Archive for 2020

OnDeck Directors Sued in Class Action For Allegedly Withholding “Material Information” From Shareholders To Make Enova Deal Happen

September 8, 2020 An OnDeck shareholder is asking the Delaware Court of Chancery to halt the sale of the company to Enova until OnDeck discloses allegedly material information that would appear to put the landmark deal in an entirely new light.

An OnDeck shareholder is asking the Delaware Court of Chancery to halt the sale of the company to Enova until OnDeck discloses allegedly material information that would appear to put the landmark deal in an entirely new light.

On September 4, Conrad Doaty filed a class action lawsuit against Noah Breslow, Daniel S. Henson, Chandra Dhandapani, Bruce P. Nolop, Manolo Sánchez, Jane J. Thompson, Ronald F. Verni, and Neil E. Wolfson for breaching their fiduciary duties owed to the public shareholders of OnDeck.

According to Doaty, the Enova offer of $90 million ($82 million stock, $8 million in cash) was not even the best bid that OnDeck received but he alleges that OnDeck’s directors and executives took it because they were individually offered “exorbitant personal compensation” including “millions of dollars in severance packages, accelerated stock options, performance awards, golden parachutes and other deal devices to sweeten the offer.”

Doaty makes reference to other bids for OnDeck with specifics including two all-cash offers, one that valued OnDeck at between $100 million and $125 million and one that valued it at between $80 million and $110 million. He says that no explanation for their rejection was disclosed.

Doaty also alleges that OnDeck relied on two sets of financial projections to evaluate a sale of the company, one for all prospective bidders (that projected a quick economic recovery) and another set that was used only for Enova (that projected a slow economic recovery). Doaty’s point is that Enova’s valuation was based on less optimistic data and that OnDeck did not publicly disclose to shareholders the more optimistic version that all the other prospective buyers of the company got to see.

“Most significantly, is that it is not pressing time to sell,” Doaty says. “The company was not facing imminent financial collapse or financial ruin.” He continues by pointing out that the company had $150 million of cash on hand and that it had successfully navigated workouts with its creditors over issues caused by the pandemic.

“Yet as a result of the frantic and unreasonable timing of the sale, the consideration offered for OnDeck is woefully inadequate.”

In addition to “exorbitant personal compensation” promised to the Board members, Doaty argues that a cheap price benefits parties who sat on both sides of the transaction, namely Dimensional Fund Advisors LP, BlackRock, Inc., and Renaissance Technologies, LLC, all of whom are said to hold greater than 5% beneficial ownership interest in both OnDeck and Enova. None of them are named as defendants.

“…even if the exchange ratio is unfair,” Doaty argues, “those institutional investors will still benefit from seeing their positions in Enova benefitted. Non-insider stockholders, on the other hand, will not be parties to the benefit.”

The law firm representing the plaintiff in Delaware is Cooch and Taylor, P.A.

Case ID #: 2020-0763 in the Delaware Court of Chancery.

You can download the full complaint here.

As an aside, deBanked mused two days prior to the filing of this lawsuit that the sales price of OnDeck was so low that early OnDeck shareholders stand to recover less of their investment as a result of this deal than investors in a rival company that was placed in a court-ordered receivership by the SEC.

What Stimulus is Next for SMBs?

September 4, 2020 Next week, lawmakers will finally be back from vacation, arguing over the next stimulus package. There are various proposals, and the two competing Republican and Democrat offerings are nearly a trillion dollars apart.

Next week, lawmakers will finally be back from vacation, arguing over the next stimulus package. There are various proposals, and the two competing Republican and Democrat offerings are nearly a trillion dollars apart.

It’s the Senate GOP HEALs act vs. the House Democrats HEROs act. But in between, what may be getting the most support? Standalone bipartisan bills that focus on extending and forgiving PPP loans.

Ryan Metcalf, head of the office of Government affairs and Social Impact for Funding Circle, has been following conversations on The Hill closely.

