants will be required to meet renewal / recertification requirements every three years, to include continuing professional education from ETA / QSP’s or the successful completion of the test.

|

The next exam dates are May 1 – 31, 2012. You can learn more about registering and what it mean to be a CPP on the ETA’s official site. And don’t forget to learn about Merchant Cash Advance. 🙂

Our Review of Square Card Reader

December 14, 2011Square is easy, extremely easy. The process of taking it out of the box and moving forward step by step until I was able to process my first transaction took a total of 11 minutes.

WHOA!

I’ve been accustomed to the payments industry standard of 1-3 days to approve and activate a merchant account. This is a whole different playing field entirely. The card reader fit right into my iPhone 4, which is currently using iOS 5.0. I downloaded the Square software from the App Store and minutes later I was processing. No instructions are necessary. The entire setup is intuitive.

The fees are fairly competitive and less expensive than PayPal. There is supposedly next-day deposit, a feature that is not even common amongst regular retail merchant accounts. I’m impressed all around.

I don’t work for Square and the last product review ( MacPOS ) I did was not very positive so I’m giving you my straight, unedited, unbiased opinion. For further information, you can contact me at Sean@merchantprocessingresource.com or visit Square at SquareUp.com

If you actually noticed the time displayed on the top of my iPhone in some of the frames, there is a gap of time longer than 11 minutes. I had to take a very important call in the middle of the process, plus I went back and redid some of the photos and screenshots. Don’t hold it against me.

-Sean

Review summary:

Website: Square Card Reader

Description: Mobile Card Reader and POS

Reviewed by: Sean Murray

Product Reviewed: Square

Date of review: 12/14/2011

Rating: 5 out of 5 stars

Look What We Got: Square

December 13, 2011The folks at Square were nice enough to send us their mobile phone hardware for free to review and play with. We’ll be doing a video review and demonstration within the next week. Stay tuned.

Thanks Square!

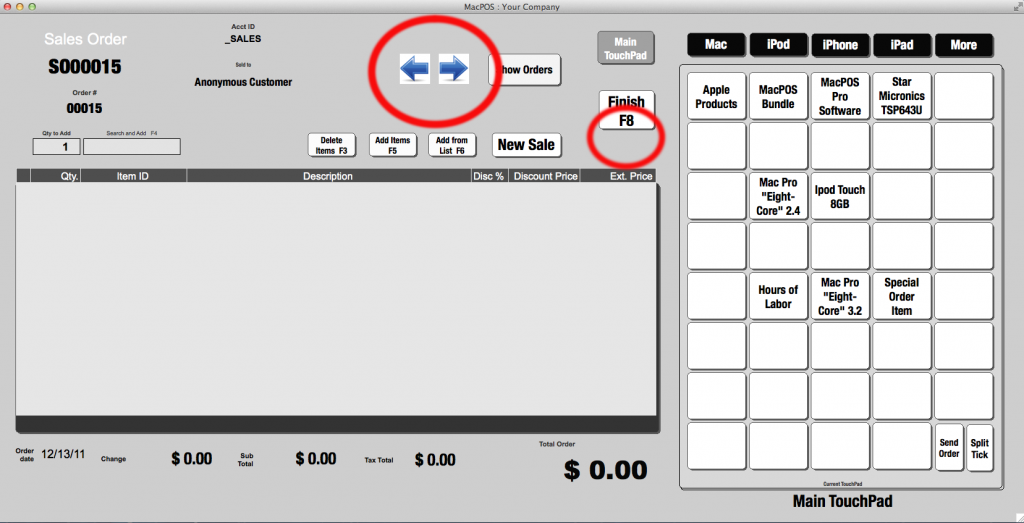

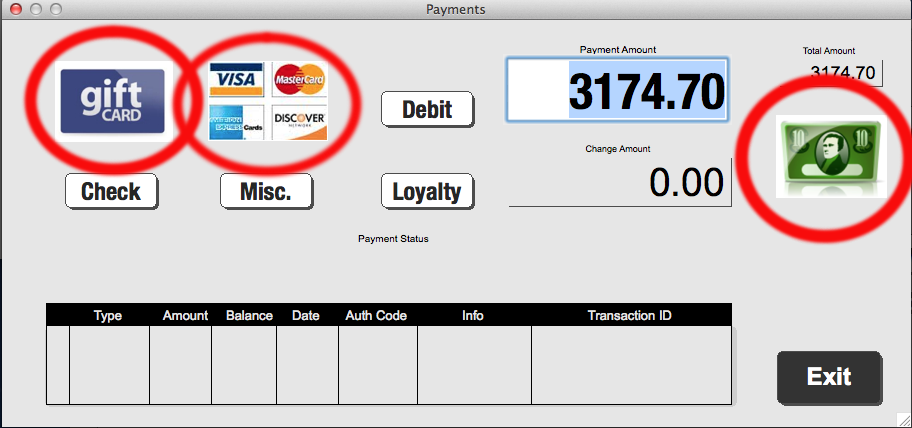

MacPOS Review – Functional, but Ugly

December 13, 2011It’s okay, not great. The biggest downside is the ugly interface, which gives the impression that the software functionality must also be subpar. While that does not appear to be the case, it certainly is a distraction during the POS experience.

White borders, mismatching shapes, and overpowering Quick Key instructions:

Review Summmary:

Name: MacPOS

Description: POS system for Apple computers. Not actually made by Apple.

Reviewed by: Sean Murray

Product Reviewed: MacPOS

Date published: 12/13/2011

2 out of 5 stars