Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.

Articles by Sean Murray

The State of Securitizations in Alternative Lending

July 6, 2020Over the last few months, “securitizations” were frequently cited as a reference point for the health of a small business lender or alternative finance provider. Given the vague information and inferences that circulated, I decided to schedule a chat with Methodical Management co-founder Gunes Kulaligil to get his perspective. Our discussion on the state of securitizations in alternative lending below:

Canadian Small Business Lender Looks Doomed In Wake of COVID-19

June 29, 2020 As well-known (1, 2) small business lenders in the United States continue to negotiate COVID-19 era workouts with their creditors, another in Canada appears to be falling off the cliff.

As well-known (1, 2) small business lenders in the United States continue to negotiate COVID-19 era workouts with their creditors, another in Canada appears to be falling off the cliff.

On Thursday, Lendified’s President & Director Kevin Clark tendered his resignation effective July 3rd. He follows other board members Edward Kelterborn and Benjy Katchen whose resignations went into effect on June 25th. Company CFO Norman Tan previously resigned on June 9th and no replacement has been named.

COVID-19’s arrival came at a difficult time for Lendified. Before COVID, the company had never turned a profit or reported positive cashflow in its entire history.

“Lendified is in default in respect of credit facilities with its secured lenders. Forbearance and standstill agreements are being discussed with these senior lenders, with none indicating to date that any enforcement action is expected although each is in a position to do so,” the company said. “However, no formal agreements in this regard have been concluded as of the date hereof.”

The company expressed that it would not be able to continue operations if it was not able to finalize a forbearance on its defaults AND simultaneously obtain an immediate infusion of capital to fund its operations.

Lendified’s board of directors is presently considering selling its assets or its entire business in order to raise revenue.

A wholly owned subsidiary of Lendified, Judi.ai, an automated loan underwriting platform, is poised to cease operations as a result of a cashflow shortfall. “[Judi.ai] requires cash infusions in the amount of approximately $100,000 per month in order to maintain operations,” Lendified reported. “Its cash reserves at this time are approximately $80,000. At this time, the Company is not in a position to continue to fund the Business and there can be no assurances that it will be able to do so in the future.”

The company went public on the Toronto Stock Exchange on May 26th via a reverse merger and has since experienced a 95% drop in its share price. The company’s market cap on Monday hovered around $700,000 USD.

If You Do MCA, You’re Not a Lender (Part Two)

June 16, 2020 A three-year-old deBanked blog post turned out to be a bit prophetic.

A three-year-old deBanked blog post turned out to be a bit prophetic.

Titled If You Don’t Make Loans, You’re Not a Lender (And definitely not a ‘direct lender’) and posted on January 19, 2017, I hypothesized that the misuse of financial language on the phone or in an e-mail, particularly if one conflated merchant cash advances with lending, could one day result in a subpoena for a deposition to explain it.

In the People of the State of New York, by Office of the New York State Attorney General v. Richmond Capital Group LLC et al, that very scenario played out. Several people were subpoenaed last year and were required to give testimony to lawyers for the New York State Attorney General to explain why internal company communications allegedly referred to MCAs as loans or why a purported MCA company website made use of lending terminology.

The answers, which are public record, were not great. At least two individuals answered that line of questioning by pleading the fifth to potentially avoid self-incrimination.

While there are a lot of colorful details to consider in this case, the AG’s lawsuit dives into the various ways in which the defendants allegedly conflated financial products, including that a defendant company allegedly advertised itself as a “lender” when it actually was not.

While the allegations in the AG’s complaint are probably somewhat unique, there are claims and arguments within them that may be worth further legal review and analysis. Contact an industry-knowledgeable attorney if you have questions.

Broker Fair Has Completed A Historic Milestone

June 12, 2020Broker Fair reached a milestone yesterday by successfully completing the industry’s first-ever virtual conference. The experimental concept was a response to this year’s restrictions and precautions on large gatherings.

We hope that the hundreds of attendees found the event fun, educational, and productive! The in-person show is still happening at Convene at Brookfield Place in Lower Manhattan on March 22, 2021.

Yesterday’s show included live sessions, a networking chat, and a virtual exhibit hall. Attendees will have formal access to the recorded sessions very soon (There were a lot of them).

Broker Fair 2020 Virtual Video Q&A

June 6, 2020Broker Fair 2020 Virtual is this week! Still have questions? I answered some of Johny Fernandez’s questions in this video interview below:

