Business Lending

Are You The Top Broker?!

November 21, 2024

Broker Battle returns on February 20, 2025 at deBanked CONNECT MIAMI. The competition, now the 2nd ever after last year’s very successful launch, is back with an improved format that allows for almost any qualified broker the opportunity to be tested LIVE in person. Broker Battle TWO will also have 3 separate broker categories versus last year’s catch-all. Those categories are Revenue Based Finance, SBA Lending, and Equipment Financing.

All competing brokers will be vetted, tested, and scored through very short judging rounds on the showcase floor. The two top scores from each category will actually compete on stage for the championship.

That means that as opposed to last year’s 6 total contestants and 7 separate battles on stage, this year’s competition could feasibly manage up to 100 contestants for which there will only be 3 total battles on stage (each being a championship). The format allows for more brokers to prove themselves in person while reducing total stage time for the final grand performance.

Each broker will win a cash prize and the distinction of being Top Broker (in their category). To be eligible for entry, you must be an active broker with good ethics and a positive reputation. You must also be registered to attend deBanked CONNECT MIAMI where it will take place and enter yourself in the battle itself here.

Broker Battle intends to foster best practices.

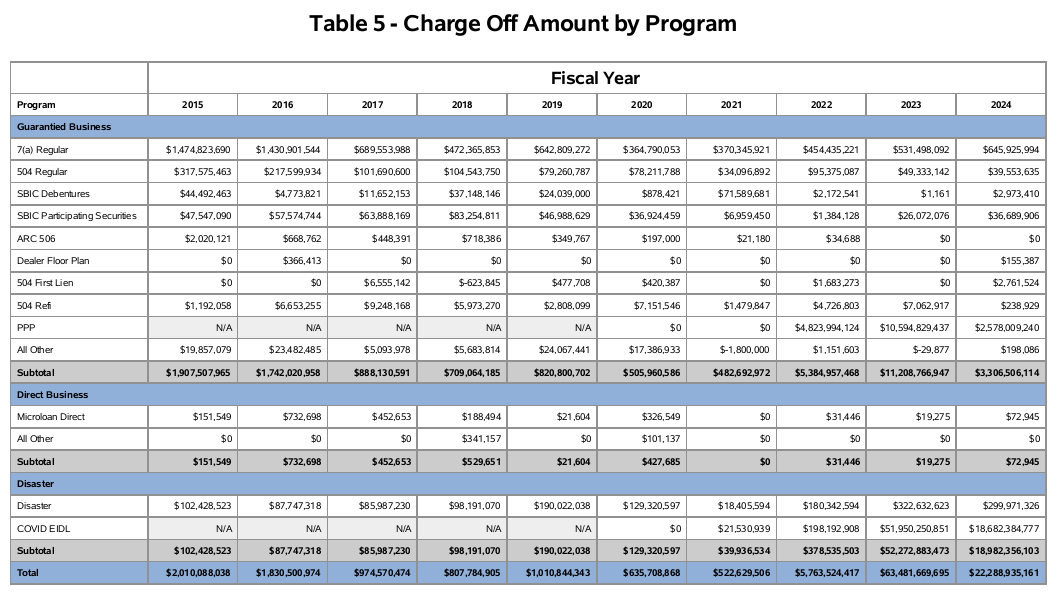

Cumulative Covid EIDL Chargeoffs Now Exceed $70 Billion

November 19, 2024The latest data from the SBA is in. It charged off $18.7B in Covid EIDL loans in FY 2024. That was down from $52B charged-off in FY 2023. The program still has an unpaid principal balance of $277B.

PPP loans were still being written off in FY 2024 as well, coming in $2.5B charged-off vs $10.6B charged-off in FY 2023 and $4.8B charged-off in FY 2022.

The EIDL program suffered astonishingly high losses during covid. Regular 7(a) loans, for example, only experienced $646M in charge-offs in FY 2024.

Shopify Capital Originates $837M in Business Loans & MCAs in Q3

November 15, 2024Shopify Capital originated $837 million in business loans and merchant cash advances in Q3, putting the grand total at $2.1B for the first 3 quarters. During the earnings call, Shopify said that loss ratios remained within the consistent range.

Compared to some of their competitors in the online space, Shopify Capital ranks third:

Q3 originations:

Square Loans: $1.38B

Enova: $1B

Shopify Capital: $837M

Ready Capital Grows as Leading Non-Bank Small Business Lender

November 10, 2024 “Ready Capital has become a leading national non-bank lender to small businesses providing a full suite of loan options from $10,000 unsecured working capital loans to $25 million plus real estate-backed USDA loans,” said Ready Capital CEO Thomas Capasse during the company’s Q3 earnings call.

