Fintech

MCA-Centric Fintech Looks to Continue Expanding into US Market

December 14, 2021

“I had an ISO once ask me if our software was for real. He was like, ‘Can it really do all that?’”

SysArc, an Indian fintech company that has branched into the US market via Texas, attended Broker Fair last week in order to pitch their product to the industry’s head honchos. The company offers software specifically catered to each component of the MCA process. With software program names like FUNDperfect and ISOperfect, deBanked was all ears.

“FUNDperfect, is a highly configurable solution with an exceptional capacity to adapt and is function-based on diverse organizational needs,” said Pria Chandrakumar, Vice President of Customer Engagement at SysArc, and winner of 2021 Fintech Woman of the Year in India. “We have a merchant portal where merchants can submit an application online, upload documents and even authorize bank verification so bank statements can be automatically pulled.”

When asked about the company’s thought process on creating an MCA-focused software, it appears as if SysArc came upon a niche after casting a net into the greater finance world. “[We’ve] always had a strong presence in the US servicing banks, credit unions, FHLBs, and MCAs,” said Chandrakumar. “We are experts in lending and cater to all forms of lending right from real estate, mortgages, personal loans, [and] small business loans.“

The biggest difficulty it seems for fintechs across the space, including SysArc, is trying to explain how tech can be useful to an industry that has been dominated by sales tactics and practices that go back generations. Chandrakumar spoke on some of reasons that make brokers and funders who operate in old-school sales mentalities hesitant to adopt fintech.

“Common misconceptions [among MCA] are affordability, complexity of software, loss of commission and mostly ignorance of what technology is capable of,” said Chandrakumar. “Brokers and funders must understand that the fintech industry has come a long way and has solved most of their operational problems.”

“The software also plays a huge role in reducing the risk since first level scoring and underwriting is done by the system, avoiding any human errors,” Chandrakumar continued.

FUNDperfect seems to be flexible in nature, so much so that it is broken down into smaller modules if needed, allowing ISOs and funders to pick the modules they need.

“ISOs can get just the brokering piece of the software called ISOperfect,” said Chandrakumar. “This takes the application through the point of selecting an offer and passing it on to the funder.”

After talking about plans of further expansion into the American market, Chandrakumar reiterated SysArc’s value in their gameplan of how to sell it here in the states. “We will use technology to make MCA financing quicker, while at the same time reducing the risks associated with funding by sharing data on merchant, ISO, and funder performances; so companies can make informed business decisions.”

Tech Creators, Artists, and Tomorrow’s Entrepreneurs Flock to Miami for NFT BZL

December 1, 2021 An attendee poses outside of NFT BZL in Miami

An attendee poses outside of NFT BZL in MiamiWhether they’re the future billionaires building the new digital world, or young people with big ideas and crypto-induced riches, money-hungry twenty-somethings showed up in droves to the FTX Arena on Tuesday for what some called the biggest NFT event to ever take place in Miami.

“NFT’s are almost like a hyper version of insurance for authenticity,” said Casey Craig, Global Head of Communications at CoinDesk and speaker during the ‘Culture Converges with Blockchain and Fashion’ panel. Craig spoke about her personal thoughts on the value NFTs provide to everyone involved in NFT buying and selling processes.

“When you think of NFTs and how you authenticate something, and how they’re preserving that rarity, it’s such a game changer,” Craig said. “I think it’s super practical. I think we need this authentication and creativity. I think it will enable not only the creators, but the people that are purchasing these NFTs.”

Other attendees were focused on using the flamboyant nature of the NFT space to sell their projects to those attendees whose goal was to find their next big tokenized investment. An artist who goes by Oona was at the event to promote her NFT project, strutting around in an outfit that covered her in real cash from head to toe.

“I make video art, and for a long time galleries didn’t quite know how to add value to

or create a unified system of value,” said Oona. “I think a lot of artists like myself are coming to the NFT space because it’s finding a way [for artists] to not give up on their dreams yet, you can actually survive and make a living from art, and connect with others through it.”

Oona spoke on the art community’s history of attaching themselves to great innovations, and how blockchain technology is just another example of creators utilizing new ways to showcase their work. “NFTs are going to become a normal part of our lives and as per usual, artists have found it first.”

Oona spoke on the art community’s history of attaching themselves to great innovations, and how blockchain technology is just another example of creators utilizing new ways to showcase their work. “NFTs are going to become a normal part of our lives and as per usual, artists have found it first.”

Other individuals in attendance were critical of the media’s take on NFTs, and how the press has built an outside perception of NFTs being of over-the-top art that has little tangible value. Raymond Chen, Community Manager of Nansen, a blockchain data management software tool, spoke on the media’s apparent naive perception of blockchain tech and how real world usage of the technology is more relatable to everyday people than most would think.

