Articles by deBanked Staff

What Big Publicly Traded Companies Say About Merchant Cash Advances

March 13, 2024deBanked examined the public messaging from some of the largest publicly traded merchant cash advance facilitators in the US and this is what it found:

SHOPIFY

A merchant cash advance is a purchase of your future sales, also known as receivables. If your application for funding is accepted, then Shopify provides you a lump sum of money for a fixed fee. Under the Shopify capital agreement, this lump sum is known as the amount advanced, and the total to remit is the amount advanced plus the fixed fee. In return, you pay Shopify Capital a percentage of your daily sales until Shopify receives the total to remit. The percentage of your daily sales that you must remit to Shopify is known as the remittance rate. The amount advanced and the remittance rate depend on your risk profile.

For example, Shopify Capital might advance you 5,000 USD for 5,650 USD paid from your store’s future sales, with a remittance rate of 10%. The 5,000 USD amount that you receive is transferred to your business bank account specified in your admin, and Shopify Capital receives 10% of your store’s gross daily sales until the full 5,650 USD total to remit has been remitted. You have the option, at any time, to remit any outstanding balance in a single lump sum.

There is no deadline for remitting the total to Shopify Capital. The daily remittance amount in USD is determined by your store’s daily sales, because the remittance rate is a percentage of your store’s daily sales. The remittance amount is automatically debited from your business bank account.

DOORDASH

DoorDash Capital is a cash advance, not a loan. With a cash advance, the offer is based on your sales and account history, and includes a simple, transparent one-time fee that you’ll know before you decide to accept the offer. A loan operates using interest, which can compound over time, and often includes other fees in addition to the stated interest rate.

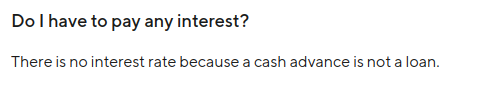

LIGHTSPEED

AMAZON

A [merchant cash advance is a] non-revolving sum of funding with flexible payment, no personal collateral required and no late fees. With flexible payment, no personal collateral required and no late fees, a merchant cash advance provides sellers funding to help run and grow their business. Unlike interest-bearing loans, the advance ties payment to a portion of a seller’s future sales for a fixed capital fee, there are no additional fees or interest charged.

NERDWALLET

Fixed withdrawals from a bank account

Merchant cash advance companies can also withdraw funds directly from your business bank account. In this case, fixed repayments are made daily or weekly from your account regardless of how much you earn in sales, and the fixed repayment amount is determined based on an estimate of your monthly revenue.

PAYPAL

A merchant cash advance is not a loan, but rather a type of financing that business owners pay back with a percentage of their future sales.

Utah Amends Definition of Commercial Finance Broker

March 11, 2024

The Utah state legislature successfully passed a bill amending some elements of its recent commercial financing disclosure law.

As part of that the definition of a broker has changed from:

a person who, for compensation or the expectation of compensation, arranges a commercial financing transaction between a third party and business in the state.

to:

a person who:

(i) for compensation or the expectation of compensation, obtains a commercial financing product or an offer for a commercial financing product from a third party that, if executed, would bind the third party; and

(ii) communicates the offer described in Subsection (2)(a)(i) to a business located in the state .

(b) “Broker” does not include:

(i) a provider; or

(ii) a person whose compensation is not based or dependent on the terms of a specific commercial financing product that the person obtains or offers.

The law will also remove the line about having to disclose “any amount of the funds described in Subsection (2)(a) that the provider pays to a broker in connection with the commercial financing transaction.”

You can read it here. The bill just needs the governor’s signature.

Nerdwallet Generated $101M in Revenue from SMB Products in 2023

March 10, 2024 Nerdwallet, a financial service shopping site, generated $101.2M in revenue across 2023 from SMB loans, business credit cards, and other financial products & services, according to the company’s latest earnings report. That was an increase of 11% over the previous year.

Nerdwallet, a financial service shopping site, generated $101.2M in revenue across 2023 from SMB loans, business credit cards, and other financial products & services, according to the company’s latest earnings report. That was an increase of 11% over the previous year.

Nerdwallet said that it has been seeing “positive momentum” for SMB products.

“As we look to the rest of the year, we expect to return to double-digit revenue growth during the second half, given recent recovery in SMB products and insurance,” said Nerdwallet CEO Tim Chen.

Nerdwallet had 14 million registered users as of December 31, 2023, which creates a strong base to generate revenue.

