Archive for 2017

CIM Commits Additional $100M to Funding Circle to Help Fuel Small Businesses

March 1, 2017SAN FRANCISCO, March 1, 2017 /PRNewswire/ — Funding Circle, the world’s leading lending platform focused exclusively on small business, today confirmed Community Investment Management (“CIM”), an impact investment firm focused on marketplace lending, will finance an additional $100 million in loans to businesses originated through Funding Circle in the U.S.

The multi-year agreement, which extends the existing relationship between Funding Circle and CIM, will allow Funding Circle to provide a much-needed, further injection of capital into America’s small business sector.

“We are thrilled to extend our partnership with CIM, who shares our values and mission to help small businesses grow and thrive,” said Sam Hodges, co-founder and US managing director at Funding Circle. “Together, through this additional investment, we can help even more businesses access the transparent and responsible financing they need to stimulate job creation and economic growth in their local communities.”

Since launching in 2010, investors at Funding Circle – including 60,000 individuals, financial institutions, government, and the listed Funding Circle SME Income Fund – have helped more than 25,000 businesses globally access $3 billion in transparent and affordable financing. CIM was one of Funding Circle’s earliest institutional partners in the U.S.

“Funding Circle is a leader in innovative lending to small businesses who are underserved by traditional lenders,” said Jacob Haar, Managing Partner at CIM. “We are pleased to expand our relationship to further empower small businesses across the United States with responsible financing.”

About CIM

Community Investment Management (“CIM”) is an impact investment firm focused on marketplace lending. CIM provides responsible and transparent financing to small businesses in the United States in partnership with a select group of technology-driven lenders. CIM combines experience, innovation, and values to align the interests of small business borrowers and investors. More information is available at http://www.cim-llc.com.

About Funding Circle

Funding Circle (www.fundingcircle.com) is the world’s leading lending platform for business loans, matching small businesses who want to borrow with investors who want to lend in the UK, US and Europe. Since launching in 2010, investors at Funding Circle – including 60,000 individuals, financial institutions, the listed Funding Circle SME Income Fund and Government – have lent more than $3 billion to 25,000 businesses globally. Funding Circle has raised $373m in equity capital from the same investors that backed Facebook, Twitter and Airbnb.

Lendio Announces First-of-Its-Kind Marketplace Lending Franchise Program

March 1, 2017Lendio, the nation’s leading marketplace for small business loans, today announced it is expanding the reach and availability of its small business lending options with the launch of a new franchise program.

The Lendio franchise program complements the company’s core value of helping small business owners fuel the American Dream. Through this program, franchise owners across the country can ease the financial hurdles for small businesses in their local community. Lendio franchisees get access to Lendio’s marketplace and technology, comprehensive training, branded marketing tools and national advertising, partnerships, and access to Lendio’s franchise support team to help coach small business owners through the lending process.

“We are thrilled to extend the availability of our online loan marketplace through our franchisees to an even broader group of small businesses who may not have been aware of the range of loan options available to them,” said Brock Blake, CEO and founder of Lendio. “With 80 percent of small business loan applications being rejected by traditional banks, now more than ever, small business owners need access to various sources of funding. Having a local presence will help bridge the awareness and trust gap for small business owners, helping borrowers position themselves and their companies for a great future.”

Ben Davis, Chief Franchising Officer at Lendio, will lead the franchise program. Together, Lendio and Davis will expand the company’s local presence and offer services to a new segment of small business owners through local franchisees, bringing options, speed and trust to Main Street, the backbone of America’s economy, in a way that has never been done before.

“Lendio’s investment in franchising meets the classic definition of an organization putting its money where its mouth is,” Davis said. “To Lendio’s already powerful online marketplace, Lendio franchisees bring a wealth of knowledge about local businesses and their capital requirements. They are connected to their communities and uniquely driven to build great neighborhoods and strong local economies.”

Lendio helps small business owners find working capital through its online platform. With a network of over 75 lenders offering multiple loan products, Lendio’s marketplace matches small business owners with various loan options. Today’s announcement comes on the heels of Lendio announcing an 87 percent annual increase of loans originated through its platform, which has facilitated more than $240 million in loans to date.

Lendio currently has franchisees in five territories, with significant interest in many others. Partners Kyle Bohrer and Bryan Gealy, in Erie, Pennsylvania, joined Lendio as the first franchise owners. Bohrer has been in the small/mid-sized business marketplace for over 10 years. Located in the Great Lakes region, Bohrer has been working on saving Erie small business owners money on their shipping. By becoming a Lendio franchisee, they are able to support businesses with their financing needs and help their community turn the corner economically.