“The media’s perception of NFTs is some [nonsense] art that is worth like a hundred thousand dollars, it’s so insane. It’s not just some JPEG on the internet, there is real utility value behind it.”

Chen spoke extensively about the value blockchain tech has for everyday consumers. “If you NFT your house, you can bypass a selling agent, buyer agent, and just cut out the middleman for these things,” Chen said.

“If you NFT your car, you can cut out the middle men when you want to sell your car when it’s used. You’re going to get low balled at a dealership, they’re going to up-charge it, and sell it to someone else for more. If you sell peer-to-peer, you cut out all the middle men, and all this slippage and transaction fees in the middle.”

Those in the fintech-esque field are also taking an interest in the NFT space, like Adam Hanna of Circle Internet Financial; who was there representing a software that allows instant payouts of crypto to dollars, or vice versa, for businesses who wish to accept crypto style payments. Hanna spoke about the next great innovation in crypto, and how whoever can figure that out is in store to cash in at an astronomical level.

“I wish I knew,” said Hanna, when asked what that next big idea is. “The NFT space as a whole is something that is still so young, really, like it’s in the past couple of months that it really took off, it hasn’t even been a full year at this point. So it’s just seeing how it’s constantly evolving, what those next projects are, and how different companies are using their own platform, or other platforms, to really promote NFTs in a different way, that’s where it’s at.”

Notable attendees that deBanked bumped into included Miami Mayor Francis Suarez, child actor turned crypto-tycoon Brock Pierce, rapper Kosha Dillz, and UFC fighter Ali AlQaisi. Members of the Miami Dolphins and Los Angeles Sparks were also in attendance, signing NFT-inspired autographs.

Whether you buy into the hype or think it’s equally as ridiculous, the NFT community will continue to be the loudest, most animated, and exuberant group in the world of modern finance.

What Works in Marketing Financial Products

November 17, 2021 Social media was at the top of the list for many marketers that deBanked spoke with, but there are certain formulas necessary to make it work, they say.

Social media was at the top of the list for many marketers that deBanked spoke with, but there are certain formulas necessary to make it work, they say.

“It’s coming up with new ways to say ‘we want to fund your deals,’” said Cassandra Lund, Social Media Manager at Lendini, when asked what the hardest part of her job is. Being heavily involved in the marketing campaigns of a large small business funding company, Lund believes social media is a prime place for setting up brand legitimacy.

“[Social media] provides something that even other forms of marketing cannot,” said Lund. “It instantly connects you to your audience and allows them to ask questions right away, either through direct message or as a comment.”

Fintech companies are also strategically using social media to start getting their name out there. Jennifer Marshall, Marketing Manager at fraud and dispute software provider Quavo, praised the power of social media; especially platforms that provide a professional environment for both consumers and businesses.

“We see the most results on LinkedIn,” said Marshall, “from both paid and organic efforts. “LinkedIn can take [businesses] a long way if their marketing team leverages tagging and mentioning [on the platform]. In the early stages of a company, when brand awareness is the top priority, [businesses] should leverage their employees’ LinkedIn networks.”

While Marshall and Lund are marketing different financial products, they both agree on the inherent value of LinkedIn to their respective companies when it comes to a buttoned-up platform for connections and content.

While Marshall and Lund are marketing different financial products, they both agree on the inherent value of LinkedIn to their respective companies when it comes to a buttoned-up platform for connections and content.

“Just create a Linkedin and Instagram and start posting,” Lund said, when asked how a business could get their foot in the social media door. “You will find people in your industry, potential clients and information about what other businesses in your field are doing. Build out from there, and your business will thank you for it.”

With the opportunity social media provides comes responsibility, and some companies have let simple mistakes hurt the perception of their brand. Lund and Marshall both believe that a misguided or typo-littered social media presence can do a company more harm than good.

“Spelling errors and bad graphics, I see these [errors] a lot on social media as it becomes more and more important to small businesses,” said Lund. “There is nothing more important on social media than a first impression, and a spelling error or hugely pixelated photos is a major deterrent.”

Marshall stressed that companies not let “B2B vs B2C” marketing practices dictate their social media efforts. “In the end, you should want to reach people where they work and where they play. Once you understand that, the value of social media to all financial companies is crystal clear.”

With new members of the work force living most of their lives ingrained in social media, it appears its value in the business world is exponential. “The younger generations have used it for years, or since being born, and it’s not going anywhere in the near future,” said Lund. “Finding new clients, new customers and like-minded business professionals on [social media] helps build your brand and stake a claim in the industry. Anyone that doesn’t think social media is important in business in general is missing out.”

