Articles by deBanked Staff

Enova: On the Ground, Small Businesses Optimistic

January 28, 2026Enova reported $1.6B in small business loan originations for Q4 2025, a big jump from the $1.4B in the prior quarter.

“There’s been a lot of noise over the year of 2025 around the impacts of tariffs and the macro economy and where we are,” said Enova CEO Steve Cunningham during the earnings call. “But I think what I wanted to highlight in my commentary is that it’s not quite as gloomy as it seems on the ground. It seems that small businesses are looking forward positively. And I think it’s reflecting in the demand that we’re seeing.”

On the ground that they see, credit quality and net charge-offs have also remained stable.

“Our internal and external data highlight that SMBs continue to express confidence in the economy and expect favorable operating conditions during 2026,” Cunningham said.

In its latest study and report it published with Ocrolus, they found that “Overall, growth expectations amassed an all-time high with 94% of small businesses projecting growth over the next 12 months.”

Enova also expects to close its acquisition of Grasshopper Bank in the 2nd half of this year and said that both companies are business as usual until that happens.

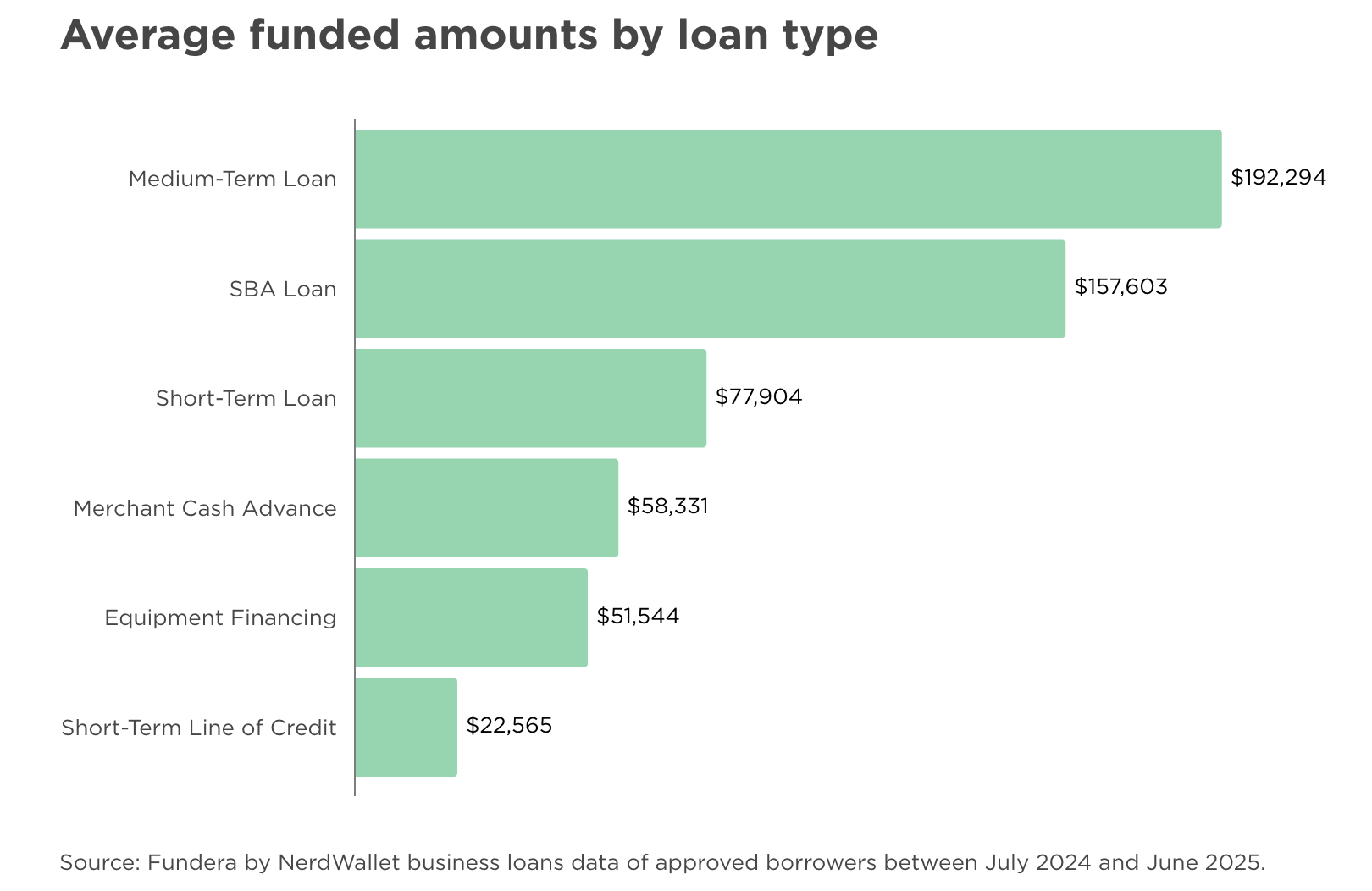

The Average MCA Deal? $58k Report Says

January 26, 2026According to NerdWallet, a leading business loan matching marketplace, the average funded amount of an MCA deal is $58,331. That’s based entirely on the company’s own internal data from July 2024 to June 2025.

