Industry News

The Latest With OnDeck

May 18, 2020A Week after OnDeck reported Q1 earnings, the company experienced its first early amortization event brought on by the COVID-19 crisis.

The news was publicized in a May 11th filing with the SEC:

On May 7th, an early amortization event occurred with respect to the Series 2019-1 notes issued by OnDeck Asset Securitization Trust II LLC, or ODAST II as a result of an asset amount deficiency in that Series. Beginning on the next payment date under the ODAST II Agreement, all remaining collections held by ODAST II, after payment of accrued interest and certain expenses, will be applied to repay the principal balance of the Series 2018-1 notes and the Series 2019-1 notes on a pro rata basis.

The company also revealed that it had amended a debt facility “so that no borrowing base deficiency shall occur during the period from April 27, 2020 to July 16,2020.”

The company also revealed that it had amended a debt facility “so that no borrowing base deficiency shall occur during the period from April 27, 2020 to July 16,2020.”

On May 15th, OnDeck notified shareholders of additional events and maneuvers through a new filing published after the closing bell. The filing stated that:

On May 12th, a similar event happened with the 2018-1 notes as had happened with the 2019-1 notes.

On May 14th, OnDeck modified the terms of a debt facility so that “from March 11, 2020 to August 31, 2020, receivables granted temporary relief in response to the COVID-19 pandemic will generally not be considered delinquent […] so long as such receivable is paying in accordance with its modified terms.”

Also on May 14th, OnDeck obtained a temporary waiver on another debt facility. “Under the waiver, the lenders temporarily waived the occurrence and existence of reported borrowing base deficiencies and any failure to cure such deficiency amount, in each case, until the close of business on May 19, 2020.” OnDeck accepted the waiver with the understanding it would enter into a broader amendment to remain in compliance with performance and other criteria in light of increased delinquency and other portfolio dynamics that result from COVID-impacted loans. “If such an amendment is not entered into or if the borrowing base deficiency is not otherwise cured, the borrowing base deficiency would constitute an event of default under the ODAF II Facility at close of business on May 19, 2020.”

The 19th is tomorrow.

A similar waiver was obtained for another debt facility. The company has until May 20th to enter into a broader amendment to remain in compliance on that one.

The company is in a fight for its survival. In late April, OnDeck “suspended nearly all new term loan and line of credit originations and previously ceased all equipment finance lending.” The company reported that it is “focused on liquidity and capital preservation and expects there will be a significant portfolio contraction, reflecting an 80% or more reduction in the second quarter origination volume.”

The stock closed at 64 cents on Friday and a market cap of only $37.3M. Shares had traded over $4 earlier in the year.

On May 7th, shareholders voted overwhelmingly in favor of keeping CEO Noah Breslow on the company’s board of directors.

Enova On Their Small Business Lending Exposure

April 30, 2020Enova’s exposure to the small business lending crisis is limited, the company said during its earnings call yesterday. The Business Backer and Headway Capital are two of the international consumer lending company’s small business lending divisions.

In terms of their overall loan book, small business loans only make up a percentage worth in the teens. “It’s very much manageable for us,” CEO David Fisher said. Fisher also said that they did not have large exposures to entertainment, hospitality and restaurants in their small business loan portfolio and were well diversified.

“Defaults […] have not increased anywhere near as much as we would have expected. Lots of payment deferrals and modifications, but with the PPP checks coming in and states opening back up, we are somewhat encouraged that we haven’t seen very high levels of default yet.”

Enova reported a consolidated Q1 net income of $5.7M.

OnDeck Reports Q1 Net Loss of $59M, Suspends Non-PPP Lending Activities

April 30, 2020O nDeck has suspended the funding of its Core loans and lines of credit to new or existing customers (unless the loan agreement has already been executed).

nDeck has suspended the funding of its Core loans and lines of credit to new or existing customers (unless the loan agreement has already been executed).

The company has also suspended its pursuit of a bank charter. The company has instituted a 15% pay reduction for its full-time employees, a 60% pay reduction for part-time employees, and furloughed additional employees that will receive benefits but no salary. OnDeck CEO Noah Breslow and members of the Board took a 30% pay reduction.