With new members of the work force living most of their lives ingrained in social media, it appears its value in the business world is exponential. “The younger generations have used it for years, or since being born, and it’s not going anywhere in the near future,” said Lund. “Finding new clients, new customers and like-minded business professionals on [social media] helps build your brand and stake a claim in the industry. Anyone that doesn’t think social media is important in business in general is missing out.”

Marketing financial products, especially new or alternative fintech solutions can be difficult, however. When asked about how to market a financial product, Francesca Ligouri, Lead National Designer at Create with Chess, a national marketing company that works in a variety of industries, spoke about the values of traditional marketing materials on top of social media. She stressed the importance of putting a tangible item that explains your business model in the hands of a potential customer that may not fully understand the product being sold to them.

Ligouri spoke about networking materials, and how sometimes the explanation of a product is best done through tangible imagery.

“It’s about using infographics and icons [to help] create a storyline of what you’re trying to say, while keeping your demographic engaged,” said Ligouri. “Illustrative materials like brochures, folders, and mailers make people want to pick up your collateral and be like ‘oh cool, what is this all about?’ instead of printing a word document of all your info and expecting people to want to read through it.”

Whether it is printed or digital materials, innovation in finance isn’t just about the technology behind the products themselves, but also about how those brands and their products are introduced to potential customers.

Mortgage Fintech CEO says Brokers are Still Relevant to Lending Process

November 12, 2021

At Money 20/20 last month, deBanked spoke with Jason Harris, CEO of Button Finance, about his company’s initiative to give access to home equity loans to borrowers that would have never been able to do so. Through this conversation, Harris also shared his thoughts on how brokers across the finance world are still relevant, and the ones who are embracing tech are the ones who are closing deals.

Button Finance is a fintech company that brings together venture and hedge fund capital with borrowers seeking lines of home equity credit. After moving into second-lien mortgages, Button Finance is looking to open up a practice which according to Harris, is mostly an exclusive borrowing process for high net worth clients who borrow from large institutions.

“The reason we like this product is because if you’re an individual, you have to go somewhere like LendingClub or to your credit card to borrow money. And those are interest rates at 20%, as high as 30%, even if you have great credit, it can be over 10%. So we want to give people a much lower cost for access to credit.”

Harris also has a desire to make the process as quick and efficient as technology allows. He is embracing not only expanding the access to capital, but making the process to obtain it simple.

“We want to make it so you can borrow money sitting on the toilet on your phone,” Harris said.

When speaking about brokers in his industry, Harris touched on how the ones who are innovating are taking advantage of such a unique time, where the amount individuals innovating are relatively low, and the opportunities given by the innovation have never been higher.

While some companies offer a completely broker-less buying process, Harris thinks the role of a broker is necessary for a borrower of any loan to be comfortable and informed during the borrowing process.

“Now with regards to the need for brokers, this is something that now happens very often,” said Harris. “When people make large purchases, they like the comfort of speaking to someone and having someone advise them. Sometimes a broker can offer you some educational knowledge. We’re in the finance world; if you’re not a finance person at all, before you borrow $500,000, you might want someone advising you along the way.”

“Different brokers have different ways of brokering,” said Harris. “Some brokers spend money and build out great technology platforms themselves, and they’re able to scale and do ten times as many mortgages as a broker who is doing high touch [business]. Other brokers will use relationship based lending and have high touch [business]. I think it’s definitely going more towards the technology route.”

While embracing the value tech has, Harris realizes that with all this technology comes a responsibility to educate borrowers on all the different processes that are changing when it comes to data transfer, verification, and approval processes. “Like every other tech company, we want to try to bring technology to this as much as possible. We want to be able to advise a borrower on the best possible product just using technology.”

While speaking specifically about the innovation the financial world is experiencing, Harris thinks that a drastic change to the finance world will be take place over a long period of time.

“Like everything, things move slowly,” said Harris. “Don’t think this will happen overnight.”

Marcus By Goldman Sachs Will Become Goldman Sachs Marcus

November 12, 2021 Brace yourself for the craziest rebrand in fintech history.

Brace yourself for the craziest rebrand in fintech history.

Just kidding.

Marcus by Goldman Sachs is changing its name to Goldman Sachs Marcus.

:::Mind Blown:::

The news, publicized by Forbes, said that the bank now feels more confident in leading the division with its own name first after initially applying caution.

Goldman found that their customers had a strong brand affinity with the name ‘Goldman Sachs’ and wanted to “be closer to the brand,” said Stephanie Cohen, Goldman’s Global Co-Head of Consumer and Wealth Management.