“We will consult with potential customers looking to create new businesses and ones looking to expand, grow or just stay afloat,” Bohrer said. “Erie is my hometown, so becoming a Lendio franchisee allows local small business owners to work with someone in their community who knows their needs, challenges and potential opportunities.”

For more information about Lendio’s franchise program, visit: https://www.lendio.com/franchise.

About Lendio

Lendio is a free online service that helps business owners find the right small business loans within minutes. The center of small business lending, our passion is fueling the American Dream by uniting the small business loan industry and bringing all options together in one place, from short-term specialty financing to long-term low-interest traditional loans. Our technology makes small business lending simple, decreasing the amount of time and effort it takes to secure funding. More information about Lendio is available at http://www.lendio.com.

# # #

In The UK, Regulators Advise Where The Line Between Banks and Non-banks Lies

March 1, 2017Online lenders shouldn’t be borrowing money from other online lenders and using that money to lend, the Financial Conduct Authority in the UK warned on Tuesday. Doing so without regulatory permission, they explained, would constitute accepting deposits and be a criminal offense.

A copy of the official letter signed by Jonathan Davidson, Director of Supervision – Retail and Authorisations, is publicly available.

According to the Financial Times, the warning was prompted after RateSetter asked the government in October 2016 if such activity was acceptable. They had been engaged in such wholesale lending, as it’s called, since 2016 but have since stopped.

Prosper, A Marketplace for the World’s Richest Banks and Billionaires?

February 28, 2017

Credit Suisse, Deutsche Bank, Goldman Sachs, Morgan Stanley, and funds tied to some of the world’s richest billionaires (including George Soros) all make up the “consortium of institutional investors” and “syndicate of lenders” involved in Prosper’s recently announced landmark deal. The terms allow for the investors to purchase up to $5 billion of loans on the platform while the lenders will provide warehouse financing up to $1 billion. It’s safe to say that this is not your father’s peer-to-peer lender.

The WSJ reported too that investors will receive warrants to buy equity in Prosper that’s tied to the amount of loans they buy, all the way up to 35% of the company if they buy the full $5 billion.

Prosper used to call itself a “peer-to-peer lending marketplace” but these days it’s adopted a slightly different label, “consumer lending marketplace.”

Back in July, I half-jokingly scoffed at the phrase marketplace lending as the industry had begun to call itself, seeing that it was morphing into just Wall Street lending after Goldman Sachs announced it would actually be launching an online consumer lending arm to compete against Lending Club and Prosper.

The deal is obviously great for Prosper, whose future seemed kind of up in the air, but it’s hard to get excited about the world’s biggest banks and richest funds now being the consortium behind an online lender who pioneered peer-to-peer lending, if things like peer-to-peer lending excited you.

To be fair, peers/retail investors can still invest on the platform too so I guess there’s that.

Prosper Marketplace Closes Loan Purchase Agreement for up to $5 Billion of Loans with Consortium of Institutional Investors

February 27, 2017SAN FRANCISCO–(BUSINESS WIRE)–Prosper Marketplace, a leading online consumer lending marketplace, today announced that it has closed a deal with a consortium of institutional investors to purchase up to $5 billion worth of loans through the Prosper platform over the next 24 months. The investors in the consortium are affiliates of each of New Residential Investment Corp., Jefferies Group LLC and Third Point LLC, and an entity of which Soros Fund Management LLC serves as principal investment manager. The consortium will also earn an equity stake in the company based on the amount of loans purchased, further aligning the group with Prosper’s future growth and success. Warehouse financing of up to $1 billion will be provided by a syndicate of lenders including Credit Suisse, Deutsche Bank, Goldman Sachs and Morgan Stanley.

“We’re very pleased to be working with this consortium of investors, and believe they will be great long-term partners as we continue to build a large-scale business,” said David Kimball, CEO, Prosper Marketplace. “This deal gives us the funding stability and additional capital markets expertise we need to continue to grow our marketplace and achieve profitability in 2017.”

Prosper has maintained positive momentum since the second half of 2016, with monthly loan originations growing steadily since July. In addition, the Prosper loan portfolio is delivering solid returns to its institutional and individual investors, with an estimated net return of 7.86%

Financial Technology Partners (FT Partners) served as strategic advisor to Prosper Marketplace and its Board of Directors on this transaction. DV01 will be the loan data agent to the consortium.

