business cash advance

Do Opportunities Abound?

June 8, 2014 Just recently I found myself in an office surrounded by some folks who had each worked in the merchant cash advance business for more than 10 years. The first generation of MCA pioneers are still out there of course but it’s rare to be in the presence of so many at one time. It was weird. Weirder still was the realization that no matter how much things have changed, some things continue to be exactly the same.

Just recently I found myself in an office surrounded by some folks who had each worked in the merchant cash advance business for more than 10 years. The first generation of MCA pioneers are still out there of course but it’s rare to be in the presence of so many at one time. It was weird. Weirder still was the realization that no matter how much things have changed, some things continue to be exactly the same.

Me: You guys looking to recruit ISOs?

Them: Damn right

As far as the industry is concerned, these guys might as well have fought in ‘Nam. They’re from another generation where life was hard and men were still men. When businesses couldn’t get bank loans, these guys were splitting payments with their bare hands and reprogramming credit card machines with nothing more than a paper clip and a ball of twine. Funding a deal wasn’t a product of technology, it was one of sweat, tears, and blood. Have you ever bled for your deals?

This August I celebrate my 8th year in the industry. Next month marks the 4 year anniversary of this blog. I enjoy reading some of my posts from back then, particularly since most of them discuss the ordeals of credit card processing. A lot of what I’ve written no longer applies and some of what I’m writing these days will be outdated years from now. As I approach 600 articles and blog posts on this subject matter, I’ve had to stop and ask myself if everything has already been written. What more can possibly be said about this business? Perhaps the tale of the industry has already been told and I am on my way to retelling exaggerated stories to anyone who will listen. I don’t want to be that wrinkled up old man swaying back and forth in a rocking chair talking about how ISOs got it so easy these days.

Sadly, even the name of the website is reflective of a previous era. This is the Merchant Processing Resource, not exactly what you’d expect a top destination to be called on the subject of alternative business lending.

Sadly, even the name of the website is reflective of a previous era. This is the Merchant Processing Resource, not exactly what you’d expect a top destination to be called on the subject of alternative business lending.

But the story’s not finished. Every passing month is filled with events that inspire a dozen new chapters, which is more than one man can keep up with. Last month at the LendIt conference, I got a glimpse of just how many opportunities still lie ahead.

Some alternative business financing companies such as Funding Circle and DealStruck are diverging away from merchant cash advance and going back to the traditional roots of term lending. Funding Circle is doing it with a 21st century twist, by making their system peer-to-peer based.

Still other firms have sprung up around LendingClub’s and Prosper’s APIs and offer their users ways to make better loan investment decisions.

And even among the players we’re all familiar with, there is innovation, growth, and new ideas. Just recently CAN Capital launched CAN Connect, a software application that can be integrated with any other company’s software. According to CAN’s release,

Through CAN Connect™, merchants will be able to receive a CAN Instant Quote™ based solely on data provided by the partner. Once the merchant elects to proceed, they are taken through a simple online application process and can obtain access to working capital without ever leaving the partner’s platform.

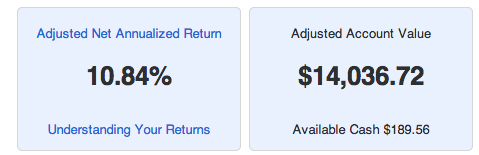

Indeed technology has even allowed me to become a lender myself,

My LendingClub portfolio, which is still very young and made up by hundreds of $25 consumer loan contributions has a current Net Annualized Return of more than 10%. Contrast that against the average U.S. savings account that pays out less than 1%.

While it’s certainly not the 54% yield that OnDeck Capital enjoys, there are levels of risk and markets set up for just about anyone interested in alternative lending.

And what might come next may not all be broker/funder related. As the industry flies in a thousand different directions, entire new industries and services are going to grow up around them. That brings me back full circle. Has everything already been written? 4 years of blogging here and this might as well be my first day.

Some things haven’t changed a bit, but the rest of it, well… we must soldier on in this strange new world.