The full scoop can be read at Forbes.

Wall Street Banker Turned Fintech CEO Builds Two-in-One App For Underserved Communities

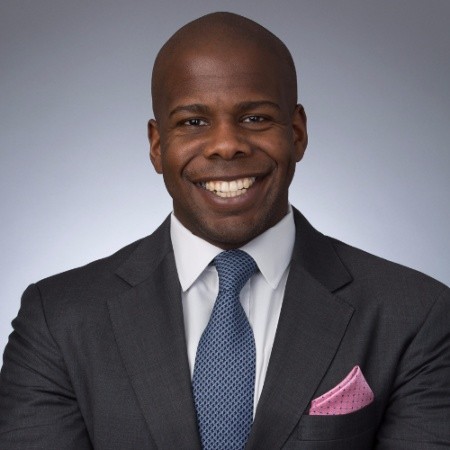

November 10, 2021 Andrew Glaze, CEO of Wealthstack, shared his thoughts with deBanked on the role fintech is playing in bringing innovation to minority communities. While actively working in the financial world and spreading awareness about the diversity issues in the field, Glaze hopes to share his story so that those in similar situations as he was know that there is a chance to achieve profound financial literacy.

Andrew Glaze, CEO of Wealthstack, shared his thoughts with deBanked on the role fintech is playing in bringing innovation to minority communities. While actively working in the financial world and spreading awareness about the diversity issues in the field, Glaze hopes to share his story so that those in similar situations as he was know that there is a chance to achieve profound financial literacy.

According to Glaze, Wealthstack is mainly a digital investment platform designed to teach diverse and underserved communities how to invest. These communities include African American, Hispanic, Asian, and veterans.

As a Jamaican immigrant, Glaze went from sleeping in a two bedroom apartment with twelve people as a child, to climbing through the financial world. According to him, he now manages over a billion dollars of capital between all of his financial endeavors.

“In Bed Stuy, I saw a lot of impoverished, poor, good and noble people who would never have the opportunity to create wealth for themselves,” said Glaze, when asked about what Wealthstack was all about. “So I created a platform that allows me to leverage my expertise and experience, and recognize the training tools within it. There’s a number of training platforms out there and there’s a few educational platforms out there, this is both.”

As a West Point and Columbia Business School graduate, he made his way through Wall Street as a banker and then a hedge fund manager. He now wants to use his adversity ridden story to provide an opportunity for those that grew up in the similar conditions he did, putting together an effort to provide a fair chance for the underserved at being financially successful.

Wealthstack users will get the education and real world practicality out of the mobile app, and they will soon be able to invest directly on the platform after they learn about what each type of investment is.

“We do a series of two to four minute videos that cover everything from the very basics of what is a credit score is, all the way up to how to value businesses based on cash flow. There’s over one hundred videos on the platform today, each video features diverse actors, so you’re able to see people that look like you.”

When asked about the biggest issue facing underserved communities, Glaze discussed access to capital as one of the things that over time, has not caught up with other bias practices being weeded out.

“I’m in a unique position as an African American veteran immigrant, and also senior financial professional, who serves on boards. I’m evaluating $500 million loans for $2 billion businesses that I’m on the board of, but then also going out and personally applying for credit at different points of time. I am very familiar with the challenges that are faced due to inherent bias.”

Although Glaze said that things changed a lot over the past hundred years when it comes to underserved communities having wealth, he thinks lending is lagging behind. “I will tell you that that same spirit of resentment against offering capital to people that don’t look like you certainly is alive and well today. And it manifests in a number of different ways.”

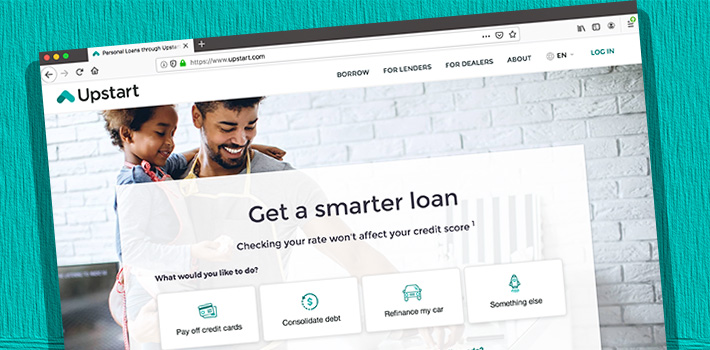

Upstart is Heading into Small Business Lending

November 10, 2021 Upstart, the fintech AI consumer lender originally known for its student loan platform, is heading into small business lending.

Upstart, the fintech AI consumer lender originally known for its student loan platform, is heading into small business lending.

