Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.

Articles by Sean Murray

Real-time Reconciliations on Revenue Based Finance Deals?

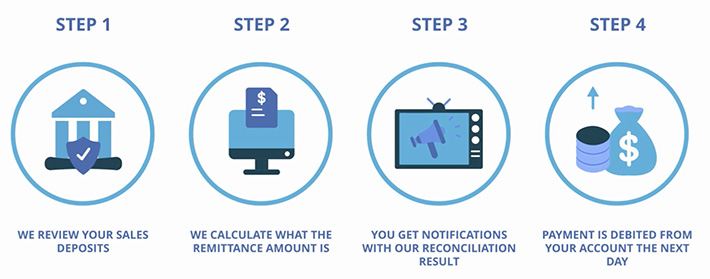

June 25, 2024In the finance world, taking a percentage of a merchant’s sales at the time a sale is consummated is called a split. It’s how revenue based financing often works when the purchased future receivables are card-based. When it’s all revenue, funding providers often rely on a combination of ACH debits and reconciliations, the frequency of which are governed by the contract. On some big e-commerce platforms, like Walmart Marketplace, for example, sales data is monitored in real-time and the appropriate split is debited out from the merchant’s bank account the next day. Some refer to this as a real-time reconciliation.

Real-time reconciliations have been attempted outside of e-commerce ever since Merchant Cash and Capital aka BizFi (RIP) pioneered this 15 years ago, but it was a manual process riddled with challenges that would hardly hold up in today’s technological world. In 2021, revenue based financing provider FundKite introduced its own system, one that was documented by deBanked at the time.

Back then, FundKite CEO Alex Shvarts said, “This product [where debits vary daily based upon true sales] works better for merchants, it works better for portfolios, if you’re actually reconciling and pulling what you’re supposed to, and not what you’re anticipating.”

Three years later, Shvarts still feels the same way and told deBanked that his daily reconciliation method has been a success and is now a leading driver of its business.

“In order to reconcile we must have access to the merchant bank accounts,” Shvarts said. “We use priority technology to do the reconciliation after we have the data. We use a combination of live Logins, Plaid, Decision logic and another piece of code we wrote. Merchants are automatically notified of the reconciliation and adjustment to the payments before we debit the accounts.”

The company touts this system as its edge on its homepage.

“Payments are based on sales, offering protection during slower periods or when no sales occur,” the site says.

“Something’s Happened” – How a funding platform weathered a shocking crisis and is flourishing

June 21, 2024 “[The CEO] called me just before seven in the morning…but [he] would never call me at that hour, so I picked up the phone and he goes ‘Paul, something’s happened, it’s very serious.’ and I’ll never forget, he says ‘you need to take care of our company.'”

“[The CEO] called me just before seven in the morning…but [he] would never call me at that hour, so I picked up the phone and he goes ‘Paul, something’s happened, it’s very serious.’ and I’ll never forget, he says ‘you need to take care of our company.'”

That’s how Paul Vega, Senior Operations Manager at Funders App, retold the story of a phone call he received in June 2021 that would shake up everything about the small business finance company he was working at. At the time, the business was known as 24 Capital, Funders App was a platform they were developing internally, and Mark Allayev who was the CEO, was riding high from having weathered all the uncertainties of startup life and the Covid era. With Vega having played a key role in that success and the business running smoothly, Allayev felt he had earned a much needed vacation and traveled to Europe with some friends.

“And it was just five days,” Allayev said. “But one of our friends had an event in New York and we just had to come back, and the only flight to New York was with a layover in Germany, in Frankfurt. So we got to flying and it was supposed to be a two hour layover in Germany, but came out to be an eight month layover in Germany.”

