Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.

Articles by Sean Murray

Richmond Capital Leaves MCA Space With Negative Case Law On the Way Out

February 24, 2026“Substantive unconscionability is clear from the MCAs’ exorbitant and criminally usurious interest rates, among other things.”

– Appellate Division, First Judicial Department, Supreme Court of New York, February 19, 2026

Richmond Capital Group was never part of the mainstream merchant cash advance industry. The company made headlines for years for its alleged connection to Jonathan Braun, who is now back in prison. After landing in the crosshairs of the FTC, a federal court permanently banned the company and its owner from working in the MCA or debt collection industries ever again in June 2022. The New York State Attorney General piled on with its own legal action and secured a $77 million judgment against Richmond and affiliated entities in February 2024.

But the New York judgment was appealed and earlier this month the Appellate Division of the First Department issued its decision, ruling heavily in favor of the Attorney General. Some of its conclusions, while Richmond-circumstance specific, ought to be examined with a wider lens. Snippets of the Court’s rulings are as follows:

On Reconciliations

“Although the MCAs have mandatory reconciliation provisions, no reconciliation was performed in practice, even though it was supposed to be performed on a monthly basis, and daily payments were fixed and did not represent a good faith estimate of receivables; there is no persuasive evidence of any ad hoc incidents of reconciliation (upon a merchants’ request), which were subject to respondents’ “sole discretion,” and there is evidence that such requests were denied; bankruptcy was an express event of default in some of the MCAs, but even where it was not, repeated nonpayment was, as was breach of the MCAs, which was the case where a merchant “interrupt[ed], suspend[ed], dissolve[d] or terminate[d]” its business; and in the event of any of these circumstances, the full uncollected amount became due and respondents were empowered to enforce the personal guarantees they required the merchants to provide.

Usurious intent is also clear as a matter of law, as, absent reconciliation, the usurious interest rates can readily be calculated based on the information provided on the face of the MCAs.”

On Unconscionability

“The MCAs were also procedurally and substantively unconscionable. Substantive unconscionability is clear from the MCAs’ exorbitant and criminally usurious interest rates, among other things. As to procedural unconscionability, it is not dispositive that many, although not all, of the merchants were sophisticated businesspeople and all had prior experience with MCAs, and respondents misrepresented the terms and nature of the MCAs and used other high-pressure tactics.”

deBanked is not a law firm. To understand the implications of this legal decision, consult with attorneys experienced with the subject matter. For example: Hudson Cook, LLP, Murray Legal PLLC, or others listed here.

CAN Capital Adds Major Equipment Finance Division, New Product for Brokers to Offer

February 23, 2026 The synergy between the working capital and equipment finance industries continues to grow with CAN Capital’s latest acquisition. CAN acquired the equipment finance portfolio and platform of Republic Bank Finance and the division will continue to operate under the name of CAN Capital Equipment Finance. A press release announced the deal this morning.

The synergy between the working capital and equipment finance industries continues to grow with CAN Capital’s latest acquisition. CAN acquired the equipment finance portfolio and platform of Republic Bank Finance and the division will continue to operate under the name of CAN Capital Equipment Finance. A press release announced the deal this morning.

CAN’s broker network and referral partners will be able to able to offer this product alongside CAN’s existing product suite.

“CAN has a large and established network of broker relationships, many of whom are already providing an equipment finance option to their small business customers,” said CAN Capital CEO Ed Siciliano to deBanked. “By adding an equipment finance product, we believe we will deepen our relationships and better serve our valued ISOs, especially those already offering this product.”

The equipment finance industry is massive. Recent valuations put it at $1.3 trillion annually.

In the official release, Siciliano said, “This acquisition is a natural extension of CAN Capital’s long-term growth strategy. We have built CAN Capital to be a scaled, durable platform that can grow both organically and through strategic acquisitions. Adding an equipment finance portfolio and platform enhances our product breadth, strengthens our market position, and allows us to serve more businesses with the right capital at the right time. This transaction reflects the momentum of our business and our continued confidence in the growth trajectory of CAN Capital.”

