Articles by deBanked Staff

People Are Using AI as a Replacement for Search

October 6, 2025It used to always be Google when it came to search, but a recent study shared by OpenAI shows that people are using LLMs in a manner that is very similar to how they used Google.

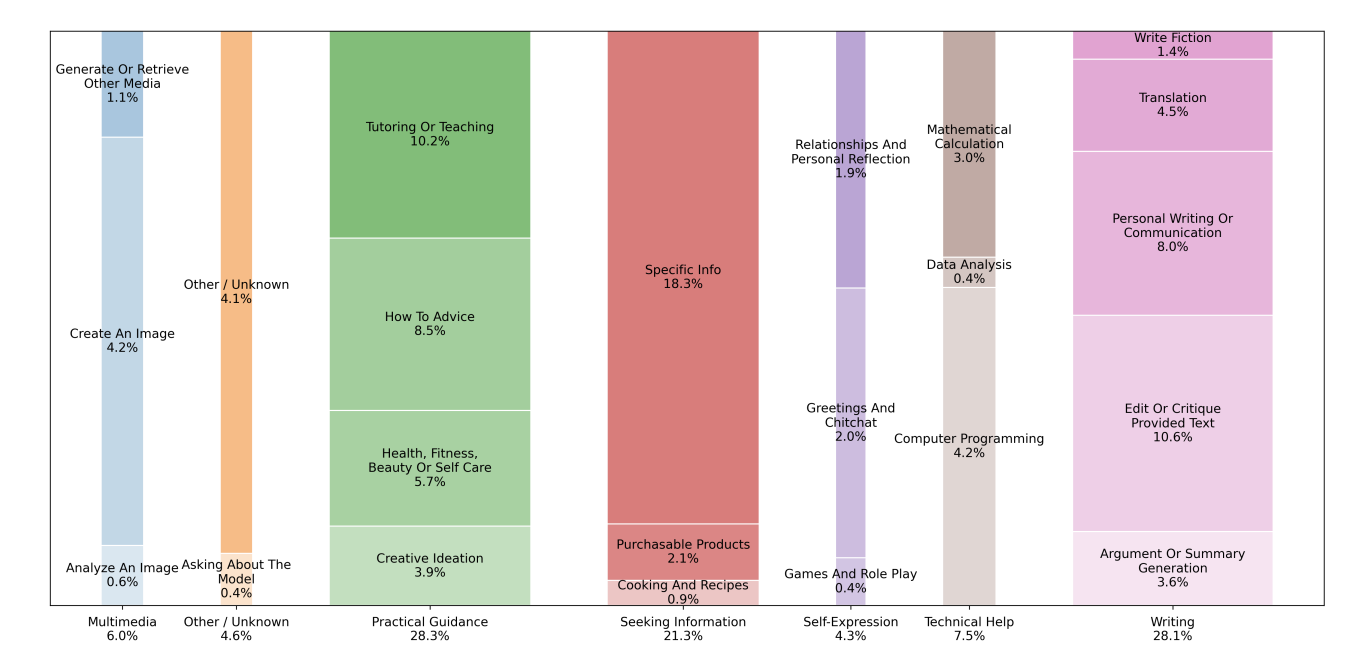

21.3% of ChatGPT interactions, for example, are about seeking information, 28.3% are about practical guidance, and 7.5% are about technical help.

The data was based on 1.1 million sampled conversations between May 15, 2024 and June 26, 2025.

“While users can seek information and advice from traditional web search engines as well as from ChatGPT, the ability to produce writing, software code, spreadsheets, and other digital products distinguishes generative AI from existing technologies,” the report says. “ChatGPT is also more flexible than web search even for traditional applications like Seeking Information and Practical Guidance, because users receive customized responses (e.g., tailored workout plans, new product ideas, ideas for fantasy football team names) that represent newly generated content or novel modification of user-provided content and follow-up requests.”

ChatGPT’s crossover as a search engine is already going one step further. Last week the company announced that it was partnering with Stripe on in-chat checkout.

