Articles by deBanked Staff

Upstart is Heading into Small Business Lending

November 10, 2021 Upstart, the fintech AI consumer lender originally known for its student loan platform, is heading into small business lending.

Upstart, the fintech AI consumer lender originally known for its student loan platform, is heading into small business lending.

“…we believe there is an unmet need to provide fast, easy access to affordable installment loans to business owners across the country,” said Upstart CEO David Girouard during the earnings call. “Every small business is different and they operate across a crazy wide spectrum of industries.”

Girouard explained that there are “significant challenges to delivering a compelling loan product that is useful to business owners,” in which there is also reliable value for the lender itself.

“This challenge is tailor-made for Upstart,” Girouard said. “While there is no shortage of credit options to business owners, we aim to deliver the zero-latency affordable credit solution that modern businesses require. This is another product in high demand from our bank and credit union partners, and we hope to bring it to market during 2022 as well.”

Upstart is no small player. The company’s market cap is currently around $20B and it is putting out about 1.5M loans a year for a total of more than $16B.

PayPal’s Lending Increases

November 8, 2021 PayPal was mum about its working capital loan products in the latest quarterly earnings report, but clues lie in an important line item, Loans and interest receivable. The figure has historically been closely correlated with originations. PayPal reported $3.7B in those receivables at the end of Q3, up from $3.2B in Q2 and up from $2.77B at the end of Q4 2020.

PayPal was mum about its working capital loan products in the latest quarterly earnings report, but clues lie in an important line item, Loans and interest receivable. The figure has historically been closely correlated with originations. PayPal reported $3.7B in those receivables at the end of Q3, up from $3.2B in Q2 and up from $2.77B at the end of Q4 2020.

The number was close to $4B at the end of 2019 so the figures represent a return to previous levels.

In the earnings call, PayPal CFO John Rainey said “growth in our short-term installment pay portfolio was the primary driver of this increase.” Rainey appeared to be referring to its Buy-Now-Pay-Later product.

Separately, PayPal announced that Venmo users should be able to pay for purchases on Amazon beginning next year.

This page has been updated to reflect the CFO’s statements that the increase was driven by short-term installment lending.

Square Loans Originated $594M in Business Funding in Q3

November 5, 2021 Square Loans, formerly known as Square Capital, originated $594M in small business funding in Q3, bringing the company to $1.6B originated YTD. Square had already been recognized among the largest small business lenders this year so far.

Square Loans, formerly known as Square Capital, originated $594M in small business funding in Q3, bringing the company to $1.6B originated YTD. Square had already been recognized among the largest small business lenders this year so far.

The Q3 figure boils down to 83,000 individual loans.

Overall, Square Loans was mentioned very little in the company’s quarterly earnings call. Company CEO Jack Dorsey said “…there’s still a lot of opportunity for us to open more of our products in more of the markets that we’re already in, such as Square Loans in more of the places that we already exist.”

The coming of Hyperinflation, a prediction made by Dorsey on Twitter just weeks prior, went completely unmentioned in Square’s official reports.

On October 22, he tweeted, “Hyperinflation is going to change everything. It’s happening.”

LendingClub Finding It Pays to be a Bank

November 1, 2021 At $48.75, LendingClub stock recently surpassed the highest valuation it has had since January 2016.

At $48.75, LendingClub stock recently surpassed the highest valuation it has had since January 2016.

Successfully becoming a bank earlier this year and dropping its peer-to-peer lending business for good, the company is showing the benefit of that by recording a net income of $27.2M in Q3.

And its loan business is still strong. LendingClub originated $3.1B in loans last quarter, up from the $2.7B in Q2.

“When we launched back in 2007, LendingClub’s vision was to leverage technology, data and our marketplace model to transform the banking industry,” said company CEO Scott Sanborn on the earnings call. “We began by bringing a traditional credit product, the installment loan into the digital age by moving it online, broadening access, lowering costs and delivering a fast and frictionless experience for borrowers, all while delivering attractive risk-adjusted returns for loan investors.”