Do you see opportunities ahead? Discuss with industry insiders on DailyFunder.

Make Your Voice Heard

May 29, 2014Have an opinion on which way the industry is headed? Or eager to read about events that you feel are most relevant? DailyFunder is running a preliminary research survey geared towards those involved in merchant cash advance and alternative business lending. It’s completely anonymous and it will be used to help steer the direction of DailyFunder, the only alternative business lending publication. That means we want to know how you think, what you think, and what you care about.

Collected responses already prove that industry insiders have a lot to say, especially in the write-in questions. So go and make sure your voice is heard. It’s anonymous and it’ll only take a minute or two.

Some of the statistical results may be published in the next issue of the magazine.

START SURVEY

Industry Leaders Tell All (Videos)

May 25, 2014A few weeks ago, I recapped my two days at the LendIt conference in San Francisco.

Peter Renton of Lend Academy, who hosted the conference, is putting up the professionally finished videos on his youtube channel. I’ve embedded the ones I think you’ll find most relevant, though I think there’s still one or two good ones that aren’t up yet.

As a side note, many of you in the merchant cash advance space have asked if LendIt was worth it. The answer is yes, but it is not a place to recruit ISOs. I actually don’t think there were any ISOs there at all. It was a good place to meet institutional investors, technology companies that cater to alternative lenders, leading industry attorneys, and the wild pack of peer-to-peer lenders. Basically, it was a way to hear and see everything outside of the bubble that can be merchant cash advance.

Next year it’s in New York City and I’ll definitely be attending again. And on that note, check out the full videos below:

The Real Impact on Small Business

May 22, 2014 It’s not easy being in the lending business. Just talking about money can make people uncomfortable. Bringing up how much money you have, don’t have, or wish you had is like bringing up politics at Thanksgiving dinner. It’s taboo in this society. It’s even rude to ask somebody how much they make a year. That’s one of two reasons why being a lender or loan broker is so difficult, you’re forced to dive head first into emotionally charged waters.

It’s not easy being in the lending business. Just talking about money can make people uncomfortable. Bringing up how much money you have, don’t have, or wish you had is like bringing up politics at Thanksgiving dinner. It’s taboo in this society. It’s even rude to ask somebody how much they make a year. That’s one of two reasons why being a lender or loan broker is so difficult, you’re forced to dive head first into emotionally charged waters.

The second reason is telling an applicant ‘no’. It feels personal even if it’s not. “It’s just business,” the bearer of bad news will say, but it never feels that way. I know that firsthand through my experience as both a broker and an underwriter. Rejection is a painful experience for an applicant no matter how professional they are.

But sometimes you get to tell an applicant ‘yes’ and that can be an emotionally moving experience as well. Looking back, the only applicants I ever heard cry were the ones that got approved. Some of those approvals were expensive but they were given an opportunity in a world where up until that point, no one was willing to give them any opportunity at all. They were the forgotten businesses of America.

PayPal’s VP of SMB Lending recently said that he feels “blessed to be serving this higher need.” Blessed was an interesting word choice. Being able to support small businesses doesn’t just make him feel happy or hopeful or satisfied, it makes him feel blessed.

What is the real impact that alternative financing companies have on small businesses? Thanks to the funding companies who took the time to find out. Today, we can see for ourselves:

Above is just a small handful of the testimonials you can find on the websites of CAN Capital, Kabbage, RapidAdvance, Fora Financial, and Merchant Cash and Capital. Real businesses, real stories, real impact.

And there you have it…

Big Deal #2 Struck in MCA Industry

May 21, 2014 Another day, another capital raise for some company or other involved in alternative business lending. That’s the way it is these days, but the news about the American Finance Solutions (AFS)/CapFin Partners deal announced on Wednesday is markedly different.

Another day, another capital raise for some company or other involved in alternative business lending. That’s the way it is these days, but the news about the American Finance Solutions (AFS)/CapFin Partners deal announced on Wednesday is markedly different.