A Conference Tale: Broker Fair vs. deBanked CONNECT

February 11, 2026Before Broker Fair was ever decided upon as a conference name it had been put up on a whiteboard next to another possibility, Broker Fest. This was in mid-2017 when there was no guarantee that we’d ever get the chance to do more than one conference. Fair was ultimately chosen over Fest because it sounded more professional, like a job fair. Fest sounded like Spring Break and not the image I wanted. We also picked a date for this Broker Fair—May 14, 2018—and a venue. We chose to have it in New York City because the overwhelming majority of deBanked readers were located in the New York Tri-State area. The thought process was that it would be just a walk, drive, or train away for most attendees and they would not need to concern themselves with the cost of flights or hotels.

Although this is not widely known, the biggest problem we immediately faced was that we had been front-run. A competitor, someone from outside the industry, tried to strike first, and announced a conference custom-tailored to our audience for January 2018 in New York City, five months before ours. Having nearly a year to market and plan our first ever conference suddenly became a huge liability. As our advertisers got called and solicited to sponsor that instead of Broker Fair, we had been advised that we had already lost the war before ever even firing a shot.

But having been a regular on the conference circuit myself, I couldn’t help but think that New York City was a terrible place to invite people to in January. That got us thinking about a counter-offensive. Our data indicated that after New York, the Miami area contained the next highest concentration of deBanked readers. After that was Southern California. And after that was Toronto, Canada. By October 2017, we came up with a concept to do something smaller than a conference, a networking event focused simply on connections that didn’t necessarily have to be broker-branded. We called it deBanked CONNECT MIAMI. I believed that executing something like that would also build confidence in the market that we could attract a big crowd, a proof-of-concept so to speak for anyone unsure if deBanked’s online audience would convert to an in-person one. And so we rented out a rooftop bar in South Beach and scheduled the first deBanked CONNECT MIAMI to take place January 2018 (a good time to be in Florida), the same month as that other conference in New York. Our networking event was a smashing success, so much so that we got front-run AGAIN. Since our event was known to be on the rooftop, yet another newly announced rival rented out the bar on the ground floor to try and divert people away from ours to theirs. Thankfully it didn’t work. Meanwhile, our competitor in New York never had a second conference.

With the path seemingly cleared for Broker Fair, we apparently then irked the ire of Kris Roglieri, the head of NACLB, by saying that our conference would be “the largest gathering of merchant cash advance and business loan brokers in the country.” Although our audience and theirs did not overlap at the time, their email marketing shifted to throwing shade at us for no reason. It seemed, however, that it inadvertently helped us, because by March 30, 2018 we ran into another problem I had not imagined, we were already sold out. Sold out in that if the venue found out how many tickets we had sold versus how many they were physically allowed to have in the space, we were going to get in very big trouble sold out. This was 45 days before the conference!

With the path seemingly cleared for Broker Fair, we apparently then irked the ire of Kris Roglieri, the head of NACLB, by saying that our conference would be “the largest gathering of merchant cash advance and business loan brokers in the country.” Although our audience and theirs did not overlap at the time, their email marketing shifted to throwing shade at us for no reason. It seemed, however, that it inadvertently helped us, because by March 30, 2018 we ran into another problem I had not imagined, we were already sold out. Sold out in that if the venue found out how many tickets we had sold versus how many they were physically allowed to have in the space, we were going to get in very big trouble sold out. This was 45 days before the conference!

Being sold out only increased the hype and I didn’t know what to do. Broker conferences didn’t sell out. That wasn’t a thing. Now it had legitimately happened. People noticed and the world began to change. Within two weeks, the National Association of Equipment Leasing Brokers changed its name to the American Association of Commercial Finance Brokers. They said the time had come to be more inclusive of all commercial finance brokers. Others would eventually follow suit.

After we managed to pull off Broker Fair 2018, with a lot of hiccups along the way, we decided that we’d continue to do smaller networking events, including Miami. They’d be deBanked CONNECT MIAMI, deBanked CONNECT San Diego, and deBanked CONNECT Toronto. We also decided to add content and speakers to the mix as well. deBanked CONNECT San Diego 2018 attracted 344 people while deBanked CONNECT MIAMI 2019 brought in 461, a number that shocked us because we had envisioned it as something small and the turnout was in fact very large. For a long time we underestimated registrations and we constantly had to contend with spaces that were too small and sold out signs on our website.

deBanked CONNECT MIAMI 2019 was also the first time we heard people refer to it as Broker Fair Miami. This I guess made sense, because that is what it was fast becoming, but to have every event mimic the New York format with a full day of speakers and pre-show party the night before seemed daunting so I hesitated to change the name of deBanked CONNECT MIAMI to Broker Fair Miami when the formats were slightly different. I also didn’t want to take away from New York being known as the “signature” conference. The demographics were essentially the same, however, and the Broker Fair name seemed to easily roll off the tongue. Americans showing up to deBanked CONNECT Toronto, for example, said that they were excited to be at Broker Fair Canada. deBanked CONNECT San Diego you say? That got referred to as Broker Fair San Diego.