About Prosper Marketplace

Prosper’s mission is to advance financial well-being. The company’s online lending platform connects people who want to borrow money with individuals and institutions that want to invest in consumer credit. Borrowers get access to affordable fixed-rate, fixed-term personal loans, and investors have the opportunity to earn attractive returns via a data-driven underwriting model. To date, over $8 billion in personal loans have been originated through the Prosper platform for debt consolidation and large purchases such as home improvement projects, medical expenses and special occasions.

Prosper launched in 2006 and is headquartered in San Francisco. The lending platform is owned by Prosper Funding LLC, a subsidiary of Prosper Marketplace. Loans originated through the Prosper marketplace are made by WebBank, member FDIC. Visit www.prosper.com and follow @Prosperloans to learn more. Prosper notes offered by Prospectus.

1 Estimated return on January 2017 production is 7.86% according to the Prosper Performance Update: January 2017

Contacts

Prosper Marketplace:

Sarah Cain, 415-593-5474

scain@prosper.com

AutoFi Unveils Online Multi-Lender Sales Solution for Used Car Dealers

February 27, 2017SAN FRANCISCO, CA (February 27th, 2017) – Today AutoFi, a financial technology company that is transforming the way cars are bought and sold, announced the launch of the first fully online sales and multi-lender financing solution for used car dealers. Financing on AutoFi’s platform will be provided by its lender network of banks, speciality lenders, and credit unions. Today, the company announced that its credit union financing will be offered in partnership with iLendingDIRECT.

- “People want buying a car to be fast, straight forward and more transparent. That’s why AutoFi is working with lenders and dealerships to make the process easier through online sales and financing.” said Kevin Singerman, CEO of AutoFi. “That’s why I’m so excited about our partnership with iLendingDIRECT. Bringing iLendingDIRECT’s network of credit unions onto the AutoFi platform means consumers will have even more competitive financing options to choose from when purchasing a car online.

- “This is the perfect e-commerce solution to get customers the auto financing they need and want in a quick and efficient manner, and enhance their car-buying experience,” said Nancy Fitzgerald, President and CEO of iLendingDIRECT.

The AutoFi platform is the first online point-of-sale solution for auto finance. It allows customers to purchase and finance a car completely online, either through a dealer’s website or an in-store digital experience. The company recently announced the world’s first online car sales and financing solution for new car dealers in partnership with Ford Motor Credit. Today’s announcement further expands AutoFi’s ability to serve the multi-billion-dollar used car sales market through its partnership with iLendingDirect.

AutoFi’s platform will now allow used car buyers to research a vehicle on the dealership’s website; select “Buy Now”; receive an automated credit decision; and get loan offers from banks, specialty lenders and iLendingDIRECT’s credit union network who compete for the car buyer’s business in real time. Consumers can then customize their financing deal by selecting down payment and loan terms; choose vehicle protection products; and e-sign all financing documents online. The new platform gives used car dealers and buyers the ability to transact online with competitive financing options in a fully automated process.

# # #

About AutoFi

AutoFi is a technology company transforming the way cars are bought and sold. The company’s platform allows auto dealers to sell cars completely online by connecting buyers with lenders in a fast, easy and transparent process. AutoFi’s team includes industry leaders from enterprise software, finance, automobile and consumer sectors who previously worked at companies including Lending Club, PayPal, and SunGard. AutoFi’s investors include Ford Motor Credit Company, Crosslink Capital, Lerer Hippeau Ventures, Laconia Capital Group, Basset Investment Group, Eniac Ventures, 500 Startups and Silicon Valley Bank. For more information visit www.autofi.com

About iLendingDIRECT

iLendingDIRECT is a national Finance and Insurance marketing firm that focuses on Auto Refinancing. We offer smart financial solutions with the customers’ well‐being in mind – committed to setting our customers up for success by saving them money and educating them about what is best for their particular financial situation. For more information on iLendingDIRECT services, visit www.ilendingdirect.com.