The company said that PPP funding has not really reached real small businesses like the ones they serve and as such only a handful of their customers have received PPP funds. While OnDeck is approved to operate as a PPP lender themselves, they have been acting as an agent of them in the interim and will dedicated their resources almost entirely to this endeavor. The company anticipates that originations of its own products could contract by 80% or more in Q2.

The company has not tripped any covenants or triggers with its own lenders as of yet but is currently in discussions with them on a path forward in this environment.

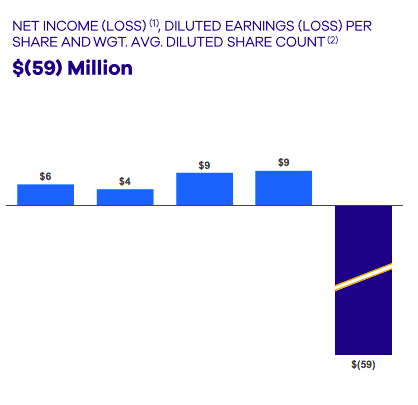

OnDeck reported a Q1 net loss of $59M on Thursday morning. The first quarter loss was driven by an increase in the Allowance for credit losses to reflect the increase in expected credit losses related to the COVID-19 pandemic. Provision for credit losses was $107.9 million. The Allowance for credit losses increased to $206 million at March 31, 2020, up $55 million or 36.1% from year-end and $58 million or 39.5% from a year ago. The 15+ Day Delinquency Ratio increased to 10.3% from 9.0% the prior quarter and 8.7% a year-ago reflecting a broad-based decline in portfolio collections since mid-March.

OnDeck reported a Q1 net loss of $59M on Thursday morning. The first quarter loss was driven by an increase in the Allowance for credit losses to reflect the increase in expected credit losses related to the COVID-19 pandemic. Provision for credit losses was $107.9 million. The Allowance for credit losses increased to $206 million at March 31, 2020, up $55 million or 36.1% from year-end and $58 million or 39.5% from a year ago. The 15+ Day Delinquency Ratio increased to 10.3% from 9.0% the prior quarter and 8.7% a year-ago reflecting a broad-based decline in portfolio collections since mid-March.

Noah Breslow, chief executive officer, is quoted in the announcement:

“In the span of several weeks, the spread of COVID-19 led to government-mandated lockdowns for small businesses both in the US and globally, placing our customers under unprecedented economic stress.After a successful and rapid transition to remote work, we effected immediate changes to our business to preserve liquidity, support our customer base, manage our loan portfolio and reduce costs. With an uncertain timetable for the reopening of the economy, and the effectiveness of government stimulus for small businesses unclear, we will be reducing debt balances in the second quarter and focusing on managing our portfolio, delivering government stimulus to our customer base and ensuring the company has the runway to scale operations again when the economy reopens.”

The company fully utilized its initial $50 million share repurchase authorization in the first quarter of 2020. On February 10, 2020, the Board authorized the company to repurchase up to an additional $50 million of common shares, and the company has approximately $23 million of remaining capacity under that authorization. The company suspended share repurchases late February but maintains authorization to resume purchases at its sole discretion.

For 2020, OnDeck expects:

- Portfolio contraction reflecting an 80% or more reduction in second quarter origination volume

- Increased delinquency and charge-offs stemming from COVID-related economic deterioration

- Reduced Net Interest Margin reflecting a lower portfolio yield

- Reduced operating expenses, on pace to cut second quarter expenses by approximately 25%.

The company had been on a modestly positive trajectory as of year-end 2019.

The company’s stock had a somewhat minor rally on Wednesday, closing at $1.61. That’s still substantially down from where it stood on February 20th at $4.22. It hit a low of 66 cents on March 18th. The share price dropped by nearly 19% after earnings were released on Thursday morning.

This story will be updated as the information becomes available.

Fundry Donates $25,000 to Community FoodBank of New Jersey

April 29, 2020Jersey-City based Fundry made a $25,000 donation the Community FoodBank of New Jersey this week. CFBNJ is an organization that “fights hunger and poverty in New Jersey by assisting those in need and seeking long-term solutions.” In addition to the over 40 million Americans who struggle with hunger every day, an estimated 17.1 million more people will experience food insecurity during this crisis, the organization says on its website.

