Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.

Articles by Sean Murray

Staying Vigilant in the Funding Business

April 15, 2024There’s a lot of funny business going on these days, so here are some things for you and your merchants to look out for:

The LOC Bait and Switch

A scammer offers the customer an impossibly good deal on a line of credit that is contingent on first entering into some other product. After the customer enters into the first transaction, the LOC offer and the scammer disappear. If your customer is susceptible to falling for something like this, make sure to advise them ahead of time accordingly.

The Mystery Funder

Despite a customer claiming to work exclusively with you as a broker, at some point a third party mysteriously enters the process and offers a separate deal to them to compete with you. Although there could be many reasons for this happening both legitimate or otherwise, including the customer not being completely forthright about exclusivity, you should communicate with your customer beforehand about who or who not to expect a communication from. Also, there are methods you can use to mitigate this by plugging up common attack vectors like an email address or phone # on a submitted application. Allow an attorney to guide you on how to do this most effectively and legally.

The Debt Advisor

Beware the debt advisor who claims they are there to help a merchant reduce the obligations of their loans or advances as many do not understand the contracts they claim to advise on. Because of this, they can potentially push a customer into a much worse situation than they otherwise might’ve been in. A merchant’s best bet is to communicate directly with the source of capital on their own. Oftentimes a contract spells out the proper protocol to follow depending on what the situation is.

Pac-man

Pac-man

They got hot full packs for sale including bank statements, social security #s, and other data ready to send your way! Before engaging in any such transaction, please consult with an attorney about the potential implications of doing something like this. Same goes for you if you were thinking about “selling your declines.”

The Ghost

Brokers often complain about customers falling for obvious scams over the phone, including the classic LOC scam, however, brokers can be just as susceptible to the same tactics. Before working with any lender or funder, you should conduct a full range of due diligence on them. This includes investigating their precise address, who the owner is, what their background is, what their ISO contract says, what their merchant contract says, etc. Too often brokers are drawn in by a commission they believe they stand to make and a smooth talking biz dev rep they talked to on the phone and skip over all the fundamentals. If the funder turns out to be a scammer, then you’ve potentially placed customers with that scammer and put yourself doubly at risk. A commission isn’t worth waiving due diligence. The stakes are too high for this industry.

What’s Happening to Trucking?

April 10, 2024 When deBanked examined the trucking industry in late 2022, the cost of trucks had shot up while margins were being squeezed. Since then major trucking firm Yellow Corp filed for bankruptcy, a bank in Iowa went belly up over bad trucking loans, Fox said that trucking had entered a Great Recession, and Freight Waves labeled trucking a “bloodbath.”

When deBanked examined the trucking industry in late 2022, the cost of trucks had shot up while margins were being squeezed. Since then major trucking firm Yellow Corp filed for bankruptcy, a bank in Iowa went belly up over bad trucking loans, Fox said that trucking had entered a Great Recession, and Freight Waves labeled trucking a “bloodbath.”

In the Freight Waves story, it summed up the issue as “too many trucks and not enough freight to move.” Other trade publications have said the real issue is a shortage of truck drivers.

deBanked pulled some of the granular stats from acclaimed data source Bizminer to see what was happening under the hood.

For General Freight Trucking (over long distances), average revenues were down approximately 20% between 2018 and midway through 2023. For refrigerated trucking services, average revenues were down 24% over the same time period. This drop coincides with a rapid rise in inflation, which means that the dollars generated more recently have even less purchasing power than they did in 2018. For example, $1 million earned in 2018 would equate to $1.24 million earned in 2024. So if one’s revenue didn’t keep pace with that, or worse yet, dropped significantly from where it had been, then they would be worse off. That’s what’s happened to trucking.

Or as the lenders in the commercial finance industry have noticed, trucking has been a complicated business as of late. Between the compressed margins and potential risks, some have opted to suspend working with this segment to err on the side of caution. It’s a big business to step away from given its depth and impact. At last count, for example, 8.4 million people worked in the trucking industry, of which 3.5 million were truck drivers. So even if one doesn’t finance trucks or lend to trucking companies, just about every business there is still depends on trucks to ship and deliver supplies. So what’s happening to trucking affects everyone.