That’s when the fun and life as he knew it came to a grinding halt. The German authorities never let him get on a plane to the United States. Instead, he was placed under arrest when his name registered as a match with Interpol. Despite his insistence that it was all some misunderstanding, he was directed to a local jail and told he’d soon be extradited to the country that wanted him, Russia. Allayev, then 31 years old, who had been born in Soviet-era Tajikistan and at the time enjoyed dual American and Russian citizenship, had not been to Russia at all since he moved to the United States in 2015. He had, however, previously worked at a family business in Russia as a youngster that found itself ensnared in the unique political environment. Allayev said that his family’s business had been the victim of fabricated allegations and they had left as a result. As an American citizen he had enjoyed international travel for years without issue, and he had almost forgotten about it all. That is until this moment in June 2021 that would change his whole world view and send his family scrambling to save him. While those efforts would eventually enlist help from Democratic Reps. Debbie Wasserman Schultz of Florida and Greg Meeks of New York, Allayev was swiftly cut off from being able to manage his business and was no longer able to contact Paul Vega directly.

“I was aware of what had happened years ago with him and his family because he was transparent with me from the first day we met,” Vega said. That fateful phone call he received that morning lasted all of 3 minutes. “I was like, Okay, I guess this is what’s happening,” Vega recalled.

For Vega, the realization hit that the company had nearly two dozen employees at the time, all of whom depended on it for their livelihood, and all of whom were probably going to question the circumstances their boss was in. Nevertheless, crisis management is how Vega had been introduced to the business from the beginning. Vega started at 24 Capital in January 2020 with about six years of industry experience under his belt, with the objective of completely revamping the underwriting process.

“I think it was actually perfect timing, I think it was meant to happen that way,” Vega said. For instance, family members living across the globe had tipped him off that Covid was going to be much worse than the oblivious American media was making it out to be. Vega was also operating out of an office in New York City where a potential doomsday scenario was a lot easier to imagine than where Allayev sat in South Florida.

“When I first expressed this idea [to Allayev] of the possibility of the universe being shut down, I know that Mark was questioning whether he had made the right decision in bringing me on because here I am brand new to the company and I’m telling him that, ‘hey, the US is going to shut down,'” Vega said. Despite having come across as alarmist, Vega felt that it was better to act on his conviction and plan for the impossible.

“Behind Mark’s back I started to research the idea of remote work, and nobody knew what remote work was back then,” he said. Vega proceeded to set up staff with home computers and began testing out software they had never used before.

“By the time they shut down the city, we were well situated to just literally flip a switch and be able to process and run the business from home,” he said.

And ready they were because not only did the company never stop funding but it also never let anyone from the company go during that time. Through it all Vega and Allayev formed a really trusting relationship with each other, the kind that would only make survival of the company possible once Allayev was detained in Germany the following year.

As days turned into weeks and weeks into months, Allayev’s extradition to Russia seemed inevitable despite a growing lobbying effort to free him. Then Russia invaded Ukraine. Once that happened, the politics in Europe changed, and Allayev was suddenly freed in March 2022 and put on a plane back to the United States. The emotional journey and the circumstances that enabled his return became a big news story in the newspapers, one of many about people whose fortunes changed for better or worse as a result of the war.

Once he was reunited with family and had the opportunity to acclimate back into life, he looked toward his business, which he now had a newfound perspective on. “Before, all I cared about was just working and just living my own life,” Allayev said. “So I think what changed is me understanding that probably your family’s the most important part and you need to focus and spend more time with your parents, your siblings, all your loved ones. I think that’s the thing that really changed my mindset.”

Of course, it wasn’t as if this perspective was shaped by losing his business in the process, because it had somehow managed to continue running like normal during the eight months he was away, thanks to Vega. Even the employees stayed on, as everybody stood in supportive solidarity with Allayev.

“So one thing that I learned that was funny when I came back is that the company could be run without me,” Allayev said. “And I think that Paul and all the other team members did an amazing job, keeping everything in place and keeping the funding amounts pretty decent.”

Today, the brand Allayev and Vega are under is known as Symplifi Capital. The company’s internal infrastructure platform has also blossomed into its own publicly licenseable service known as Funders App for companies that want to be their own funders. Allayev says that Funders App provides technology, underwriting services, collections, accounting, servicing, distribution of funds, contracts, white label services, and more. It can be customized to provide just what one needs. A sizable number of companies are already using it, to the point where last year Funders App announced it had collectively originated $500M in funding to small businesses since inception.