“Up until Monday, Pelosi said they weren’t even going to even put a bill forward for a new stimulus,” Metcalf said. “But then yesterday [Tuesday] Secretary Mnuchin said he was open to doing a standalone PPP loan. It’s the one that has the most bipartisan support; they can’t meet anywhere else than PPP.”

Funding Circle is one of the world’s largest online lenders, with about $10 billion in global loans to date. Metcalf said Funding Circle mostly offers US loans in the $25,000 to $500,000 range, and as a funder for PPP, offered more loans in just eight days in August than half of their total business in July. His company had to cut off funding requests, locking out some customers that needed help, simply because the deadline had ended.

“When PPP ended on August 8th, the narrative was that PPP had died out, and there was no interest in it, but that is a complete fallacy,” Metcalf said. “We were processing loans for the smallest of small businesses- 10-15 employees- well under $50,000 loans, the people still needed help.”

Steve Denis, Executive Director of the Small Business Finance Associaton (SBFA), has also been engaged in the process. He has been petitioning members of Congress on behalf of what he calls truly small business, those under 10 employees or nonemployers that still need help.

“‘Real’ small businesses: ones with under ten employees that are really grinding, like small hair salons, retail stores, and mechanics don’t really have traditional banking relationships,” Denis said.

SBA data from July found that most of the loans made (66.8%) were in the $50k range and to very small businesses, but the largest amount of capital went towards firms that applied for a $350k-$1M sized loan.

Denis said that the higher dollar amount PPP loans were more profitable for banks to make, so disproportionate funding went toward bigger businesses with pre-established finance connections. This disparity is backed up by research. Studies, like one from the National Bureau of Economic Research (NBER), found that firms with stronger connections to banks were more likely to be approved for PPP funds.

“The way fees are structured: there’s an incentive for big banks to prioritize bigger deals at [commission] rates like 3% or 5%,” Denis Said. “They’d rather make that on a $500,000 deal than on a $40,000 deal.”

Denis said the SBFA was lobbying for Congress to create a prioritized amount of money authorized only for smaller loans, under $100,000-$150,000, to focus on those really small businesses with less than five employees.

Like Metcalf, Denis sees the most likely outcome is an extension of PPP- at least until the end of the federal fiscal year budget in September. If the Fed cannot agree on a budget, the government will go into shutdown- and this year would be the worst time to shut down.

“The only thing that motivates Congress to move big legislation like this are deadlines; there’s a big deadline coming up,” Denis said. “At the end of September, the fiscal year runs out and there needs to be a budget agreement.”

Metcalf said that the next round of PPP programs need to make sure businesses can get their first loan if they haven’t already, and streamline the loan forgiveness process to keep the SBA from getting overwhelmed.

Metcalf said that the next round of PPP programs need to make sure businesses can get their first loan if they haven’t already, and streamline the loan forgiveness process to keep the SBA from getting overwhelmed.

“We need a forgiveness bill that streamlines the process; lenders will not have the resources to process forgiveness, a first PPP and second PPP as it is,” Metcalf said. “In my call with the SBA two weeks ago, they said for processing new 7(a) lender applications and all the other business they do to resume their normal business we’re looking at six months.”

The PPP proposal that Metcalf likes the best is called the Paycheck Protection Small Business Forgiveness Act, which stipulates a one-page forgiveness form for all loans made under $150,000. Metcalf said he saw support from a bipartisan group of over 90 members of Congress.

Another opportunity is the Economic Injury Disaster Loan (EIDL) program- offering long term loans to businesses with less than 500 employees that need financial help. Both Denis and Metcalf encouraged business owners to check out the program, which offers loans directly from the government without the need to prove forgiveness.

In the end, Denis said he was interested in the Republican “Skinny Bill” that is a cheaper breakdown of the GOP HEALS Act, but he said it is all up in the air.

“This is just me guessing,” Denis said. “I have talked to these people every day, but even members of Congress on Capitol Hill have no clue what’s going to happen.”

What is ‘Lending as a Service?’