Thank you, @FundryC, for such a generous donation! Support like this is essential as we continue to meet the growing need. https://t.co/kLhDxn5orJ

— Comm. FoodBank of NJ (@CFBNJ) April 28, 2020

United Capital Source CEO Jared Weitz Appeared on Fox News

April 21, 2020This week, Jared Weitz, CEO of United Capital Source, appeared on Fox News to talk about the PPP, EIDL, and small business lending. Video below:

BFS Capital Hires Peter Ng as CRO

March 20, 2020 Last week BFS Capital announced that it has appointed Peter Ng as Chief Revenue Officer. Coming from BlackBerry, where he served as Senior Director of Global Alliances and Business Development, Ng will be responsible for leading all revenue-related functions as well as overseeing the development of partnerships.

Last week BFS Capital announced that it has appointed Peter Ng as Chief Revenue Officer. Coming from BlackBerry, where he served as Senior Director of Global Alliances and Business Development, Ng will be responsible for leading all revenue-related functions as well as overseeing the development of partnerships.

“I’ve had the privilege of working with Peter over the past few years and have always been impressed with his unique ability to drive business growth through new, innovative and diverse channels,” CEO Mark Ruddock said. “BFS continues to develop our executive talent pool as we pursue our mission of reimagining small business financial services, and we are particularly thrilled to have him join our leadership team.”

At BlackBerry, Ng lead the company’s global Independent Software Vendor partnerships program. Here Ng oversaw the creation of new partnerships and revenue streams with the launch of BlackBerry’s ISV Affiliate program as well as the addition of over 120 partners in less than three years. Ng was also instrumental in starting up the BlackBerry World mobile app store. He joined BlackBerry after the Canadian multinational acquired Viigo, where Ng was Vice President of Sales and Services.

“I’m excited to accept the role as Chief Revenue Officer,” Ng said in a statement. “This will be the third opportunity I’ve had to work with Mark Ruddock, who is truly a transformational leader. Having built an app ecosystem from scratch, I see a similar opportunity to create one for the small business owner. I’m looking forward to bringing my extensive global partnership experience and passion for startups to BFS Capital to help grow and diversify sales channels. The BFS Capital platform, combined with a robust partner ecosystem, will unlock exciting new financial products and services for underserved small businesses and drive an unparalleled customer experience.”

OnDeck’s Chief Accounting Officer is Leaving The Company

March 16, 2020On March 9th, OnDeck filed a disclosure with the SEC that their Chief Accounting Officer, Nicholas Sinigaglia, would be leaving the company on May 1st. Sinigaglia was with the company for more than 5 years.

OnDeck said it was doing this as part of changes it had made to streamline its finance organization.

Shares of OnDeck have dropped by more than 50% since that time, likely wrought by the sudden economic disruption.

Funding Metrics Deal Puts Them On The Map

March 4, 2020 A new $100 million revolving credit facility is poised to give a big boost to small business funding provider Funding Metrics. The company operates the Lendini and QuickFix Capital brands, and this new credit facility comes as the company seeks to increase its base of more than 9,500 small businesses served so far.

A new $100 million revolving credit facility is poised to give a big boost to small business funding provider Funding Metrics. The company operates the Lendini and QuickFix Capital brands, and this new credit facility comes as the company seeks to increase its base of more than 9,500 small businesses served so far.

“We now have the money to grow over all aspects of that spectrum,” President Jim Carnes said. Since 2014, the company has provided more than $500 million dollars of funding to small businesses in a variety of industries, including healthcare, real estate, construction, restaurants and others.

The $100 million worth of revolving credit comes from what the company called a “a multi-billion dollar institutional credit fund,” with Brean Capital serving as Funding Metrics’ exclusive financial advisor for the transaction. The new credit line as well as a newly developed website and streamlined funding process will allow for growth and fantastic customer service. Among the company’s main ideals is to provide funding request approvals or denials within three hours or less.

One of the main challenges for online small business funding and its related activities in 2020, said Funding Metrics co-founder David Frascella, is increasing awareness of all the offers and products out there, including from his company. “There are plenty of options in today’s market,” he said. Increasing that awareness, he added, is something the industry should come together to better address. “We look forward to additional submissions from the ISO network and funding the next wave of small business leaders nationwide,” he said.

Funding Metrics is also a platinum sponsor of Broker Fair 2020 on May 18th in New York City.