The most striking moment of them all, however, happened after we moved all of our cryptocurrency content off into another brand, one we called deCashed instead of deBanked. deBanked’s wide variety of content had grown an entire following outside of just small business finance and resulted in the experiment of an entirely unrelated networking event in May 2022 called by the same name, deCashed. Although it had a large turnout from the crypto industry, and it was only about crypto, dozens of people from the small business lending space assumed it was effectively Broker Fair Bitcoin, with some attendees flying in from as far as Europe, Canada, and California to say they were excited to be at their first Broker Fair.

The most striking moment of them all, however, happened after we moved all of our cryptocurrency content off into another brand, one we called deCashed instead of deBanked. deBanked’s wide variety of content had grown an entire following outside of just small business finance and resulted in the experiment of an entirely unrelated networking event in May 2022 called by the same name, deCashed. Although it had a large turnout from the crypto industry, and it was only about crypto, dozens of people from the small business lending space assumed it was effectively Broker Fair Bitcoin, with some attendees flying in from as far as Europe, Canada, and California to say they were excited to be at their first Broker Fair.

Alas, the only event truly called Broker Fair these days remains to be the annual show in New York City (next one is June 1, 2026). deBanked CONNECT MIAMI has now become the biggest of the year, however, surpassing every other event. deBanked CONNECT MIAMI is projected to have more than 1,000 attendees this week. Meanwhile, deBanked CONNECT Toronto got nixed due to Covid and deBanked CONNECT San Diego was replaced by B2B Finance Expo in Las Vegas. The latter one now being a collaboration with a major trade association.

Today, there’s a lot of new events popping up with the word Broker in the name. I’m not surprised. It’s a very important profession. And if you feel the urge to label deBanked CONNECT MIAMI as Broker Fair Miami, you’ll be forgiven. It just means that back in 2017 we did a really good job in picking a name that would stick. On the other hand, perhaps we goofed. It’s become obvious that inside of every deBanked CONNECT MIAMI is a little taste of getting away, like you’re going on Spring Break, something that feels more sensational than a fair. If only there were a word for what it could have been…

See you there.

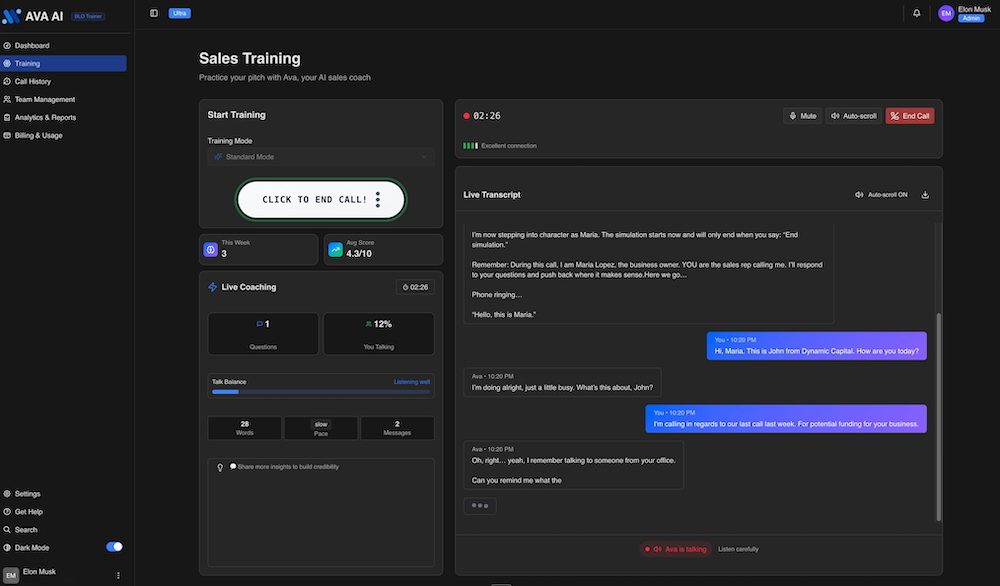

Getting Your Reps to Perform at the Ultimate Level? This ISO is Using AI to Train Them

