Uncategorized

No New SBA Loans Being Accepted. Don’t Understand? We’ll Draw You a Picture

August 23, 2011

On September 27, 2010, the Small Business Administration(SBA) temporarily sweetened the deal on the popular 7(a) loans. As part of the Small Business Jobs Act, government backed default guaranties rose to 90% and many of the major fees were waived.

By late December, the funds for this program had been fully allocated and exhausted. But the announcement was poorly communicated, resulting in thousands of unsuspecting bankers and applicants left stranded and confused. To deal with the drama, the SBA set up queues, where applicants were either placed on standby to take the place of a cancelled Jobs Act loan or to be transitioned into the regular 7(a) loan without the deal sweeteners.

But leave it to the SBA to underestimate the intelligence of their clients. Worried that bankers and business owners might not understand the concept of closing one program and offering them another, they drew a picture.

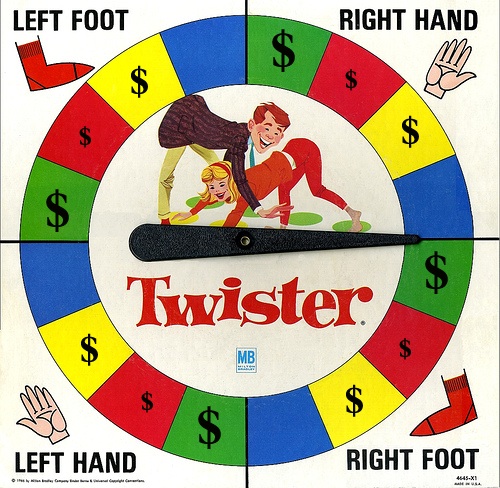

Actual image being used on SBA.gov to explain the status of Jobs Act loans

In case the phrase “No New Loans Being Accepted” is obscure and cryptic, we can decipher the message using the Daily Transition Phase Alert meter. It’s a state of the art, super genius meter, that was handcrafted by NASA scientists, and topped off with the modern pizazz of a traffic light. Green is GOOD. Red is BAD. Big dollar sign GOOD. Small dollar sign BAD. If the meter is yellow, speed up and try to beat the light but make sure there are no cops behind you first.

Bankers should start using this system en masse. Instead of an outright decline, they can simply inform applicants that their lending ability is in Phase Red. Persistent businesess can take their chances in the underwriting process and battle it out using the Daily Transition Phase Alert meter 2.0. Left foot on $. Right hand on. But watch out for blue because blue is very bad! Blue automatically allows the bank to raise your business checking account fees and increase your credit card processing rates.

The Amazing Daily Transition Phase Alert Meter 2.0!

While your bank is busy playing games with you (they’re not just mind games anymore!), alternative financial firms such as Merchant Cash Advance providers are busy funding applicants in less than 7 days on average. The process is easy, only minimal paperwork is required, it’s credit score flexible, and every business is doing it these days. Want to find out the status of your Merchant Cash Advance application? We’ll hand draw you a picture:

Choose your funding source wisely…

– The Merchant Cash Advance Resource

Say Goodbye to Debit Cards

August 23, 2011Originally Published on March 11, 2011.

We’ve been saying it since December 2010, that Debit cards will cease to exist when the new Wall Street reform laws go into effect. On February 18th, we argued that the cost of a debit card transaction would shift from the retailer to the customer. You can view that article here: Debit Card Costs May Be Put on The Consumer – Don’t Make us Pay!.

We were right on the mark. Today JPMorgan Chase announced that debit card carrying customers would soon be subject to a purchase cap of $50 – $100 per transaction. As a result, a huge chunk of the U.S. population would no longer be able to make an average size purchae. The new video game system? Too big. A computer? Too much money. A bar tab? Better bring cash…

The reason for such a dramatic change was provoked by Debit card reform. In July 2011, the Federal Reserve will begin enforcing a maximum debit card transaction cost of 12 cents. For card issuing banks, payment networks, acquirers, and ISOs, this 12 cents is too low to be profitable, let alone sustainable. As a result, banks must make up for the loss by charging consumers.

For more information, check out the CNN article.

– deBanked

Two Additional Direct Funders Added

August 23, 2011

Two direct providers of Merchant Cash Advance have been added to the directory. They are:

- Empire Merchant Advance

- Genesis Capital Enterprises

That brings the total to 29.

Merchant Processing Resource Will Be Closed for Summer Break

August 23, 2011

deBanked / Merchant Cash Advance Resource will be closed for a summer break through June 21st. We have given our editors and authors some time off. You are still welcome to chat openly in the forums. A moderator will check in from time to time. We would like to thank all of our readers for checking in with us and look forward to sharing more useful and insightful news when we come back.