Medium-term loans (2-5 years) came in with the highest average of $192,294 and short-term lines of credit produced the lowest average of $22,565.

NerdWallet depends heavily on web traffic to generate leads so this is potentially representative of merchants who use Google or ChatGPT to find financing versus all possible channels.

Becoming a Successful Broker

January 22, 2026ARE YOU READY FOR DEBANKED CONNECT MIAMI 2026?!

Check out the full agenda for February 12th at the Fontainebleau.

There will also be tech demos happening non-stop on the show floor. This event is one you won’t want to miss.

REGISTER BEFORE IT’S TOO LATE.

Fintech Small Business Lender Origination Volume Snapshot

January 16, 2026It was full speed ahead in 2025. Here’s how the origination volume stats were trending among the biggest fintech small business lenders for the first nine months of last year.

| Lender | First Three Quarters 2025 | All of 2024 |

| Square Loans | $5 billion | $5.7 billion |

| BHG Financial | $4.4 billion | $3.7 billion |

| Enova | $4 billion | $3.98 billion |

| Shopify Capital | $2.8 billion | $3 billion |

| PayPal | $1.6 billion | $3 billion |

deBanked tracks fintech small business lenders that publicly report (or privately report to us) their origination volumes. Square Loans became the largest in 2021 and has held on to the top spot ever since. Their advantage (and limitation) is that they lend only to merchants in their POS payments ecosystem.

A dark horse not listed, because precise origination volumes are not available, is Parafin, an embedded lender that works through partnerships with DoorDash, Amazon, Walmart, TikTok and more. At last report, the company said it had made more than $14 billion in offers.

New Jersey Reintroduces APR Disclosure Bill for Commercial Financing

January 14, 2026A commercial financing APR disclosure bill was introduced in the New Jersey State Senate on Tuesday. The bill is mostly templated from other state legislation in which estimated APR disclosures on sales-based financing transactions would be determinable by using either the Historical method or Opt-in method. Senator Troy Singleton introduced it as Senate Bill 1760 and it is described as a bill that “requires certain disclosures by providers of commercial financing.” It can be viewed here.