“I think there’s so many talented kids and young people that have the vision to create their own companies but they just have absolutely no help and no backup,” Allayev said, “and this is what we want to create with funders. We want to help those people, we want to get them in, train them, help them, and provide them with the right tools, the infrastructure, and even with leverage, even the money because you need capital to become a funder.”

Allayev drew some of this inspiration from how he started in the business in late 2016, when he talked to numerous companies about what they could provide to help him launch his business and felt like nobody could provide all the pieces. As for the trajectory forward, their eyes are on efficiencies and growth.

“As you know speed is kind of the name of the game here,” Vega said. “If the typical lending house is taking three to four hours to put out an offer, make a decision, ask for additional information, our goal is to have a file from submission to funding in that three-to-four hour timeline where most people are just getting an answer back to the ISO. So we’re hoping to have the merchant funded in that timeline. And that’s going to create just a huge competitive advantage for us.”

That’s the kind of thing they’re working on today. The backdrop with what happened to Allayev is now just part of the company’s founding story. For Vega, there was never any question that it wouldn’t work out. Referencing the early months of Covid when companies were doing mass layoffs, he expected that Allayev would ultimately, through no fault of his own, do the same.

“[Allayev’s] the only person that I know in the whole industry that actually said, ‘I’m not doing that, I’m keeping everybody’ and kept his word,” Vega said. “That day he sold me. That’s a big portion of the reason why I have so much trust in him, because he’s a man of his word.”

SellersFi Surpasses $1B in Loans Since Inception, Experiences Success Through E-Commerce Funding

June 14, 2024The timing of it all was fortuitous for SellersFi. When the company announced in January that it had secured a partnership with Amazon to provide eligible Amazon sellers with access to credit lines, it was clear that its fresh equity raise and credit facility of up to $300 million were going to be put to use. SellersFi wasn’t the only partner, however, and Amazon still did most of the lending to its own sellers directly, a business it had been in for more than a decade, but it was still a big relationship to have. But then it got better. In March, Amazon announced that it would end its direct lending program and rely entirely on its partners instead. For SellersFi that meant it would have the opportunity to service even more sellers on the platform than before. Since then, SellersFi has quietly surpassed $1 billion in loans since inception.

“What we are seeing now is less competition,” said Ricardo Pero, CEO of SellersFi, in a call with deBanked. He partially attributed that to the current interest rate environment which has impacted those with small margins. SellersFi, however, has experienced a lot of success. The company knows the e-commerce space particularly well, the only space it operates in, since its the only US lending platform also approved as a payment service provider member for Amazon. They started their relationship with Amazon as a service provider 3 years ago. While Pero said they have seen “nothing that points to a recession,” their experience suggests that even if one were to happen in the future, consumers would react by seeking out bargains on e-commerce platforms, reinforcing their position as the niche to be in. As readers may recall, a flight to e-commerce is also what happened during the pandemic.

E-commerce, however, is a broad umbrella, and Amazon is not alone in the universe. Millions of businesses rely on various platforms for e-commerce from basic templates with API connections to Shopify and more. Even big box brick and mortar retailers are waking up and rapidly inching their way into e-commerce. Walmart is just one example, which not only accommodates individual sellers on its platform but also offers merchant cash advances to them.

“The competitive landscape is changing for our clients,” Pero said. Pero added that they know what’s going on because they talk to these clients all the time and that even in the e-commerce business there are person-to-person relationships. “Customers mention their account managers by name,” Pero said. “We have a reputation as a partner to these merchants.”

One trend they’ve noticed over the last year or so is their strategy towards borrowing. While merchants have always typically used funds for things like advertising or inventory, the previous low rate environment enabled behavior where merchants could borrow first and then figure out how to spend the funds second whereas now that rates are higher there is a lot more of a deliberative approach to precisely how much they should get and what it will be used for in advance. It’s something they see all the time now and agree with. “You need to plan,” Pero said.

Merchants Still Concerned About Inflation, Recession, (and Bird Flu?)