Don’t Just Say You Can Do SBA Loans, Learn How to Broker Them

April 6, 2024 “As in anything else, once you master the learning curve, you’re fine,” says Bob Coleman. “The reason why SBA lending is difficult is you may not know the rules.”

“As in anything else, once you master the learning curve, you’re fine,” says Bob Coleman. “The reason why SBA lending is difficult is you may not know the rules.”

And that’s where Coleman comes in, a former lender turned news source and educator of SBA loan brokers, he offers his own online course called the Certified SBA Loan Broker Training, which is open to commercial loan brokers of various backgrounds that want to master SBA. Without training, brokers unaccustomed to the process can get lost and bogged down if they try to figure it out on the fly.

For instance, “If you drop something off at your lender, the lender is going to come back with 15 things and you may not know exactly what they want,” Coleman says, “and therefore the difficulty arises when you don’t know exactly what the lender wants and you ask the borrower and then it becomes a long drawn out affair.”

It’s precisely this scenario that scares brokers accustomed to light paperwork and perks like 2-hour approvals in the short-term working capital space from even attempting to try their hand at SBA. But even the merchants can be scared off by a longer more arduous process. Coleman also acknowledges that there has been a collective awakening throughout the mainstream commercial finance space that speed is on every business owner’s mind.

But speed can be a matter of experience and just knowing what to do, how to do it, and who to do it with. Besides, in an era of creeping one-stop-loan-shops that can do it all, it will become increasingly difficult for today’s broker to tell a customer that they don’t really know how to do the harder stuff and to always default to a short term loan or MCA when the broker next door is ready to put an SBA loan together if that’s the best course of action. As most brokers are aware, many short-term working capital brokers also offer equipment financing at the very least and vice-versa these days.

“A successful broker is one that cultivates a relationship with a few lenders,” Coleman says. “A broker is more entrepreneurial [versus an in-house business development officer], has access to a number of different products, and they work with a core level of lenders or funders.”

“A successful broker is one that cultivates a relationship with a few lenders,” Coleman says. “A broker is more entrepreneurial [versus an in-house business development officer], has access to a number of different products, and they work with a core level of lenders or funders.”

And that all comes down to training, which Coleman’s course offers for SBA.

“The loan broker course is geared for loan brokers who have a basic knowledge of commercial lending,” Coleman says. “We’re not going to go through and tell them how to analyze an income statement or a balance sheet, but we are going to tell them what SBA lenders are looking for.”

Coleman’s course is designed to take 12 weeks, though with it being online those enrolled can move at their own pace. As a benefit those taking the course get access to Coleman himself and can ask him questions and can join his weekly live show. There’s also the Coleman Roundtable where brokers and lenders dial in together once a week so that lenders can provide updates on what type of deals they’re looking for.

“It’s always a moving target of what the lenders will do,” Coleman says, “As we go through economic cycles, lenders tweak their credit boxes of what they want, and the brokers have to understand the lenders have a tremendous amount of pressure from a lot of stakeholders on how they want their portfolios to look.”

To that end, any broker that maybe tried their hand on an SBA loan in the past and walked away discouraged shouldn’t give up on it entirely.

“SBA is constantly changing,” Coleman says. “If you had a bad experience three or four years ago with a particular lender, forget about it and find out what’s new.”

Bob Coleman will be speaking alongside Sean Murray at Broker Fair New York City on May 20 if you’d like the opportunity to learn more from him and pick his brain in person.

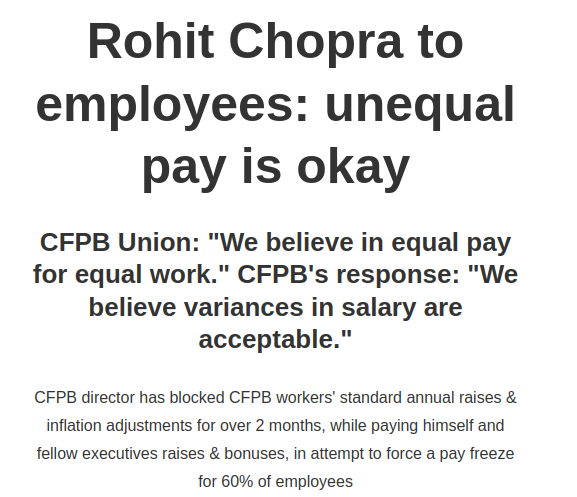

Federal Regulator Tasked With Small Business Finance Oversight is Now Protesting Itself?