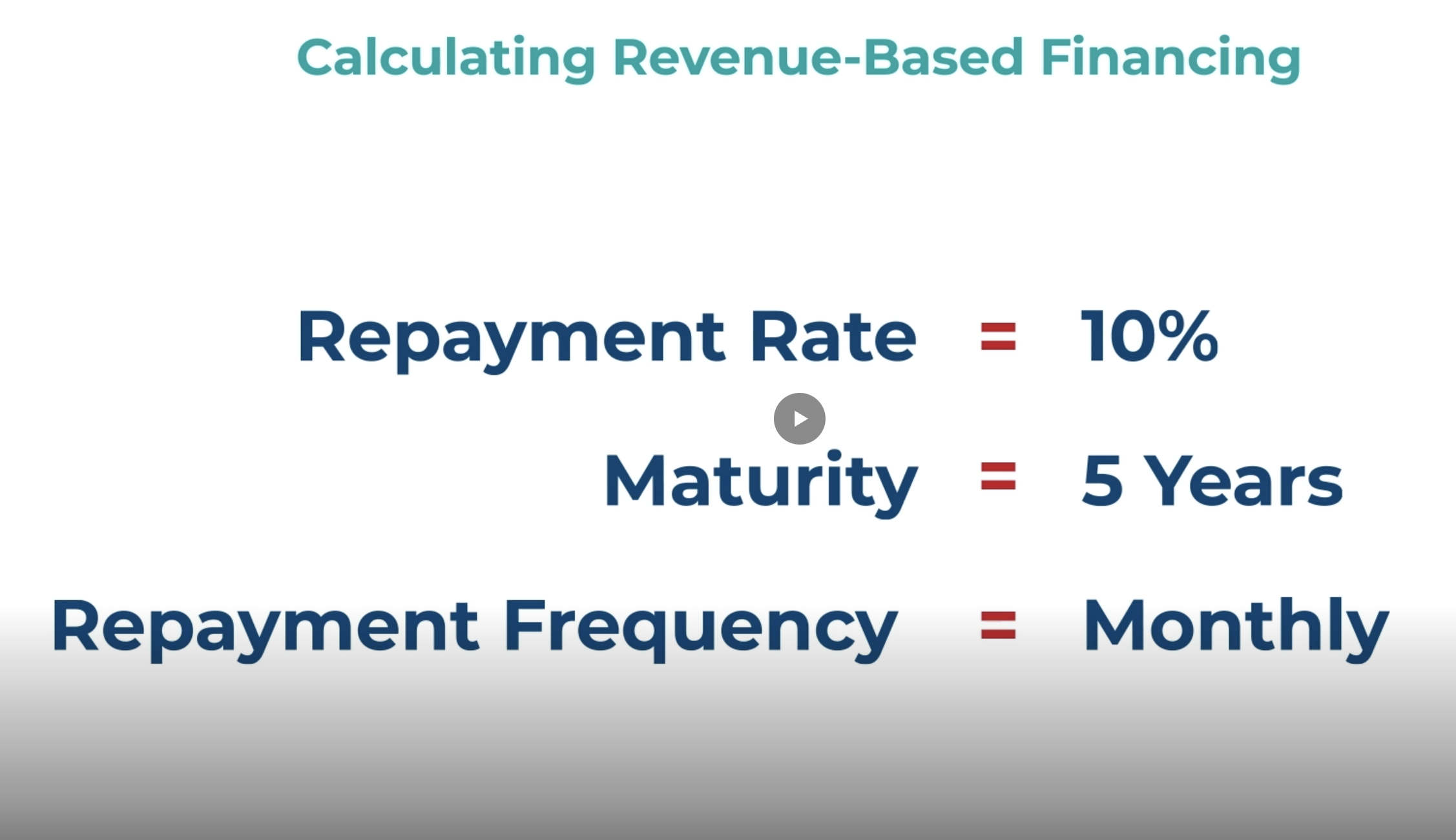

California Partnered With a Revenue Based Financing Provider

January 13, 2026On the California Small Business Loan Match website operated by The California Infrastructure and Economic Development Bank (IBank), is a list of vetted partner small business lenders that the state guarantees loans for. One of those lenders is AltCap California which actually offers revenue based financing.