February 2, 2026“I‘m unable to get 80, 90 guys to work in the area that I am in so I have to actually max out the team that I have,” says Steven Edisis, CEO of Dynamic Capital. “So my whole thing is onboarding guys and getting them to perform at the ultimate level.”

Edisis says that training small business finance sales reps takes extreme discipline, hours and hours of manual training. Training in the morning. Training in the afternoon. Training at night. Training and then some more training. Some of that training involves roleplaying. Other times it’s live calls. In either case, he’s found there are weaknesses in those systems. For instance, in a roleplay, the trainer has to contend with maintaining rapport with the individual they’re training. Persistent unfavorable feedback, even if warranted, could actually be demoralizing and create tension in the relationship.

“When you’re roleplaying with your buddy, your buddy’s a human,” Edisis says. “After two or three or four times of them getting it wrong, do you just stop correcting it? And you let it go.”

The end result is that they’re not actually in top shape and ready for calls, but they could be deceived into thinking that they are. Meanwhile, live-call training presents another dilemma. If you give the trainee good leads and they mess up, are the good leads wasted? And if you give them really cheap leads and they don’t get anywhere with them, how are they supposed to be judged or learn from it?

For Dynamic Capital, the solution to all of the above has been AI. About a year ago, Edisis began using an AI agent called Ava, a product by Reech AI that’s led by CEO Liran Weissenberg. Ava does for Dynamic Capital what Edisis did for a long time, trains, but on steroids. Trainees, experienced reps, and even veteran pros at the game can roleplay with Ava, a voice AI, in any setup of circumstances they choose. It can be a straight-up cold call, a warm lead, or a follow-up, for example. It can be tuned to easy mode, regular mode, hard mode, or even impossible mode. The best part is that Ava knows how to play the role of a merchant, speaks in real time, and speaks with human-believable tones and emotions. Voice AI technology, once considered clunky or plagued by latency in years past, has finally become virtually indiscernible from a real person.

In a live demo performed for deBanked to show it in action, the AI answered the phone and Edisis went right into the normal flow of business.

“This is Steven with Dynamic Capital. Last week you went online, requested some information for some working capital for your business, how are you today?”

“I’m ok, just a little busy right now,” Ava responded somewhat suspiciously. “yeah, I remember poking around online. I put in my info but I never really got a clear idea what you guys actually do.”

From there, Edisis played it out to a conclusion. When it was over, Ava rated him on his performance, gave him a score, and shared what he did well, as well as things he could have done better. It seemed to understand the relevance of open balances a merchant might have with loans or MCAs, which is key to making it impactful. Ava’s an AI, so a trainee would not be able to attribute the constructive criticism it offered to being singled out or picked on. For instance, if the AI said the trainee needed to work on tone and pacing of speech, there’s no way for the trainee to attribute that to personal bias from a trainer.

“The cool thing is that we can model the AI to behave in very specific scenarios and to have very specific analysis,” said Weissenberg of Reech AI, who created Ava.

Meanwhile, no real leads were wasted in the process. This is especially valuable since Edisis says that he teaches a specific technique—or rather, an art—called the interruption, a very delicate tactic used to keep a call on track. But it only works if delivered correctly, because it involves literally interrupting the prospect while they’re speaking. Learning how to interrupt in the circumstances that call for it is a massive gamble that could not only lead to lost sales revenue but also negative customer feedback if executed poorly. This is a perfect example of where AI training comes into play.

“It’s really nice to [practice it] on Ava versus blowing up and getting negative reviews from a live person,” Edisis said. “So that’s a really cool way that I can train people.”

Weissenberg said that when Ava is being used across a whole sales floor, a sales manager can view transcripts of all the calls, along with feedback and analytics. One could literally have a full-on simulated call center where all the prospects are AI agents being used to train reps.

