Articles by deBanked Staff

California DFPI Seeks to Dismiss Commercial Financing Disclosure Lawsuit

March 17, 2023Clothilde Hewlett, in her official capacity as Commissioner of the California Department of Financial Protection and Innovation, has asked the Court to dismiss the lawsuit over commercial financing disclosures brought by the Small Business Finance Association (SBFA). Both sides have entered in all their arguments (the DPFI filed its reply on March 13th.) It is now up to the Court to decide if the claims survive this stage of litigation.

And Now Florida Has Introduced a Commercial Financing Disclosure Bill

March 16, 2023 Florida has joined the chorus of states introducing commercial financing disclosure bills. While Florida’s bill looks more like Utah’s than it does California’s or New York’s, it seems to make a point about brokers using potentially deceptive business practices. Brokers take note, especially the last paragraph.

Florida has joined the chorus of states introducing commercial financing disclosure bills. While Florida’s bill looks more like Utah’s than it does California’s or New York’s, it seems to make a point about brokers using potentially deceptive business practices. Brokers take note, especially the last paragraph.

A broker may not:

Assess, collect, or solicit an advance fee from a business to provide services as a broker. However, this subsection does not preclude a broker from soliciting a business to pay for, or preclude a business from paying for, actual services necessary to apply for a commercial financing product, including, but not limited to, a credit check or an appraisal of security, if such payment is made by check or money order payable to a party independent of the broker;

Make or use any false or misleading representation or omit any material fact in the offer or sale of the services of a broker or engage, directly or indirectly, in any act that operates or would operate as fraud or deception upon any person in connection with the offer or sale of the services of a broker, notwithstanding the absence of reliance by the business;

Make or use any false or deceptive representation in its business dealings; or

Offer the services of a broker by making, publishing, disseminating, circulating, or placing before the public within the state an advertisement in a newspaper or other publication or an advertisement in the form of a book, notice, handbill, poster, sign, billboard, bill, circular, pamphlet, letter, photograph, or motion picture or an advertisement circulated by radio, loudspeaker, telephone, television, telegraph, or in any other way, in which the offer or advertisement does not disclose the name, business address, and telephone number of the broker. For purposes of this subsection, the broker shall disclose the actual address and telephone number of the business of the broker in addition to the address and telephone number of any forwarding service that the broker may use.

Both the State Senate and House versions of the bill were introduced by republicans.

Working With Multiple Brokers for a Business Loan? Here’s What to Talk About With Them

March 15, 2023 If you decide to engage with multiple brokers at once to try and secure the best possible business loan terms, here are some tips to ensure that happens:

If you decide to engage with multiple brokers at once to try and secure the best possible business loan terms, here are some tips to ensure that happens:

1. Request a clear breakdown of loan terms and fees: You should ask each broker to provide a comprehensive breakdown of the loan terms, including interest rates, repayment schedules, and any associated fees (such as origination fees, late payment fees, or prepayment penalties).

2. Emphasize the importance of transparency: You should stress that you value transparency in the lending process and expect full disclosure of all fees, terms, and conditions. This will help you make a well-informed decision and avoid any hidden costs or unfavorable terms.

3. Ask about their lender network: You should inquire about the range of lenders they work with and their expertise in securing loans for small businesses in you specific industry. This will give you a better understanding of their ability to find the most suitable lender for you needs.

4. Mention that you are considering multiple brokers: By telling each broker that you are speaking with other brokers, you are creating a competitive environment. This may encourage them to offer more favorable loan terms in order to secure you business.

5. Discuss you business strengths: You should highlight you business’s strong points, such as a solid credit history, steady cash flow, or a well-developed business plan. This will help demonstrate to the brokers that you are a low-risk borrower, which could potentially lead to better loan terms.

6. Ask for references or testimonials: You should request references or testimonials from other small business owners who have worked with the broker in the past. This will give you an idea of their level of customer satisfaction and the quality of loan terms they have been able to secure for other clients.

What a Prime Customer Would Expect From a Non-Bank Lender

March 15, 2023In the current banking environment, we asked what a prime customer would expect from a non-bank lender should they be forced to go that route:

Customer Experience:

I would expect a seamless, user-friendly online or mobile application process, with responsive customer support via phone, chat, or email. I would appreciate transparency in terms and fees, as well as clear communication about the loan approval process and timeline.

