Lender / Broker Ecosystem Transparency Solved

What happens when a broker sends in a deal and is told it’s declined, only to find out that it was approved and funded for another broker? Usually, a very angry post on social media. The problem is that everyone wants maximum transparency, but how to get it? Who can trust who? What can be done? When will someone do it?

Well, call me insane, but I’ve taken a crack at solving it. And don’t get mad at me because I use the word blockchain because I promise this is not about crypto. Everything would still be ACH-based and recorded just as you already do it, but this little piece of tech would sit underneath it without any manual effort. All automated. No work. Also, it’s possible I’m just totally wrong or have missed some possibilities. You be the judge. Realistic or dream world?

1. Brokers and Merchants don’t need to use the blockchain or know how to use it.

2. A dev at a lender justs need to understand digital wallet addresses and a little feature about them called Non-Fungible Tokens to build or implement a third-party add-on of this. (These “NFTs” have nothing to do with art, they are just uniquely identifiable text files logged into the blockchain with metadata inside them.)

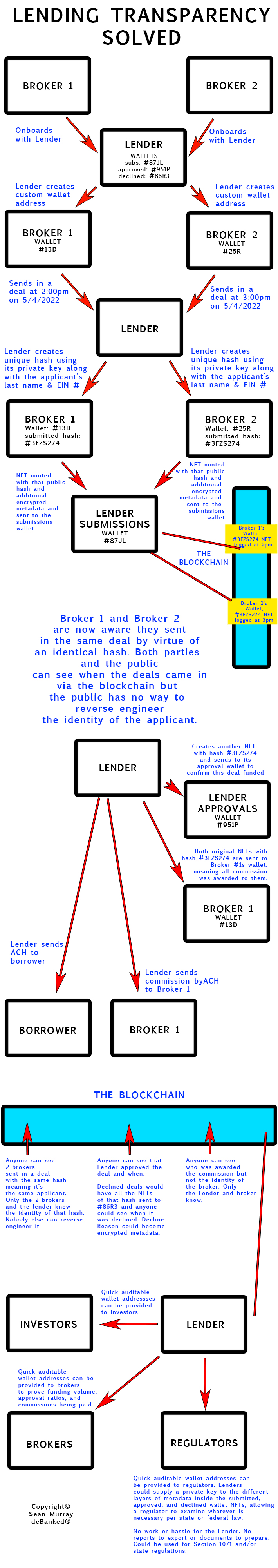

First, here’s my diagram:

Here’s what it’s doing:

1. When brokers sign up with a lender, the lender assigns a uniquely identifiable blockchain wallet address to them on an automated basis.

2. When a broker sends in a deal, the lender creates a unique encrypted hash of the applicant’s bare minimum identifiable data (like last name and EIN #). This hash is placed into a text file in plain english along with the applicant’s application data encrypted. (also automated).

3. The lender creates a Non-Fungible Token from the broker’s wallet address and sends it to the lenders’s official submission wallet. (automated). This wallet will show the NFTs for every deal ever submitted to this lender. Nobody will be able to reverse engineer info about the deals and only the broker who submitted the deal will be aware of what the hash of the deal is. This gives them a chance to view exactly when their deal was logged and if there’s any duplicate hashes in the wallet that would signal that same deal had already been submitted by someone else and when it was submitted.

4. If the deal is approved by the lender, the lender pays the broker and funds the merchant via ACH like normal. Then the lender creates an NFT with the same public hash and sends that one to its approval wallet. The original NFT sent to its submissions wallet is now sent to the broker’s wallet, signaling that they have been awarded the commission on this deal. (automated).

5. If the deal is declined, the lender creates an NFT with the same public hash and all the NFTs for this deal are sent to the decline wallet, signaling that the deal was killed and nobody was awarded the commission on it. (automated).

Every deal’s NFT has to eventually be moved to approved or declined. They can’t sit in submissions in perpetuity.

End result: brokers that submit deals can see if their deal has been submitted before and when it was submitted. Brokers can verify if the deal was funded, when, and if commissions were paid to someone. No actual money is changing hands via crypto (though there might be transactions fees to move NFTs around.) Investors and regulators can also examine the flow and if necessary, be given access to a private key so that they can unlock and view the metadata in the submissions, approvals, and declines themselves.

Naturally, everyone’s first question is: what happens if the lender tries to bypass this?

1. A broker who submits a deal that does not see an NFT created for it in the lender’s submissions wallet, already knows that the lender is trying to operate outside the system. Time to move on!

2. A lender that shows a deal was declined and commissions paid to nobody could be easily discovered if the borrower shows a statement with proof that they received a deposit. No need to speculate what happened. Time to move on!

3. A broker that submitted a deal first can show that its deal was logged first in the submissions wallet. Anyone on social media or the public square could also confirm that and the lender could not manipulate the data to play favorites.

4. Lenders that operate outside of it would show little-to-no submissions or approval volume, signaling to a broker that for some reason they do not want the anonymized data auditable.

5. Lenders that are not real that go around pretending to be a lender just to scoop up deals would be hard-pressed to provide the three verifiable wallet addresses showing the volume of submissions, approvals, declines, and the respective ratios for the latter two. If they can’t show that they’ve ever done any deals or paid commissions, even if you can’t see what the individual details are, they’re not real.

6. After a lender moves the deal’s NFT to a broker’s wallet to signal they’re being awarded the commission, it’s possible the lender does NOT actually ACH the broker the commission. In that case, the broker would have a nice verifiable public display that shows it was supposed to be paid the commission for all to see. Public pressure ensues.

7. If the lender secretly pays a broker the commission but then publicly marks the deal as declined so that another broker who sent in the same deal doesn’t suspect what happened, well then the broker who got paid is going to be suspicious that the lender could do the same thing to them. There’s an incentive to be honest.

8. Merchants need not know about any of this. It doesn’t concern them.

9. The broker does not interact with the blockchain in any way except in the case it just wanted to view the data.

10. The lender does not have to manually interact with the blockchain at all. The system would just be bolted on to an existing CRM. It would do all the above by itself.

Last modified: May 4, 2022Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.