September 3, 2020I‘ve heard of SaaS, but now there’s LaaS, Lending as a Service. I recently spoke with Timothy Li, CEO of Alchemy, a fintech infrastructure company that offers that and more. You can check it out below!

Lendini is Back

September 2, 2020 Bensalem, PA –September 3, 2020– Lendini is excited to announce its return to small business funding. Through superior efficiency and analysis, the company has improved the process of alternative funding from some of the brightest minds in finance, technology and analytics. With updated (temporary COVID-19) guidelines, they remain dedicated and committed to their merchants and ISOs in these unprecedented times.

Bensalem, PA –September 3, 2020– Lendini is excited to announce its return to small business funding. Through superior efficiency and analysis, the company has improved the process of alternative funding from some of the brightest minds in finance, technology and analytics. With updated (temporary COVID-19) guidelines, they remain dedicated and committed to their merchants and ISOs in these unprecedented times.

Lendini works directly with you to prepare the best package for your client, whether that be a Business Cash Advance (BCA) or Merchant Cash Advance (MCA). Simply put, Lendini advances money based on the average monthly gross sales of a business or average monthly credit card sales. Money can be advanced quickly because securing assets and collateral is not required.

Get clients funded in 4 easy steps; application submission, information review, approval or denial, final review and your client is funded. Minimal documentation is required. The company must have 18 months in business with $7,500 per month in gross sales and an average daily balance of $750. We require a minimum of 5 deposits, monthly into the business bank account.

Funding Stipulations:

- Bank login

- Funding call with merchant

Required Documents:

- Application

- All 2020 business bank statements + MTD

- Signed and dated agreement

- Proof of business existence

- Meets state registration requirements

- Proof of ownership

- Merchant interview

- Driver’s license

- Voided check (starter checks will not be accepted)

Industries accepted:

- Restaurants (with takeout)

- Pharmacies

- Healthcare

- Manufacturing

- Transportation (freight)

- Healthcare (primary care)

- Automotive repair

- Grocery stores

With $540 million dollars funded to 15,000 small businesses, Lendini offers incomparable solutions customized specifically for your client. The company prides itself in being able to offer up to $300,000 in as little as 1 business day (in most cases). Funding can be used for any business purpose you may have.

Lendini is not a bank and does not provide loans, they offer cash advances. With Lendini, business owners receive the capital they need without lengthy delays or excessive paperwork. In general, Lendini offers pre-approvals in under three hours and next day funding of approved advances. The staff provides unparalleled customer service and treats each business owner with the respect they deserve.

Ocrolus Named #1 Fastest Growing Fintech By Inc.

September 1, 2020 Ocrolus, a document analytics company, was recently named Inc.’s #1 fastest growing fintech company in the US and #1 fastest growing software company in NYC. The rating is based on percentage revenue growth between 2016 and 2019. Ocrolus placed as the #30 fastest-growing private company in America overall.

Ocrolus, a document analytics company, was recently named Inc.’s #1 fastest growing fintech company in the US and #1 fastest growing software company in NYC. The rating is based on percentage revenue growth between 2016 and 2019. Ocrolus placed as the #30 fastest-growing private company in America overall.

Ocrolus was founded in 2014 and has grown by 8,000% to become an industry-leading document scanning platform. Automating document applications for partners like BlueVine, Cross River, and Square, Ocrolus recently facilitated 761,455 small business applications for PPP loans.

So what sets Ocrolus apart? CEO and Co-Founder Sam Bobley credits the growth factor on just how fast and accurate the Ocrous API is.

“Lenders who were not using Ocrolus were not able to get to underwriting decisions as fast as lenders that were using Ocrolus- we saw a domino effect,” Bobley said. “Once we got a few big consumers on the platform, we were able to quickly onboard more and more funders and help them increase speed in their underwriting process.”

Bobley also said that while competitor document applications struggle with the accuracy at which they can read documents, landing somewhere in the 70-85% accuracy area, Ocrolus boasts more than 99% accuracy.

