|

Related Headlines

| 09/09/2024 | PayPal to integrate w/ Shopify |

| 07/27/2023 | Shopify launches biz credit card |

| 05/06/2023 | Shopify Capital has huge first quarter |

| 02/08/2023 | Lendica integrates w/ Shopify, Salesforce |

| 09/08/2022 | Leadership shakeup at Shopify |

Stories

Shopify Capital Originates $837M in Business Loans & MCAs in Q3

November 15, 2024Shopify Capital originated $837 million in business loans and merchant cash advances in Q3, putting the grand total at $2.1B for the first 3 quarters. During the earnings call, Shopify said that loss ratios remained within the consistent range.

Compared to some of their competitors in the online space, Shopify Capital ranks third:

Q3 originations:

Square Loans: $1.38B

Enova: $1B

Shopify Capita: $837M

Shopify Capital’s Funding Business Grows in Q2

August 14, 2024Shopify Capital originated ~$700M in business loans and merchant cash advances in Q2. During the earnings call, Shopify CFO Jeff Hoffmeister referred to its Capital division as a “growth business” that had increased in volume. Shopify has otherwise seemed to downplay mention of this division since early last year. In terms of origination volume, the company is still not as big as Enova or Square Loans.

Shopify’s rival, Amazon, used to offer funding to its clients directly as well, but switched to referring its clients to third party lenders earlier this year.

Shopify Capital MCA, Loan Origination Growth Appears to Slow Down

May 9, 2024Shopify Capital, the funding arm of Shopify that provides merchant cash advances and loans to merchants on its platform, experienced no increase in these related receivables in Q1 compared to Q4 2023. The company typically records significant growth in this figure each quarter. Shopify used to broadcast its origination figures far and wide in each quarterly earnings report and call but has since gotten shy about this segment of its business and no longer discloses originations. Instead, its balance sheet line item for “Loans and merchant cash advances” is virtually all there is to go by now and they were listed at $815M in Q1 vs $816M the prior quarter. This, of course, only reflects anything they’ve kept on balance sheet and could be a misleading indicator if those receivables are being sold off or taken on by a third party.

Shopify’s major rival, Amazon, never disclosed origination figures for its Amazon lending program, and in March announced that it was discontinuing its in-house lending program altogether after a 12-year run.

Shopify is still among the largest online small business lenders in the US.

Shopify Capital Renewal Rate Greater than 70%

February 13, 2024Shopify Capital’s funding business is continuing to gain momentum, according to the company’s latest quarterly earnings. Shopify stopped specifying precisely how much it is originating (perhaps because deBanked kept turning those numbers into posts every quarter for years) but still lists the receivables from its loans and merchant cash advances as a line item on its balance sheet. There the balance increased from $580M to $816 year-over-year.

“We know the capital product has been effective because we’re seeing a repeat renewal rate of over 70%, a testament to our ability to help merchants access the funding they need for growth, particularly ahead of key sale times, including the crucial Q4 holiday shopping season,” said Shopify President Harley Finkelstein during the call.

Originations Increased, Losses Decreased for Shopify Capital

November 2, 2023 Shopify Capital is still experiencing an increase in business loan and merchant cash advance originations, according to the company’s latest Q3 earnings report. The company recently stopped disclosing precisely how much it is they are originating, however. It used to give precise numbers but starting this year Shopify now only cites its loans and merchant cash advance receivables balance.

Shopify Capital is still experiencing an increase in business loan and merchant cash advance originations, according to the company’s latest Q3 earnings report. The company recently stopped disclosing precisely how much it is they are originating, however. It used to give precise numbers but starting this year Shopify now only cites its loans and merchant cash advance receivables balance.

“Transaction and loan losses decreased for the three months ended September 30, 2023 compared to the same period in 2022, primarily due to a decrease in losses related to Shopify Capital.”

So funding is up, losses are down, which is precisely the opposite situation that is going on at rival PayPal.

Shopify somewhat skimmed over its Shopify Capital business in its Q3 earnings announcements and on its official call except to state that it’s a strong segment that is growing.

Shopify Capital Continues to Gain Momentum

August 2, 2023Shopify Capital continues to gain momentum, according to the company’s most recent quarterly earnings call. Historically, the company has broadcast its precise business loan and merchant cash advance origination figures for each quarter but this time it held off from doing that. Instead, it emphasized that it had “$719 million in loans receivables and merchant cash advances outstanding on June 30, 2023.” As that figure came straight off the balance sheet, that could be compared to the $629M outstanding in the quarter before. So, receivables went up but originations was not disclosed.

Nevertheless, Shopify explained that Capital was among several business segments that were leading to some of highest cross-sell volumes they have ever achieved.

“The team is working tirelessly,” said Shopify President Harley Finkelstein. “They’re executing it really effectively.”

Shopify Capital’s Funding Volume Continues to Surge

May 6, 2023Shopify’s business lending and merchant cash advance division originated a whopping $477M in the first quarter of 2023. That’s up substantially from the $346.7M produced in the first quarter last year. Despite the continuous strong increase, Shopify Capital was not mentioned or even asked about during the company’s quarterly earnings call.

Shopify is a huge e-commerce business. The company generated $1.5B in revenue in Q1 and generated a net income of $68M.

