Announcements

Becoming a Successful Broker

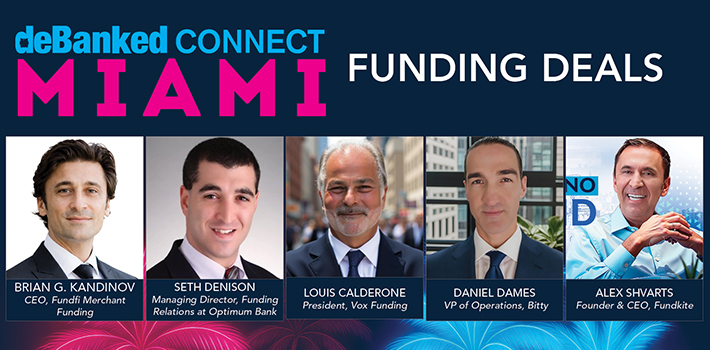

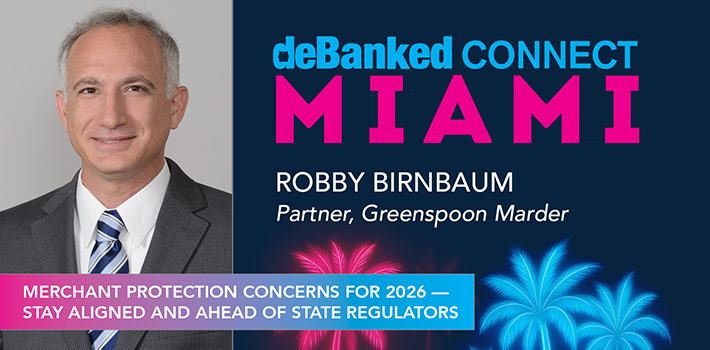

January 22, 2026ARE YOU READY FOR DEBANKED CONNECT MIAMI 2026?!

Check out the full agenda for February 12th at the Fontainebleau.

There will also be tech demos happening non-stop on the show floor. This event is one you won’t want to miss.

REGISTER BEFORE IT’S TOO LATE.

DailyFunder Mobile App Update 2.1.3

January 21, 2026DailyFunder 2.1.3 Mobile Update

• Opens right to Activity Feed

• 1-tap to show you’re going to the next industry event

• See who else tapped and DM them

• Deal Bin in the Activity feed

• Recent industry news headlines in Activity Feed

• See event info and who’s exhibiting

DailyFunder has > 17,000 members in the industry.

Event networking integration on the Desktop browser

More features and fixes to come. App/Site registration is still limited to the Desktop browser version of the site.

Maxim Commercial Capital Grew Team by 21% during 2025

January 20, 2026LOS ANGELES, CALIF. (Jan. 20, 2026) – Maxim Commercial Capital (“Maxim”) announced the addition of Lyndon Elam as Chief Operating Officer and Donald Cosenza as SVP of Business Development while steadily navigating the volatile economy during 2025. Maxim fuels small businesses and entrepreneurship nationwide in underserved market segments by providing loans and leases from $10,000 to $3 million collateralized by over-the-road trucks, trailers, construction and agricultural heavy equipment, and real estate.

“We began 2025 with an aggressive plan to invest in our most valuable asset, our people, and we are pleased to announce the expansion of our executive and operating teams,” said Michael Kianmahd, Maxim’s CEO. “Both Lyn and Don have tremendous experience, exceptional energy, and strong leadership skills to help propel Maxim into 2026 and beyond. We also expanded our operations and accounting teams with skilled, growth-minded talent to support our vision to be the nation’s preeminent alternative lender to small and mid-sized businesses.”

Founded during the 2008 financial crisis, the privately-owned lender remained a reliable funding source for small and mid-sized businesses through 2025’s market turbulence caused by shifting interest rates, an economic slowdown, disruption in the trucking markets, and tariffs. Keys to Maxim’s success over its 17 year history include its steadfast commitment to funding non-prime customers, including startups and those with challenged credit; serving as a reliable funding source for its referral network of equipment vendors and finance brokers; and offering creative funding solutions, such as no cash down transactions where the business may pledge excess equipment or real estate as collateral.