Confidence Stable For Small Business Lenders and MCA Companies

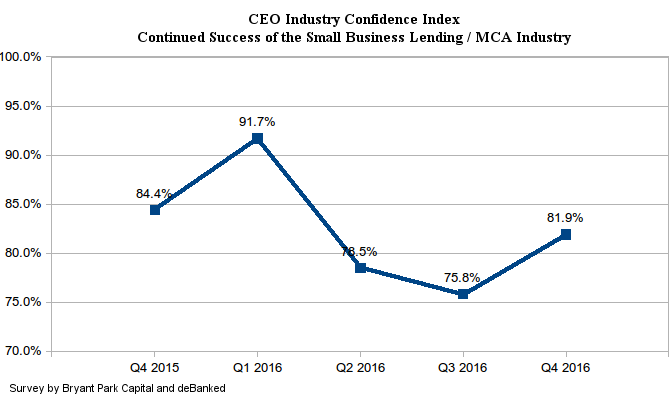

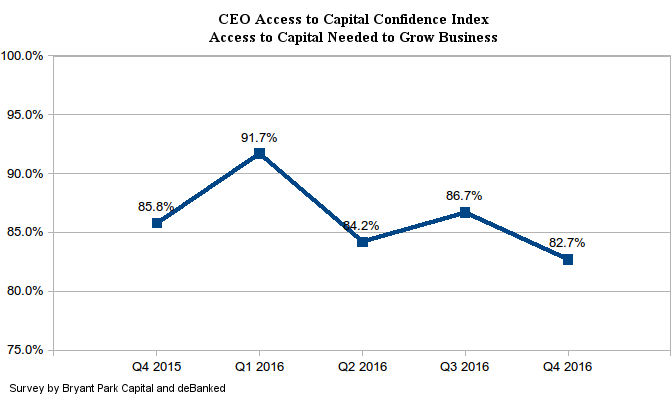

February 26, 2017Recent events may be putting a slight damper on the confidence of industry CEOs in being able to access capital needed to grow their businesses, but continued success of the industry in general is ticking back up. This data is according to the latest survey conducted by Bryant Park Capital and deBanked of small business lending and merchant cash advance company CEOs.

Confidence in the industry’s continued success bumped back up to 81.9% in Q4, while confidence in being able to access capital reached its lowest level since the survey’s inception. Still, at 82.7%, it’s high.

In late November of 2016, CAN Capital, one of the industry’s largest companies, encountered problems that caused the company to suspend funding. Several of their competitors since then have reported a boost in submission volume, which they partially attributed to that event.

Pressure on companies to merge or exit the market may also be kindling optimism for larger players who stand to gain market share.

The Road To Training The Best Sales Reps

February 26, 2017

Alternative-finance industry executives tend to agree on at least two basic rules for building a successful sales team: Hire people who know how to sell and never stop training them. Following the second rule requires knowledge and perseverance. The first one takes a leap of faith.

To obey Rule No. 1, companies have to find ways of determining who possesses that elusive quality known as salesmanship, even among inexperienced job candidates. To that end, most firms make an educated guess based on experience, intuition, common sense, high hopes and the good graces of Lady Luck.

“We look at personality traits,” says Zach Ramirez, a World Business Lenders vice president and manager of the company’s Costa Mesa, Calif., branch. “We’re looking for an outstanding person – the highest-caliber person we can find. They should be hard-working and competitive. You can underline ‘competitive.’ They should have a fire inside them.”

“We want someone who’s hungry for money and is going to be a go-getter, says Chad Otar, CEO and executive funding manager at Excel Capital Management Inc. “It’s a feeling that you get when you talk to them. You can tell when a person is going to sit back and not do anything.” In addition, good candidates aren’t intimidated by the challenge of learning how the industry works, he notes.

“It’s really about how you connect with someone,” according to Amanda Kingsley, who owns Options Capital and also works as a sales training consultant. “Even over the phone, you need to treat people with understanding. You need to inspire the trust that you could provide the advisory help they need.” Small details, like remembering a potential client’s daughter just got married, mean a lot, she says.

“It’s really about how you connect with someone,” according to Amanda Kingsley, who owns Options Capital and also works as a sales training consultant. “Even over the phone, you need to treat people with understanding. You need to inspire the trust that you could provide the advisory help they need.” Small details, like remembering a potential client’s daughter just got married, mean a lot, she says.

“It comes down to drive and personality,” says John Celifarco, sales manager at Sure Funding Solutions. He finds there’s not much room for the thin-skinned and it takes a certain kind of person to succeed. “When you find the right people, it usually clicks pretty quick,” he says. “For the people who don’t work out, it usually falls apart pretty quick.”

“I look for strong personalities,” says Isaac Stern, CEO of Yellowstone Capital. “I don’t believe you can necessarily teach someone to sell,” he asserts. “This isn’t an easy sell, so you have to have a Type A personality. They’re on the phone and they’re confident whether they know the product or not in the beginning.” The interview process can “weed out” candidates who aren’t going to find success, he says.