June 12, 2024 Seventy-eight percent of businesses expressed that they are somewhat concerned or very concerned about the cost of goods/inflation right now. The exact same percentage said the same about a possible recession. That’s according to the latest State of Small Business Report compiled by IOU Financial. Interest rates were top of mind too, though not as much as in previous survey periods. For example, while 68% said that they were somewhat concerned or very concerned about interest rates right now, that figure was the lowest recorded since Spring 2022 (at 84%), the first time that survey question was asked. Respondents were right to be concerned at the time since that’s the precise period that rates began to rapidly rise from 0% to the >5% level that they’re currently at.

Seventy-eight percent of businesses expressed that they are somewhat concerned or very concerned about the cost of goods/inflation right now. The exact same percentage said the same about a possible recession. That’s according to the latest State of Small Business Report compiled by IOU Financial. Interest rates were top of mind too, though not as much as in previous survey periods. For example, while 68% said that they were somewhat concerned or very concerned about interest rates right now, that figure was the lowest recorded since Spring 2022 (at 84%), the first time that survey question was asked. Respondents were right to be concerned at the time since that’s the precise period that rates began to rapidly rise from 0% to the >5% level that they’re currently at.

Of the respondents who answered the write-in portion, a little less than half cited access to proper funding as among the biggest challenge to running their business right now and as the reason they are being held back from growing their business. Concerns about being able to hire qualified staff was also cited on several occasions, an issue that has persisted since the bi-annual survey first started asking about it.

Notably, IOU has persistently asked respondents to weigh in on their concerns about public health as a business challenge despite the world largely having moved on from covid already. While it would come as no surprise then that the percentage of respondents that were somewhat concerned or very concerned about public health in Spring 2022 (63%) had dropped in half by Fall 2022 (30%), the percentage has slowly crept upwards ever since. Fifty-one percent of respondents said that they are currently somewhat concerned or very concerned about public health. Since no further questions were asked to elaborate on that selection, one wonders if they were referring to the recent headlines about Bird Flu.

Trading MCA for Mortgages

June 5, 2024 “I like multiple ways of getting business,” said Julio Sencion, Principal at Alta Financial. “If I did one thing and one thing only and that slows down, it affects my bottom line, so I like to keep my doors open for more opportunity and I think the ISOs should as well.”

“I like multiple ways of getting business,” said Julio Sencion, Principal at Alta Financial. “If I did one thing and one thing only and that slows down, it affects my bottom line, so I like to keep my doors open for more opportunity and I think the ISOs should as well.”

Sencion’s not funding MCAs today, he’s doing mortgages, a business he had been in for years prior to the Great Recession. In the early 2000s, he said that everyone wanted to be a mortgage broker, himself included when he got into it. Like many in that business at the time, the fallout of it all pushed him to seek out a new revenue stream and a product that was still in demand. By 2011 he and a partner were running a large MCA brokerage shop in New York with nearly 70 sales reps on the floor. Sencion liked the business but not necessarily the conversion rates on the leads he was buying. By his count only 2-3% of the leads would become a funded deal, a metric deemed too low in the industry era of yesteryear. Old habits die hard, however, because he couldn’t help but continue to think like a mortgage guy.

“We realized that we had a couple of different questions on our application, one of them was ‘Do you own real estate? Commercial, residential?’ 40 to 50% of our clients owned real estate, so because of that we spun off a division for commercial lending.”

By 2016 Sencion exited MCA and went back into traditional finance. He’s now a principal at Alta Financial, which not only does mortgages but has also found a unique niche to source borrowers from, MCA brokers.

“So let’s say for example you’re an ISO and the client says ‘yes, I own real estate’ I’ll be interested in looking at that product,” Sencion said. “Then you will click a link that we will give you, that link will open up the questionnaire and you will fill out that questionnaire and then my agent will receive that lead from that questionnaire with all the data in it.”

Referrals of this nature in the biz are not new, but perhaps the circumstances are. One of Sencion’s account managers, Jamie Schiff, is also a former MCA rep himself, and he’s found this business to be better.

“I think over the past a year and a half, from my perspective, I think the MCA space is just a bit saturated,” said Schiff. “There’s a million and one funders out there.”