It’s the Rockbridge Growth Equity (RGE)/RapidAdvance deal all over again, the welcoming of a major MCA company into a wider lending family. Though the release does not specify the amount of equity CapFin Partners acquired in the transaction, nor any valuation figure, the headline literally says it’s significant.

CapFin Partners is also a significant investor in Contintental Business Credit (CBC), an asset-based lender that’s been in operation since 1989. The CapFin deal will bring AFS and CBC together strategically. As said in the release, “the union of these two financial lending companies will widen the portfolio of services offered, which now include merchant cash advances, factoring and asset based loans.”

The design is strikingly similar to the RapidAdvance/RGE deal.

AFS/CapFin

The investment and close relationship with CBC will provide operational expertise, a diversified client base and a larger pool of capital for funding customers

RapidAdvance/RGE

By aligning with Rockbridge, we will leverage our new relationship with its portfolio of companies, bringing best practices and expertise to nearly every aspect of our business.

Both funders were founded in the pre-recession era, giving investors a chance to review performance and returns both through good times and bad.

Two years ago I predicted that “MCA will simply assimilate into other financial products.” As is the case with these two deals, it’s already becoming just one product out of many offered by financial institutions. Elsewhere in the industry, MCA companies are offering true loans to stay competitive and some funders are passing on MCA completely to focus just on traditional business loans with terms up to 10 years and traditional interest rates.

The AFS deal proved yet again though that there is a market to buy (or buy into) established reputable merchant cash advance companies. That should give hope to new funders that are trying to formulate a long-term exit strategy.

Congratulations to American Finance Solutions.

Would an APR Help?

May 14, 2014Merchant cash advance industry hater Ami Kassar added to his collection of rants today in the Wall Street Journal by writing about the True Costs of Cash-Advance Loans.

Bloomberg BusinessWeek writer Pat Clark, knowing full well that Kassar and I have sparred online, tweeted:

curious what @financeguy74 thinks RT @akassar: The true cost of cash advance loans: my latest @wsj column http://t.co/BjyqMgM8Uz

— Patrick Clark (@pat_clark) May 14, 2014

My response:

My response:

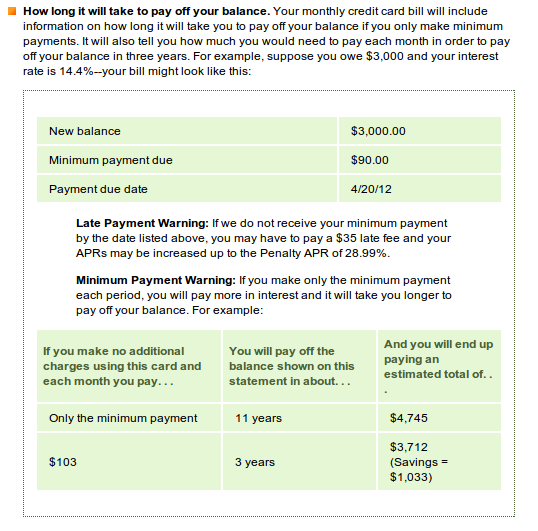

Do I think merchant cash advances when structured as loans should include a prominently displayed APR on the contract?: Yes, though I believe this is less helpful than the dollar for dollar cost explanations that are already presented. But in the name of maximum transparency, it would be a good thing to have on there.

Do I think less business owners would use such loans if the APR was prominently displayed?: No

If DealStruck can make their model work, then great. What I want to know is, what happens to the businesses they won’t approve?

Alternative Lending: Big Government and Big Data

May 7, 2014– Professor Michael Barr at LendIt 2014

One of the clear themes of the LendIt 2014 conference was that borrowers are willing to pay extra for speed and convenience. Regulators have taken note of this trend but they’re still supportive of the alternative lending phenomenon anyway. Truth be told, the government is acting like a weight has been lifted off its shoulders. Ever since the 2008 financial crisis, the feds have prodded banks to lend more, but they’ve barely budged, especially with small businesses. Non-bank lenders have relieved them of the stress and all they need do now is make sure everybody plays nice.