“The coolest thing about the app is the analytics,” Weissenberg said. “It’s only going to get better too because AI is getting smarter and it’s getting more human.”

“On top of [new trainees], my other guys over the years—some have been here up to ten years—every once in a while they get a little rusty, revert back to bad habits, etc.,” Edisis said. “This allows me to keep them honest. And when some new person comes to me and tells me my leads are bad, I say, “let’s go to Ava… you tell me your pitch, I’ll do the same pitch.”

If Edisis significantly outscores them, it becomes evident that lead quality isn’t the issue, but rather all the other factors that go into having a successful call.

“It keeps some honesty between the program and reality,” he said.

No, Texas Did Not Ban Merchant Cash Advances

January 28, 2026 When Texas passed HB 700 last June, deBanked was among the first to point out that its most notable component was a prohibition on automatic debits of a recipient’s deposit account by a commercial sales-based financing provider unless they had a perfected first position. Some observers were quick to tell us that we had it all wrong, that MCAs had effectively been “banned” entirely and that we should have reported it that way. This was premised on a belief that perfecting a true first position on a recipient’s deposit account was a near-insurmountable obstacle (for MCAs that rely on ACHs instead of credit card splits) and thus a nuanced discussion of how to comply with the new law a moot debate.

When Texas passed HB 700 last June, deBanked was among the first to point out that its most notable component was a prohibition on automatic debits of a recipient’s deposit account by a commercial sales-based financing provider unless they had a perfected first position. Some observers were quick to tell us that we had it all wrong, that MCAs had effectively been “banned” entirely and that we should have reported it that way. This was premised on a belief that perfecting a true first position on a recipient’s deposit account was a near-insurmountable obstacle (for MCAs that rely on ACHs instead of credit card splits) and thus a nuanced discussion of how to comply with the new law a moot debate.

But if the state legislature had intended to ban sales-based financing outright, it simply could have done so. Instead, it codified a framework for how to legally provide sales-based financing. It provided guidance on registration, disclosure, and oversight. And it even went as far as to say that the Finance Commission of Texas cannot “adopt a maximum annual percentage rate, finance charge, or fee for commercial sales-based financing transactions.” This was an incredible signal: No cost cap on sales-based financing.

The Texas Office of Consumer Credit Commissioner (OCCC) even held an open forum this past November to hear from impacted parties on the best way to craft and enforce the rules going forward. And so while they’re now busy promulgating those precise rules, collective minds have returned back to the original language surrounding that “certain automatic debits” are “prohibited.”

CERTAIN AUTOMATIC DEBITS PROHIBITED.

A provider or commercial sales-based financing broker may not establish a mechanism for automatically debiting a recipient’s deposit account unless the provider or broker holds a validly perfected security interest in the recipient’s account under Chapter 9, Business & Commerce Code, with a first priority against the claims of all other persons.

This language does not say that merchants cannot pay sales-based financing providers entirely. Others agree. deBanked spoke with one company, MCA Pay, which analyzed what the law says and they created a tool for merchants to pay sales-based financing providers in an orderly easy manner so that funders do not in fact have to automatically debit a recipient’s deposit account at all. Though there are some layers to how it’s done, merchants are, on their own volition, setting up a system to initiate payments to whichever funder they choose. They’re in control.

Far from theoretical, this methodology is already being used by merchants in Texas to pay sales-based financing providers, according to MCA Pay.

“We’re comfortable from a regulatory perspective, but I encourage everybody who uses this platform to run this by their counsel,” a representative said. “We’re putting the control back into the merchant’s hands.”

The two main partners at MCA Pay, Gavriel Kalfa and Moshe Klar, do not hail from within the industry, but they worked with experienced operators in the industry while building out the system. MCA Pay is not the payments provider or a law firm, they’re just the platform that loops the pieces together.

“Hopefully we’ve made a product here that’s going to allow MCA to continue in Texas compliantly for everybody,” they said.

How a Mother-Daughter Broker Shop Persevered and is Positioned for Growth

January 15, 2026Sharpe Capital facilitated nearly $5 million in funding to small businesses across the United States in 2025. Next year, they hope to double it. What makes the company unique is that it operates as a mother-daughter team, one of the very few in the industry to be structured that way. But how Wendy Rivera and her mother, Sonia Alvelo, got there is a story of circumstances and perseverance.