Creatively structured financings during the year included 100% purchase financing for a 20-year-old waste management company in New York with four trucks, and a pending $1.0MM contract, to purchase a $200K 2022 Isuzu FTR Diamond Truck outfitted for trash bin cleaning secured by a first lien on the newly purchased truck and the business owners’ home; a $110K real estate secured term loan to refinance $99K in high-rate MCA loans for the experienced owner of a stone and garden retail store and landscaping business, reducing the borrower’s debt service by $2,400 per month; and a $42K title loan on a 2020 Peterbilt 567 Cement Mixer for an experienced contractor to fund repairs on a Class 8 Day Cab purchased at auction.

Class 8 truck financings during the year comprised loans and leases for experienced and startup owner operators in 41 states across the U.S. Representative fundings included: a $52K 2021 Peterbilt 579 with 514K miles for 25% down for an owner operator with less than two years’ time-in-business, 725 FICO, and charged off credit cards; an affordable $29K 2018 Freightliner Cascadia 125 with 560K miles for 25% down for an experienced owner operator with a 704 FICO and late mortgage payments; and a $42K 2020 Freightliner Cascadia 126 replacement truck for 25% down for an existing customer with a 542 FICO, late on auto payments, and collection accounts on credit cards who had totaled his previous truck.

“We are looking forward to deploying new credit guidelines in early 2026,” noted Elam. “Our committed team is eager to offer a broader and deeper credit spectrum across heavy equipment verticals to benefit borrowers and our vendor and finance broker referral partners.”

About Maxim Commercial Capital

Maxim Commercial Capital is redefining access to capital for underserved small and mid-sized business owners nationwide, helping them unlock growth opportunities and fueling their dreams of entrepreneurship by providing essential loans and leases (“financing”) from $10,000 to $3 million secured by heavy equipment, real estate, trucks, and trailers. The company funds equipment purchase financings and leases, working capital, and debt consolidations. Maxim’s more creative financing structures leverage equity in real estate and owned heavy equipment to facilitate growth and preserve customers’ cash. As a leading provider of transportation equipment financing, Maxim supports startup and experienced owner-operators and non-CDL small fleet owners with financing for class 8 and class 6 trucks, trailers, and reefers. Learn more at www.maximcc.com or by calling 877-776-2946.

###

Contact:

Michael Kianmahd, CEO

Maxim Commercial Capital

(213) 984-2727

NMEF Reports $1.8 Billion in 2025 Originations Doubling Assets Under Management

January 20, 2026JANUARY 20, 2026, NORWALK, CT – North Mill Equipment Finance LLC (“NMEF”), an independent commercial equipment lender and lessor headquartered in Norwalk, Connecticut, reported $1.8 billion in total originations for 2025, including syndicated volume of $566 million. The record originations resulted in a doubling of assets under management to $2.4 billion.

Full-year record originations were driven by a series of targeted strategic actions, including the acquisition of Pawnee Leasing, the purchase of the Midland Equipment Finance portfolio, and the origination and syndication of assets through a joint venture with Oaktree Capital Management focusing on Fair Market Value (FMV) leases.

“2025 demonstrated the durability and scalability of our platform,” said David Lee, Chairman and Chief Executive Officer of NMEF. “We continued to diversify origination sources, deepen our FMV and syndication capabilities, and integrated strategic acquisitions, all while maintaining disciplined underwriting and operational rigor. NMEF was able to execute on these transactions with speed, structural creativity, and offering certainty of close, reinforcing its position as a flexible and reliable capital partner”

“Syndication activity was a significant contributor to 2025 results, with approximately $566 million syndicated across multiple initiatives.” added Mark Bonanno, President and Chief Revenue Officer “Our syndication strategy is designed to deliver consistent execution and alignment for our partners. By combining origination expertise with thoughtful risk distribution, we’re able to support larger transactions, move with speed and certainty, and create durable value across the capital structure.”

According to Tom Lyle, Chief Operating Officer, “Operationally, 2025 was defined by execution. We integrated acquisitions, optimized portfolios, and scaled infrastructure in line with a clear operating plan. The consistency of that execution underpinned both the doubling of assets under management and a record year for NMEF.”