One of the clear themes of the LendIt 2014 conference was that borrowers are willing to pay extra for speed and convenience. Regulators have taken note of this trend but they’re still supportive of the alternative lending phenomenon anyway. Truth be told, the government is acting like a weight has been lifted off its shoulders. Ever since the 2008 financial crisis, the feds have prodded banks to lend more, but they’ve barely budged, especially with small businesses. Non-bank lenders have relieved them of the stress and all they need do now is make sure everybody plays nice.

Professor Michael Barr, a former US Treasury official, key architect of the Dodd-Frank Act, and Rhodes Scholar, believes the best way forward is to empower consumers. That’s something lenders can accomplish through education and transparency. On transparency, he cited many of the commendable practices that credit card companies and mortgage companies have implemented, but did not fail to note that these were forcibly instituted through regulation (Hint hint…).

When a LendIt attendee asked Barr to name someone in the alternative lending industry that is a great role model for transparency, Barr answered by saying, “I haven’t seen anyone in the industry doing things the way I would do them in regards to education and disclosure.” On the path towards transparency, “the potential is not yet realized,” he added.

While it sounded as if he favored eventual regulation of alternative lending, he offered all in attendance advice to prevent it. “Take the high road to prevent regulatory interest,” he said.

Barr’s sobering presentation also covered the Consumer Financial Protection Bureau (CFPB) and the role they might play in alternative lending, if any. Payday lenders and debt collectors were their primary supervisory targets he said, but added the “the CFPB has the flexibility in the marketplace to address problems before they occur.” That flexibility essentially gives them jurisdiction over whatever they decide they want to be in their jurisdiction.

Sophie Raseman, the Director of Smart Disclosure in the U.S. Treasury Department’s Office of Consumer Policy appealed to the industry in a different manner. “Small businesses are at the heart of the economy. We want to serve you [alternative lenders] better so that we can better serve them,” Raseman pleaded. As part of that, she came bearing gifts, a reminder that the federal government had loads of data available via APIs at http://finance.data.gov. The government wants to make sure we have access to as many tools as possible, most likely to help drive borrowing costs down. If you need to verify someone’s income, Raseman recommended the IRS’s Income Verification Express Service.

The Income Verification Express Service program is used by mortgage lenders and others within the financial community to confirm the income of a borrower during the processing of a loan application. The IRS provides return transcript, W-2 transcript and 1099 transcript information generally within 2 business days (business day equals 6 a.m. to 2 p.m. local IVES site time) to a third party with the consent of the taxpayer.

The irony with this service is the two business day timeline, though I haven’t confirmed if that’s still the case. Delays and archaic data aggregation methods are the exact things alternative lenders are trying to overcome. Kabbage comes to mind as the length of time it takes for them to go from application to funding can be as quick as 7 minutes, a time frame I found to be reality after watching the demonstration by Kabbage’s COO, Kathryn Petralia.

Kababge’s blazing speed is made possible by access to big data, which made Petralia an excellent choice to have on the Big Data Credit Decisioning Panel. She was joined by Noah Breslow of OnDeck Capital, Jeff Stewart of Lenddo, and Paul Gu of Upstart.

Stewart, whose company lends internationally presented the idea of mining not just data on social networks, but the photographs on them. One possibility was measuring whether or not borrowers appeared in photographs with other borrowers known to be bad, or whether or not they hung out with undesirables such as ex-convicts. He was a big believer in association risk, speculating that friends of bad borrowers also made them more likely to be bad borrowers themselves.

Breslow of course said you have to be careful with the noise of social media as there can be a lot of false signals. Does that mean there are big data problems then? Upstart’s Paul Gu said, “we have small data problems” in reference to why there seems to be so much trouble evaluating applicants that have little to no credit history. Gu believes that basic information such as where a borrower went to college, their major, and their grades can be used as an accurate predictor of payment performance and his company has acquired the data to back that up.

Breslow of course said you have to be careful with the noise of social media as there can be a lot of false signals. Does that mean there are big data problems then? Upstart’s Paul Gu said, “we have small data problems” in reference to why there seems to be so much trouble evaluating applicants that have little to no credit history. Gu believes that basic information such as where a borrower went to college, their major, and their grades can be used as an accurate predictor of payment performance and his company has acquired the data to back that up.

