How Much Elevate Spends to Acquire Customers

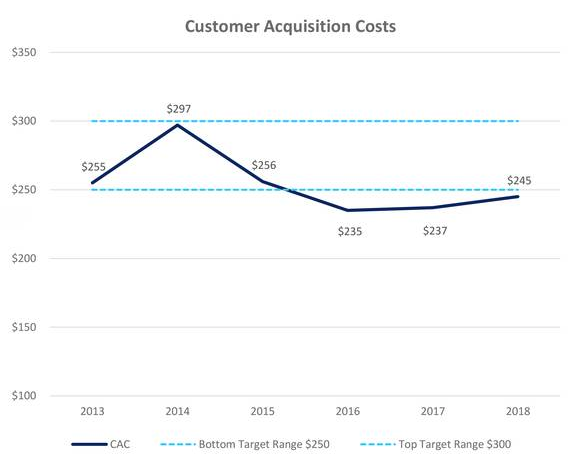

How much does a non-prime consumer lender spend to acquire a borrower? According to Elevate’s Q4 earnings report, the company spent less than $150 per borrower to originate $31 million in loans towards their partnership with FinWise Bank. Overall, however, their cost of acquisition has hovered below $245.

Elevate’s direct mail channels made up 42% of acquisitions in 2018. That’s down from 54% in 2017. In the company’s earnings call, Elevate CEO Ken Rees said of the decreasing reliance on direct mail, “we believe this sets us up for strong future growth through these expanded channels.”

Elevate offers three products to non-prime customers: RISE, a state-licensed online lender that offers up to $5,000 in unsecured installment loans and lines of credit, Elastic, a bank-issued line of credit, and Sunny, a short-term loan product for customers in the UK. RISE and Elastic serve the US market.

Separately, Elevate reported $787 million in revenue for 2018, an increase of $113 million, or 17%, compared to 2017’s full-year revenue of $673 million.

Last modified: February 11, 2019