Looking ahead, NMEF stated it will remain focused on disciplined growth, portfolio quality, and continued investment in scalable platforms to support long-term expansion.

About NMEF

NMEF is a premier lender working with third-party referral sources to finance small to mid-ticket equipment commercial leases and loans ranging from $15,000 to $3,000,000 and up to $5,000,000 for investment grade opportunities. NMEF accepts A – C credit qualities and finances transactions for many asset categories, including medical, construction, franchise, technology, vocational, manufacturing, and material handling equipment. NMEF is majority owned by an affiliate of InterVest Capital Partners and is headquartered in Norwalk, CT, with regional offices in Irvine, CA, Fort Collins, CO, Plymouth, MN, Voorhees NJ, and Murray, UT. One of NMEF’s controlled affiliates, BriteCap Financial LLC, is a leading non-bank lender providing small businesses with fast, convenient financing alternatives such as working capital loans since 2003 from its main office in Las Vegas, NV. For more information, visit www.nmef.com and www.britecap.com.

Heron Expands into SMB Credit Broker Market with Full Deal Flow Automation

January 15, 2026New York, NY – January 2026 – Heron Data, an AI platform that helps fintechs automate document-heavy workflows, today announced its expansion into the SMB credit broker market with the launch of Heron Broker Suite — an end-to-end solution that automates the entire broker deal flow from application intake to CRM.

The launch marks Heron’s entry into a market where manual work has long been the standard. Leading brokerages including Big Think Capital and TFS Financial are already using Heron Broker Suite in production, reporting processing cost reductions of up to 80%, offer-to-rep response times under 60 seconds, and teams refocused from data entry to revenue-generating work.

The Challenge

For most brokers, the daily workflow is manual and repetitive: scrub bank statements, match deals to funders, fill out portals, then dig through hundreds of emails to find approvals. The workload adds up fast:

- 5-20 minutes per application on bank statement scrubbing and light underwriting

- 10-15 minutes to match each deal to lenders based on internal policies

- 3-5 minutes per funder portal × 50+ submissions per day

- Hundreds of decision emails daily — approvals buried alongside declines, spam, and stips

Most brokerages spend $10K-$20K/month on offshore or data entry teams just to keep up — and even then, deals slip through the cracks, growth stalls without adding more headcount, margins shrink, and top performers burn out on doing data entry.

The Solution

Heron Broker Suite automates the entire workflow in four steps:

| 1. Scrub Bank Statements → Extracts revenue, positions, NSFs, and fraud signals in seconds |

| 2. Smart Lender Matching → Routes each deal to the right funders based on broker-defined criteria |

| 3. Auto-Fill Funder Portals → Submits applications via portal, email, or API — however each funder requires |

| 4. Process Funder Offers → Reads decision emails and syncs approvals, declines, and pending status to CRM instantly |

The moment a funder responds, reps see it. What used to take all day now happens in minutes — faster responses, more deals closed, and a business that scales without adding headcount.

The Impact

Brokers using Heron are seeing immediate, measurable results:

- Up to 80% reduction in processing costs

- Offer-to-rep response in seconds, not hours

- Zero missed approvals — every decision synced automatically

- 2-3x volume capacity with the same team

- Teams refocused on deal strategy and lender relationships

Big Think Capital, a high-volume New York brokerage managing over 5,000 decision emails per day, cut offer-to-rep response time by 98% — from over 30 minutes to under 60 seconds.

“The first broker to get the best approval is the one that’s going to win the deal. If you’re not able to use AI to automate manual workflows, you’ll end up falling further and further behind your competition.”

— Chris Forsberg, VP of Operations, Big Think Capital

TFS Financial automated over 4,000 monthly decisions — eliminating the equivalent of two full-time employees’ worth of manual data entry.

“Rather than uploading decisions all day, my team can now focus on making sure the right applications get to the right lenders — and that we’re getting approvals back faster for our customers.”

— Sydney Stewart, Manager of Broker Desk, TFS Financial

Heron’s Expansion into the Broker Market

Heron has spent years helping funders and fintechs automate bank statement analysis and underwriting workflows, processing over 500,000 files per week for more than 150 customers.