“The flow is simple: a ChatGPT user asks for product recommendations in the chat,” Stripe said of it. “When they are ready to buy, they are presented with a Stripe-powered checkout inline in the chat.”

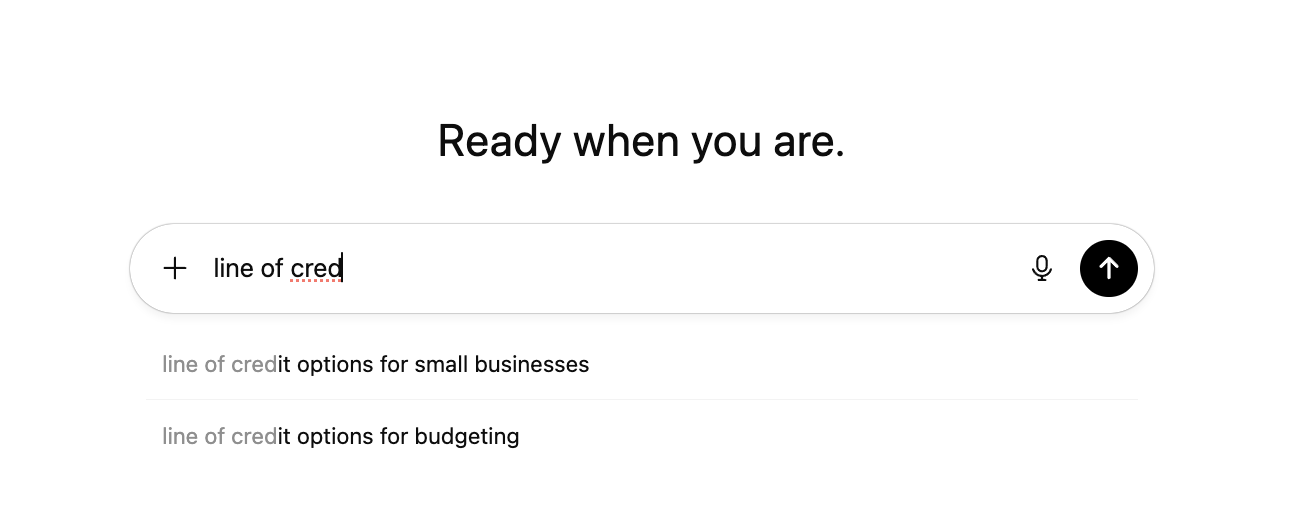

And just as recently, ChatGPT is now also leaning into auto-complete queries, similar to what Google already does.

Typing “line of cred” into a query box, for example, shows “line of credit options for small businesses” as a potential query for the user to choose from.

Revenue Based Financing Continues to Spread at Global Pace

September 30, 2025 Earlier this month, Uber Eats joined the revenue-based financing movement by partnering with Pipe Capital.

Earlier this month, Uber Eats joined the revenue-based financing movement by partnering with Pipe Capital.

Karl Hebert, Vice President of Global Commerce and Financial Services at Uber, said of it, “We are happy to team up with Pipe to bring working capital to Uber Eats. Restaurants are our partners at Uber, and the backbone of our communities, yet many struggle with access to capital.”

It’s an unsurprising step considering rival DoorDash rolled out a merchant cash advance program nearly four years ago, though Uber arguably began experimenting with MCAs nearly ten years ago. And Uber is hardly doing it just to do it. Uber, for example, rolled out Uber Eats Financing, a revenue based financing product in Mexico through a partnership with R2 this past January, which went so well that they also rolled it out in Chile months later.

📢 Announcing a big milestone for R2 & @Uber!

Following a successful launch in Mexico, we’ve expanded our partnership with Uber Eats to Chile — bringing frictionless access to capital to thousands of merchants across the region. https://t.co/61WgP1ZtHy

— Roger Larach (@rogerlarach) April 30, 2025

In Chile with R2, the service is described as taking place entirely within the Uber Eats Manager App with a 5-minute application process and payments made automatically and deducted by a fixed percentage from sales made using the platform.