Alvelo is a known entrepreneur in the space through her own small business finance brokerage Latin Financial, but technically she was also associated with another brokerage at the same time, Sharpe Capital. Her business partner and life partner, Brendan Lynch, co-founded Sharpe with her more than a decade ago, but Lynch primarily ran Sharpe while Alvelo ran Latin, sister companies of sorts but with separate operations. The two celebrated a grand opening of a big joint office in Wethersfield, CT in 2022, which was attended by deBanked and a slate of local politicians. The Sharpe team wore green shirts and the Latin team wore blue.

Sadly, Lynch passed away in December 2024 from cancer at only 45 years old, but not before he could finally tie the knot with Alvelo, making her known as Alvelo-Lynch once and for all. Lynch’s last interview with deBanked happened four months before he passed and one of his final messages he had hoped to get out through us was a reminder for people to remember to take care of their health.

In the challenging time afterward, Alvelo took the reins of Sharpe and eventually her daughter, Wendy Rivera, emerged as a key reason the company continues to be successful.

Rivera, Connecticut-born and raised, had originally been working in retail when she became curious about her mother’s and Lynch’s business in 2018. When working for them became a possible next step for Rivera, they didn’t give in to nepotism and made her interview as a candidate just like anyone else. But she turned it around on them.

“They would tell you that I interviewed them in regards to what the company was and everything like that, but I asked the right questions,” Rivera told deBanked. “Everything was moving smoothly, and I decided to move forward.”

It started off as a part-time gig and eventually became full-time. Her role was to bring in deals and work closely under the tutelage of Lynch, who had a natural knack for connecting with people, particularly small business owners.

“They had a special place for him in their hearts,” Rivera said. “Brendan has taught me so much. He pretty much taught me this industry. I’ve worked with him side by side for the past seven-plus years.”

Rivera obviously learned from her mother as well, but Alvelo’s typical Latin Financial client was primarily from within the Spanish-speaking community while Sharpe’s was much more broad. To give some perspective on that, Alvelo, for example, says that today 80% of her entire Latin Financial customer base resides in Puerto Rico.

So Rivera spent her time on Sharpe and now she’s the primary person responsible for its operations. In what was a transitional year fraught with grief and challenges, the two revamped everything to focus on efficiency. Now they’re finally getting back to thinking about how to expand.

Along the way, Rivera realized that relationships in this business have a tremendous impact and can serve as its own form of marketing.

“Honestly, what’s been working for us is word of mouth,” Rivera said when it comes to acquiring customers. “Really. It sounds very old school but it really works. Once you take care of one merchant, they’ll tell their friends or whoever the case may be, and then they’ll reach out to us, and it just keeps growing that way.”

But those referrals wouldn’t come if they didn’t have the right funders in place to help them out. That means they have to know and trust who they are doing business with on the other side. Coincidentally, attending deBanked events, which Rivera has done, has been an eye-opening experience for her in getting to see who they are working with.

“I feel like once you actually meet the person, I don’t even think a phone call will do enough, you get a feel for what kind of person they are, and if they are in the industry for the right reasons,” Rivera said.

And in all those meetings, another thing she’s realized is that being part of a purely mother-daughter team is unique even within the family business segment of the industry which tends to lean toward father-son. But the two talk business just like any other shop: during work, after work, even during dinner they talk about deals.

Though it’s been a lot and Rivera says she’s overdue for a vacation, she says it’s a job she really enjoys.

“If you love numbers, if you love people, if you love helping people, I think it’s definitely a great position to be in,” Rivera said of working in the industry. “But you have to also be in love with the job as well. Because if you’re not in love with it, there’s going to be a lot of things that’ll hold you back.”

The motivation now is just to pick back up and have an even bigger 2026.

“Brendan and my mom had different ways of running their companies, Sharpe and Latin Financial, and so I feel like [Brendan] kind of taught me his kind of ways for Sharpe Capital and also maybe leaving an open door for opportunities down the road as well,” Rivera said. “And now that I’m in that spot, I can see that.”

deBanked’s Top Stories of 2025

December 31, 2025With deBanked having closed out its 15th year (WHOA) of being online, it appears that merchant cash advance content still dominates in views. I know this because these were the top five most read stories of 2025:

#1 – Texas Passed an MCA ACH Prohibition

Without a perfected first position, Texas no longer allows commercial sales-based financing providers to automatically ACH debit a merchant’s bank account.