Success snowballed, and Ocrolus was helping grow businesses. The API directly addresses many financial institutions’ problems with scale- typically, more applications require more manpower to sift through paperwork.

“Typically, when a customer starts using our platform, within one year of using our platform, they double their volume, and within two years they quadruple,” Bobley said. “One of the reasons for that is they no longer have to staff up and deal with the operational complexities of handling the fluctuating volume of loans.”

With Ocrolus plugged in, customers were free from a major operating cost, and could go all out taking on new clients- which would mean more paperwork to process with Ocrolus.

Today, the company employs more than 900 team members across four offices but was founded in New York City. And like Seinfeld, Bobley loves the city, especially as a thriving hub for fintech activity.

“There’s no better place to do it than in the heart of the financial center of the US here in New York City,” Bobley said. “We’re right near where a lot of our lender customers are operating.”

On the news of recent acquisitions and reports that companies like PayPal and Intuit are ramping up their involvement in small business lending, Bobley said he sees larger entities in fintech as an opportunity for pricing transparency and better access to capital.

“I think the headline here is that financial services firms are recognizing that there’s a significant amount of businesses that used to be underserved,” Bobley said. “The bigger players are raising their eyebrows and want to get more involved, which in my opinion will be ultimately good for small business.”

And when it came time for Ocrolus to do its part for small business, Bobley said that more than 430,000 PPP applications of the 761,455 that were made using their partner network got approved, saving an estimated 1.5 million jobs.

“It’s always great when you know you can connect your work to a greater purpose for the community, so it’s really just a cool rewarding experience,” Bobley said. “It’s been fantastic, but we think we’re still in the early innings in terms of what we can do as a company- not just in small business lending but also in consumer mortgage and auto.”

Become CEO Eden Amirav Speaks Optimistically About Kabbage and OnDeck Acquisitions

August 31, 2020 Eden Amirav, CEO and co-founder of Become, shared his optimistic insight into what the recent round of acquisitions in the fintech lending world might mean. With the purchase of Kabbage by AMEX and OnDeck by Enova, the industry is moving toward consolidation.

Eden Amirav, CEO and co-founder of Become, shared his optimistic insight into what the recent round of acquisitions in the fintech lending world might mean. With the purchase of Kabbage by AMEX and OnDeck by Enova, the industry is moving toward consolidation.

“For many years, we saw many different players and high competition, now we’re starting to see consolidation,” Amirav said. “When a big player like AMEX puts in close to $1 billion [allegedly] in an acquisition of the IP and tech of Kabbage- an amazing technology for underwriting- we think that it’s a very good sign of belief in the industry, it shows the huge potential that AMEX sees in it.”

Eden said from the beginning, Become was happy to be a part of the journey of Kabbage as a partner.

Become is a company that empowers small businesses to improve their fundability and choose lending options through proprietary tech that rates businesses for their loan potential. Become has been a partner with Kabbage in the past, the company says.

Last year, Become underwent a rebranding, adopting a contact-free tech-only mindset. Needless to say, that move came with some unforeseen benefits- contact-free finance is now the name of the game.

Become partnered with Kabbage for loan facilitation in PPP, and Amirav said it was a huge opportunity for alternative finance.

“At the beginning [of the pandemic] there was no supply – practically all the lenders stopped lending,” Amirav said. “We built a very quick process that allows small business to sign the PPP and get the forms ready and get access to the funds as quickly as possible.”

Amirav said that it is because of the dire need for capital and traditional institutions’ inability to respond that alternative fintech markets became so attractive. He hopes that through the purchase, Become will have the opportunity to keep working with Kabbage and feature AMEX on the platform.

“Now that PPP is over we will start seeing alternative lending come back with a more important role- and I think the fintech lending industry as a whole has proven that it has an important role in assisting small business,” Amirav said. “Banks are serving big companies and traditional clients, fintech companies are really there to serve the mom and pop shops.”