“Ready Capital has become a leading national non-bank lender to small businesses providing a full suite of loan options from $10,000 unsecured working capital loans to $25 million plus real estate-backed USDA loans,” said Ready Capital CEO Thomas Capasse during the company’s Q3 earnings call.

Ready, in some ways, has flown under the radar in recognition. On the one hand the company is the top non-bank SBA lender in the country and fourth overall SBA lender in the country. On the other hand, the company has previously acquired Knight Capital, iBusiness Funding, Madison One Capital, select non-SBA assets of Fountainhead, and Funding Circle USA. The result is that the overall organization is a powerhouse with a current public market cap of $1.25B.

iBusiness Funding, once the technology arm of Knight Capital, has played an integral role for the company. For example, when Ready acquired Funding Circle USA, it did it through the iBusiness Funding brand.

“[In 2019, iBusiness Funding was] a leader in unsecured small business lending,” Capasse said on the call. “And then they adopted their tech to the PPP which was very accretive. And since then there’s been the initiative within the SBA to emphasize small loans below $350,000, which many times are minority women-owned businesses, and so that’s been a significant initiative by the SBA& and so what we’ve done is iBusiness has developed a tech stack, which is now being marketed as a third-party underwriting model for banks. Banks just do not focus on that at all. Even if they do SBA loans, it’s mostly for larger loans again above the $350,000 to the $5 million. So the idea with iBusiness is to grow the revenue stream from this software-based business.”

On Funding Circle, Capasse said that the newly acquired subsidiary would be “accretive to earnings once fully ramped.” The numbers offered so far was that $6.6 million growth in Q3 origination income came from small business working capital loans through the Funding Circle platform.

Nerdwallet: Continued “Pressure in SMB Loan Originations”, Search Engine Traffic Flux

October 30, 2024 “We continue to see pressure in SMB loan originations, with rates remaining elevated and underwriting remaining tight,” said Lauren StClair, CFO of NerdWallet on the Q3 earnings call, “However, this was more than offset by growth in our renewals portfolio, which showcases the benefit of our vertical integration strategy and the reoccurring nature of the vertical when we pursue a higher touch experience.”

“We continue to see pressure in SMB loan originations, with rates remaining elevated and underwriting remaining tight,” said Lauren StClair, CFO of NerdWallet on the Q3 earnings call, “However, this was more than offset by growth in our renewals portfolio, which showcases the benefit of our vertical integration strategy and the reoccurring nature of the vertical when we pursue a higher touch experience.”

NerdWallet CEO Tim Chen further said that it was a “tough macro environment in SMB loans.”

Their SMB business overall, which includes several products, not just loan referrals, did well however in Q3, generating double digit YoY growth for a total of $27.8M in revenue.

Of additional note is NerdWallet’s commentary on search engine traffic and its impact to its business.

“After a stronger start of the quarter, we saw some additional deterioration in our search visibility in mid-Q3,” said Chen. “While traffic to our monetizing shopping-oriented content started to rebound as we exited the quarter, traffic to our non-monetizing learning-oriented content did not. As a result, Monthly Unique Users were down 7% year-over-year in Q3.”

deBanked drew attention to their search engine observations this past August after hearing Chen muse that the current state of organic search result rankings were not actually helping business owners get business loans. Chen dived into this subject yet again on the Q3 call, the full quote of which is worth including:

“So, during our Q2 call, our search visibility was broadly stabilizing and actually starting to rebound a little bit. And then soon after our Q2 call, things took a turn for the worse. So with our shopping traffic, things got worse in August and September. But then going into October, rebounded back to a level that was a bit better even than where we were when we did the Q2 call. We think we did some things on our end to clean up the user experience that were net positive. Now, there were some exceptions, so for example, parts of credit cards and personal loans are still lagging. But, overall, we got a pretty good place – we got to a pretty good place on shopping pages and feel like we’ve figured out what to improve.

Conversely, for that far bigger bucket of education-oriented traffic that is less commercial in nature, things got progressively worse throughout the quarter and recently stabilized at a lower level. So, what’s happening there is a renewed push by search engines to incorporate their own answers directly into the search results, like you mentioned AI overviews as an example. So, for those of you who have been following search over the years, this isn’t really anything new. So, for example, at one point when you search for the weather, it didn’t show up directly in the results, and eventually a module was inserted there. That trend towards the simpler stuff being pulled into search results is inevitable, and we’ve always been more insulated from that, but historically it happens in waves, and sometimes haircuts are MUUs.