In the US with Pipe, it says that the Uber Eats App Manager will show capital offers from Pipe that are customized based on restaurant revenue, cash flow, and business performance.

Uber joins Amazon, Walmart, Shopify, Intuit, Stripe, DoorDash, PayPal, Square, GoDaddy, Wix, Squarespace and others in offering a revenue-based financing product.

Revenue-based financing as a product type is available in but not limited to the US, Canada, Mexico, Chile, UK, Germany, Ireland, Spain, South Africa, Nigeria, India, Hong Kong, Netherlands, Australia, Japan, Brazil, Singapore, and more.

Covid EIDLs With Real Estate as Collateral Have Much Lower Default Rate

September 29, 2025369,588 Covid-era EIDL loans valued at $47 billion had been charged off by December 2024, according to a recent report issued by the Office of Inspector General (OIG).

It turns out that collateralizing real estate may have made all the difference in the outcome. For loans over $25,000, for example, the SBA relied on simple blanket liens as collateral. This allowed the agency the right to take possession of the borrower’s assets upon default, such as inventory, equipment, and any other tangible or intangible property owned by a business. If that was supposed to be a deterrent to default, it hasn’t shown considering the raw number of defaults so far.

On loans over $500,000, however, business borrowers were supposedly required to put up real estate as collateral but according to the OIG, they approved the loans regardless. Consequently, of the 58,024 COVID-19 EIDLs exceeding $500,000, only 4,718 were secured with real estate. Only five of those real-estate-backed loans had defaulted as of July 2024. Compare that with the 4,605 loans over $500,000 without real estate as collateral that have already defaulted and been charged off. The difference is clear.

As of July 2024, none of the five defaults with real estate had been foreclosed on yet.

Full OIG Report here.

Only One Month Until B2B Finance Expo

September 27, 2025The B2B Finance Expo is October 28-29. Returning to Wynn Las Vegas after its incredible inaugural success in 2024, this groundbreaking event will once again bring together leaders from Small Business Lending, Equipment Finance, Real Estate Lending, Revenue Based Financing, and beyond. Over the course of this exclusive two-day event, brokers, lenders, funders, and service providers alike can expect networking opportunities, insight sessions, and much more.

Sponsorships / Exhibiting: SOLD OUT

Wynn Discounted Room Block: SOLD OUT

Backup Discounted Room Block: Click Here

Tickets Still Available at: REGISTERING NOW.

B2B Finance Expo is powered by deBanked in collaboration with the Small Business Finance Association (SBFA).

RadioShack Owners Accused of Running a Ponzi Scheme

September 25, 2025When the RadioShack brand was acquired in 2020 by Retail Ecommerce Ventures, LLC, the company shifted gears into a new direction, cryptocurrency. Using Twitter, now X, as its main base of messaging, the RadioShack account rapidly became outwardly controversial and hostile in order to generate eyeballs and attention. It was quite successful and piqued my curiosity to the point that it ended up on deBanked in 2021.

At the time the company said “RadioShack DeFi is focused on the early majority. It will become the first to market with a 100 year old brand name that’s recognized in virtually all 190+ countries in the world.”

When I actually inquired about information on its new DeFi platform, all I received was a digital coupon for a boombox…

I signed up to learn more about @RadioShack ‘s DeFi project and instead got offered a discount on a new boombox. pic.twitter.com/0O3i8llgyL

— Seán Murray (@financeguy74) December 30, 2021

But the party seemed to come to an end and the account stopped tweeting on November 17, 2022.

Why'd @RadioShack go dark after Nov 17, 2022? They were one of the most epic crypto troll accounts on twitter.

— Seán Murray (@financeguy74) February 15, 2023

Now, according to the SEC, it has been revealed that the owners of RadioShack and other defunct brand names had been conducting a ponzi scheme precisely through November 2022.