Somewhere along in the discussion though the meaning of automation got twisted. OnDeck for instance has an automated process, yet humans play a role in 30% of the loan decision making. Does that mean they are not actually automated? Breslow clarified that aggregating data from many different sources using APIs and computers was automation and that there was still a role for humans. The goal is to make sure that humans aren’t doing the same things that the computers are doing.

“The world’s greatest chess human can beat the world’s greatest chess algorithm,” said Lenddo’s Stewart. “Humans should be pulling what the algorithms can’t think of,” added Breslow. He presented an example of an applicant satisfying all of an algorithm’s criteria but sending up a red flag at the human level. “Why would the owner of a New York restaurant live in California?” Breslow asked. That’s something an algorithm might get confused about. It might mean nothing or it might mean something.

“The world’s greatest chess human can beat the world’s greatest chess algorithm,” said Lenddo’s Stewart. “Humans should be pulling what the algorithms can’t think of,” added Breslow. He presented an example of an applicant satisfying all of an algorithm’s criteria but sending up a red flag at the human level. “Why would the owner of a New York restaurant live in California?” Breslow asked. That’s something an algorithm might get confused about. It might mean nothing or it might mean something.

“Algorithms are probabilistic,” Stewart reminded the audience. They spell out the likelihood of repayment, they don’t guarantee it.

For Kabbage, algorithms and automation have been instrumental in allowing them to scale. “I don’t need to hire a lot more people to serve a lot more customers,” Petralia explained.

“Let the data speak for itself,” Breslow proclaimed. And there is a lot of statistically interesting data. “People with middle names perform better than people without them,” added Breslow.

For Gu, borrowers with degrees in Science, Technology, Engineering, and Mathematics fare better than their academic peers, though he wouldn’t reveal which major is #1. That information, while probably available to OnDeck, likely plays little or no role. “There is a lot more data to analyze on the business side than the consumer side which is why [things like] the social graph is a little less relevant,” Breslow said.

In the end, lenders don’t need to go on a wild data goose chase to learn all about their prospective clients. Kabbage applicants for instance are asked to provide their online banking credentials in the very first step of the applications. “A lot of people would be surprised as to the amount of data borrowers are willing to share,” Petralia proclaimed. Indeed, many alternative business lenders and merchant cash advance companies are analyzing historical cash flow activity using third party aggregating services like Yodlee, something that requires the client’s credentials.

During Kabbage’s earlier demonstration, some members in the audience worried that factors such as deposit activity could be gamed. Petralia assured them that their algorithm was sophisticated enough to detect manipulation and at the same time explained that they analyzed far more than just deposit and balance history.

Perhaps all this technology though has gone overboard. Is it possible to predict performance just based on what the applicant says? Believe it or not, “the language someone uses is an indicator of default probability,” Stewart said. But even that kind of detection has become automated. “Lenddo uses semantic analysis. People tend to use different words when they’re desperate.”

Who knows, a year from now getting a loan might be as easy as picking up your phone and saying, “Siri, send money.” Just make sure to delete all the photos of you hanging out with criminals off your phone first. A lender might use them against you.

LendIt Conference: The State of Alternative Business Lending

May 6, 2014 Have you heard? Banks aren’t lending. Nobody at LendIt seems to mind though. Ron Suber, the President of Prosper Marketplace, said earlier today that banks are not the competition. That’s an interesting theory to digest when contemplating the future of alternative lending. If banks are not the competition, then who is everyone at LendIt competing against? I think the obvious answer is each other, but much deeper than that, the competition is the traditional mindset of borrowers.

Have you heard? Banks aren’t lending. Nobody at LendIt seems to mind though. Ron Suber, the President of Prosper Marketplace, said earlier today that banks are not the competition. That’s an interesting theory to digest when contemplating the future of alternative lending. If banks are not the competition, then who is everyone at LendIt competing against? I think the obvious answer is each other, but much deeper than that, the competition is the traditional mindset of borrowers.