The challenge with this different product, according to Schiff, is getting an MCA broker to wrap their mind around a deal that could take a month to close when they might be used to 2-3 days. But on the upside Alta Financial does all the work and they really just want a broker to qualify a lead and submit the details. If a loan closes the broker gets paid. Quite a number of MCA broker shops are already doing this with them, the company said. Once these files are in hand, they underwrite various factors including credit score of the borrower. While just about any kind of property could qualify except for gas stations, they said that multifamily properties are the most common they get.

“People will be surprised how many clients have real estate, not just a [primary home], but they own just a small multifamily down the road that they never touched or tapped into,” said Sencion. “So I think it’s important nowadays to have the ISOs ask the question because if they didn’t do the cash advance they could always flip this into a mortgage.”

While all of Alta’s loans are secured by real estate, they can look beyond the value of the asset by evaluating an applicant on the rental income they generate or look at the average revenue from their business bank statements and base a loan amount off of that. Naturally, the rates and terms are much more attractive than what’s available in the unsecured market. There’s also the added benefit of these products being able to work alongside an MCA or to buy out existing ones. It’s a commission a broker might not have gotten otherwise.

“I’m actually excited, it’s something different but it’s kind of the same,” said Schiff. “And it’s such a smaller space that I don’t have to worry about every other month 10 other new funders popping up…”

As for Sencion, he said that the barriers to entry are higher than the MCA business, between the education, state licensing, how to process the files, etc.

“It takes years to get to the level of where we’re at, to be able to underwrite, fund deals, sell to a secondary market,” said Sencion. “And I think that’s where the edge comes in, you can’t get a cash advance guy, no matter how big they are, to get into my space unless they team up with a mortgage company. No one’s out there trying to become a mortgage company anymore like it was back then.”