BlueVine is Back and Now With Business Checking Accounts

August 28, 2020 BlueVine, a leading small business lender, has resumed its normal services after generating $4.5 billion in PPP loans to more than 155,000 businesses. The company had continued to offer its normal lending products even while others in the industry paused completely, the company says. Herman Man, the chief product officer, said that BlueVine has also fully launched a small business checking account platform.

BlueVine, a leading small business lender, has resumed its normal services after generating $4.5 billion in PPP loans to more than 155,000 businesses. The company had continued to offer its normal lending products even while others in the industry paused completely, the company says. Herman Man, the chief product officer, said that BlueVine has also fully launched a small business checking account platform.

“Our goal always was to be that small business banking platform,” Man said. “Last year at Money 20/20 we announced we were going to build a small business checking account. Recently, we launched it post-COVID, derailing our plans. We have a breadth of offerings now, and we are that small business platform.”

BlueVine also released a survey this week of more than 800 small business owners to learn what they need most in an ever-changing market. Their findings supported their online product offering. Distressed by COVID-19, the respondents reported an overwhelming interest in reliable customer service, day to day support, and fee-less transactions.

77% of small business owners surveyed reported demand for direct guidance in day-to-day accounting. In the face of an emergency, many respondents noted that banks were more interested in new customers than servicing current customers.

Following this emergency support trend, nearly nine out of ten or 87% of small business owners said access to emergency credit was necessary from the same bank providing them regular service. Accessing credit from the same provider was not just important, but over half or 64% reported it was exceptionally so.

Finally, 58% of business owners reported that a lack of overdraft, monthly, or maintenance fees were the essential features a business checking accounts could offer.

With the launch of a checking account platform, BlueVine can service the needs of these businesses, offering one common platform that connects factoring services, payments services, and now credit and banking services.

“If a small business wanted to take a line of credit and do it on a Friday night, using our algorithm and things that are automated, it could run through our system; if they get approved, money would be transferred into their checking account instantaneously,” Man said. “This isn’t something they have to wait until Monday morning. It will land immediately, so that’s a huge game-changer.”

Banks, Non-Banks, Fintech and More Came Through for Lendio on PPP, But it Wasn’t Easy