See: Texas Governor Signs Sales-Based Financing ACH Prohibition Into Law

#2 – Ban on Refinancing MCAs With SBAs

The world took note when the SBA stated that: “merchant cash advances and factoring agreements are not eligible for refinancing for Standard 7(a) loans, 7(a) Small loans, SBA Express loans, Export Express loans, and International Trade loans.”

See: SBA Places Restrictions on Use of Proceeds to Refinance Merchant Cash Advances and Factoring Agreements

#3 – The CFPB Proposed Removing MCAs From Section 1071

After years of preparing for a world in which MCAs would be subject to CFPB small business loan data collection rules, the agency proposed taking MCAs out.

See: CFPB Reverses Course: Now Proposes to Remove Merchant Cash Advances from Section 1071 Rule

#4 – Getting Backdoored? Try This Watermark

One of the biggest stories of 2025 was a proposed solution to the backdooring problem.

See: Getting Backdoored? Put Your Mark on the Docs

# 5- New California Law Goes into Effect on January 1, 2026

This story was posted at the very end of the year and yet managed to secure a place as the 5th most read story on deBanked in 2025. Is the industry ready for this new law???

See: Brokers and Funders – Are You Ready for Changes to California Law Effective January 1, 2026?

How Daniela Cano and Nicole Paliobeis Originate More than $100 Million in Funded Deals a Year

December 19, 2025Daniela Cano and Nicole Paliobeis account for $10 million in revenue-based financing volume every month at Spartan Capital. That’s $120 million annualized. As the top two ISO relationship managers in the company out of eight total, Cano and Paliobeis operate in one of the most pivotal roles in the industry.

“It’s extremely fast paced, not one day is ever the same,” says Paliobeis, whose official title is Business Development Manager. “It’s always different between the person that you’re speaking to at your broker shop or your partner.”

Dozens of stories have detailed the high-octane lifestyle of what it’s like to be a broker, but the deals they originate don’t get funded unless they’re in sync with the right people at the right funding shops. Funders know this, so whom they choose to handle this part of the business is among the most important decisions they can make. After all, a funder can’t fund anything without deals coming in the door.

B2B Finance Expo 2024

“We’re the middleman between the deal going into the system, expediting the deal, getting that approval, the competing aspect of it, contracts, funding, going back and forth with the underwriter to get the deal done,” says Cano, who is the Director of Business Development.

“Our days do not end at 6pm eastern time, our days will end sometimes at 10 or 11 o’clock at night,” Cano adds. “We both have brokers that are on the West Coast, we have brokers that are traveling, just like we would be traveling. So I think part of it is we try to give them that customer service that they want.”

Cano also says that it’s not just late nights but also early mornings, when calls and texts can start rolling in at 7am, even before underwriters are in the office.

“Typically, I always have my laptop on me no matter the time of the day,” says Paliobeis. “And if somebody calls me or they need a contract or they need a bank verification and it’s like an SOS emergency. I’m like ‘Hang on, hold on, hot spot, sign on, send everything over to them. Your docs are in your Merchant’s inbox’ and then go from there.”

For Cano, her edge is that she’s worked in the industry for 14 years. Originally starting at a broker shop herself, she eventually switched sides and became an ISO relationship manager at a time when, she says, there were very few women in that role. That statistic, she adds, has changed significantly since. In the beginning, she was occasionally on the receiving end of comments that were less than kind, but that has become much less common over time.

“Eighty percent of my ISO partners are male, and then the rest are women,” says Cano. “And those women are going to be like the heads of strategic partnerships, funding managers, or they’re the ones that are moving a lot of the volume for the broker shop.”

Paliobeis puts her clientele in the 80–90% male range, at least as far as whom she interacts with at each company. Broker shop owners themselves still appear to be overwhelmingly male, though there is no precise research that nails down the percentage. Cano says she’s found the male-dominated aspect of the broker business surprising, but that it should not be viewed as intimidating to any woman considering entering the space.

“Don’t be scared of that male figure aspect of it,” she advises. “For any woman, just don’t be scared, just definitely go forward and do it.”