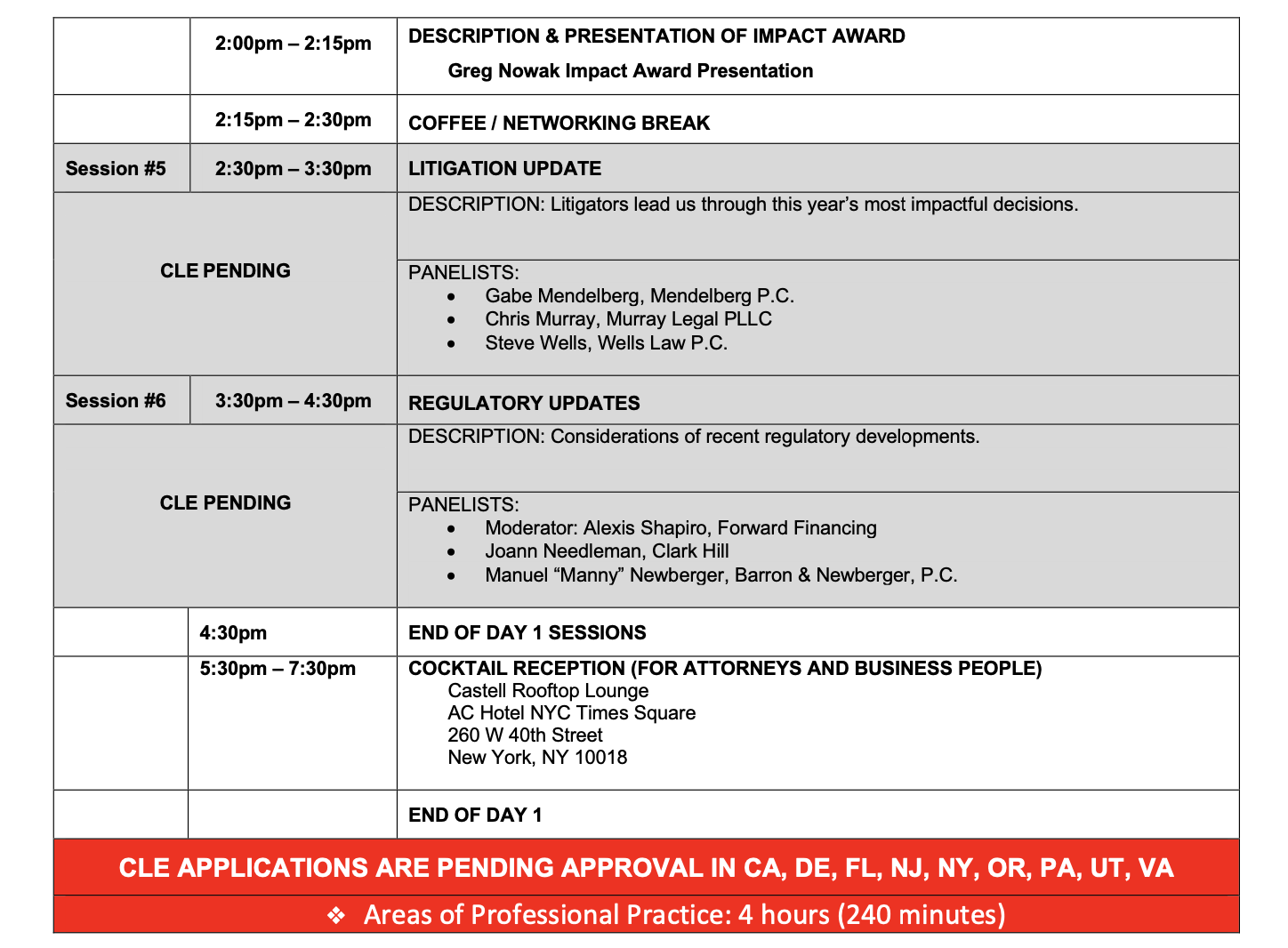

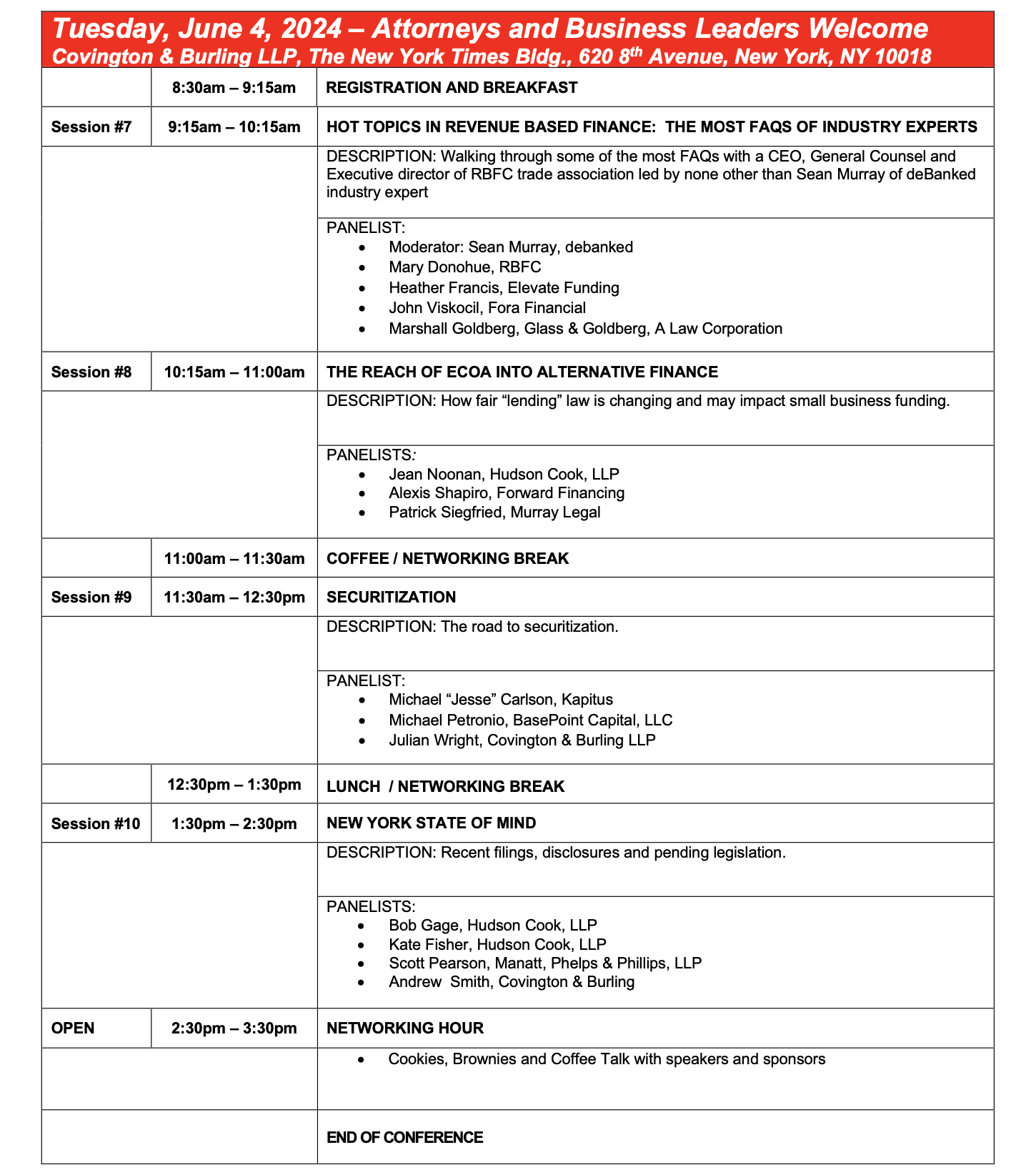

At the AFBA Conference

June 3, 2024I’ll be moderating a panel on “Hot Topics in Revenue Based Finance” at the Alternative Finance Bar Association (AFBA) conference early Tuesday morning at the office of Covington & Burling in Times Square, NYC. (Agenda here) This is the AFBA’s 6th annual conference. The first day (June 3) of the two-day event was only open to attorneys, while business people are permitted to attend on day two (June 4).

Panelists include:

• Heather Francis, Elevate Funding

• John Viskocil, Fora Financial

• Mary Donohue, Revenue Based Finance Coalition

• Marshall F. Goldberg, Glass & Goldberg

Among the major speakers of the day will be Andrew Smith, a partner at Covington & Burling LLP, who was formerly the Director of the Bureau of Consumer Protection at the FTC.

Almost Sold Out – The Industry’s Legal Conference in NYC (AFBA) – Features Big Name Speakers

May 29, 2024 This is the last chance for attorneys and executives interested in the most comprehensive industry legal education to register for the Alternative Finance Bar Association Conference taking place in NYC. While the day of June 3rd is for attorneys only, the evening of June 3rd and the full day of June 4th are open to business people!

This is the last chance for attorneys and executives interested in the most comprehensive industry legal education to register for the Alternative Finance Bar Association Conference taking place in NYC. While the day of June 3rd is for attorneys only, the evening of June 3rd and the full day of June 4th are open to business people!

The outstanding lineup of speakers includes Andrew Smith, a partner at Covington & Burling LLP, who was formerly the Director of the Bureau of Consumer Protection at the FTC, and Bob Zadek, Of Counsel for Buchalter.