Brokers face the same challenge on the other side of the deal — and now have access to the same automation.

“Brokers didn’t build their businesses to fill out portals and babysit inboxes. They built them to help small businesses get funded. We’re giving them their time back.”

— Johannes Jaeckle, CEO, Heron Data

Heron Broker Suite is built for fast growing brokerages looking to scale with AI from day one—turning automation into a competitive advantage as they grow. Every Heron product is designed to keep humans in control, so teams stay focused on the work they do best.

Moreover, Heron integrates directly into existing workflows and broker systems—including Salesforce, CloudSquare, LendSaaS, and more—so brokerages can automate operations without disrupting how they work today.

With this expansion into the broker market, Heron expects to help brokers reclaim thousands of hours each year—transforming what was once an operational bottleneck into an advantage.

About Heron Data

Heron Data is an AI solution that eliminates repetitive, manual work in lending, insurance, and finance. The company processes over 500,000 files per week for more than 150 customers, including FDIC-insured banks and leading insurance companies. Heron raised $16.5M in Series A funding in 2025, led by Insight Partners with participation from Y Combinator.

Learn more at herondata.io

CFG Merchant Solutions® Reinforces Commitment to Seamless, Compliant Funding for ISO Partners Ahead of California SB 362

December 29, 2025New York, NY — CFG Merchant Solutions® announced its full operational readiness for California Senate Bill 362 (SB 362), set to take effect January 1, 2026. While the legislation expands commercial financing disclosure requirements statewide, CFGMS has proactively implemented compliance-ready systems designed to preserve fast, frictionless funding for its ISO partners without disrupting sales velocity or merchant experience.

A Pro-Active Approach to Compliance Without Compromise for ISO Partners

CFG Merchant Solutions® has taken a pro-active, partner-first approach to CA SB 362 implementation by integrating compliance directly into its funding infrastructure. This ensures that expanded disclosure requirements do not slow down deal execution or capital delivery.

CFG Merchant Solutions® Is Fully SB 362 Compliant

- We have trained our sales, underwriting, and operations teams to follow SB 362 requirements consistently and accurately.

- We are fully prepared to provide merchants and partners with all required disclosures and supporting documentation.

These enhancements allow ISO partners to move directly from offer to funding with the same speed and confidence they have grown to expect from CFGMS, while remaining fully compliant with CA SB 362.

Clear Expectations, Faster Execution for ISO Partners

To ensure seamless compliance across all origination channels, CFG Merchant Solutions® expects ISO partners to:

- Avoid the misleading use of “interest” or “rate”.

- Ensure sales teams are properly trained to stay compliant.

CFGMS will continue to provide guidance, tools, and training resources to support partners as the effective date approaches.

CFG Merchant Solutions® Commitment to Transparency and Compliance

If you have questions about SB 362, APR disclosures, or compliance expectations, please reach out to your CFG Merchant Solutions® representative or reach out directly to our compliance department at compliance@cfgms.com.

More guidance will follow as implementation continues. Thank you for your continued support and cooperation.

Not yet a CFGMS ISO Partner? Sign up in seconds: https://cfgmerchantsolutions.com/partnerships

MEDIA CONTACT

NICK DEFEIS

HEAD OF MARKETING, CFGMS

NDEFEIS@CFGMS.COM

Frankie DiAntonio Announces the Launch of The Lexington Foundation, a New Nonprofit Dedicated to Supporting Families in Need

December 16, 2025 Middle Country, NY — Frankie DiAntonio, Founder and CEO of Lexington Capital Holdings and Lexington Estates, today announced the official launch of The Lexington Foundation, a nonprofit organization created to support families in need, beginning in his hometown of Middle Country and expanding globally as the foundation grows.

Middle Country, NY — Frankie DiAntonio, Founder and CEO of Lexington Capital Holdings and Lexington Estates, today announced the official launch of The Lexington Foundation, a nonprofit organization created to support families in need, beginning in his hometown of Middle Country and expanding globally as the foundation grows.