Don’t expect someone with a background in outside sales to find happiness spending eight hours a day on the phone as an inside salesperson, warns Stephen Halasnik, managing partner at Financing Solutions. As a direct financing company, his firm hires salespeople different from those an ISO or broker employs, he says. His company expects salespeople to act as consultants who are knowledgeable about finance and empathetic to small-business owners.

Nearly every company prefers candidates with selling experience, possibly in telemarketing. Some seek reps with a background in selling financial services, but others prefer prospective employees who are new to the industry. “I don’t want to hire someone else’s problem child,” Stern asserts. “I’d like them to learn the way we do things from start

to finish.”

“Different offices have different cultures, so someone who has worked well in one office might not work well in another,” Celifarco says. People hired from other companies may bring bad habits, he says. They may approach the job in a variety of ways they’ve learned elsewhere and thus prevent the company from presenting a consistent face to the public, he says. “Every company has an identity,” he contends.

“Different offices have different cultures, so someone who has worked well in one office might not work well in another,” Celifarco says. People hired from other companies may bring bad habits, he says. They may approach the job in a variety of ways they’ve learned elsewhere and thus prevent the company from presenting a consistent face to the public, he says. “Every company has an identity,” he contends.

Applicants without a sales background sometimes rise to the occasion and succeed, says Ramirez. In fact, one of his top sales managers joined the company with no sales experience. Former entrepreneurs, even those without a sales background, often have a lot in common with other small-business owners and that helps them do well, he notes.

Excel Capital Management seeks salespeople with differing backgrounds for two different types of roles in its sales force, says Otar. Openers work on salary and should have phone sales experience so they’re comfortable on the telephone. Closers, who work for commissions, should have experience at selling financial services products or something closely

related, such as stocks or mortgages, he says.

While good hiring practices bring good employees into the company, they also guard against inviting bad ones into the fold. World Business Lenders uses several third-party companies to perform background checks and pre-employment screening, but most often calls upon ADP, says Alex Gemici, the company’s chief revenue officer. ADP performs evaluations that comply with the laws of the states where the employees are located, he says.

Eliminating unsavory candidates carries special significance in the alternative-finance business, notes Ramirez. “It’s critically important that they have no background issues,” he says. “In this industry there a lot of bad apples out there. It’s important that they don’t infiltrate our organization.”

“It’s very difficult to find loyal guys,” Otar laments. “They come in and utilize all your systems and then you catch them stealing.” In other words, they pass deals along to other companies. Otar has caught three of his closers doing exactly that. “You’ve got to be very careful,” he warns, adding that it’s difficult to spot bad actors because they’re skilled at selling themselves.

Once a company chooses the best candidates, the training can begin. New salespeople always start on Mondays at World Business Lenders, and the company’s corporate headquarters conducts sales training nationwide that day, says Gemici. The full day of instruction originates at headquarters, and new hires at branch locations participate on Skype. Subjects include the industry in general, specific company products and sales tips.

On Tuesdays, the World Business Lenders branches take over the training for a day or more, Gemici notes. That instruction, which lasts as long as the branches decide, can include having the new employees “shadow” more-experienced workers and having crack salespeople listen in on the phone calls of the new staffers as they make their pitches.

In the World Business Lenders office in California, Ramirez continues the training every day of a new employee’s first two weeks on the job. Tuesday and Wednesday of the first week, he spends the full eight-hour day with them. After that, he sets aside at least two or three hours of instruction each day. “I want to err on the side of over-training,” he explains.

From there, education continues as long as employees work for the company, Ramirez says. That can include spot training that he institutes anytime he sees a problem or an opportunity for improvement. Ongoing training also helps salespeople keep up with changes that occur in the industry, he notes.

The sales staff in the California office of World Business Lenders also assembles in a conference room for regular sales meetings. Ramirez picks a rep who’s outstanding at some aspect of the job to deliver a short lecture on the subject at those meetings. A star at prospecting, for example, could explain tricks of that part of the trade and then field questions on the subject. “That way, everybody can learn what everybody else knows,” he says.

For ongoing training at Financing Solutions, Halasnik calls his staff into a “huddle” for 10 minutes every day. They review what deals are pending so that salespeople know what management is seeking and can use that knowledge when they’re gathering data from customers. “We’re looking for reasons to give someone financing that doesn’t fit the cookie cutter approach a bank would use,” he notes. The team also use the huddle to share information about the industry.

At Sure Funding Solutions the sales staff meets every couple of weeks for ongoing training. They talk about some aspect of the sales process, such as opening, closing, dealing with banks, what’s working and what’s not working, says Celifarco. “I’ve been in this business since ’08, and I’m still learning new things,” he notes, adding that changing one phrase in a pitch could get better results.