In 2014, however, it was their designation as a “tech company” rather than as a financial company that saw their valuation surge to nearly 3x higher than what it is now. (Note: The company did a reverse 1:5 stock split in 2019). But now as a bank, that valuation is surging back.

“Now with the added funding benefit of our bank, we’re able to generate positive unit economics,” Sanborn said.

OnDeck originated $462M in Small Business Loans in Q3

October 28, 2021 Enova, through OnDeck, originated $462M in small business loans in Q3, according to the company’s earnings call. That was up from $400M the quarter before.

Enova, through OnDeck, originated $462M in small business loans in Q3, according to the company’s earnings call. That was up from $400M the quarter before.

“…as we’ve been predicting, small businesses have been beneficiaries of the pent-up consumer demand and the resulting increased spending,” said Enova CEO David Fisher.

Fisher also touched upon the CFPB regulatory inquiry disclosed in the earnings release, downplaying it somewhat as “routine.”

“I want to touch on the CID that we announced in our press release,” he said. “The CFPB is investigating a handful of issues several which were self reported by Enova. We have been cooperating fully with the CFPB as we always do. This is a routine process with the CFPB, particularly in our industry. We’ve been through it with them in the past. As a result, we anticipate being able to work with the CFPB to expeditiously complete this investigation.”

This story has been updated to fix typos

Enova Posts Q3 Results, Admits It is Dealing With Regulatory Situation

October 28, 2021 Enova’s Q3 report is very brief and to the point. Through both its consumer loan and business loan operations, the company generated a net income of $52M on $320M in revenue.

Enova’s Q3 report is very brief and to the point. Through both its consumer loan and business loan operations, the company generated a net income of $52M on $320M in revenue.

“We are pleased to again report a strong quarter of growth across all of our businesses,” said David Fisher, Enova’s CEO.

There was no mention of OnDeck by name this time around, its major small business lending division. Instead, Enova was sure to draw attention to a regulatory inquiry it had received from the CFPB.

“The Company has received a Civil Investigative Demand (‘CID’) from the Consumer Financial Protection Bureau (‘CFPB’) concerning certain loan processing issues,” the company stated. “Enova has been cooperating fully with the CFPB by providing data and information in response to the CID. Enova anticipates being able to expeditiously complete the investigation as several of the issues were self-disclosed and the Company has provided, and will continue to provide, restitution to customers who may have been negatively impacted.”

The language is particularly concessive. Whatever happened, they felt the need to self-report it and to provide restitution to customers.

This is likely to be queried in more detail during the company’s earnings call this evening.