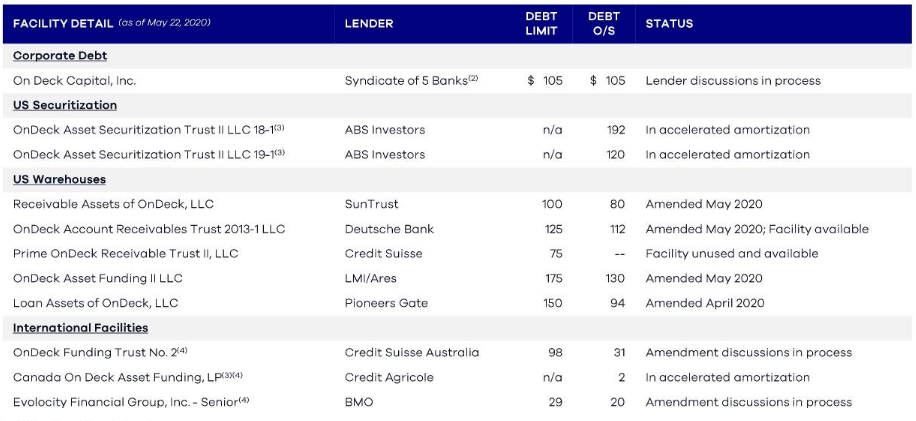

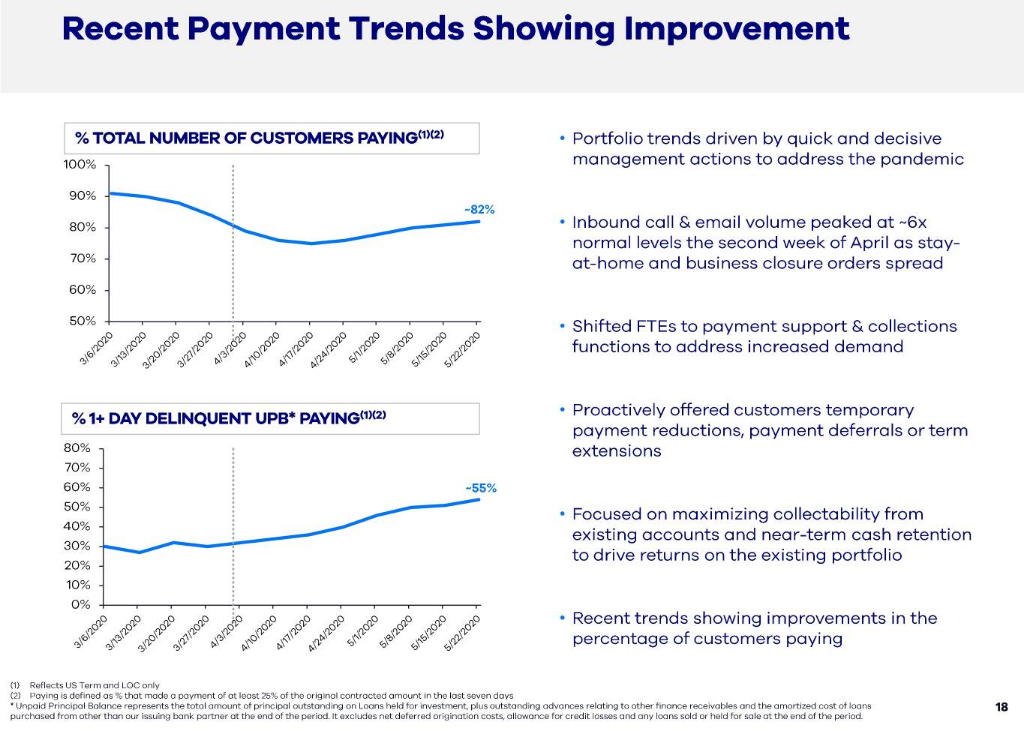

OnDeck Status Update

May 28, 2020OnDeck submitted an unprompted mid-quarter update with the SEC early this morning on its status. Unlike previous submissions, the company prepared a visual of its debt situation. The bad news is that there is a good amount of negotiating with creditors left to be done. The good news was that there was an uptick in borrower payments. The attached graphics were pulled straight from their filing.

The company also said that it believes it is “well-positioned to benefit from economic recovery & market dislocation.” It based that belief on the below stated bulletpoints:

- Small business lending is a large market and will be critical in leading the economic recovery.

- OnDeck has deep experience from a 14-year operating history to increase originations with a targeted approach and reshape the portfolio.

- OnDeck is a scaled platform with demonstrated historical profitability and an established brand, unlike many competitors.

- Consistent with the last crisis, banks are likely to retrench further and only selectively serve SMBs.

- Expected consolidation of SMB lending industry will ultimately lead to improved unit economics and growth opportunities.

The full presentation, which is mostly a recap of the company’s Q1 earnings data, can be accessed here.

OnDeck Hits Payout Event Trigger on $105M Credit Facility

May 22, 2020Earlier today, OnDeck filed a status update to shareholders with the SEC. The company’s portfolio performance triggered an Asset Performance Payout Event (Level 1 they say) with a credit agreement that at present has an outstanding balance of $105 million.

The event triggers monthly principal repayments which, if not cured or amended, would commence with a $13 million payment on June 17, 2020. Subsequent principal payments are based on a percentage of the currently outstanding balance of $105 million until the Corporate Facility matures in January 2021. The Company is in active discussions with the Corporate Facility lender group to evaluate potential options with regard to this facility.

OnDeck was able to further modify agreements on two credit facilities (ODAF II and ODART) to which they had previously secured only interim relief of a few days.

Shares of OnDeck have hovered between 60 cents and 70 cents in the past week.

Broker Fair, Not a Webinar… A Virtual Reality Conference

May 21, 2020 Coming June 11th, Broker Fair in Virtual Reality. Much different from a webinar, Broker Fair Virtual will actually be a virtual world with a lobby, exhibit hall, networking lounge, and auditorium. Attendees will be able to interact with each other as well as visit and interact with sponsors at their virtual booths.

Coming June 11th, Broker Fair in Virtual Reality. Much different from a webinar, Broker Fair Virtual will actually be a virtual world with a lobby, exhibit hall, networking lounge, and auditorium. Attendees will be able to interact with each other as well as visit and interact with sponsors at their virtual booths.

There will be live video sessions too of course (see the agenda here), but if you’re there for the networking, get ready for a totally unique experience!

Broker Fair 2020 Virtual isn’t replacing the In-person event. That’s been rescheduled to 3/22/21 at the same location, Convene at Brookfield Place in New York City. All attendees registered for the in-person event are able to attend this virtual event on June 11th for free. If you never registered for that, you can still buy tickets that grant access to both at: https://brokerfair.org/register/

See you at Broker Fair!