Interest Rates:

Since non-bank lenders typically have less stringent regulations and higher risk tolerance than traditional banks, I would expect the interest rates to be somewhat higher than those offered by prime credit banks. However, I would still look for competitive rates, possibly through comparing multiple non-bank lenders, to ensure I’m getting the best deal possible.

Loan Terms:

I would expect flexible loan terms, such as the ability to choose the loan duration, repayment schedule, and options for early repayment without penalties. Additionally, I would expect clear terms and conditions, including any fees associated with the loan, such as origination fees, late payment fees, or prepayment penalties.

In summary, while I would anticipate higher interest rates and potentially less stringent lending requirements, I would still expect a high level of customer service, transparency, and flexible loan terms from a non-bank lender to make the borrowing experience as positive as possible.

Signature Bank Shuttered By Regulators, Customer Service to Continue Uninterrupted

March 12, 2023 If you’ve been following the news, then you’ve heard that Signature Bank was shut down by the New York Department of Financial Services on Sunday. Signature was a popular bank in the small business finance industry. Although it is now under the control of the FDIC, “Depositors and borrowers will continue to have uninterrupted customer service and access to their funds by ATM, debit cards, and writing checks in the same manner as before,” the FDIC said. “Signature Bank’s official checks will continue to clear. Loan customers should continue making loan payments as usual.”

If you’ve been following the news, then you’ve heard that Signature Bank was shut down by the New York Department of Financial Services on Sunday. Signature was a popular bank in the small business finance industry. Although it is now under the control of the FDIC, “Depositors and borrowers will continue to have uninterrupted customer service and access to their funds by ATM, debit cards, and writing checks in the same manner as before,” the FDIC said. “Signature Bank’s official checks will continue to clear. Loan customers should continue making loan payments as usual.”

The FDIC is now marketing the institution to potential bidders. All depositors will be made whole, thanks to a special exception ordered by the Treasury Department.

Signature Bank relied mainly on commercial customers and enjoyed a famous director, former Congressman Barney Frank, the architect of Dodd-Frank, aka the Wall Street Reform and Consumer Protection Act of 2010.

All Registered Sales-based Financing Providers in Virginia (List)

March 11, 2023Is the revenue-based financing provider you do business with registered to operate in Virginia? On July 1, 2022, Virginia’s commercial financing disclosure law went into effect and with that the necessity to register one’s business. As of March 8, 2023, this is the official list of registered sales-based financing providers:

- Advance Servicing Inc.

- Accredited Business Solutions LLC dba The Accredited Group

- Advance Funds Network LLC dba Advance Funds Network

- AdvancePoint Capital LLC dba advancepoint

- Ally Merchant Services LLC

- Alpine Funding Partners, LLC

- Business Capital LLC

- Byzfunder NY LLC dba Tandem dba Nano-FI

- Bridge Capital Services, LLC

- CFG Merchant Solutions, LLC

- Clarify Capital II LLC dba Clarify Capital

- Cloudfund VA LLC dba Cloudfund LLC

- Capflow Funding Group Managers LLC

- Clear Finance Technology (U.S.) Corp. dba Clearco

- Coast Premier LLC dba Coast Funding

- Commercial Servicing Company, LLC

- Corporate Lodging Consultants, Inc.

- Crown Funding Source LLC dba Crown Funding Source

- Diesel Funding LLC

- Direct Capital Source Inc.

- Dealstruck Capital LLC

- EBF Holdings, LLC

- Essential Funding Group Inc

- Errant Ventures LLC

- FC Capital Holdings, LLC FundCanna

- Fidelity Funding Group LLC

- Front Capital LLC

- Finova Capital, LLC

- Fintegra, LLC

- First Data Merchant Services LLC

- FleetCor Technologies Operating Company, LLC

- Flexibility Capital Inc.

- Fora Financial East LLC

- Forward Financing LLC

- Fox Capital Group Inc.

- Fundamental Capital LLC

- Funding Metrics, LLC dba Quick Fix Capital

- Good Funding, LLC

- Granite Merchant Funding, LLC

- Invision Funding LLC

- Itria Ventures LLC

- Jaydee Ventures, LLC dba 1 West Capital dba 1 West Commercial

- Kapitus LLC

- Knight Capital Funding III, LLC

- Lexington Capital Holdings Ltd

- LG Funding LLC

- Legend Advance Funding II, LLC dba Legend Funding

- Liberis US Inc.