Shopify Capital Seeing “Incredibly Strong Renewals From Previous Borrowers”

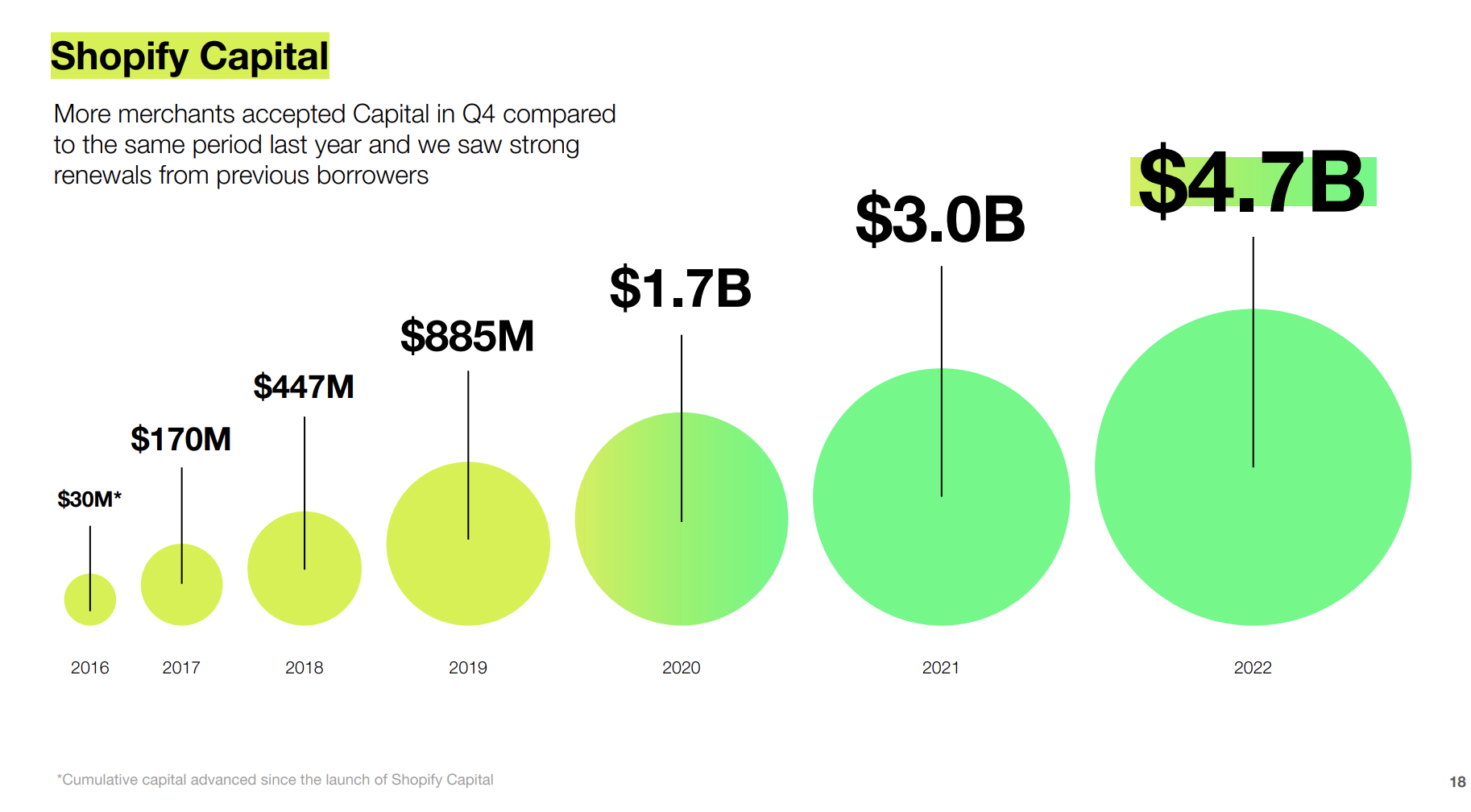

February 16, 2023Shopify Capital originated $393.2M in MCAs and business loans in Q4, an increase of 21% YoY, the company revealed. The company also began funding small businesses in Australia last year, bringing the total countries it does business in to four.

“[Shopify] Capital has acted as a lifeline for merchants, especially through the pandemic and this tough macro environment, allowing them to conveniently access capital when they need it most,” said Shopify President Harley Finkelstein. “Capital is now available in four countries, and our machine-learning algorithms to underwrite merchants keeps getting better.”

Finkelstein also noted that the company is “seeing incredibly strong renewals from previous borrowers.”

The graphic below, illustrating the cumulative growth of Shopify Capital’s originations, was shown in the company’s Q4 earnings presentation:

Paperstack?... just got a deal in where we see a company called "paperstack" is taking a variable amount daily (kind of like shopify capital)...has anyone ... |

See Post... shopify capital would probably be the best option for your friends. tell them to click settings, then shopify ... |

Which Companies are Funding for E-Commerce Businesses?... shopify) business that's been operating for a little under a year making roughly $10k/month on average., , not looking for a complicated application process - need a service that's quick (and if it's good i h... |

See Post... shopify - better yet where is this dudes problem with mr wonderful?..... $1 a cupcake in perpetuity is alot more criminal than 14% of sales for 12-18 months.... |