‘Peers’ Are Almost Gone From Lending Club’s Funding Mix

Long gone are the days of peer-to-peer lending.

Long gone are the days of peer-to-peer lending.

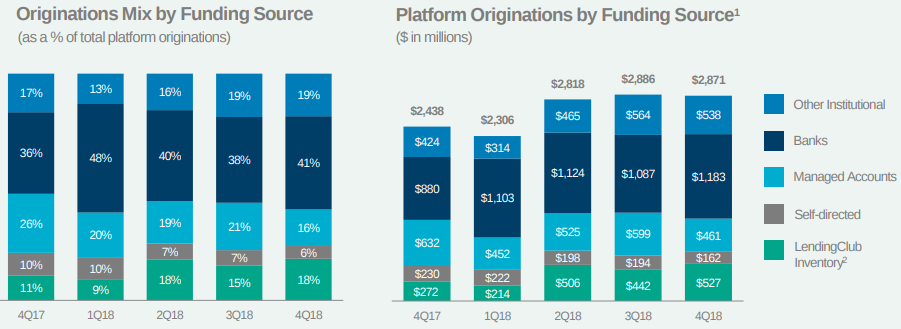

On Tuesday, Lending Club, a pioneer in the peer-to-peer lending space, reported that only 6% of its Q4 originations came from individual self-managed accounts. Accounts professionally managed for individuals made up 16%, with the rest of the loans being funded by a combination of banks, institutions, and Lending Club itself.

Nearly 4 years ago, the ratio was flipped. Self-managed accounts made up 24% of originations in early 2015 and accounts professionally managed for individuals made up 51%.

Despite the changes, Lending Club still identified itself as a “marketplace connecting borrowers and investors” in its Q4 2018 earnings report. A review of the site revealed that it is still possible for individual investors to manually review unfunded loans on the platform and invest in them, though it prods investors to rely on Lending Club’s automated investing strategy instead. The implication for manual investors is obvious, that banks, institutions, automated investment algorithms, and Lending Club itself are more likely to fully fund the best borrowers before the individual has a chance to even see them on the platform.

According to the blog of LendItFintech co-founder Peter Renton, Lending Club is producing among the lowest returns of any platform in the field, with his own accounts generating from 1.57% a year to 4.35% a year.

Last modified: February 20, 2019