The Lexington Foundation represents a deeply personal milestone for DiAntonio. Giving back to the community has long been central to his vision as a leader and entrepreneur, and the foundation formalizes a lifelong goal to create meaningful, lasting impact beyond business.

“At its core, The Lexington Foundation exists for one reason: to help those who need us,” said Frankie DiAntonio. “As we grow, as we build, and as we succeed, our responsibility to give back only becomes greater. This foundation is my commitment to honoring that responsibility.”

The foundation will initially focus its efforts on supporting families in Middle Country who are facing financial hardship, providing assistance and resources to help them navigate difficult times. Over time, the mission will scale beyond Long Island, then New York State, and ultimately extend its reach nationwide and across the world.

DiAntonio emphasized that The Lexington Foundation is guided by a simple but powerful belief: leadership is measured not only by success, but by service.

The launch of The Lexington Foundation was made possible through the support of dedicated team members, partners, and community leaders who share a commitment to compassion, service, and impact. The organization will announce upcoming initiatives, fundraising efforts, and community programs in the coming months.

About The Lexington Foundation

The Lexington Foundation is a nonprofit organization founded by Frankie DiAntonio with a mission to support families in need through direct assistance and community-focused initiatives. Beginning in Middle Country, New York, the foundation is committed to expanding its reach globally as it grows, guided by the belief that success carries a responsibility to give back.

Donald Cosenza, CLFP Joins Maxim Commercial Capital as SVP, Business Development

December 16, 2025 LOS ANGELES, CALIF. (Dec. 16, 2025) – Maxim Commercial Capital (“Maxim”) is pleased to announce Donald S. Cosenza, CLFP, has joined the company as Senior Vice President, Business Development. Cosenza brings more than 25 years of senior-level sales and marketing experience at national financial services firms to Maxim, where he will lead the company’s national referral partner marketing strategy.

LOS ANGELES, CALIF. (Dec. 16, 2025) – Maxim Commercial Capital (“Maxim”) is pleased to announce Donald S. Cosenza, CLFP, has joined the company as Senior Vice President, Business Development. Cosenza brings more than 25 years of senior-level sales and marketing experience at national financial services firms to Maxim, where he will lead the company’s national referral partner marketing strategy.

“Bringing Don aboard is a key accomplishment for our firm,” said Michael Kianmahd, Maxim’s CEO. “His deep experience and proven success in the equipment finance industry are vital attributes to help propel Maxim to the next level and achieve our vision of becoming the nation’s preeminent alternative lender to small and mid-sized businesses.”

Cosenza previously served as chief marketing officer of North Mill Equipment Finance (“NMEF”) for eleven years, where he built a partner program resulting in relationships with hundreds of referral agents and banks nationwide, established NMEF’s brand, and developed and managed all marketing communications platforms. Previously, Cosenza was VP of Marketing for UnitedHealthcare’s national accounts and served as an E-commerce Leader for GE Capital’s factoring business.

“I am excited to join Maxim at such a pivotal moment in the organization’s growth trajectory,” said Cosenza. “The company’s strong leadership, experienced and committed team members, and well-defined strategic plan together provide an exceptional platform to serve the growing needs of small and mid-sized businesses. I am eager to cultivate initiatives to strengthen our market presence and establish a new standard of excellence in the industry, and to reconnect with industry colleagues in the broker and banking communities, many of whom I consider to be personal friends.”

About Maxim Commercial Capital

Maxim Commercial Capital helps small and mid-sized business owners nationwide by providing loans and leases (“financing”) from $10,000 to $3 million secured by heavy equipment, real estate, trucks, and trailers. It funds equipment purchase financings and leases, working capital, and debt consolidations. Maxim’s more creative financing structures leverage equity in real estate and owned heavy equipment to facilitate growth and preserve customers’ cash. As a leading provider of transportation equipment financing, Maxim supports startup and experienced owner-operators and non-CDL small fleet owners by funding loans and leases for class 8 and class 6 trucks, trailers, and reefers. Learn more at www.maximcc.com or by calling 877-776-2946.

###

Contact:

Michael Kianmahd, CEO

Maxim Commercial Capital

(213) 984-2727