April 5, 2024If you saw a protest outside the office of the CFPB in Washington DC lately, you’d be forgiven for assuming it was a group of aggrieved consumers. Alas, it’s something much more bizarre, the CFPB protesting itself. That’s because the regulator is currently engaged in a labor union dispute with its own employees over fair pay. Mind you this is the same regulator that is tasked with adjudging fairness in the private sector. CFPB employees are members of Chapter 335 of the National Treasury Employees Union (NTEU) and this union is currently engaged in heavy mobilization and protest efforts against the CFPB.

The campaign slogan is Pay Up, CFPB, which has been printed on banners that are being paraded by CFPB enforcement attorneys outside the CFPB office on 1700 G St NW. The NTEU actually has a formal online signup sheet for CFPB employees to pick their time to picket outside. On April 3rd, the union even took a page out of the New York City playbook when it apparently wheeled in a Scabby the Rat inflatable.

Apparently this guy was in front of CFPB headquarters yesterday. pic.twitter.com/5mq7R2h1Tf

— Evan Weinberger (@reporterev) April 3, 2024

As recent as March 27, the National President of the NTEU scolded CFPB Director Rohit Chopra in a letter that accused him of being uncooperative in negotations.

“I believed you when you said you valued CFPB employees and that you respected NTEU as CFPB’s exclusive representative. However, your actions have not supported your words. I have reached out to your office multiple times, both by letter and by phone without receiving a proper response. To build a strong relationship, we must prioritize communications to work through issues, especially when we disagree. Instead, you have avoided all communication. I have even offered to meet with you on the weekend to let you know my commitment to this relationship and to stress to you how important having ongoing discussions is to help resolve this dispute. Your lack of response is unacceptable.”

– NTEU President Doreen P. Greenwald to CFPB Director Rohit Chopra

The irony of this all cannot be overstated. While the CFPB is literally preparing to enforce 888 pages of regulations in small business lending to assess fairness in the marketplace, the union representing the CFPB’s employees has declared that the CFPB’s leadership does not believe in fairness.

Meanwhile, the CFPB just settled a separate lawsuit with its own employees over previous claims that it had discriminated on the basis of race.

Stop the Debt Settlement People, Funders Come Up With Merchant-Friendly Alternative

April 3, 2024 Are debt settlement “advisors” interfering with your contracts and putting your merchants in a bad spot? The industry is now taking the reins on a solution. It’s called GreenLedger, a platform for funders to work together on resolving a merchant’s situation with no debt settlement middlemen encouraging an intentional default, taking fees, and making false promises.

Are debt settlement “advisors” interfering with your contracts and putting your merchants in a bad spot? The industry is now taking the reins on a solution. It’s called GreenLedger, a platform for funders to work together on resolving a merchant’s situation with no debt settlement middlemen encouraging an intentional default, taking fees, and making false promises.

Founded by Elevate Funding CEO Heather Francis, who aims to eventually make it a non-profit, merchants would go to this industry-collaborative platform, indicate who they have open contracts with, and the platform would notify the funders directly.

“From there, the primary points of contact at each funder can get together to come up with a more specific and comprehensive payment plan that works with the merchant’s needs,” said Francis. “GreenLedger’s mission is to work directly with our small business clients to stabilize their revenue-based financing arrangements and avoid breaching their agreements, eliminating the need for potentially predatory middlemen.”

The platform has already been generating interest.

“As an attorney deeply committed to the financial empowerment of small and medium-sized businesses, I am thrilled to endorse Elevate Funding’s creation of GreenLedger,” said industry attorney Patrick Siegfried. “This initiative represents a pivotal step in our ongoing battle against the increasing prevalence of unscrupulous entities in the commercial finance debt settlement industry. Far too often, these bad actors employ deceptive sales tactics and bind clients with unfair contracts, leading not to the promised debt relief but to further financial strain for small businesses. GreenLedger, with its dedication to transparency and integrity, stands as a true avenue for business owners seeking legitimate and effective financial solutions. Its mission to root out malpractices and safeguard the interests of small businesses is not just commendable but essential in today’s challenging economic landscape.”

To learn how you can participate and cut the debt settlement people out of the picture, attend this webinar on April 16th.