Happy summer!

– deBanked

We’re Back! – Updates Soon

August 23, 2011Posted on June 21, 2011 at 11:37 PM

We’re back from break and will be rolling out content again as usual. We may need a few days to catch back up though!

– The Resource

Bank Loan Advertisements are nothing but a bait and switch

August 23, 2011

We stay in touch with many people in the financial industry, and not just Merchant Cash Advance. Back in late March we learned that lending was so tight, that credit cards were barely attainable. That was when the unemployment rate was 8.8% and as of May 2011, it’s back up to 9.1%. That was when the economy was expected to grow by 2.9% in 2011 but is now on pace for 2.7%. The point? If it was impossible to get a loan back in March, then how much worse could it get?

We stay in touch with many people in the financial industry, and not just Merchant Cash Advance. Back in late March we learned that lending was so tight, that credit cards were barely attainable. That was when the unemployment rate was 8.8% and as of May 2011, it’s back up to 9.1%. That was when the economy was expected to grow by 2.9% in 2011 but is now on pace for 2.7%. The point? If it was impossible to get a loan back in March, then how much worse could it get?

An insider shares it can get worse, much worse. Our friend Tim (name changed) is the manager of the small business lending unit of a major national bank. Any loan less than $1 Million dollars is considered to be for small business. Tim’s unit is on track to do more loans this year than last year and none of them are going to retail stores or restaurants. Did we hear that right?

“Retail stores and restaurants are too flakey to give money to.” That wasn’t just his opinion either because that’s actually part of the bank’s underwriting policy. They are completely prohibited from lending to those business types. So we had to ask…

What if they had 25 years in business? Declined.

What if the guarantors had 800 credit? Declined.

What if they had $5 Million in cash reserves in the bank? Declined.

What if…? Declined. Declined. Declined.

There is no criteria that would make them eligible, period. Tim admits that the interest charged on a loan is not profitable by itself anyway so to take any degree of default risk even if it’s small, is not worth it. Instead, they rely on their loan clients to open a business checking account with them, use their merchant processing, and sign up for other services on which they can charge fees and earn income. Their unit has an average turnover time of 3 months from the time the application is submitted to the time the loan is funded.

“We usually get a jump on setting them up with all our services right when they apply for the loan, so we can start earning on them right away,” Tim said. We wondered why they wouldn’t let restaurants and retail stores apply then. “Oh we let them apply for loans… we just don’t tell them they’re declined until after we’ve locked them into other fee generating services. They’re unlikely to pack up and change banks after that so it works out for us.”

There’s a term for this tactic and it’s called a ‘bait and switch.’ There really seem to be no loans for the businesses that need them, an assertion bolstered by the Small Business Administration’s 2011 1st Quarter report. Lending to small businesses has fallen by $15 Billion.

So where’s the money?

There are still alternative sources available, but we’ve yet to find anything that rivals the speed and flexibility of a Merchant Cash Advance (MCA). Too many small businesses hold out the hope that a bank will help them and pass up the opportunity to obtain alternative financing like a MCA. But how many missed opportunities will it take until it’s too late? How many businesses will sign up for checking accounts and expensive merchant processing, only to find out that no loan is coming and all they’ve acquired is an expensive long term contract for no value in exchange.

If you’re a restaurant or retail store, you can research our directory of verified funding providers HERE. Don’t wait for the bank to approve a loan they’re not allowed to approve and instead get what’s most important, the capital to grow.

– The Merchant Cash Advance Resource

Debit Card Reform to Be Finalized June 29th

August 23, 2011Posted on June 28, 2011 at 12:14 AM

The Federal Reserve is scheduled to finalize debit card reform on June 29th as dictated in the Durbin Amendment of the Wall Street Reform Act. The rough draft of the legislation that was issued back in December 2010 mandates a 12 cent cap on interchange fees. Interchange is the array of fees paid to the banks that issue the cards every time their cards are used.

Proof Interchange Reform Will Fail

There is some speculation that the Fed may raise the cap to an amount slightly higher than the original 12 cents. Ultimately, banks stand to lose billions of dollars over the next year since the law takes effect on July 21, 2011. We will update you on the outcome.

– deBanked

New Look and Feel for the Resource

August 23, 2011Posted on July 13, 2011 at 1:37 AM

Notice anything different about us? We’re better looking now! We got tired of the old raggedy blogger look and have upgraded to a sleeker, cleaner, more web browser friendly format. There are other reasons for our sudden change of skin but we’ll reveal the reasons for that in a few weeks…

It’ll be good. reallll good…

😀