Ongoing training at Excel hinges on monitoring phone calls to ensure openers are asking the appropriate questions to qualify leads and that closers are working effectively, Otar emphasizes. “It’s a never-ending process to learn what to say at the right time,” he says of his company’s training policies. Salespeople who have mastered the basics can bring their own personalities into their presentations to avoid sounding as though they’re reading from a script and thus foster an organic conversation, he notes. “That’s perfect – it’s golden,” he exclaims.

Kingsley agrees. “Don’t be too ‘salesy,’” she counsels. “That’s the best sales advice I can give.” Nobody enjoys receiving a telemarketing call, she reminds her trainees. Larger companies probably won’t heed that tip because they’re focused on volume, but smaller companies can avoid the “salesy” trap, she says.

Training should also teach originators to avoid industry jargon on their calls because prospects simply may not know the lingo, Kingsley cautions. Closers should learn from their training that knowledge of the customer’s industry can help build a relationship, she says. And knowing the customer’s industry also helps salespeople convey a deeper understanding of creditworthiness to underwriters, she maintains.

Financing Solutions trains salespeople to reveal information to clients through a string of questions instead of merely throwing out statements about the company’s products, Halasnik says. The questions can include how the customer’s business works and how he’ll use the money. That can allow the client to sell himself, and it can help the salesperson explain the client’s situation to the underwriters, he says.

Salespeople should learn to present themselves as professionals and avoid sounding like used car dealers, Halasnik maintains. “They have to understand business,” he notes, adding that training must convey that sensibility because “they don’t really come in that way.” In fact, he maintains that financing Solutions has to persevere in continuing to help the sales staff understand how small-business owners think.

Even though training never ends, it eventually pays off, Halasnik contends. He looks forward to the time – possibly in six months or so – when the roles reverse because his salespeople are picking up so much information that they’re training him. The fact that sales reps are making contact with customers keeps them in touch with the pulse of the industry, he notes.

But problems can arise even with the most persistent training efforts, so it’s also vital to begin the process with employees who are trainable, Kingsley suggests. “Some people listen to you, but then they don’t act on the advice,” she maintains. Others don’t want to expend the effort necessary to research their customers’ industries. “If you’re going to make $10,000 off of a sale, put in the work for it,” she admonishes.

Some companies are hiring lots of salespeople and putting them to work quickly as part an effort to achieve sheer volume, Kingsley says. Instead, she recommends training a smaller number of reps to conduct themselves in a transparent manner that promotes repeat business.

World Business Lenders allows for a 90-day period to determine whether a new salesperson and the company are a good fit, says Gemici. Turnover occurs during that period, often because the company is growing so quickly that it’s necessary to take on a few inexperienced employees, he says. For salespeople who complete the 90 days, the success rate is high, he notes.

World Business Lenders allows for a 90-day period to determine whether a new salesperson and the company are a good fit, says Gemici. Turnover occurs during that period, often because the company is growing so quickly that it’s necessary to take on a few inexperienced employees, he says. For salespeople who complete the 90 days, the success rate is high, he notes.

“We like to say six weeks,” Otar says of his company’s probationary period. By then, a closer should be making four to seven deals a week, he suggests, noting that openers should generate 15 to 25 leads weekly and five to seven should be getting funded.

Salespeople can require four months to really catch onto their jobs, according to Halasnik. He finds that he can gauge their progress by the quality of the questions they ask, not by what they say. As they learn the business, their questions improve, he notes.

The effort required to find and train salespeople can tempt some companies to steal good employees from their competitors, but the problem’s no more severe in the alternative-finance industry than in other businesses, according to Ramirez. “I never intentionally poach someone else’s employees, although people have tried to recruit mine,” he says. “Most of these people are clients. These competitors of ours send deals to us so I don’t want to do anything to jeopardize that relationship nor do I think that’s a good business tactic.”

So where are those prospective employees hiding? World Business Lenders employs a full-time in-house recruiter to ferret them out. Excel finds candidates on industry blogs or through general employment websites. Kingsley urges companies to contact colleges to seek out finance majors. Stern says he puts up a post and receives “tons of resumes.”

Wherever the employees come from, one of the keys to their success lies in understanding the customer’s business, Halasnik maintains. “If you only think of your business as money, it could be a little bit boring,” he says. “If you think about who the clients are and how they got there and who their customers are, that’s the fun part of the job.”