The biggest challenge the wider alternative lending industry faces is awareness and understanding. Those happen to also be two of Suber’s three edicts for growth. The third is education. Just because alternatives are available today doesn’t mean that potential borrowers know about them or feel comfortable enough to use them. Today we are competing against the old way of thinking.

Revolution?

Other products in the new “share economy” have encountered a similar struggle. Several presenters today cited Uber as having revolutionized the way people use taxis. “A long time ago, people used to stand on corners and hold out their hand to get a cab, but that’s all changed,” was the oft-paraphrased proof that age-old industries were falling like dominoes. But as a New York City resident, I hadn’t quite noticed a change at all. Hailing cabs off the street is still very much the norm. It is only by sheer coincidence that I used Uber for the very first time to travel to JFK airport on my way to this conference.

I first encountered Uber a year ago when an acquaintance dazzled me with his ability to summon a car using an app on his phone. It was then that I became aware, but I did not understand how it worked. It took me 12 months to get comfortable enough to try it myself, and the experience was okay I guess if you discount the fact that my driver went through the E-ZPass lane without actually having an E-ZPass. Needless to say, that led to a major holdup that caused me to almost miss my flight.

If it took me a year to get past the confusion of hailing a cab from my phone, I can only imagine what potential borrowers must think when told they can raise money from their peers, the crowd, or a lender that requires payments to be made every single day.

Perhaps most telling about the awareness challenge, is that many people I’ve spoken to at LendIt had never heard of a 16 year old product known as merchant cash advance. That speaks volumes about how much more work merchant cash companies still have to do in order to gain mainstream awareness.

Even those fully aware were not entirely certain about how to define the product. In the Online Lending Institutional Investors Panel, merchant cash advance was briefly discussed as a topic but it was almost entirely spoken in the context of being something that OnDeck Capital does. That would come as disheartening news to OnDeck since they have spent considerable resources in positioning themselves as anything but a merchant cash advance company. Confusion over what somebody is or isn’t will probably increase especially as alternative lenders from different industries start to compete for the same clients.

Funding businesses instead of people

Brendan Ross, the President of Direct Lending Investments, and the moderator of the Short Term Business Lending panel pointed out that a dentist could pursue two different loan options and get completely different results. With excellent credit a dentist could expect to land a 3-5 year personal loan at 7-8% APR on a P2P platform. If he were to apply for the loan using his dental practice though, he could expect to incur costs over 25% and get nothing longer than 2 years.

Ross, who was a very active moderator, subscribes to the belief that businesses are overpaying for credit. Unlike the consumer loan space, there hasn’t been price compression. The cost of business capital remains high, perhaps higher than what is necessary to turn a reasonable profit. Ross argued that the padded cost serves as a hedge against defaults and economic downturns. “The asset class works even when the collection process doesn’t,” Ross said. “The model works with no legal recovery.”

Building on that premise, Ross asked the panelists if an increase in defaults were simply the cost of doing business towards automating the underwriting process.

Stephen Sheinbaum, the CEO of Merchant Cash and Capital argued that just the opposite had occurred, that automation had led to a decrease in defaults. Others on the panel confirmed a similar outcome, though Rob Frohwein of Kabbage admitted they could potentially weather higher defaults through automation by offsetting it against decreased infrastructure costs.

Noah Breslow of OnDeck echoed something similar to Frohwein in the Small Business Term Lending Panel. He asked this question, “Do underwriters add value or not?” and followed up by saying that 30% of their deals were still manually underwritten, usually the deals that are larger.

Is full automation right around the corner?

The debate between humans and computers in risk analysis is a featured segment in the third issue of DailyFunder that is being mailed out this week, but there is another angle that is seldom discussed, whether or not customers want automation. Breslow said today that, “if customers want full automation, we are prepared to deliver it.” They’ve learned over time that “many customers want someone to talk to at some point in the transaction.” Rohit Arora, the CEO of biz2credit expressed much of the same in a recent interview with DailyFunder’s Managing Editor Michael Giusti.