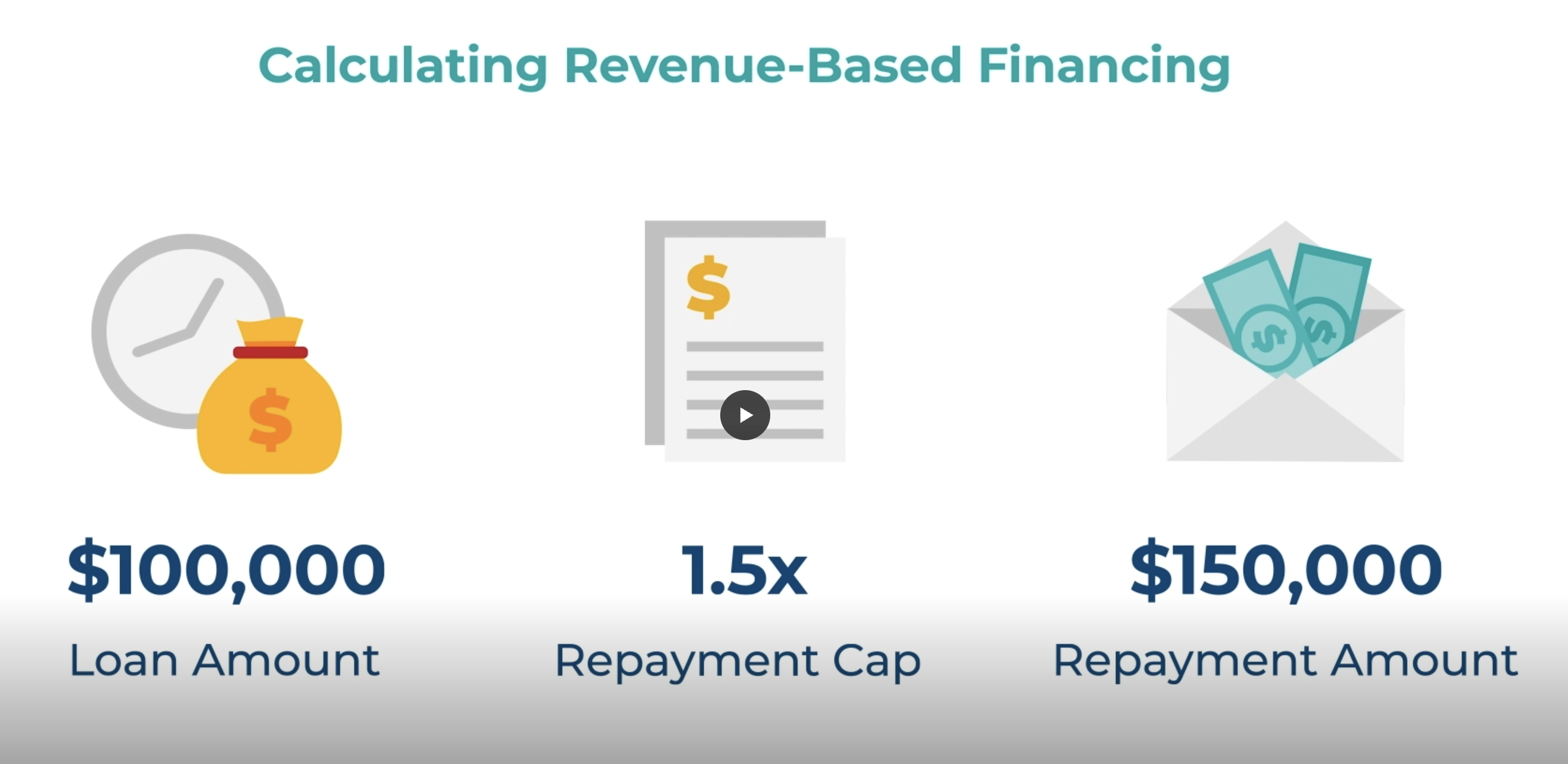

At face value, AltCap describes the cost of its revenue based financing as having to pay up to 7.5% of monthly revenue with a total cost of 1.4x to 1.5x. Its multi-part video education series describes revenue based financing costs as working in the following way:

Repayment Cap: Multiple of the total loan amount used to calculate the set dollar amount to be repaid. (Total Cost of Capital)

Repayment Rate: Share of revenue taken to repay the loan. (Holdback %)

It reinforces this in its Case Study example of Juice Boost (the 2nd video) where it explains that the metrics used to calculate the cost of Revenue Based Financing are the Repayment Cap (factor rate) and Repayment Rate (holdback %).

In its final video, the 4th video, it tells borrowers to inquire about APRs to make comparisons against companies like Square, Amazon, Stripe, and Shopify.

“Revenue-Based Financing allows small businesses to raise funds by pledging a percentage of future, ongoing revenues in exchange for capital provided by a lender,” the website says. “Revenue-Based Financing is different than debt financing. Interest is not paid on an outstanding loan balance and there are no fixed payments. Instead, payments are proportional to a firm’s performance, offering a flexible, patient source of financing.”

Factor Gives Update on “Killing MCAs” in Texas

January 9, 2026Cole Harmonson, CEO of Dare Capital and a board member for the American Factoring Association, posted an update last month on the recent Texas MCA legislation and campaign to “fight the MCA cronies.” It appeared on the Commercial Factor’s magazine website. You can read it here.

Harmonson shared his strategy on how to kill MCAs in Texas, which focuses mainly on the DACA component of securing a first position: “If you get the Springing DACA, then the bank will not give anyone else (i.e., an MCA) a DACA, and therefore no MCA can legally sweep your customer’s account, thereby killing the MCAs in Texas,” he wrote.

Harmonson had previously shared that the factoring industry had been responsible for the MCA legislation in Texas and that it served as a “blueprint,” suggesting that a similar legal framework could be attempted in other states.

New Year, New Lenders?

January 5, 2026There’s a couple new lenders on the block to keep an eye on.

One of them is named Slope. Backed by both JPMorgan and OpenAI CEO Sam Altman, Slope offers revolving lines of credit up to $5 million. And they’re already out there. Seemingly overnight they’ve become capital providers for a number of large e-commerce platforms including Amazon and Walmart and are now listed alongside Parafin on both. When they announced their deal last year with JPM, they said that the US embedded financing market was worth $20 billion and that the B2B economy was $125 trillion. Slope is also offering a new AI underwriting tool.

Another is named Uncapped. Walmart says that Uncapped offers term loans while Amazon says that Uncapped offers lines of credit. The Uncapped website says that they offer loans from $10,000 to $2 million and that they accept business from business loan brokers. The company was technically founded in 2019, but in the UK.