| Report Demonstrates How Online Lenders Benefit Economy Read more |

|

IOU Planning for 25%-30% Originations Growth After a profitable Q1, IOU paves way for growth Read more |

|

|

|

Why Small Businesses Sought Financing in 2017, and Why They Were Denied |

| According to a Fed study, Forty-six percent of small businesses received all the financing they sought, 12 percent received most (more than 50 percent) of it, 20 percent received some (less than 50 percent) of the financing they desired and 23 percent were denied financing altogether. Read more |

Breakout Capital Announces New $15MM Credit Facility with Medalist Partners |

| The facility will support Breakout Capital’s growth across traditional business loans, Breakout Bridge loans, and FactorAdvantage℠program loans. In the patent-pending FactorAdvantage℠program, Breakout Capital complements traditional A/R factoring with a hybrid business loan, enabling consolidations or overadvances. Read more |

|

|

|

New Law Benefits Small Banks |

| Among the changes this new law makes to Dodd-Frank is reducing the number of banks that are subject to strong government oversight because they are considered "systemically important." Banks with assets of $50 billion or more had been considered "systemically important." As of today, only banks with assets of $250 billion or more will get that moniker and be subject to the strictest government regulations. Read more |

GreenSky Lists on the Nasdaq |

| GreenSky facilitates point-of-sale financing that enables over 12,000 merchants to offer easy payment options to over 1.7 million consumer customers. Read more |

|

|

|

Uplyft Capital Launches New Brand Identity, Putting its Business Friendly Technology Capabilities at the Forefront |

| With the announcement of the rebrand, Uplyft Capital’s has also redesigned its consumer-facing user experience to better help customers and partners stay organized and efficient. Read more |

Experian Revealed Data from Its Survey |

| 78 percent of lenders believe alternative credit data improves financial inclusion Read more |

|

|

|

PeerStreet Surpassed $1B in Loans |

| Having historically focused on short term bridge loans on non-owner occupied residential properties, PeerStreet is now expanding into other real estate asset classes including buy-to-rent, multifamily and small balance commercial real estate loans. The company recently announced two senior real estate hires, filling the roles of Chief Real Estate Officer and Head of Commercial Real Estate to help expand these programs. Read more |

OCC Encouraging Small-Dollar Lending |

| The new guidance from the Office of the Comptroller of the Currency (OCC) makes explicit that the regulator would be open to banks offering such short-term loans, inviting banks to compete with alternative financial products like payday loans. Read more |

|

|

|

Prosper Raises Loan Cap to $40k |

| The announcement was made through a blog post on May 24th Read more |

In Canada, P2P Lending Will Help Small Businesses Stay Afloat |

| With interest rates on the rise and the Canadian banks moving up lending rates, the higher cost and reduced availability of credit will affect all Canadian businesses, like a rising tide lifting all boats. Inevitably some boats will be swamped and sink, particularly if they are smaller and more vulnerable. Read more |

|

|

|

Get Certified in MCA Basics |

| Make sure you know how MCAs really work before you sell them Read more |

Online Lenders Tighten Rules After a Wave of Defaults |

| Via Bloomberg: SoFi, Prosper, Lending Club, and Avant now demand higher average credit scores and shorter maturities Read more |

|

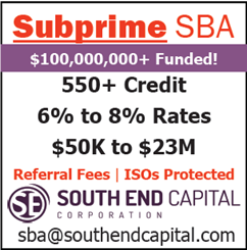

| Thanks to Our Email Newsletter Sponsors |

|

|

Found this email in your junk folder? Make sure to specifically whitelist both sean@debanked.news and funded@debanked.deals :-) |

SUBSCRIBE HERE |