The only dissenting voice was Gary Chodes, the CEO of Raiseworks who seemed to be of the belief that human involvement in underwriting was nothing short of ridiculous. He stated that, “if you look back over the last 20 years, the loss rates on business loans under 24 months has been really low.” To him, that data seemed to be proof enough that complete automation could and should be achieved, though he admitted to performing back-end checks such as landlord verifications. They currently have no physical underwriters however.

Is there a transparency problem?

Tom Green, a VP of LendingClub shared an interesting tale. While trying to convince potential borrowers to ditch a merchant cash advance in favor of a LendingClub business loan, they get pushback on the cost of their money. The reason being? Some borrowers think they’ve already got a great deal or at least a better deal than what LendingClub is offering. The problem stems from the borrower’s belief that the holdback percentage set up in their future revenue sale (the most common way a merchant cash advance is set up) is the APR.

Merchant Cash Advance Companies pay cash upfront in return for a specified amount of a businesses’s future sales. They collect these sales by withholding a percentage of each credit card transaction or bank account deposit until the agreement is satisfied in full. On a dollar for dollar basis, the cost of these programs typically range from 20%-49%, but on an APR basis, substantially higher. The holdback % is not even a factor in the APR. Green said they’ve learned that some small business owners are not sophisticated when it comes to finance.

Merchant Cash Advance Companies pay cash upfront in return for a specified amount of a businesses’s future sales. They collect these sales by withholding a percentage of each credit card transaction or bank account deposit until the agreement is satisfied in full. On a dollar for dollar basis, the cost of these programs typically range from 20%-49%, but on an APR basis, substantially higher. The holdback % is not even a factor in the APR. Green said they’ve learned that some small business owners are not sophisticated when it comes to finance.

Ethan Senturia, the co-founder of Dealstruck would probably agree. Earlier today he said, “you need to speak the borrower’s language.” Some understand APR, some don’t. “Dealstruck offers more than just APR comparisons to borrowers,” Senturia said. “Whatever helps them understand.”

When the OnDeck Capital model and merchant cash advance model were questioned as possibly being bad for borrowers, Tom Green was quick to clarify. “There are different capital needs that small businesses have,” he said. And “there is a trade-off between the length of the term and the risk.”

OnDeck Capital’s clients are not entrepreneurs born yesterday. “The typical customer has been in business for 10 years,” Breslow said. Their deals are “structured to protect through daily and weekly payments in addition to the interest rates we charge,” something he reminded everyone was “not single digits.”

Still, transparency issues remain in business lending. Sam Hodges, the Managing Director of Funding Circle explained that when he was previously a small business owner, there were hardly any lenders willing to provide him with an amortization schedule. Ashees Jain, a managing partner of Blue Elephant Capital Management admitted he would find it hard to justify the high rates of merchant cash advance if asked by a regulator, so he’d rather not invest in that market. When it comes to those types of transactions, they “don’t want to have to explain themselves” at some point in the future.

Scott Ryles, the managing member of Echelon Capital Strategies, LLC commented on OnDeck capital’s model as unbelievable. “The arbitrage is huge,” Ryles said. And Eric Thurber the managing director of Three Bridge Wealth Advisors believes that alternative business lenders are at odds with themselves. “They always talk about their risk management,” Thurber said, but he feels that players in that industry are concerned with how much market share they have. That conflicts with risk management in his opinion.

They pay or they don’t

At the end of the day Ashees Jain said as far as unsecured loans go, “borrowers pay or they don’t.” The recovery process on secured loans can be 12-18 months Jain said, a statistic cited by Brendan Ross earlier in the day.

It’s clear at LendIt that there are a lot of products available, but Ryles summed it up nicely. In the consumer space, all the volume is in the 36 month installment loans, he reckoned. For businesses it’s merchant cash advance. “It’s an awareness thing,” Ethan Senturia said in regards to getting businesses to use alternative lending sources.

It is indeed. Awareness, education, and understanding…