Paliobeis, who comes from a background in luxury home sales and luxury retail sales and is now in her fourth year of small business finance, has found joy in realizing that her past experience can open doors in this space. For more than five years, she was a connoisseur of high-end watches—an accessory that some brokers are very into. Rolexes, for example, are something she commonly sees on wrists at industry conferences, along with the occasional Patek Philippe, Audemars Piguet, or even a Richard Mille.

Paliobeis, who comes from a background in luxury home sales and luxury retail sales and is now in her fourth year of small business finance, has found joy in realizing that her past experience can open doors in this space. For more than five years, she was a connoisseur of high-end watches—an accessory that some brokers are very into. Rolexes, for example, are something she commonly sees on wrists at industry conferences, along with the occasional Patek Philippe, Audemars Piguet, or even a Richard Mille.

“Every once in a while I see a watch and I’m like, ‘Oh, that’s really nice,'” says Paliobeis.

But relationship-building takes time in this industry, and to do it right, it can’t be surface level. Cano says that a good partnership effectively means making someone a personal friend—letting them into your personal life via Facebook or Instagram, knowing each other’s birthdays, or knowing when and whom they’re getting married to. Paliobeis offered her own example, saying she had recently been introduced to a partner’s family.

“At the end of the day we’re human,” says Paliobeis. “We’re talking to you every single day, like things are going to come up with your family, or day to day, life and so on.”

Having that bond comes in handy because sometimes the brokers themselves run into communication troubles with their merchants and get stuck. When that happens they can ask Cano or Paliobeis if they can step in and talk to the merchants to get over a hurdle, which they’ll do.

Though the two are essentially on the same team and are often seated next to each other in the office, they work with their own book of relationships and compete on deal volume.

“Always every day probably around noon, and then around 5:30 we’re like, ‘what’s your number?'” says Cano, as they try to beat each other out on units funded. They hope the competitive camaraderie will eventually propel them to doing a collective $40 million a month, or nearly half a billion dollars a year.

“We compete and it’s friendly competition, but we’re also rooting for each other,” Cano says. “So even if it’s not Nicole or myself, or it’s one of the ISO managers that are getting a big deal, or if they just started and they’re new in the industry and they did something, we have a gong, and we bang the gong.”

Coincidentally, one of the other Spartans is Cesar Valero, a business development executive who won the B2B Finance Expo poker tournament in 2024 in Las Vegas, got featured in a writeup last year, and is now the company’s Director of Revenue. Suffice it to say, the Spartan Capital team are familiar faces in the industry.

Coincidentally, one of the other Spartans is Cesar Valero, a business development executive who won the B2B Finance Expo poker tournament in 2024 in Las Vegas, got featured in a writeup last year, and is now the company’s Director of Revenue. Suffice it to say, the Spartan Capital team are familiar faces in the industry.

Beyond that, there are a couple of other ingredients that make what they do possible. One is the ability to stand on a brand with modern technology. Cano says that many brokers today are fintech-savvy and have certain expectations around the submission and approval process, including that deals be API’d into their system—something that accounts for most submissions at Spartan Capital. The other ingredient is strong leadership at the top.

When it comes to working for Frank Ebanks, the company’s CEO, Paliobeis says she “loves it.”

“[Frank’s] a very hands-on CEO,” she says. “He’s always available. If we need something and we’re here in the office, we can just go knock on his door and just say, ‘hey, need you for this, I want to pick your brain’ and so on. So it’s very nice to have that.”

Cano says that just as she and her colleague take calls early in the morning or late into the night, Ebanks does the same for them when they need him.

“He does give that role model aspect that this is how you grow a company, that this is how you do it,” Cano says. “And he’s crushing it.”

“I tell Frank, ‘I’m growing old here, so I’m gonna stay here,’ I actually really like my current role and the company I’m with and the partners we work with,” Cano adds. “We have the team, we have everything.”

And so while funders compete and do the dance to maximize deal flow, being among the top ISO relationship managers in the space is, overall, an enjoyable experience, they say.

“It’s the friendships that you’re building, everything that’s happening, I love it,” Cano says. “I wouldn’t change it for the world. It’s chaos and it’s chaotic, and every day is different… I love that you’re able to see different businesses and help them out. So I truly, truly like this part of it.”