“Critical to our aspiration of delivering consumers and SMBs with a trusted financial ecosystem is our ability to register and engage users – in turn allowing us to drive repeat visits, collect data and provide users with unique insights via nudges,” the company said. “We are focused on growing the traffic and engagement on our platform, as well as increasing our number of registered users, who have a lifetime revenue value five times greater than our non-registered users and more than twice the transactions and sessions, on average.”

Amazon Discontinues Its In-House Business Loans

March 9, 2024 After deBanked reported that Amazon’s on-balance-sheet business loan receivables had remained steady throughout 2023, the company has abruptly decided to terminate its in-house lending program altogether.

After deBanked reported that Amazon’s on-balance-sheet business loan receivables had remained steady throughout 2023, the company has abruptly decided to terminate its in-house lending program altogether.

Through an email confirmed to Fortune, Amazon ended its in-house term loan business on March 6. That same story says that they will continue to work with third party lenders and funders as they have been doing for a while. Some of their partners include Lendistry, SellersFi, and Parafin.

The in-house program had been running since 2011 and was first discovered by deBanked in 2013.

While the company was shy about disclosing origination figures, it carried approximately $1.3B in loan receivables on its books throughout last year.

The Amazon news coincides with the announcement that business loan rival Funding Circle has decided to exit the US market. Funding Circle US is currently up for sale.

Wow we sort of called this @amazon sellers pic.twitter.com/MOWsPWxcb1

— Amazon Sellers ASGTG (@AmazonASGTG) March 7, 2024

FOR SALE: Funding Circle US?

March 8, 2024 Funding Circle has decided to focus just on its UK business. The company is open to selling off its US business, it revealed.

Funding Circle has decided to focus just on its UK business. The company is open to selling off its US business, it revealed.

“Whilst the US business offers attractive long term growth, it also requires a significant amount of cash and capital to grow the SBA proposition and we don’t believe that this is the best course of action for the Group,” said Funding Circle CEO Lisa Jacobs. “We have received indications of interest for the US business and will update further in due course.”

The US segment originated $491M in 2023 while generating $40.4M in revenue and a $29M net loss. That loss was steeper than the $11.6M recorded in 2022.

Funding Circle had just recently secured an SBLC license after years of lobbying for the SBA to end the 40-year pause. When that happened, it was anticipated to be a big boon for them.

Compared to the competition in 2023, Funding Circle’s American origination volume was only 1/6th that of Enova’s.

The Schedule at a Glance

March 7, 2024See what’s up next on the 2024 Agenda:

|

Broker Fair 2024 – New York City – May 20, 2024 Venue: Metropolitan Pavilion Hotel: Renaissance New York Chelsea Hotel Preshow Venue (Evening May 19): Somewhere Nowhere Register Here B2B Finance Expo – Las Vegas – Fall 2024 |

Small Business Administration Upgrades its Business Loan Marketplace

March 5, 2024 Add the SBA to the list of organizations capitalizing on the popularity of business loan marketplaces. The Administration recently announced the next generation of its Lender Match tool.

Add the SBA to the list of organizations capitalizing on the popularity of business loan marketplaces. The Administration recently announced the next generation of its Lender Match tool.

“The enhanced Lender Match will provide Americans seeking funding to start and grow their businesses with a simple, online tool that will more effectively match them with the SBA’s competitive lending products and additional offerings from a trusted network of banks and private lenders,” the SBA said.

The updated homepage says that the tool will match applicants with competitive rates and fees while offering unique benefits like lower down payments, flexible overhead requirements, and no collateral needed for some loans.

“Borrowers will now be able to easily view all of their matched lenders in one place, allowing the borrower to find and compare lenders to help them decide where to apply for a loan. The enhanced tool will also verify borrowers and screen for fraud to streamline the process for both lenders and borrowers. Importantly, with Lender Match, small businesses that are not matched to lenders will be connected to the SBA’s local network of free advisors to help them get capital-ready.”

The SBA says that it gets 50,000 requests for capital every month through Lender Match, a platform which now has nearly 1,000 SBA lenders and 257 community-based lenders.

Matching borrowers with lenders is big business right now. In January, for example, SoFi launched its own small business loan marketplace.

Louisiana Introduces Commercial Financing Disclosure Bill

March 3, 2024Louisiana is the latest state to introduce a commercial financing disclosure bill. SB 335 is a copy & paste of the law that recently passed in Florida.

Other states with pending legislation on the subject include Missouri, Kansas, Illinois, and Maryland.

You can read the Louisiana bill here.