The CFPB Now Wants to Work With Loan Marketplaces?

March 27, 2024 Things are getting weird in government land. The CFPB, the regulator in charge of collecting data from small business finance companies starting this Fall, has just revealed what one of its long term goals of that might be, incorporating the data into loan marketplaces.

Things are getting weird in government land. The CFPB, the regulator in charge of collecting data from small business finance companies starting this Fall, has just revealed what one of its long term goals of that might be, incorporating the data into loan marketplaces.

That’s because on Wednesday, CFPB Director Rohit Chopra said that he plans to do exactly that with another industry the agency collects data on, the credit card industry.

…reliable information about interest rates is also just hard to come by. So, we instead see people comparing cards by annual fee, or rewards, or perhaps just signing up for a card from the same bank where they have a checking account, assuming the interest rate they’re charged will be competitive. To help make this process easier, we are assembling a pricing data set for third-party comparison websites and others to use to help consumers find the best deal for them. This will rely on data submitted under existing requirements of the 1988 law. I hope to share more about those plans in the coming months.

While it may be a leap at this stage to say that this will happen in the small business finance industry any time soon, virtually none of the speculation surrounding what the CFPB will actually do with the data it collects, if anything at all, has been that it would be integrated into loan marketplaces for merchants to compare options. Given current trends across all levels of government this is not so preposterous. For example, the City of New York just introduced its own business loan marketplace and the SBA just upgraded theirs. Couple this with a slew of recent regulatory enforcement activity in the private sector and the idea that there is a plan for government-run business loan marketplaces that are powered by federal agency loan data for comparison shopping is not incomprehensible.

On Long Island? You Might See Signs

March 26, 2024

Billboards for Broker Fair 2024 have gone up across several Long Island towns this past week, including locations in Glen Cove, Syosset, Westbury, Bay Shore, and Valley Stream. The conference, built specifically around a broad range of commercial finance brokers, will take place on May 20 in New York City. Long Island is among the largest geographical employers of brokers in the United States.

Broker Fair attendees can expect to learn from industry pro Peter Ribeiro, meet a wide range of funders/lenders & vendors, pitch their deals, and find out what they need to be doing to remain compliant and become successful.

Broker Fair 2024 will take place at the Metropolitan Pavilion in New York City. Brokers pay the lowest price for entry. There is also a pre-show party the night before on May 19th at a Lounge called Somewhere Nowhere NYC (yes that’s really the name!).

If you’re a broker, Broker Fair 2024 is an event you cannot miss!

Let’s Hop on a 5 Minute Call

February 28, 2024There’s a fantastic meme account on X where “Hunter” spreads the comedic gospel of cold calling one’s way to becoming a billionaire. Hunter suggests that true sales people take freezing cold showers, tip their landlords for sub-par living arrangements as respect for creating optical conditions to grind, and to make cold calls every day, every night, during holidays, and while being seated in an ice bath at the Cheesecake Factory.

We need to teach cold calling in elementary school pic.twitter.com/fwqaaG2uA2

— Hunter (Let's hop on a quick 5 min call) (@huntercoldcalls) February 22, 2024

We all know that cold showers help you become a better cold caller

But to unlock your true potential, you need to cold shower while cold calling

Introducing, the next generation of call centers pic.twitter.com/vrTwI7b094

— Hunter (Let's hop on a quick 5 min call) (@huntercoldcalls) February 21, 2024

A national cell phone outage just destroyed my business, my life, and the entire world

Thousands of my cold calls went unanswered today because the national cell phone network wasn't working

I would have helped each and every one of those prospects improve their lives

And I…

— Hunter (Let's hop on a quick 5 min call) (@huntercoldcalls) February 22, 2024

The account, which can sometimes be found trolling celebrities by asking them to hop on a quick 5 minute call in the comments, is likely relatable to any salesperson that’s experienced the rigors of the hustle. For instance, I can recall one particular day in 2015 when I was making cold calls from a waterfront skyscraper in Jersey City when a plane flew by the window and then LANDED right there in the Hudson River. What to do? Go look? Not possible. Had to make more cold calls!

That plane, of course, was flown by Captain Sully Sullenberger, of which the feat of landing there became known as the Miracle on the Hudson. I am proud to say that because I ignored all of it and continued to make cold calls while it was happening that I am now worth $463 trillion as a result.