Loan Fraudsters Resorting to AI Generated Faces

According to a sneak peek posted by Lendio CEO Brock Blake, fraudsters are stopping at nothing to game the government’s emergency loan system.

According to a sneak peek posted by Lendio CEO Brock Blake, fraudsters are stopping at nothing to game the government’s emergency loan system.

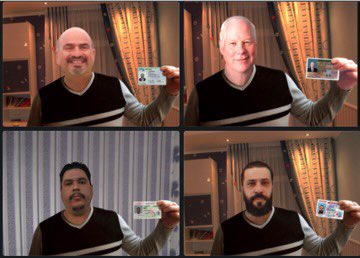

“Wanna glimpse into what lenders are experiencing with attempted fraudulent applications?” Blake wrote in a tweet. “Here are four ‘applicants’ seeking a loan.”

Four pictures showing computer-generated “business owners” all have the same sweater, but different heads. People are using AI tech to create randomized, just barely discernible pics of borrowers holding IDs beside them to beat new compliance measures.

It’s like a techno arms race between an automated scanning system that looks for fakes versus an automated fake ID and person generator that tries to make passable fakes.

After a year of PPP and EIDL success stories and fraud concerns, funders are still beating back scam artists. During a recent U.S. Senate hearing, SBA Inspector General Mike Ware said his office had secured $2.1 billion in fraudulently claimed PPP and EIDL loans.

In related news, the SBA announced the $28.6 billion Restaurant Revitalization Fund applications would open on Monday, May 3. Fraudsters start your fake restaurant owner generators.

Last modified: April 27, 2021Wanna glimpse into what lenders are experiencing with attempted fraudulent applications?

Here are 4 different “applicants” seeking a #ppploan. pic.twitter.com/kdbLmNGlvt

— Brock Blake (@BrockBlake) April 26, 2021

Kevin Travers was a Reporter at deBanked.