Declined For Funding? Lack of Time in Business Beats Out Lack of Credit Worthiness

A study conducted by Square Capital and the Stevens Center for Innovation in Finance at the Wharton School at the University of Pennsylvania, pulled back the curtain on small businesses and the financing process.

A study conducted by Square Capital and the Stevens Center for Innovation in Finance at the Wharton School at the University of Pennsylvania, pulled back the curtain on small businesses and the financing process.

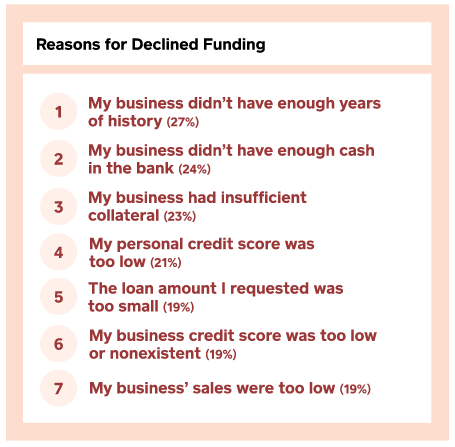

Notably, the #1 reason that businesses said they had been declined for funding (regardless of the source) wasn’t credit, it was that they hadn’t been in business long enough.

#2 was (ironically) a lack of cash in the bank.

#3 was insufficient collateral.

Personal credit worthiness and business credit worthiness ranked #4 and #6 respectively.

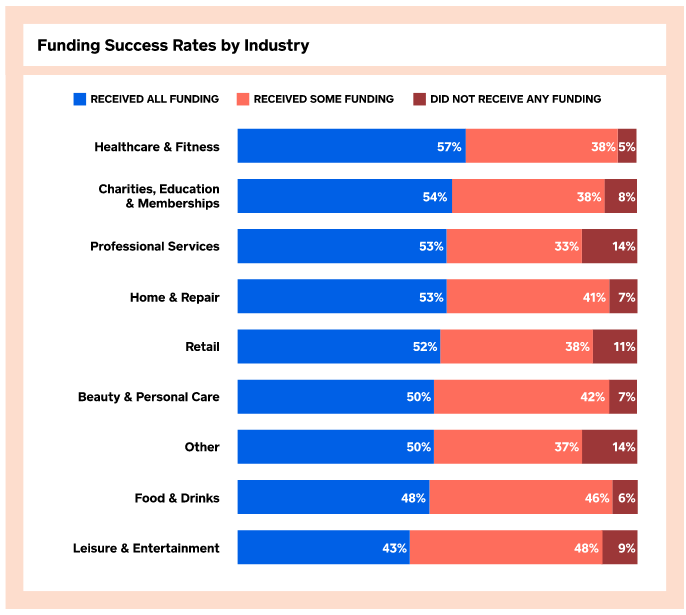

These findings were one of many in the report published by Square last week. Among other key details were that healthcare & fitness businesses were the most likely to receive all the funding they sought whereas leisure & entertainment businesses were the least likely to receive all the funding they sought.

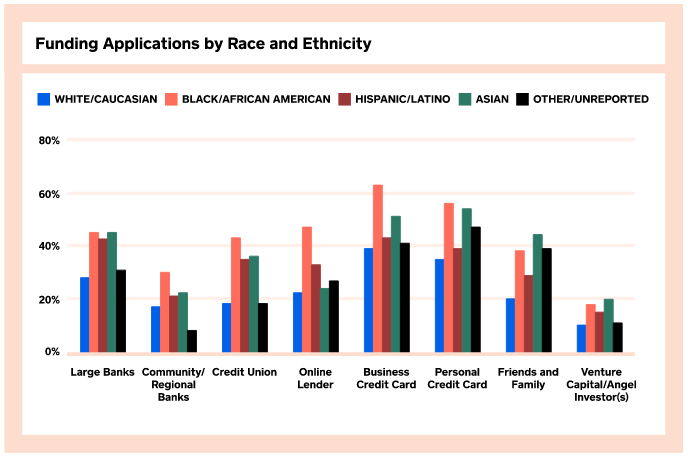

Black/African American business owners were more likely to apply for financing in the last 12 months than any other ethnic/racial group. A chart in the report shows that they were more than twice as likely to apply to an online lender or credit union than white business owners.

The full Square Capital report can be viewed here.

Last modified: January 20, 2020