“…we believe there is an unmet need to provide fast, easy access to affordable installment loans to business owners across the country,” said Upstart CEO David Girouard during the earnings call. “Every small business is different and they operate across a crazy wide spectrum of industries.”

Girouard explained that there are “significant challenges to delivering a compelling loan product that is useful to business owners,” in which there is also reliable value for the lender itself.

“This challenge is tailor-made for Upstart,” Girouard said. “While there is no shortage of credit options to business owners, we aim to deliver the zero-latency affordable credit solution that modern businesses require. This is another product in high demand from our bank and credit union partners, and we hope to bring it to market during 2022 as well.”

Upstart is no small player. The company’s market cap is currently around $20B and it is putting out about 1.5M loans a year for a total of more than $16B.

Ireland is Funding Fintech Through Government Investment

November 2, 2021 The Irish government has taken a serious liking to fintech. With a broad history of being active in financial services, the nation believes they can attract companies from around the world to reap the benefits of employing Irish citizens, while also tapping a major source of export revenue through an up-and-coming industry.

The Irish government has taken a serious liking to fintech. With a broad history of being active in financial services, the nation believes they can attract companies from around the world to reap the benefits of employing Irish citizens, while also tapping a major source of export revenue through an up-and-coming industry.

With access to capital for small businesses just as difficult here as it is in the US, a new fintech company looking for start-up cash may be able to turn to Dublin to get a major investment, rather than dealing with a retail investor or a venture capital firm here in the states. Enterprise Ireland, the organzation that runs these programs, is trying to tempt fintech companies looking for a fresh start or an international expansion to start that process in Ireland.

“Enterprise Ireland is the trade development and venture capital arm of the Irish Government,” said Claire Verville, Senior Vice President of Fintech and Financial Services at Enterprise Ireland. “We are a semi state agency and our mandate is to help support indigenous Irish enterprise to grow and expand in global markets.”

Just like in the United States, it is extremely difficult for an Irish business to walk into a big bank and get a loan. It’s in these situations where the Irish government has decided to make a direct investment themselves. Through Enterprise Ireland, according to Verville, the Irish government can provide capital to startups across a range of areas, in exchange for things like loan repayment or government equity in the company.

“In addition to the kind of more traditional trade development stuff that you would see from any government promoting their indigenous businesses abroad, we do invest directly in companies through equity and participate directly as a [limited partner] in funds to funds.”

Verville spoke about how the Irish government has been looking to extend funding to fintech startups for some time. “Our fintech portfolio is over 200 companies now, we have been one of the most active investors in Europe in a long time. We are one of the most active global investors across all sectors, and we’re really focused on early stage capital for fintech.”

When asked about the decision making process that goes into Irish investments, Verville portrayed it the same as if it was a private firm making the same move. “We will vet like any other investment, make sure we’re comfortable with it, make sure that the business is verifiable, and that we understand the track record of the team,” she said.

When asked about the decision making process that goes into Irish investments, Verville portrayed it the same as if it was a private firm making the same move. “We will vet like any other investment, make sure we’re comfortable with it, make sure that the business is verifiable, and that we understand the track record of the team,” she said.

Through investing in fintech, Enterprise Ireland appears to believe they will give their small business owners better access to capital. If the industry can create a Euro-American hub in Ireland, the latest tech and funding innovations will develop there, giving access to that technology to Irish businesses first. If Irish small business lenders can use Irish technology to help an Irish merchant, everyone wins.

With financial innovation in Europe being leaps ahead of the US, Verville believes the Irish employees working in finance would be better suited to deal with some of these new innovations over Americans because of their familiarity with these systems that are already in place. She hinted at things like EMV cards being around in Ireland for years at the consumer level before they ever made it to the United States.

As far as incentive for profit, Enterprise Ireland isn’t concerned with the success of their investment from a financial perspective as other investment groups are. They instead focus on things like employment numbers and longterm sustainability for those jobs acquired through their efforts in investing in industries like fintech.

“Because we are attached to the government, we aren’t a money-making mission as far as venture capitalists go. We are focused on employment in Ireland, which is partly why it’s so important that the companies are founded in Ireland and that they are building their employee base in Ireland, and on export revenue.”

Verville spoke about how only when businesses in Ireland do well, Enterprise Ireland only does well, too. “We do make money off some of our investments, and that’s government money. We get our budget set by the government department every year, just like any other government agency.”

To be eligible for funding from Enterprise Ireland, a business needs to be based in Ireland, have an Irish LLC, and must have a significant amount of Irish employees. According to Verville, the Irish market is ripe for American small businesses, especially alternative finance.