Individual Investors Heart of Lending Club, CEO Says

Lending Club CEO Scott Sanborn sent out an email late Wednesday night to individual investors to remind them that they are “emphatically” the heart of their marketplace.

Lending Club CEO Scott Sanborn sent out an email late Wednesday night to individual investors to remind them that they are “emphatically” the heart of their marketplace.

“Our individual investor base is over 150,000 members strong,” the email says, but it was unclear if this is the amount of active investors or all investors that have participated since they launched in 2007.

Lending Club is doubling down on efforts to serve individual investors, Sanborn wrote, by staffing up on their investor services team and dedicating more engineering resources to improve the investment experience.

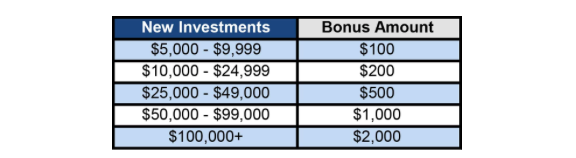

To prove this commitment, they’re offering investors that deposit new money and fully invest it by August 15th a matching bonus of 1% to 2% of the investment amount. The bonus can’t be withdrawn and they say you might have to pay taxes on it in the fine print.

Not mentioned in the email is the consideration of a Bankruptcy Remote Vehicle (BRV) to protect note investors from the underlying credit risk of Lending Club itself, something that many individual investors have been asking the company for. Lending Club rival Prosper instituted a BRV in 2012.

The question now is, will a potentially taxable small bonus that can’t be withdrawn be enticing enough to convince retail investors to double down on their commitment to Lending Club?

Last modified: June 1, 2016Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.