A June 4th panel moderated by deBanked‘s Sean Murray will feature speakers Heather Francis at Elevate Funding, Mary Donohue at Revenue Based Finance Coalition, John Viskocil at Fora Financial, and Marshall Goldberg at Glass & Goldberg. Tickets are almost sold out.

For questions, email Lindsey@lrohanlaw.com or fitzgeraldmegan19@gmail.com

How Everybody Suddenly Became a Direct Funder

May 8, 2024 It’s hard to distinguish a broker from a funder these days especially in an environment where seemingly reliable evidence might not indicate what you think it does. For instance, I recently made an off-the-cuff post about “white label funding” on social media that opened up a lot of eyeballs to a practice that’s been happening behind the scenes for years that could totally change what you think you know about the business, and help explain why deals might be spreading further beyond what a broker intended. For instance, the catchphrase “of course we’re direct, just check our lawsuits out in the courts,” cannot be relied upon to indicate one is direct at all. Say what!

It’s hard to distinguish a broker from a funder these days especially in an environment where seemingly reliable evidence might not indicate what you think it does. For instance, I recently made an off-the-cuff post about “white label funding” on social media that opened up a lot of eyeballs to a practice that’s been happening behind the scenes for years that could totally change what you think you know about the business, and help explain why deals might be spreading further beyond what a broker intended. For instance, the catchphrase “of course we’re direct, just check our lawsuits out in the courts,” cannot be relied upon to indicate one is direct at all. Say what!