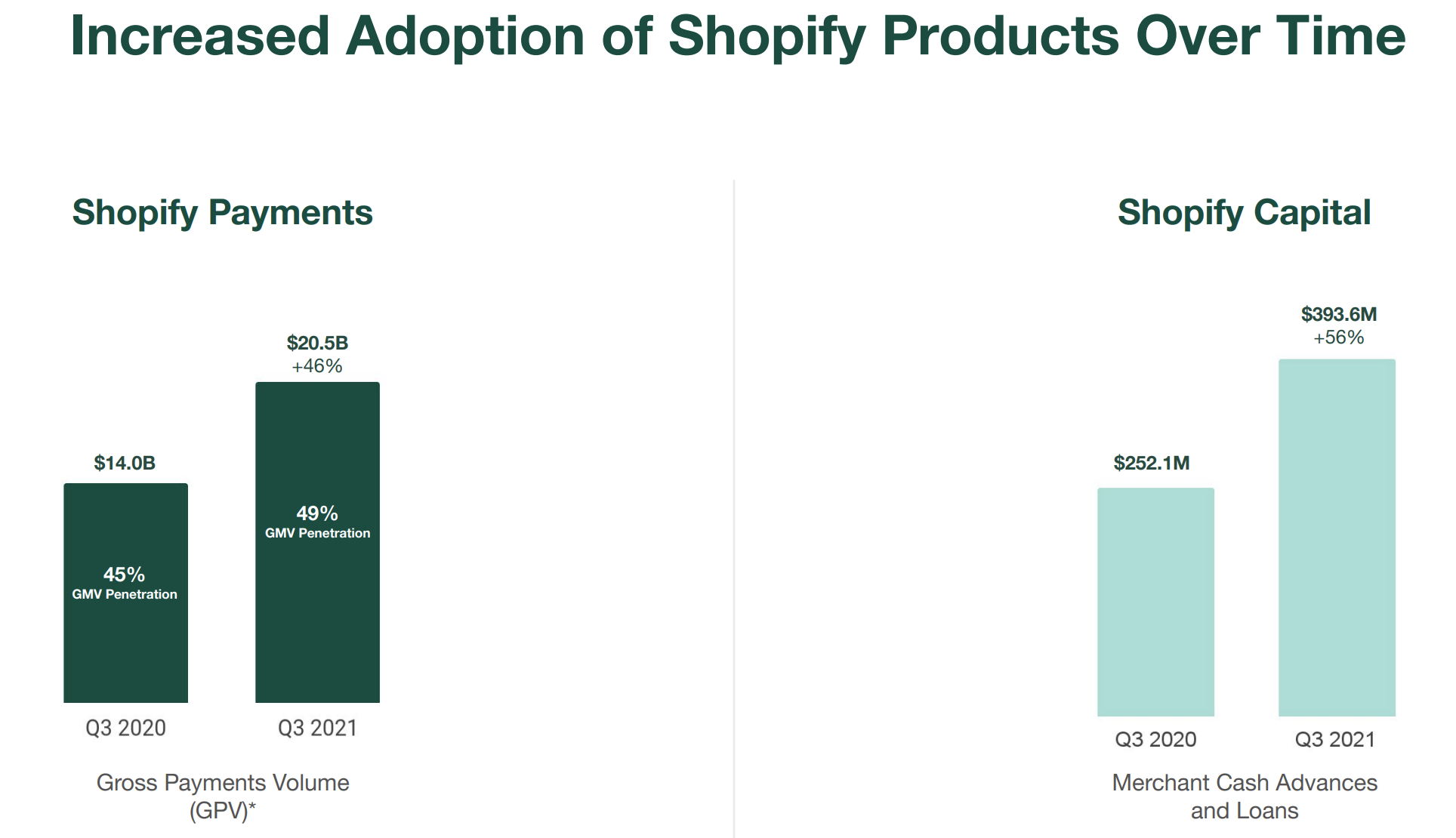

Shopify Capital Originated $393.6M in MCAs and Business Loans in Q3

October 28, 2021Shopify Capital, the funding arm of e-commerce giant Shopify, originated $393.6M in merchant cash advances and business loans in Q3, the company reported. That’s up from the $363M in the previous quarter.

Covid was a boon to Shopify Capital given its dependence on e-commerce businesses. Its 2020 funding volume was almost double that of 2019.

“Shopify Capital has grown to approximately $2.7 billion in cumulative capital funded since its launch in April 2016,” the company announced. The large volume and continued success has landed the Shopify Capital division in the company’s “core” bucket of “near-term initiatives” that will build the company for the long term, according to a presentation accompanying Q3 earnings.

Robinhood Posts Rough Q3

October 26, 2021 Robinhood revealed a steep $1.3B loss on Tuesday. Thought it was highly attributable to share-based compensation, several areas of their growth went into reverse. Transaction-based revenues, for example, were only $267M in Q3, a sharp drop from the $451M in Q2.

Robinhood revealed a steep $1.3B loss on Tuesday. Thought it was highly attributable to share-based compensation, several areas of their growth went into reverse. Transaction-based revenues, for example, were only $267M in Q3, a sharp drop from the $451M in Q2.

That’s not all. Assets Under Custody, Average Revenue Per User, and Monthly Active Users all shrank as well.

“This quarter was about developing more products and services for our customers, including crypto wallets,” said Vlad Tenev, CEO and Co-Founder of Robinhood Markets, in the company’s official statement. “More than one million people have joined our crypto wallets waitlist to date. With 24/7 live phone support, we believe that Robinhood is becoming the most trusted and intuitive platform for retail and crypto investors. And looking ahead, we’re committed to delivering tax-advantaged retirement accounts to help everyone invest for the long term.”