- Libertas Funding, LLC

- Liquidibee 1 LLC dba Liquidibee LLC dba Altfunding.com

- Loanability, Inc.

- Millstone Funding Inc.

- National Funding, Inc.

- Nav Technologies, Inc.

- Pearl Alpha Funding, LLC

- Pearl Beta Funding, LLC

- Pearl Delta Funding, LLC

- Proto Financial Corp.

- PWCC Marketplace, LLC

- Parafin, Inc.

- PayPal, Inc.

- Payability Commercial Factors, LLC

- Pinnacle Business Funding LLC dba Custom Capital USA dba EnN OD Capital

- Platform Funding LLC

- Prosperum Capital Partners LLC dba Arsenal Funding

- QFS Capital LLC

- RFG USA Inc.

- Rival Funding, LLC

- Riverpoint Financial Group Inc.

- Rocket Capital NY LLC

- ROKFI LLC

- Ruby Capital Group LLC

- Rapid Financial Services, LLC

- Reliant Services Group, LLC

- Retail Capital LLC dba Credibly

- Revenued LLC

- Rewards Network Establishment Services Inc.

- Secure Capital Solutions Inc.

- Sky Bridge Business Funding, LLC

- SMB Compass LLC dba SMB Compass

- Santa Barbara Tax Products Group, LLC

- SellersFunding Corp.

- Sharpe Capital, LLC

- Shine Capital Group LLC

- Shopify Capital Inc.

- Shore Funding Solutions Inc.

- Streamline Funding, LLC

- Stripe Brokering, Inc.

- The LCF Group, Inc.

- United Capital Source Inc.

- Upfront Rent Holdings LLC

- Upper Line Capital LLC

- Vader Servicing, LLC

- Velocity Capital Group LLC

- Vivian Capital Group LLC

- Vox Funding, LLC

- ZING Funding I, LLC

In The Funding Biz? Here’s What to Know

March 9, 2023Are you in the biz of funding small biz? Listen to these execs tell you how to make it work!

Effective Broker Training

Successful Digital Marketing With Zack Fiddle

Measuring the Impact of Technology on Your Funding Business With Adam Schwartz

Building a Successful Funding Brokerage With Frankie DiAntonio

Funding Circle US Originates $393M in 2022

March 2, 2023The American arm of Funding Circle originated $393M in business loans in 2022, according to the company’s latest public financial statements, nearly quadruple the previous year.

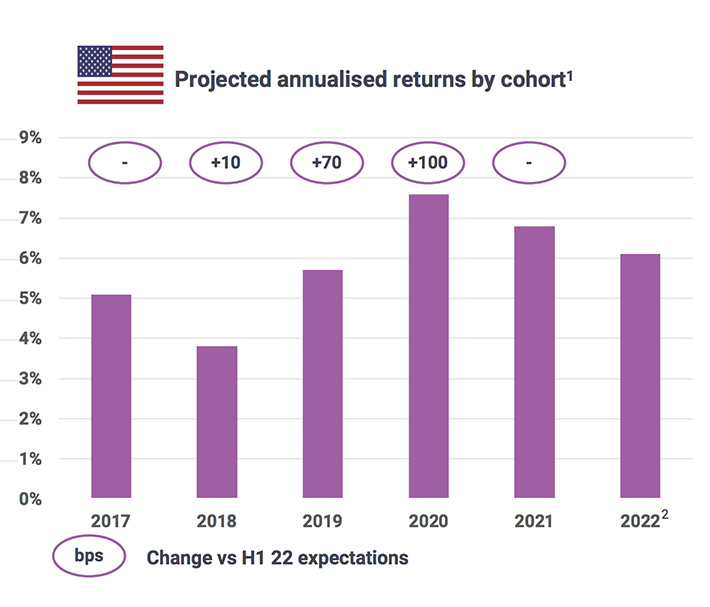

The majority of Funding Circle’s loans are currently projecting annualized returns in the vicinity of US inflation levels. A graph of their loans by cohort is below:

Funding Circle US has a fairly diversified base of capital, having worked with eight forward flow funders in 2022, one of which was a credit union.

The UK still remains the overall company’s primary market. It originated £723M in business loans in 2022, not including those part of government support scheme programs.