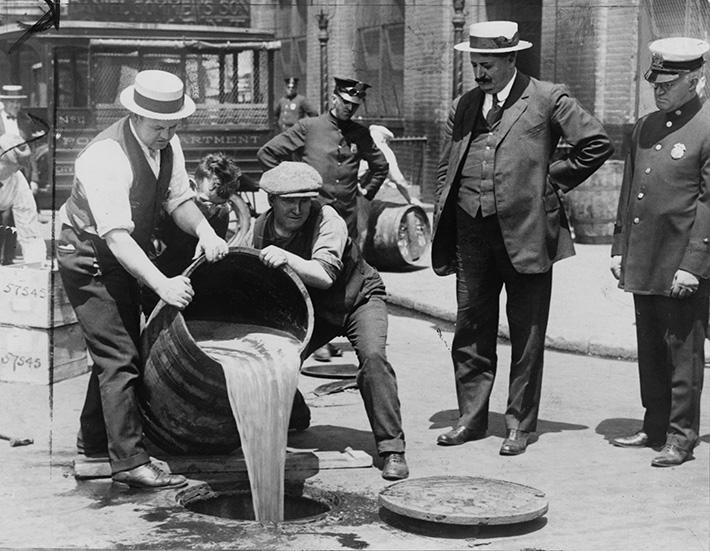

Maryland MCA Prohibition Bill Morphs Into MCA APR Limit, Broker Licensing, Double Dipping, Uniform Disclosure, and Go to Jail Bill

Update: A Recording of the Hearing is Here

Plans to enact “prohibition” in Maryland on merchant cash advance transactions abruptly came to a halt last year, but the legislature there has brought the issue back front and center in 2021, designing a system of prohibition while dropping the actual word from the name.

Plans to enact “prohibition” in Maryland on merchant cash advance transactions abruptly came to a halt last year, but the legislature there has brought the issue back front and center in 2021, designing a system of prohibition while dropping the actual word from the name.

No MCA transacted in the state would be permitted to have an estimated APR that exceeds 24%, for example. The penalty for violating such a statute can be imprisonment for up to 3 years.

Newly introduced House Bill 664 (SB0532) would “prohibit a person from engaging in the business of making or soliciting a sales-based financing transaction unless the person is licensed by the Commissioner of Financial Regulation” and would require that an applicant “for a license having $20,000 in available liquid assets and to have demonstrated a sufficient level of responsibility to command public confidence and warrant faith in the honest operation of the business.”

The 26-page bill includes a laundry list of requirements and restrictions like specific disclosures, how to calculate a forward-looking estimated APR on an MCA, and a limitation of 24% on that APR.

The bill draws heavily from the recently passed law in New York, going so far as to copy and paste the section requiring MCA funders to disclose if there is literally any “double dipping” in the contract.

The Commissioner of Financial Regulation would retain sole authority to judge compliance with the law.

A House committee hearing on the bill was conducted yesterday and a subsequent one in the Senate is scheduled for February 23rd at 1pm.

You can read the full version of the Maryland House Bill here.

Last modified: February 23, 2021Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.