Here’s how white labeling came about, what it means (roughly speaking), and how it works. Please note there are certainly many iterations and variations to it:

More than ten years ago, the MCA arms race to recruit ISOs became ultra competitive and everyone began looking for an edge. Some tried high commissions or faster approvals or higher risk funding or customer service and so on and so forth. Others got more creative, turn the ISOs themselves into funders and leverage their incredible abilities to sell themselves! If a broker was called Cool Funding Co, then the funder might organize an LLC or register a DBA with an extremely close spelling, like Cool Funding Capital, LLC or Cool Funds Co, Inc, something that otherwise wouldn’t raise any eyebrows if one was dealing with Cool Funding Co. The real Cool Funding Co, white label entity in hand from a funder, could now market itself as “direct” and take to the interwebs and telephones to solicit deals from fellow brokers. When Cool Funding Co would get the deal, they would direct it to the real funder, who then prepares a contract with the white labeled name that looks very much like Cool Funding Co. Cool Funding Co gets a cut of every deal funded and also the honorary and distinguished advantage of being a funder in a market full of brokers! They can even syndicate on them which perhaps makes it look and feel even more direct!

Thus kicked off an extraordinary boom of white labeling, which carries through from beginning to end. If a deal defaults under the Cool Funding Capital, LLC contract, then that’s the name that will appear as a plaintiff in the court system. Hence, court records can be misleading to an outside observer who aren’t aware of this practice. You might be dealing with Cool Funding Co, but Cool Funding Capital is actually another funder entirely who actually did the deal behind the scenes.

Not content to let just one funder dominate this market, dozens of funders followed by offering white label services to brokers to front as a funder. This would allow brokers to shop a deal around to all those they have a white label relationship with and create the appearance that whomever approved it was actually them in the end. For a time, not offering white labeling was considered a major disadvantage because then brokers would have to reveal some other company’s name on the contract, risking the possibility that whichever broker they had solicited would cut them out of the process in the future and go truly direct.

The only tell would be that suddenly Cool Funding Co sure seemed to have a lot of legal names, like Cool Funding Capital, Cool Funding Two, Cool Merchant Funding, Cool Cap, and more, both on their contracts and in the court system, all indications but not necessarily definitive proof of white labeling. And not to say that any of this is deceptive or bad or immoral. White labeling exists in many industries and at the end of the day it allowed really good sales people to capitalize on the relationships with people who already liked them. It was smart, genius even. And if the deals get funded and everyone is happy, who cares?

Even some funders got in on it too, shopping out their declines to other funders only to put out a contract in front of their broker with a white label, leaving them to have no idea that someone else is actually doing the deal. Again, this isn’t necessarily deceptive, and can easily be marketed as a benefit. Instead of a broker having to waste time submitting a deal to five funders, they can submit to just one that they really like and the funder will get it done whether on their own balance sheet, through syndication, or through a white label somewhere else. The broker will only have to deal with that one relationship. The deals get done. Everybody wins.

The ironic thing is that white labeling became such a common feature that few people even talk about it anymore. White labeling can even be done in-house in which a funder today can just be a composite of several different syndication funds all while being white labeled under one marketable brand name. The point is that determining who is direct is not easily determined, and especially not from “looking someone up in the courts.” If there is one solid takeaway from this information its to be informed about what is possible and to help you ask better questions with potential relationship partners.

Ask questions things like these:

- Do you rely on white labeled contracts?

- Do you rely on syndication? If so, from who, where?

- How many of your own underwriters do you have? Can I speak to them?

- How much of your own money do you put in the deal?

- If I look up the legal entity on your funding contract, who will show as the owner?

Red flags for a possible white label or broker:

- Says they can fund any and every type of deal

- Multiple commission structures

- Relies entirely on statements like “look me up in the courts” for authenticity

And there you have it. Be careful out there. A great way to cut through the nonsense is to get to know your relationships in person! There are also plenty of funders who don’t white label at all because they don’t want to deal with any of the risk or complexities that come with it.