How the FDIC Defines Marketplace Lending

Marketplace lending is one of this year’s hottest buzzwords but its meaning is not very intuitive. According to a recent Federal Deposit Insurance Corporation (FDIC) report, “marketplace lending is broadly defined to include any practice of pairing borrowers and lenders through the use of an online platform without a traditional bank intermediary.” This might sound similar to peer-to-peer lending and that’s because it’s the same thing, the FDIC explains. “Although the model, originally started as a ‘peer-to-peer’ concept for individuals to lend to one another, the market has evolved as more institutional investors have become interested in funding the activity. As such, the term ‘peer-to-peer lending’ has become less descriptive of the business model and current references to the activity generally use the term ‘marketplace lending.'”

Voilà, marketplace lending is what you get when peers are replaced by private equity firms, pension funds, and hedge funds. Additionally, there is a general assumption that the intermediary platform is also underwriting and grading the loans.

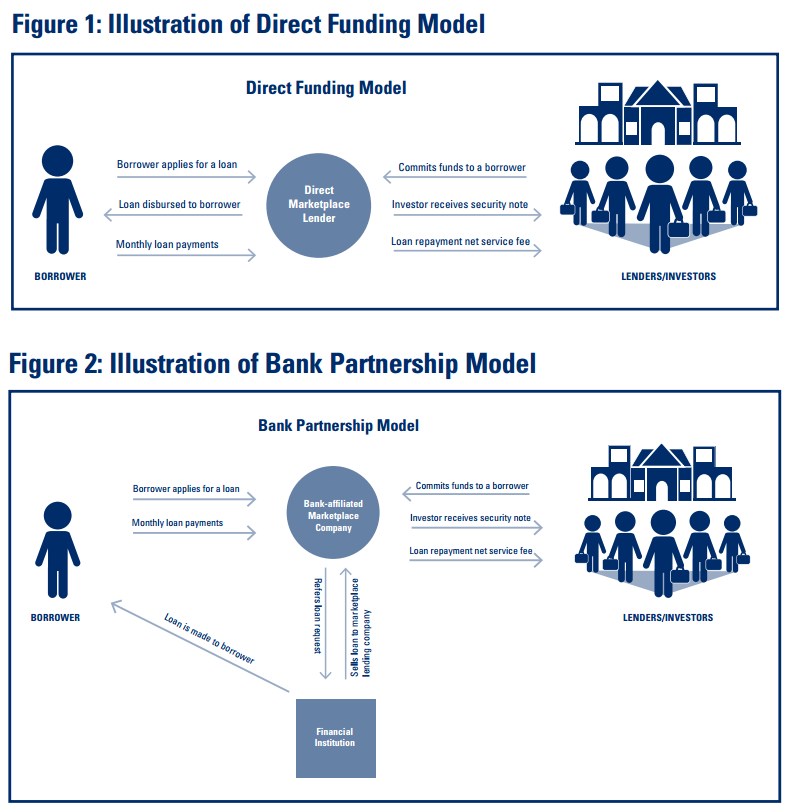

The FDIC separates marketplace lenders into two categories, the “direct funding model” and “bank partnership model,” both of which are illustrated below:

In both circumstances, investors are actually buying securities, rather than participating in the loans themselves.

The FDIC says that marketplace lending can encompass unsecured consumer loans, debt consolidation loans, auto loans, purchase financing, education financing, real estate loans, merchant cash advance, medical patient financing, and small business loans.

For even more information, read the official report.

Last modified: February 5, 2016Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.