Apple’s Credit Card Looms Despite No Clear Launch Date

“A new kind of credit card. Created by Apple, not a bank.”

“A new kind of credit card. Created by Apple, not a bank.”

Now plastered across Apple’s website, these words signal the company’s next advancement into finance with Apple Card, the new credit card service it is launching later this summer. And they’re only half true.

While it is a novel take on credit cards, it’s not entirely free of banking’s influence, as Goldman Sachs has partnered with Apple for it. According to Margaret Keane, CEO of Synchrony Financial, the largest provider of store credit cards, there “were a lot of us” bidding for the partnership with Apple, “us” being banks and card providers, but Goldman came out on top.

The spoils of war being won in this case are a 2023 earnings-per-share gain of 2% by 2023 for Goldman, as well as the responsibility of managing all card payment disputes. The latter of which being an anomaly amongst Apple services, as the company has a history of overseeing all aspects of the customer experience.

What Apple stands to gain in comparison is a 1% gain by 2023. Being below the industry average, neither of these forecasts are something to be excited about. But these figures aren’t surprising, with the card offering no fees and low interest rates it appears as if Apple Card will be launched with the hope of staking some of the market share rather than seeing profits soar.

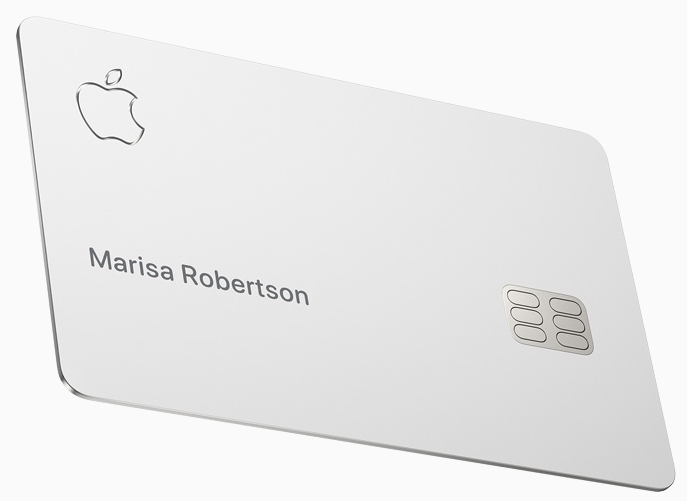

Offering financial statements and analysis via an app, as well as being available in two forms, a digital card in Apple Wallet and a titanium card that features no numbers on it, front or back, Apple Card bares a striking similarity to the recent trend of app-based banking witnessed in Europe, with the likes of N26 and Revolut booming in popularity in previous years.

Where Apple differs from these companies is that it specializes in credit, thus it offers a range of features unique to both the format and their position as a near-omnipresent tech giant. Auto-fill integration with Safari; cash back on each purchase made with Apple Card, being 3% on any Apple products purchased, 2% on non-Apple purchases, and 1% when using your Apple Card at a vendor who doesn’t accept Apple Pay; an APR range of 13.24-24.24; and options for when you’d prefer to pay your interest, complete with clear payment schedules, are all being promised. As well as this, Apple is hoping to combat the common inconvenience of cryptic merchant names that pop up in statements. Jennifer Bailey, Vice President of Apple Pay, explained that “With Apple Card we use machine learning and Apple Maps to transform this mess into names and locations that you’ll recognize.”

All of this was outlined back in March, when Tim Cook took to the stage in Cupertino, California to claim that Apple is making the “most significant change” to credit cards in five decades. But months have passed since this assertion, and as the vague release date of “summer” offers no specificity to Apple fans who are holding their breath, those who are curious about Apple Card are left to be satisfied by the infrequent reviews that slip out from Apple employees who are enrolled in the program’s beta.

We’ll find out if the wait will be worth it sometime soon, probably, but until then there’s always the 1986 Apple credit card that can be ogled at until Apple Card is released to the public.

Last modified: July 14, 2019Brendan Garrett was a Reporter at deBanked.