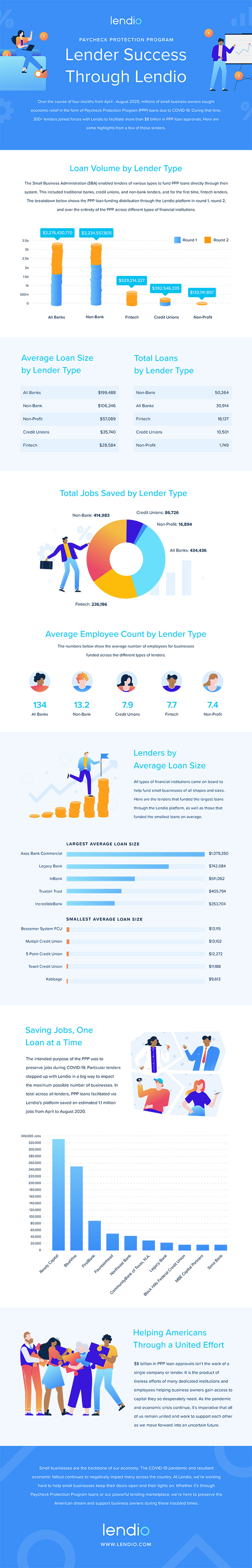

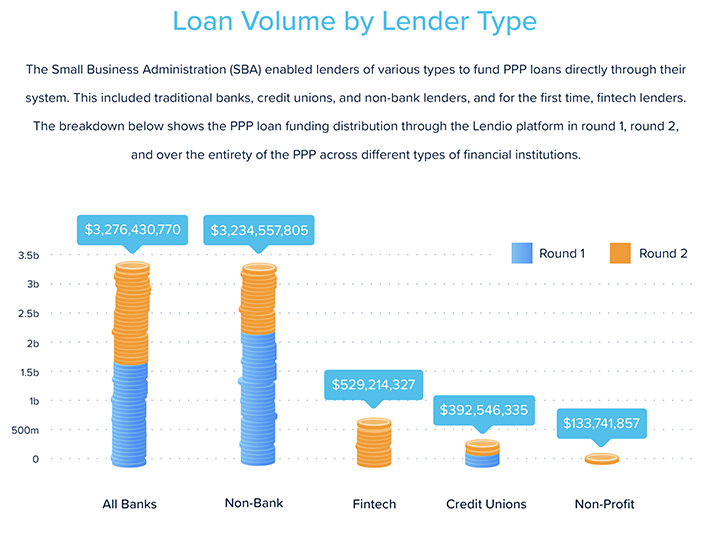

August 27, 2020 Last week, Lendio, a facilitator of small business loans, released a report analyzing the $8 billion of PPP loans that were approved through its lending platform. A coalition of more than 300 lenders was able to give aid, saving an estimated 1.1 million jobs, Lendio indicates.

Last week, Lendio, a facilitator of small business loans, released a report analyzing the $8 billion of PPP loans that were approved through its lending platform. A coalition of more than 300 lenders was able to give aid, saving an estimated 1.1 million jobs, Lendio indicates.

Through Lendio’s service, traditional banks approved the most funding at $3.3 billion- or about 44% of the PPP dollars on the platform. Though non-bank lenders secured the highest number of approvals at 50,264 transactions in lesser dollar amounts.

Fintech lenders funded 6% of the total loan volume through the platform.

Lendio was well situated to facilitate lending from institutions to those that needed help through funds provided by the SBA. Brock Blake, CEO, and co-founder of Lendio, said the company’s success in delivering on PPP was no accident— they had to remove all stops and almost bet on the success of the PPP program.

“Our mission at Lendio is normally ‘Fueling the American Dream’: helping the American business owner accomplish their dream,” Blake said. “We tweaked our mission during this timeframe to ‘Saving the American Dream.'”

Blake said while other companies were closing their doors and sending off employees on furlough, Lendio took on 250 new hires- and buckled down for thousands of hours of engineering work to overhaul their system. Not just loan sales, but legal processes, onboarding, training, and backend tech work had to be updated in just days.

This all came on fast, but so did the quarantine. Beginning in April, more than 100,000 business owners applied for economic relief under the PPP using Lendio’s online marketplace.

The demand for capital was outrageous.

“It was more demand in one weekend than the SBA had seen in the last 14 years combined,” Blake said. “We were helping these business owners that were watching their entire lifes’ work flushed down the drain in a matter of weeks, and they were desperate for capital.”

Lendio was finding that many institutions could simply not handle the volume, Blake said, and he knew if banks were only able to process loan requests for their current customers, there would be an exploding demand for loan processing. The company took on 100 new partners who needed help during this time.

“Our systems were tested to their limits, like 1000 times more pressure than we ever saw before,” Blake said. “Some partners of ours got so much demand they couldn’t handle it and turned off their spigot. So we scrambled to find lenders that would take on new customers.”

Though it was ten times more challenging than anything Blake has done in his career, it was ten times more satisfying. Lendio doubled the number of loans it has issued since 2011, and quintupled the dollar amount the platform facilitated in just four short months. Where are they going to go from here?

For one, Lendio is one company out of many that are hoping for another round of PPP funding. Blake said he is getting customer feedback all the time asking for help, dealing with quarantine regulation that is harming business, like restaurants that have nowhere to seat patrons.

Outside of PPP, Blake said that many of the 110,000 businesses they served are now applying for other loans, or using Lendio’s bookkeeping and loan forgiveness applications. Lendio is happy to help business owners and banks through this tough time by launching digital applications.

“Before, lenders across the country were requiring business owners to come into branches [with] paper applications,” Blake said. “Now, there’s not one business owner in America that wants to walk into a bank branch. The demand for lenders to go digital is as high as it’s ever been.”