Taino Adrian Lopez, Alexander Farhang Mehr, and Maya Rose Burkenroad, were charged this week for running a $112M ponzi scheme. Apparently, none of the household brand names they acquired were generating any profits, but they claimed to investors that they were in order to raise capital. “Consequently, in order to pay interest, dividends and maturing note payments, Defendants resorted to using a combination of loans from outside lenders, merchant cash advances, money raised from new and existing investors, and transfers from other portfolio companies to cover obligations,” the SEC claims.

In addition to RadioShack, the accused operated Brahms, Linens ‘N Things, Modell’s, Stein Mart, and Pier 1 Imports.

Sold Out? How to Get a Hotel Room for B2B Finance Expo

September 25, 2025The B2B Finance Expo coming up in Las Vegas is in high demand. The discounted conference room block is entirely sold out but it is still possible to secure a room at the Wynn directly at full price. If that’s too steep, the conference has secured an additional block across the street where the rooms are approximately 80% lower in price. To take advantage of the extremely discounted rooms, use this link. The event itself is at the Wynn!

The conference is on October 28-29.

MCA Reconciliation Can’t be Reviewed as “Illusory” if the Merchant Didn’t Even Engage in the Reconciliation Procedure

September 25, 2025In Apollo Funding Co v Dave Reilly Construction, LLC, The Appellate Division of the Second Department of the Supreme Court of New York, reversed the lower court’s denial of the plaintiff’s summary judgment motion. For background, Apollo purchased DRC’s future receivables, DRC breached the agreement, Apollo sued and moved for summary judgment, and DRC entered a defense that the agreement was actually an unlawful usurious loan. Based on DRC’s defense the lower court denied Apollo’s summary judgment motion.

Upon Apollo’s appeal in the Second Department, the Court found: “the plaintiff established that the transaction set forth in the agreement was not a loan. The terms of the agreement specifically provided for adjustments to the daily payments by DRC to the plaintiff based on changes to DRC’s daily receipts. Concomitantly, as the amount of the daily payments could change, the terms of the agreement were not finite, and because DRC did not engage in the agreement’s reconciliation procedure, our review of the claim that the process was illusory is precluded [emphasis ours]. Moreover, no contractual provision existed establishing that a declaration of bankruptcy would constitute an event of default.”

The Second Department ruled that Apollo had “otherwise established its prima facie entitlement to judgment as a matter of law on the complaint, and the defendants failed to raise a triable issue of fact in opposition, the Supreme Court should have granted the plaintiff’s motion for summary judgment on the complaint.”

The original case ID in the New York Supreme Court was 035156/2023. The Appellate Division’s Decision and Order was issued September 24, 2025.

FICOs Are 580 and Below, Repayment Rates Are Above 97%

September 23, 2025Block recently published an interview with Juan Hernandez, the company’s Head of Credit and Underwriting for its consumer lending divisions. Among the most interesting details Hernandez revealed is that 70% of Cash App Borrow customers have FICO scores of 580 or below, but their repayment rates are above 97%.

“That is only possible because our models are continuously learning from customer activity across Cash App and Afterpay,” Hernandez said of it.

Block sees income, deposits, spending patterns, savings behavior, and repayment behavior across the spectrum of its ecosystem and is able to use that data to make better predictions than legacy third party credit indicators.

“The future of credit will be based on actual repayment ability, not outdated proxies,” Hernandez said. “With near real-time data and modern modeling, we can finally build a system that is more inclusive and safer than traditional credit scores that look backward, update slowly, and often misclassify people who are capable of managing credit.”

“The future of credit will be based on actual repayment ability, not outdated proxies,” Hernandez said. “With near real-time data and modern modeling, we can finally build a system that is more inclusive and safer than traditional credit scores that look backward, update slowly, and often misclassify people who are capable of managing credit.”

Block has made a name for itself in the lending space. Cash App Borrow originated $9B in loans in 2024 while its sister company Square Loans, which provides capital to small businesses, is the largest online small business lender that deBanked tracks. Square Loans originated $5.7B in 2024.

In March of this year Block received FDIC approval for its industrial bank, Square Financial Services Inc, to offer the Cash App Borrow loan product directly.