So, we’ve generally seen a re-baselining after any major changes, and then eventual growth from there as you lap the impact. Oftentimes, those changes are rolled back. And so, over the last 10 years, I’d say these changes come in waves, and we’re in the middle of a big wave, and as long as we focus on delivering consumer value, we’re steering in the right direction, and things tend to sort themselves out. So, this headwind is driving our outlook for further MUU deceleration in Q4, because of the full quarter impact of some of the stuff that happened with those headwinds.

Now, in the long run, I do think an improving search experience is a win for the overall ecosystem and keeps it healthy and growing. And, really, I’d say the silver lining here is that Q3 was pretty brutal as far as some of the headwinds we faced in organic search, especially in highly commercial areas, and being able to hit like a 12% NGOI margin in Q3 in spite of that headwind is really a testament to some of the progress we’ve made in building a brand and a direct relationship with our users and our increasing competitiveness in other channels.”

PayPal is Back to Growing its Merchant Lending Program

October 29, 2024 After taking drastic action over the last year to rein in surging SMB lending charge-offs, PayPal believes it has corrected the issue.

After taking drastic action over the last year to rein in surging SMB lending charge-offs, PayPal believes it has corrected the issue.

“We have now fully lapped the actions taken last year to tighten credit underwriting and reduce on balance sheet risk,” said PayPal CFO Jamie Miller on the Q3 earnings call. “We’re seeing better performance across the portfolio, and have now started to modestly grow merchant originations. We’ll continue to prudently manage the portfolio’s exposure with the goal of sustaining our balance sheet-business model, while providing our customers with more ways to manage their cash flow, spending and borrowing needs.”

The reduction in originations since the pullback had been severe, down by as much as 50% by deBanked’s prior estimates.

Enova Surpasses $1 Billion in SMB Loans in a Single Quarter For First Time

October 23, 2024Enova’s small business loan arm had a huge 3rd quarter.

“Notably, for the first time in our history, we originated over $1 billion in small business loans, up 33% year-over-year and 14% sequentially,” said Enova CEO David Fisher during the company’s earning call. “The main drivers of this growth are consumer spending and confidence from small business owners in this current economy.”

Additionally, he said:

As discussed on our first quarter call, we identified opportunities within our SMB business that we believe would support continued strong growth with improved unit economics. We continue to see the benefits of this strategy in the third quarter as small business originations growth was strong, small business revenue yield continued to move higher sequentially and the small business quarterly net charge-off ratio remained on the low end of our expected range. Expectations for our future credit performance remained stable as the consolidated consumer and small business fair-value premiums were all largely unchanged from last quarter.

TikTok is Now Offering Business Financing

October 7, 2024 Add TikTok to the list of tech platforms offering business loans. TikTok Shop Capital is now “offering sellers access to fast and flexible business financing,” the company states on its website. Unsurprisingly, one of TikTok Shop’s partners is Parafin but the company also lists Storfund and Kanmon as funding partners. Storfund announced its deal with TikTok earlier today and said that its program would be called Daily Advance.

Add TikTok to the list of tech platforms offering business loans. TikTok Shop Capital is now “offering sellers access to fast and flexible business financing,” the company states on its website. Unsurprisingly, one of TikTok Shop’s partners is Parafin but the company also lists Storfund and Kanmon as funding partners. Storfund announced its deal with TikTok earlier today and said that its program would be called Daily Advance.

“TikTok is not a lender or loan broker,” the company website states. “TikTok partners with third-party lenders and financing providers to offer TikTok Shop sellers business financing options.”

The process works different depending on which solution a customer uses. For example, Storfund repayments are automatically debited from TikTok Shop payouts, Parafin repayments are automatically debited from the business bank account associated with TikTok Shop payouts, and Kanmon requires repayment via auto-pay deductions from the business bank account provided during the application process.

The Parafin option does not appear to be a standard merchant cash advance. TikTok says it would actually be a Parafin commercial flex loan issued by Celtic Bank. There is no credit check required for it.

TikTok’s foray into business financing is invite-only. “If a seller has an available pre-qualified and/or pre-approved offer, it will appear within Seller Center under the Finances tab,” the website says.